There’s this guy on Twitter, Paul Fairie, who does these threads using old newspaper clippings to show how the stuff we worry about today is the same stuff people have been worrying about for decades.

There was one called a brief history of we are raising a generation of wimps. Every older generation thinks this (and will always think this…it’s called progress).

There was also a brief history of no one wants to work anymore.

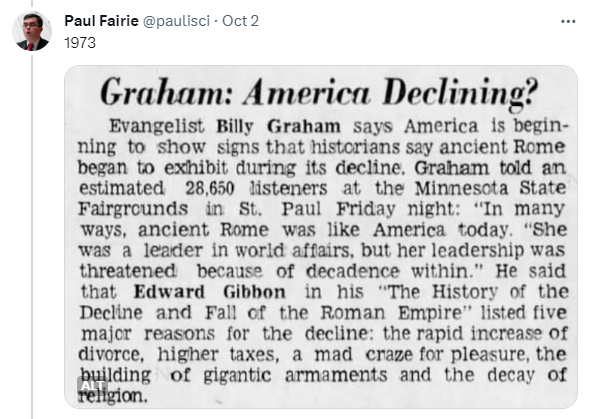

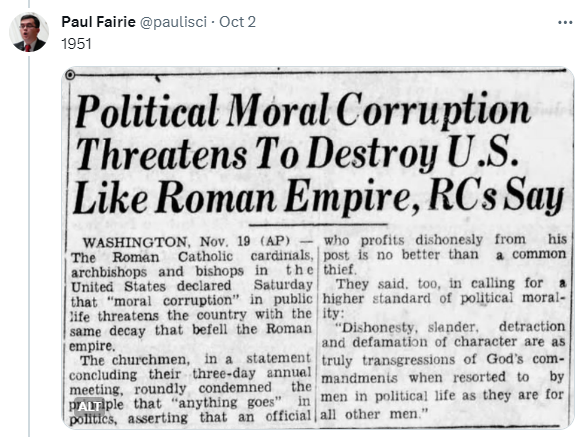

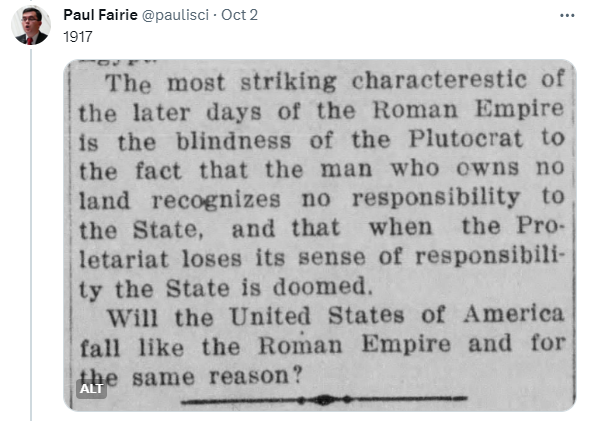

And a recent favorite: A brief history of America is in decline like the Roman Empire.

There are plenty of recent examples of this but here’s one from 1973:

This was in 1951:

And all the way back to 1917:

That was just a taste but you get the idea.

My whole life people have been predicting things like a crash of the dollar, a government debt crisis and the end of America as we know it.

In the 1980s, Japan was going to overthrow the United States as a global power. In the 2000s it was China.

I’m not completely dismissing the idea that other world powers will rise. I just think it’s a bit premature to be dancing on the grave of the United States just yet, especially as an economic power.

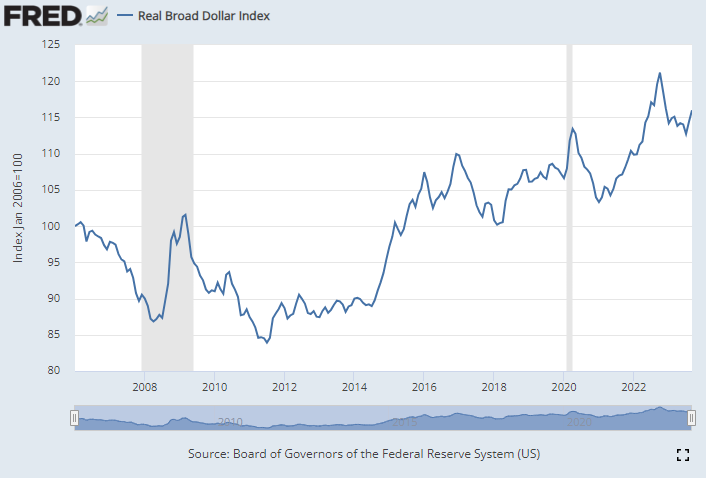

The dollar remains the global reserve currency and has actually strengthened since the Global Financial Crisis:

Currencies are always and forever cyclical but some people were sure the dollar would crash following the 2008 crisis. Nope.

