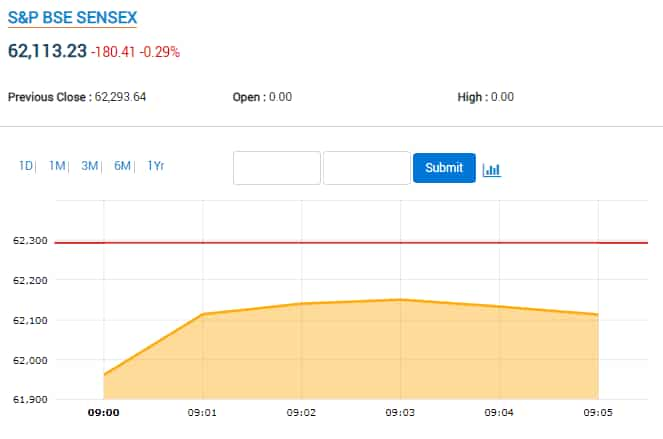

Indices scale new highs, Sensex tops 62,500, Nifty above 18,550; Energy shines

The rising number of cases of Covid in China and citizens retaliating against the Zero-Covid policy kept markets under pressure on Monday with most indices losing ground. Tokyo ended lower and Hong Kong/China indices tumbled sharply. European market is also trading lower in the morning session.

Indices defied global headwinds with Sensex jumping 200 points and Nifty 50 points

Indian stock market remained immune to negative global cues with indices touching record highs on Monday but trimmed some of the gains towards the end.

The strong showing helped Sensex close above the 62,500 mark and the Nifty to go above 18,600 intraday. Sensex ended 211 points higher to close at 62,504, while Nifty gained 50 points to end at 18,562.

