- By Shari Vahl & Alex Moss

- Reporter, You and Yours

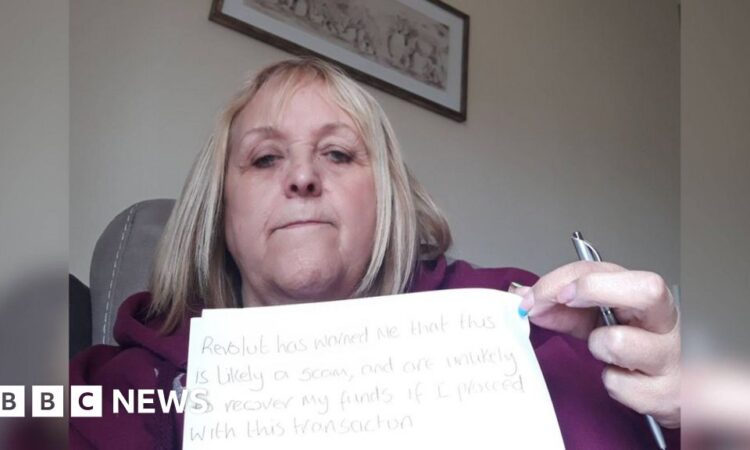

Ann was asked by her bank to send a picture stating she had been warned her transaction was likely to be a scam

A retired couple lied to their banks after falling under the spell of scammers who stole £86,000.

Ann and James were so “brainwashed” by the promise of giving money to their children they lied when banks tried to stop their payments to fraudsters.

The couple, both retired nurses, were scammed into taking out loans as well as handing over their life-savings.

The financial industry said the scam tactic, known as ‘The Spell’, was the biggest challenge it faced.

Ann and James, who has prostate cancer, were lured into putting their money into a bogus cryptocurrency platform after spotting an advert on social media which was apparently endorsed by the political journalist Andrew Marr.

After sharing their phone number, they were contacted by a woman who went under the name of Giselle Thomas, pretending to be a financial adviser for a company called ISA Investments.com.

Andrew Marr said the fact the scammers had used his name was a “violation”

Ann, 65, said: “We felt at ease with her straight away. She encouraged us to ask questions and at one point I remember asking her what was in it for her.

“She said, ‘well, it’s like this, if you make money, I get money and we get rich together.’ She said ‘we’ll be celebrating with plenty of champagne and bubbles.'”

The couple, from West Yorkshire, thought their money was going to buy cryptocurrency and were encouraged to open a Revolut account, an online banking platform, so the transactions could be carried out.

They made a first payment of £100, transferring the cash from their Virgin Money account into their Revolut one. Within days they were shown fake information on an app about how their investment had risen to more than £600.

‘We were buzzing’

By this stage, the couple said Giselle was constantly on the phone and was ringing them several times a day.

“Obviously we thought this was amazing. Giselle said ‘look at the profit you’ve made’,” Ann said.

“So the next step then was well, you’ve made £600 on £100, so imagine how much you’re going to make on £5,000.”

However, when the couple tried to make a second, larger payment, both Virgin and Revolut paused the transaction and sent messages warning it could be a scam but Giselle convinced them otherwise.

“She was quite angry and tried to encourage me to be angry. She was coaxing me about what I needed to tell them [the banks] and that I needed to be firm with them.

“So I did. I phoned Virgin and they asked me various questions about what the money was for. I literally just said what she told me to say – that the money was for a holiday.”

Ann said Virgin staff even questioned whether the money was being invested in cryptocurrency but because Giselle had warned this may happen, she lied and said no.

The pair continued to see their money growing on the fake app with the £5,000 snowballing to £23,000.

“I was beside myself, I was so excited. We were buzzing thinking about how much we could give the kids and the lovely holidays we’d be able to have.

“We had no reason not to believe her because we could see the numbers there on the app.”

Image source, Getty Images

People working in fraud prevention said ‘The Spells’ were getting more powerful

They went on to transfer more money despite bank alerts and Revolut asking Ann to send a picture of herself holding a sign saying she had been warned it was likely a scam. Eventually, the money went through with the fake app showing it had risen to £45,000.

Meanwhile, Giselle had convinced the couple to download some software, which was actually a remote access tool that allowed the scammers to control their devices, emails and security codes. This allowed the fraudsters to make three loan applications for a total of £50,000 using James’s details.

Even when one of the companies rang James and asked what the money was being used for, James lied and said it was for home improvements.

‘Disappeared from face of Earth’

Once their apparent profits had risen to more than £80,000, the couple decided they wanted to withdraw the money with Giselle telling them she would get it released.

But after waiting several hours, Ann said the “penny finally dropped”.

“I was so hurt by the fact that someone I thought I’d built a rapport with… she called me dear and sweetie and that’s not the sort of thing I’d expect a scammer would do.

“This person was a future friend, someone I would choose to meet at some point to meet up with, to hug and share a coffee.”

James added: “I never dreamt she would disappear from the face of the Earth and leave me £50,000 in debt with no way of paying it.”

Jim Winters, head of fraud at Nationwide, said victims of this kind of fraud were referred to as being under ‘The Spell’ of scammers.

“They are coached, very professionally, by very sophisticated fraudsters who invest an awful lot of time into this social engineering and coaching of their victims.

“We are finding the spells are more and more powerful and more and more effective and the customers, we’re finding it’s harder and harder to break the spell.”

A spokesperson for Revolut said it was sorry to hear the couple had been “targeted by ruthless and highly sophisticated criminals” and that it “invests heavily to protect and support customers.”

Virgin said it had “strict controls in place to identify vulnerability and prevent our customers from becoming victims of scams.”

Meanwhile, Andrew Marr said he was “so sorry” to hear what had happened to the couple and the fact his name was wrongly used to endorse the fake money-making scheme was a “violation”.

“We all depend on our reputations in different ways and I have never endorsed any commercial product of any kind.”

For more on the story, listen to Radio 4 You and Yours on Thursday, 26 October at noon.