The U.S. economy was described as the cleanest dirty shirt in the laundry hamper for much of the 2010s as other developed and emerging economies struggled mightily.

It would also be hard to argue any country survived the pandemic as well as ours.

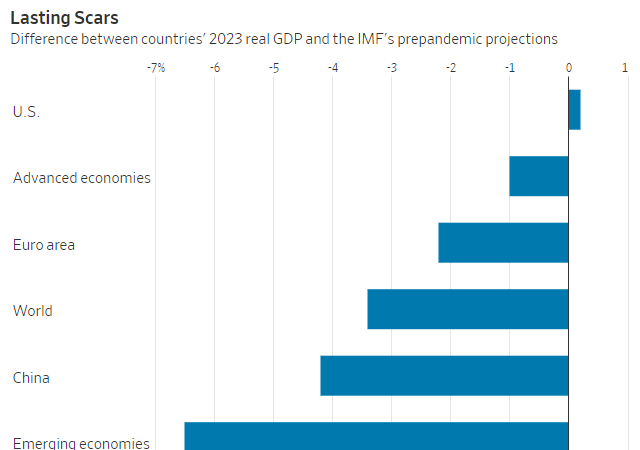

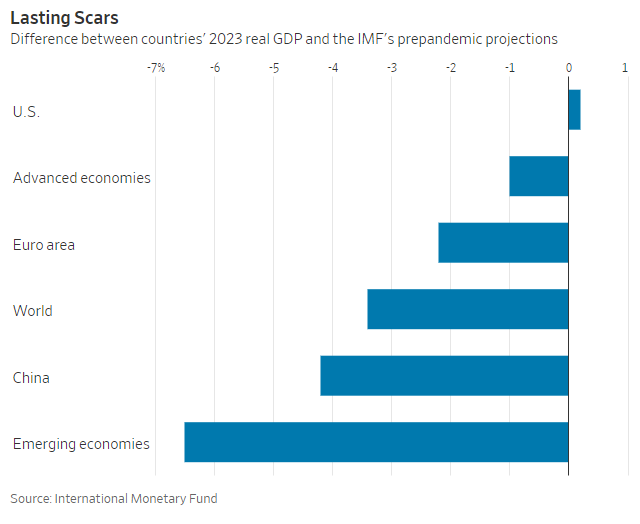

U.S. economy is actually in a better place than where the IMF projected it to be in 2019 before the pandemic (via WSJ):

The rest of the world is worse off economically speaking.