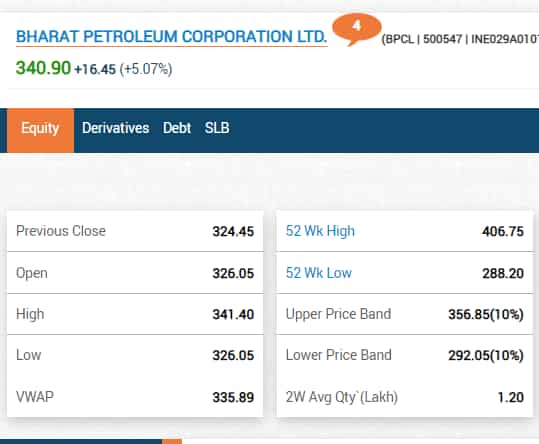

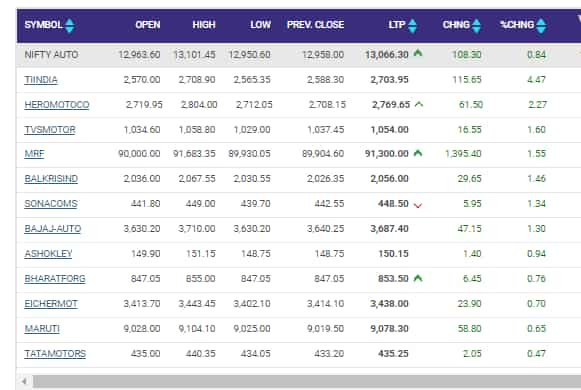

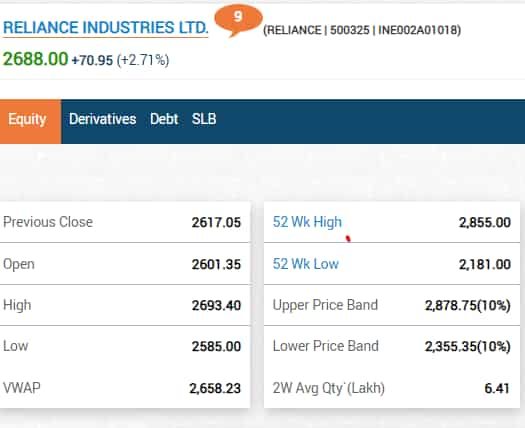

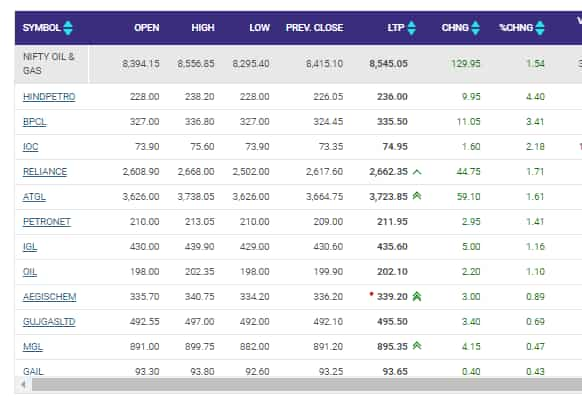

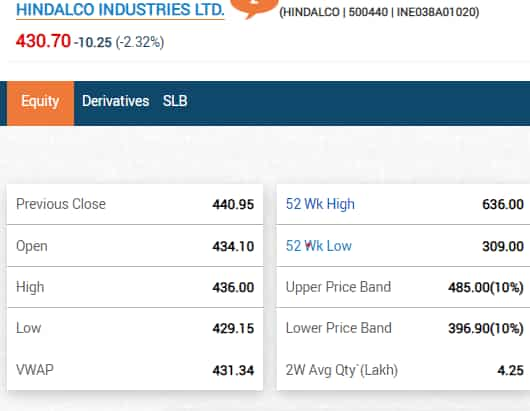

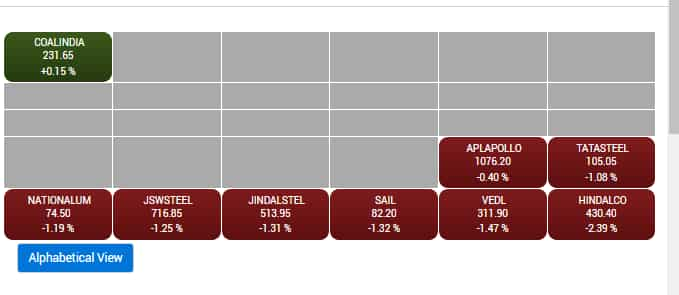

Oil & Gas stocks got the boost due to a dip in global crude prices with the index jumping 1.5%. Auto stocks also remained strong. Metal struggled in today’s session and shed 1%.

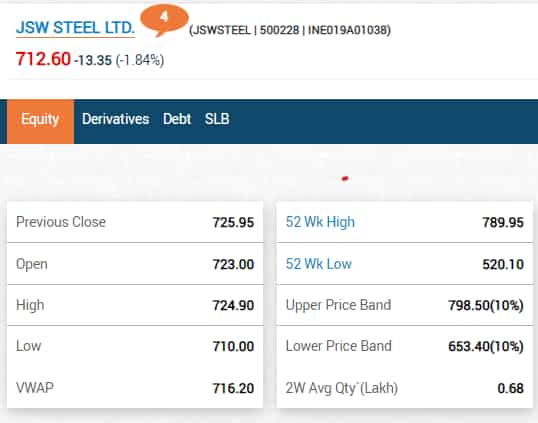

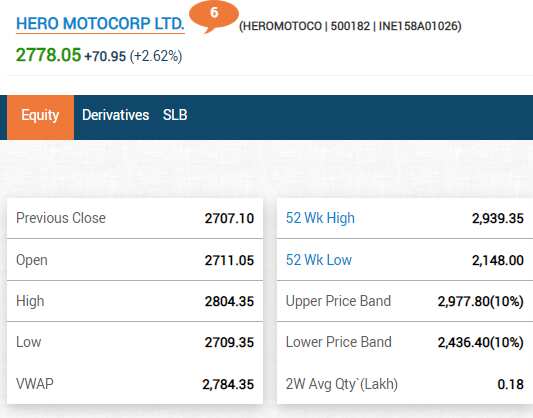

Among stocks, BPCL jumped 5% followed by Reliance Industries and Hero MotoCorp. Hindalco and JSW Steel contributed to the drag in the metal index. Apollo Hospitals also shed in today’s session.

Asian stocks remained under pressure as protests in China over renewed COVID-19 clampdowns hurt investor sentiment.

Japan’s Nikkei closed lower as tech stocks declined in line with their Wall Street peers. The Nikkei ended the day down 0.42%.

A sense of chaos and uncertainty swept through Chinese markets on Monday as growing protests against Covid curbs and a record number of infections complicated the nation’s path to reopening.

The Hang Seng China Enterprises Index closed down 1.7% after slumping as much as 4.5% earlier. On the mainland, the CSI 300 Index closed down 1.1%, its biggest decline in a month.

The European stock benchmark was dragged lower by oil and mining companies as events in China weighed on commodity prices. The STOXX index was trading lower in the morning session.

