Should you lock in a mortgage rate before the next Fed meeting? Experts explain how to ease interest rate misery

Homebuyers might be better off locking in a mortgage rate now amid the strong possibility that interest rates will increase further this year, experts warn.

The Federal Reserve held interest rates steady at its meeting last month – keeping benchmark borrowing costs between 5.25 and 5.5 percent.

But economists are becoming increasingly convinced that the central bank will hike rates by a quarter percentage point before the end of the year in a bid to curb inflation – and rates are likely to remain high for a while after that.

While the Fed does not directly dictate mortgage rates, its actions influence the real estate market.

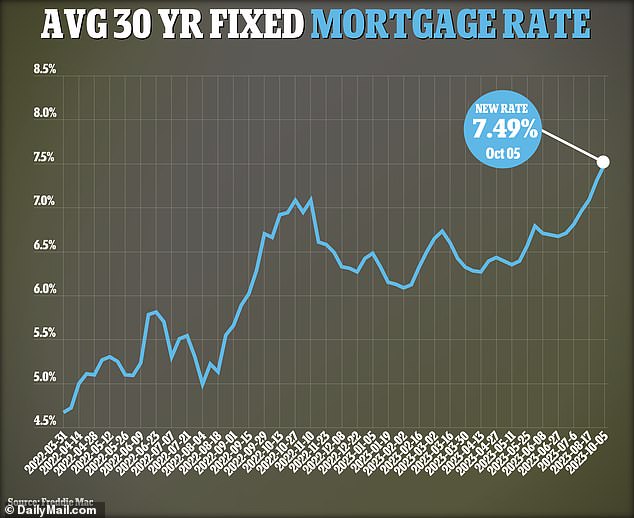

The average 30-year fixed-rate mortgage has soared to 7.49 percent, according to the latest data from lender Freddie Mac. But it could surge even higher in the coming months – so it may be wise to lock in sooner rather than later.

The average 30-year fixed-rate mortgage has soared to 7.49 percent, according to the latest data from lender Freddie Mac

Volatile mortgage rates have been one of the most talked-about consequences of economic turmoil since the Fed began hiking interest rates in March 2022.

Deals on a 30-year fixed-rate mortgage are not tied by the Fed’s funds rate but by the yield on 10-year Treasury bonds.

Such yields are influenced by inflation, Fed actions and the response of investors.

Financial expert Andrew Lokenauth told DailyMail.com: ‘If you want to buy, you should lock in a fixed rate right now.

‘The way the Fed is moving and raising their rates, it’s going to trickle back down to consumers.

‘I think interest rates are going to continue to go up this year and perhaps into next year – and then maybe in 2025 they will level off.’

He advised that Americans should consider their options. ‘If you lock in a deal today and rates go down, you can always refinance. And if rates go up, you locked in a good deal and you look like a genius.’

There are many online tools which will tell you when your break even point is and when refinancing will make sense, he added, as you will have to pay a fee to do so.

‘If refinancing will save you money in the first year or two, then you should do it,’ he said.

Lokenauth, founder of TheFinanceNewsletter.com, warns that home buyers should never get an adjustable rate because if prices go up, you’re going to be paying more and you might not have that in your budget.

‘A fixed rate is the best thing to do because you can budget it in,’ he said.

Financial expert Andrew Lokenauth told DailyMail.com: ‘If you want to buy, you should lock in a fixed rate right now’

A widespread shortage of homes for sale is also likely to contribute to mortgage rates staying higher for longer, Lokenauth said.

Homeowners who are locked into cheap mortgages of 2 or 3 percent are refraining from selling, which is restricting housing supply and in turn pushing up property prices.

Pending home sales are down 13 percent from a year ago, according to real estate company Redfin, and the total number of home sales is down 16 percent year-on-year to September.

Jeff Scott, from First Option Mortgage in Atlanta, Georgia said the ‘massive supply and demand issue’ is a reason for home buyers to lock in at the current rate – and they may have more power when negotiating a deal.

‘There are far more buyers than sellers in the current market,’ he told DailyMail.com. ‘This is causing sellers to offer more concessions to buyers so they can buy-down rates.’

Buy-downs involve a seller agreeing to pay a lump sum of money that is then used to reduce a buyer’s interest rate over a set period of time – and it can shave thousands off their loan repayments.

‘With several clients, we’ve offered what’s called a 2/1 buy-down,’ he said.

‘What this does is buy down the interest rate by two points in year one, and one point lower in year two, before going to the note rate in year three. This takes the stress of a high monthly payment off the buyer for two years.

‘As inflation cools and rates drop, the buyer can then refinance under the lower note rate without missing out on what is still very strong appreciation.’

Scott said the concession had become a ‘savior’ for a lot of people in the current environment.

‘They have become extremely popular as it means the homebuyer is able to buy more time.’

The seller also benefits, he added, as they are able to get the sale through as we head into what could be a difficult winter ahead.