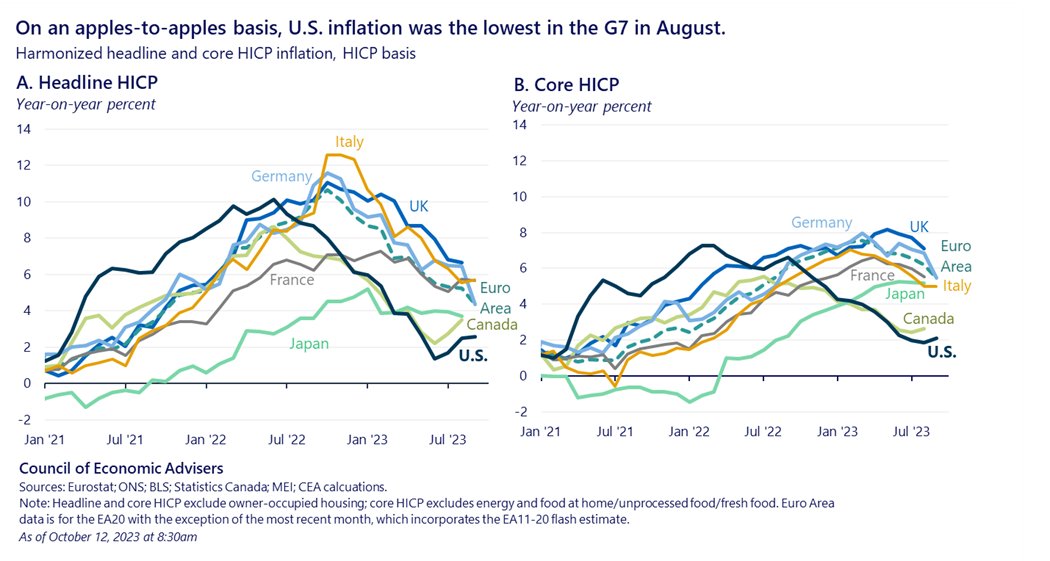

The U.S. currently has the lowest inflation in the G7 as well (via CEA):

So the U.S. economy has experienced higher growth and less inflation than the rest of the developed world.

