The Chartered Insurance Institute said its confidence has been restored in the Personal Finance Society, following “positive” conversations at both boards.

CII Group chief executive Alan Vallance told Money Marketing: “The recent conversations we have been having at both boards have been very constructive. That’s something we’ve relayed to our members directly.”

He said the boards have seen “a lot of the issues recognised” and some “constructive proposals formed”.

“The CII Group is much more reassured about the PFS going forward, which is really positive,” he added.

The PFS held its annual general meeting in late September. Vallance said members of its board provided a similar summary to their members.

“We are all in the same place – looking forward to the future, rather than back to the past,” he added.

Vallance was appointed as the new CEO of the CII in April 2022, a month after previous CEO Sian Fisher stepped down.

He took up the role in August 2022, the same day as Don MacIntyre became interim CEO for the PFS. The PFS is still yet to appoint a permanent CEO.

The CII and the PFS had been at loggerheads for months and, just before Christmas last year, the deteriorating relationship between the two bodies came to a head.

The dispute centered on the status of the PFS within the broader CII group, with management of both parties making allegations against the other.

On 21 December the CII Group appointed a majority of directors to the PFS board, after “independent mediation” failed.

The CII accused the PFS of being poorly run and insisted a series of “serious governance risks” at the PFS left it with “no alternative” but to step in.

Among the failures listed were a “lack of collective decision making” by the PFS board and a “failure to act in line with the articles of association” approved by PFS members.

The PFS hit back and said these allegations were simply a “smokescreen” to distract from the CII’s own failings to acknowledge or listen to PFS member concerns.

PFS member director Vanessa Barnes accused the CII of “scheming to take control of the PFS reserves”.

In an email to CII Group chair Helen Phillips seen by Money Marketing, she said: “I recognise that you have changed your strategy with regard to the attempts to de-register the PFS following three failed attempts.

“I am concerned however that you will use the majority to take the PFS member reserves by stealth.”

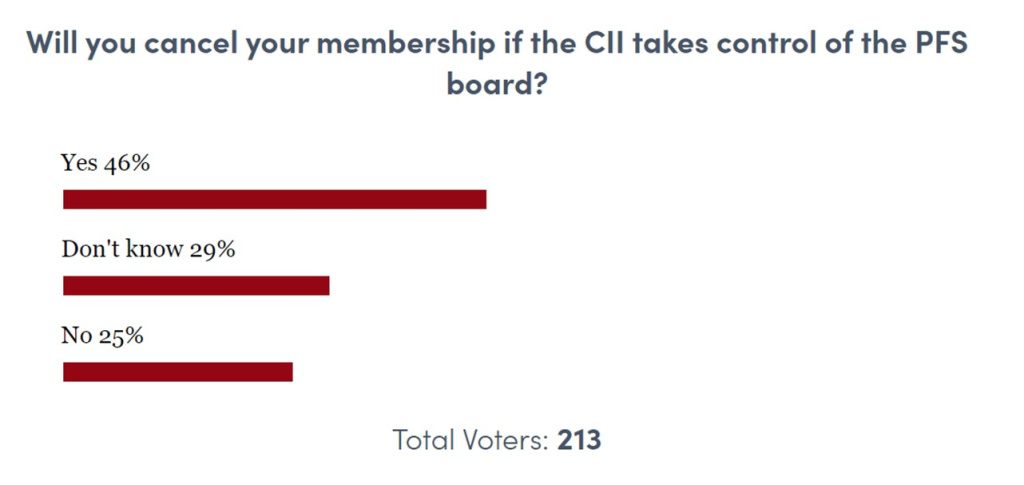

A January reader poll on Money Marketing suggested the majority of members would leave if the CII took over the PFS.

In January this year, the PFS began a consultation process, asking members what they consider an appropriate representative board structure for the PFS.

It also looked into how the CII’s decision could impact PFS members in regard of chartered status, SPS [statement of professional standing], access to exam and CPS [continuing professional development].

In February, the PFS board shared a summary of its consultation findings with the CII.

Then, in July, the PFS appointed Carla Brown and Daniel Williams as directors to its board.

It followed the news the previous month that two independent directors had resigned from the board due to “significant concerns” regarding the independence of the organisation.