JHVEPhoto/iStock Editorial via Getty Images

V.F. Corporation (NYSE:VFC) stock price is down 55% year-to-date as high inflation around the world, hiked interest rates, and COVID-19 restrictions especially in China, caused the company’s 2Q 2023 (three months ended September 2022) revenue in the Americas region, EMEA region, and APAC region to be lower than in 2Q 2022 (three months ended September 2021). Due to partial recovery of the Consumer Sentiment Indices, lower inflation rates, easing the lockdowns in parts of China, plunged freight rates, and lower USD strength against major currencies (compared with two months ago), VFC’s revenues in the three months ended December 2022 are supported. However, interest rates and inflation rates are still high and the global economic recession is still out there. Freight rates are still significantly high and the negative impact of appreciated USD against major currencies on VFC’s revenues is not negligible. Furthermore, due to hiked energy prices, a considerable part of consumer expenditures will be devoted to energy in the following months (as a result of colder temperatures). V.F. Corporation expects its full-year 2023 adjusted EPS to be between $2.40 to $2.50, compared with the full-year 2022 adjusted EPS of $3.18, and the full-year 2023 previous outlook of $2.60 to $2.70. The stock is a hold.

Quarterly results

In its 2Q 2023 (quarter ended on 1 October 2022), V.F. Corporation reported revenues of $3081 million, compared with 2Q 2022 revenues of $3198 million, down 4% YoY, driven by lower Vans revenues (down 13% YoY), lower Timberland revenues (down 4% YoY), lower Dickies revenues (down 19% YoY), partially offset by higher The North Face revenues (up 8% YoY), and higher other brands revenues (up 4% YoY). In the Americas region, VFC’s revenues decreased from $1807 million in 2Q 2022 to $1754 million in 2Q 2023. In the EMEA region, the company’s revenues decreased from $973 million in 2Q 2022 to $932 million in 2Q 2023. Finally, in the APAC region, VFC’s revenues decreased from $419 million in 2Q 2022 to $394 million in 2Q 2023. VFC’s international revenues decreased from $1583 million in 2Q 2022 to $1511 million in 2Q 2023. V.F. Corporation reported direct-to-customer (DTC) revenues of $1146 million in 2Q 2023, down 4% YoY. Also, its wholesale revenues decreased by 4% YoY to $1935 million in 2Q 2023.

VFC’s total costs and operating expenses increased from $2640 million in 2Q 2022 to $3171 million in 2Q 2023. As a result of increased expenses, decreased revenues, and noncash impairment charges related to the Supreme reporting unit goodwill and indefinite-lived trademark intangible asset of $422 million, V.F. Corporation’s net income of $464 million for the three months ended September 2021 (2Q 2022), turned into a net loss of $118 million for the three months ended September 2022 (2Q 2023). The impairment charges were driven by non-operating factors including higher interest rates and foreign currency fluctuations. On an adjusted basis (adjusted for the non-cash impairment of $422 million), VFC’s EPS in 2Q 2023 was $0.73 compared with 2Q 2022 adjusted EPS of $1.11. The company reported an adjusted operating income of $379 million compared with the 2Q 2022 adjusted operating income of $534 million.

VFC announced a cash dividend of $0.50 per common share for the three months ended September 2022 compared with $0.49 per common share for the same period last year. VFC’s short-term borrowing increased significantly from $10 million in September 2021 to $1693 million in September 2022. On the other hand, the company’s long-term debt decreased from $4683 million in September 2021 to $3526 million in September 2022. VFC’s cash, cash equivalents, and restricted cash decreased from $1362 million in September 2021 to $554 million in September 2022.

“VF’s balanced performance in Q2 demonstrates the resiliency of our brand portfolio against a more disrupted global marketplace. Our purpose built portfolio of iconic, deeply-loved brands continues to benefit from tailwinds in the outdoor, active, streetwear and workwear spaces while we also actively address the near-term challenges at Vans, the ongoing COVID-related disruption in China, and the broader macro-economic and geopolitical headwinds, which have created tremendous uncertainty for all businesses and consumers,” the CEO commented.