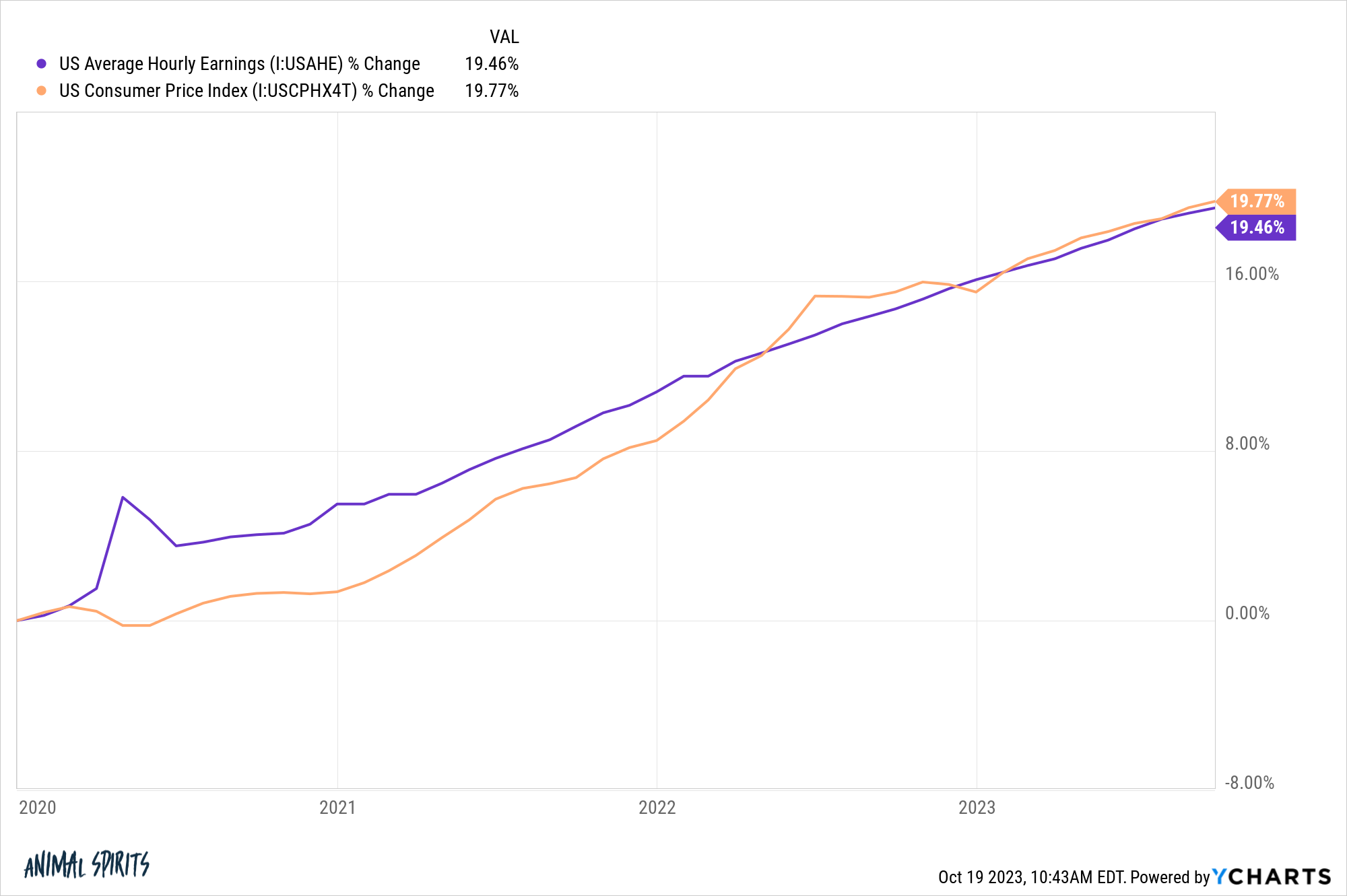

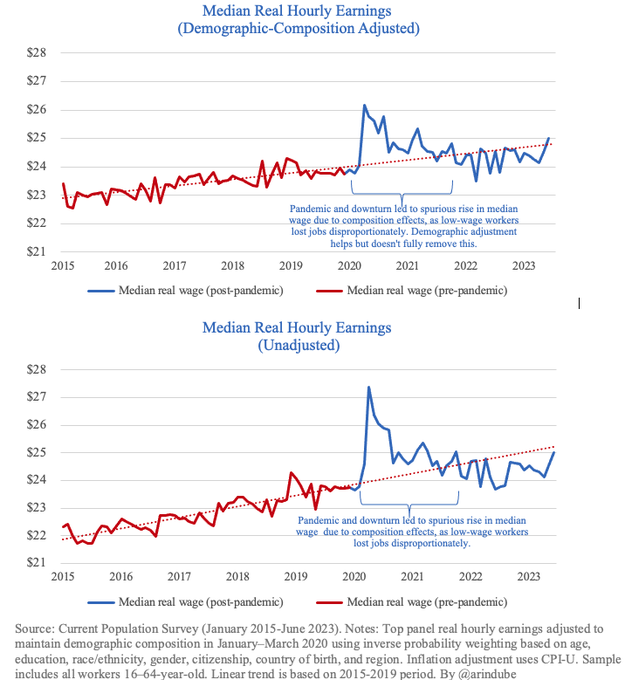

During the worst inflation of the past 40+ years, wages have been keeping pace with prices:

In fact, we’re back on trend for pre-pandemic wage growth (via Arin Dube)

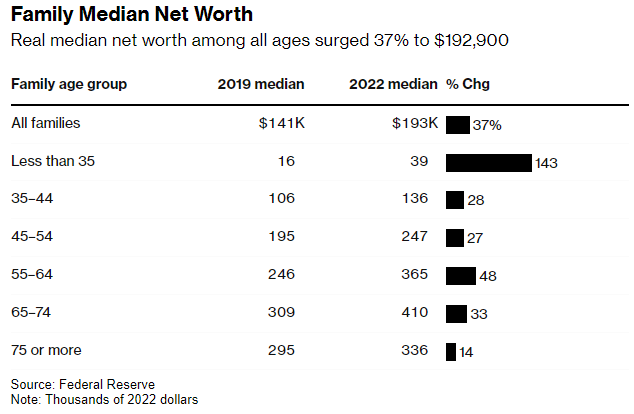

Plus Americans just experienced their largest three year increase in wealth ever going back to 1989:

Per Bloomberg:

Inflation-adjusted median net worth jumped 37% to $192,900 from 2019 to 2022, according to the Federal Reserve’s Survey of Consumer Finances out Wednesday. That marked the largest three-year increase in data back to 1989, and it was more than double the next-largest one on record, the Fed said.

Read that again. We just had the largest three year jump in wealth in this country and it was more than double the next-largest increase on record.

Listen, America is not bulletproof.

We have a lot of problems in this country.

We’ve always had problems and we’ll certainly have more problems in the future.

Maybe our hubris will take us down someday.

But to the doomers predicting the end of the U.S. empire, I say: Good luck betting against America.

It’s always been a losing trade and I don’t see that changing anytime soon.

Michael and I talked about the American empire and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why I Remain Bullish on the United States of America

Now here’s what I’ve been reading lately:

Books:

Video:

1I’m going to have more to say