A multidimensional analysis on VFC’s revenues

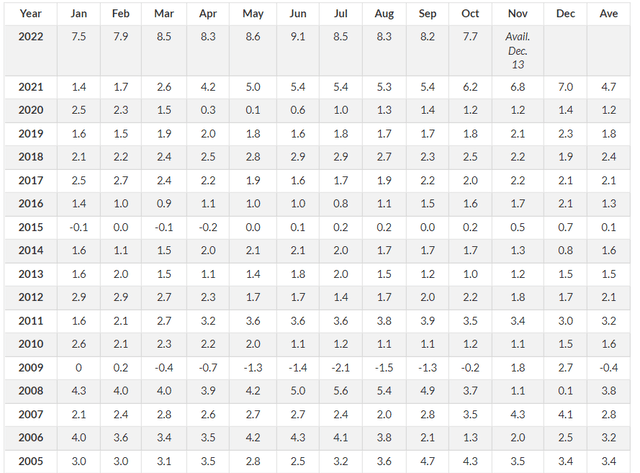

Due to the increased inflation rates in 2022, consumer spending on VFC products decreased. Figure 1 shows that in the United States, the monthly inflation rates in July, August, and September 2022 were 8.5%, 8.3%, and 8.2%, respectively. In October 2022, the U.S. monthly inflation rate decreased to 7.7%. As a result of the Federal Reserve’s continuing tight monetary policy, the U.S. inflation rate in October 2022 was lower than in the last 8 months. However, inflation rates are still historically high.

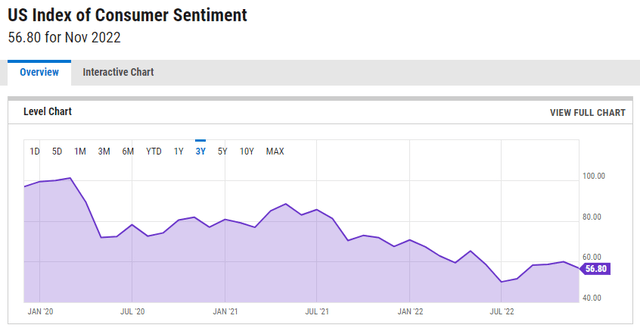

According to Figure 2, the U.S. Index of Consumer Sentiment (ICS) decreased significantly in the past two years. In July, August, and September 2022, ICS was 51.50, 58.20, and 58.60, respectively. It increased to 59.90 in October; however, it decreased to 56.80 in November due to rising borrowing costs, declining asset values, and weakening labor market expectations.

Figure 1 – U.S. monthly inflation rates

Figure 2 – US Index of Consumer Sentiment

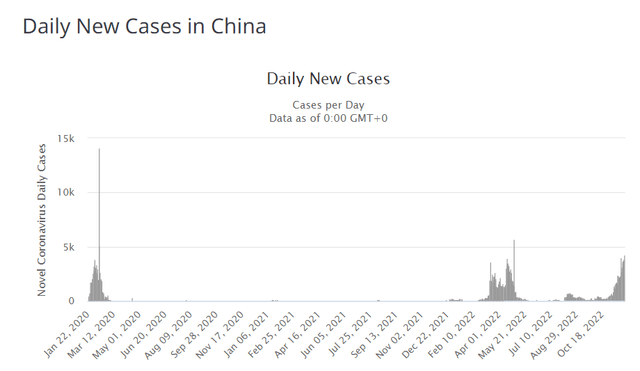

In China, it seems that the government is starting to ease its COVID-19 restrictions as a result of recent protests In Guangzhou, residents returned to work, in Chongqing, some residents were no longer required to take regular Covid tests, and in Beijing, a senior health official played down the severity of current Omicron variants. Also, in Shanghai, 24 districts were released from lockdowns. However, it is worth mentioning that the number of daily new COVID-19 cases in China has been increasing (see Figure 3) in the past few weeks, implying that we cannot expect lockdowns in China to end completely soon.

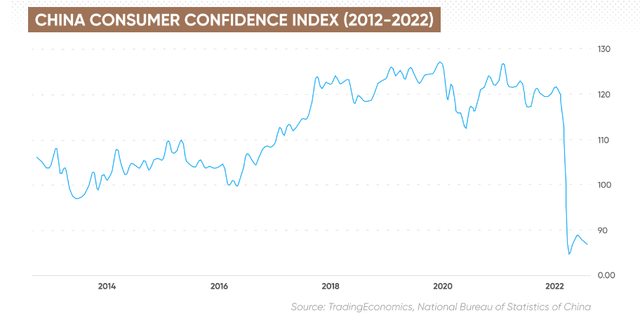

Figure 4 shows that Consumer Confidence Index in China plunged in 2022. As the lockdowns in China ease further, the country’s Consumer Confidence Index may recover.

Figure 3 – Daily COVID-19 new cases in China

Figure 4 – China Consumer Confidence Index

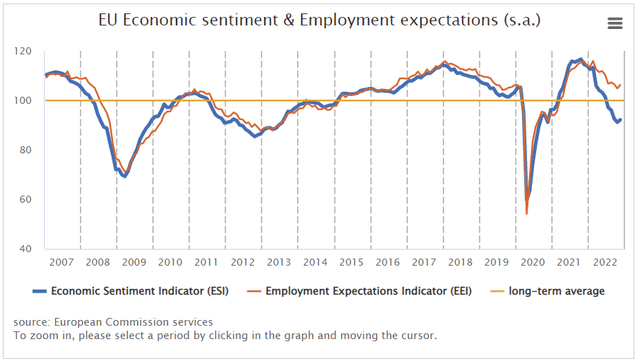

In European Union, the Economic Sentiment Indicator (ESI) increased in November 2022 as a result of more optimism among consumers and services (for the first time since February). Also, the EU’s Employment Expectation Indicator (EEI) increased in November 2022 (see Figure 5). However, ESI and EEI are considerably lower than a year ago, meaning that the EU is still in a recession. As the war in Ukraine is still going on, I don’t expect the economy of the European Union to recover to its past standards soon

Figure 5 – EU’s ESI and EEI

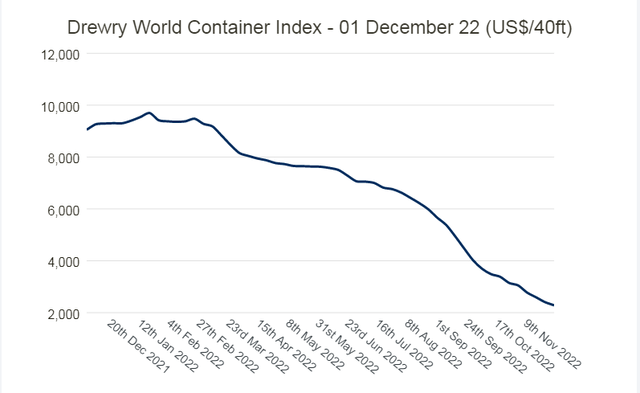

According to Figure 6, in the week ended 1 December 2022, Drewry World Container Index decreased for the 40th consecutive week, down 75% compared with the same week last year. The Drewry World Container Index is of $2284 per 40-foot is now 78% below the peak of $10377 (in September 2021). However, it is 61% higher than average 2019 (pre-pandemic) rates of $1420 per 40-foot vessel. It means that VF will face lower supply chain disruptions in the future.

Figure 6 – Drewry World Container Index

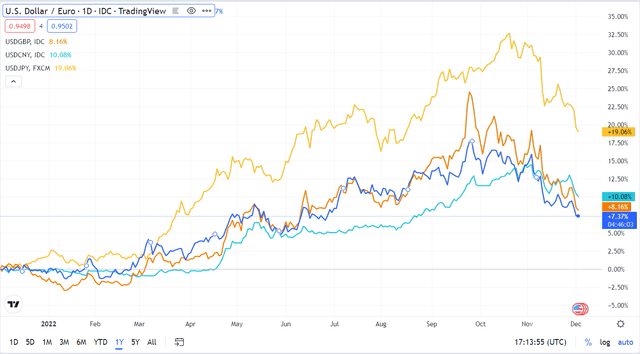

Moreover, as a result of the U.S. dollar appreciation, VFC revised its earnings outlook to reflect increased negative impacts from foreign currency fluctuations. Figure 7 shows that the USD has significantly appreciated against EUR, GBP, JPY, and CNY from December 2021 to October 2022. However, in the past few weeks, USD has lost some of its strengths against the mentioned currencies, implying that the negative impacts of foreign currency fluctuations on VFC’s earnings in its 3Q 2023 quarter may be lower than in the company’s 2Q 2023 quarter.

Figure 7 – USD against EUR, GBP, JPY, and CNY

According to EIA, due to colder forecasted temperatures this winter and higher heating oil prices, the average U.S. home expenditure on heating oil will increase by 45% compared with last winter. Also, the average U.S. home expenditure on natural gas will be higher than last winter. Thus, U.S. consumers will spend a greater portion of their disposable income on energy in the following months. Also, energy prices in European Union are still very high. Thus, in my opinion, a great part of the consumer expenditures in the EU will be devoted to energy in the following months.

Summary

Altogether, V.F. Corporation’s financial results in the second half of its fiscal year will not be better than in the first half. The world is still in recession and despite lower inflation rates and better consumer sentiments in the United States, European Union, and China, I don’t expect VFC’s revenues to improve significantly in the following months. The stock is a hold.