View Full Image

FM Nirmala Sitharaman urges startups to focus on climate change solutions

Union Finance Minister Nirmala Sitharaman suggested startups to focus on climate change and farming solutions. Speaking at Vananam Startup Inclusion Summit , Sitharaman pointed out that India, which is playing its role in the Paris Agreement on Climate Change, should find solutions to address the vagaries of climate change

Addressing the national-level summit organised by Vananam to promote inclusion in the start-up ecosystem in India, she said, “Atmanirbhar Bharat is not just for defence or strategic matters, food security or manufacturing areas. It is also self-sufficiency to be able to transition to a better climate in India.” (Read More)

BPCL tops the stock charts; jumps 5% and leads the energy index surge

View Full Image

IndiGo to Wet Lease Boeing Wide-Body Jets to Meet Travel Demand

IndiGo is planning to fly another airline’s Boeing Co. larger jets as it tries to plug capacity gaps amid a surge in travel demand.

India’s biggest airline said in a statement Monday that it is working on finalizing a contract for inducting Boeing 777 aircraft on a so-called wet lease basis for the winter schedule. Wet leasing refers to the practice of leasing an aircraft, along with crew to fly the plane and provide service onboard.

IndiGo didn’t specify how many 777 jets would be involved or from what airline. A person familiar with the matter said India’s Directorate General of Civil Aviation had given IndiGo the green light to wet lease six 777s from Turkish Airlines for three months, with the ability to extend that arrangement. (Bloomberg)

Gold falls by ₹61; silver sheds ₹146

Gold price slipped by ₹61 to ₹52,822 per 10 gram in the national capital on Monday amid a fall in prices of the precious metal overseas, according to HDFC Securities.

In the previous trade, the yellow metal had touched ₹52,883 per 10 gram.

Silver also declined by ₹146 to ₹61,855 per kg.

“A weaker rupee and strong physical demand following the marriage season supported limiting the fall of domestic gold prices,” said Dilip Parmar, Research Analyst at HDFC Securities.

In the international market, gold was trading lower at USD 1,750.46 per ounce while silver was down at USD 21.25 per ounce. (PTI)

Goldman says China may end covid zero earlier than expected

China may end its Covid Zero policy earlier than previously expected, with chances growing of a messy and slow exit as infections spread and residents protest virus controls.

Goldman Sachs Group Inc. forecasts a 30% probability of China reopening before the second quarter of 2023, saying there’s some chance of a “disorderly” exit. Teneo Holdings LLC said the social unrest could prompt the government to move faster in adjusting its zero-tolerance approach to combating infections. (Read More)

Kotak Mahindra Asset Management on markets touching record high: Near-term volatility should not deter investors from following their asset allocation

Nilesh Shah, Managing Director, Kotak Mahindra Asset Management Company: “The markets touched all-time high thanks to the systematic investment plan (SIP) flows. Investors should maintain their asset allocation and SIP investment with long-term outlook. Near-term volatility should not deter investors from following their asset allocation.”

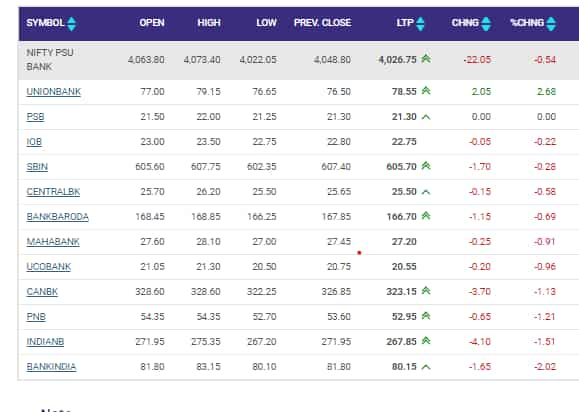

PSU Bank index under pressure with most stocks trading in red

View Full Image

PV sales in India set to hit record 3.8 million units in FY23: Icra

The passenger vehicle (PV) market is set to touch an all-time high of 3.7-3.8 million units in FY2023, a growth of 21-24% over the previous fiscal, driven by robust demand, according to a report by ratings firm Icra.

“With ease in supply chain constraints and semi-conductor shortage, capacity utilisation of the OEMs improved to healthy levels over the past few quarters – factoring in a continuation of strong demand sentiments, the OEMs have now revved up their capacity expansion plans,” the report said. (Read More)

Cement industry margins set to contract in FY23; price hikes imminent

Cement companies are expected to register a 8-9% rise in their volumes in FY23 on strong demand, but operating profit margin may decline due to high input costs, CareEdge Ratings said on Monday.

“Driven by the housing and infrastructure sectors, the cement industry has witnessed a V-shaped recovery and healthy growth in FY22. At 350 million tonnes, the demand surpassed pre-Covid levels of 331 MT in FY19 and is expected to grow by 8-9% y-o-y in FY23,” the report said. (Read More)

Cosmo First’s board to consider share buyback this week; stock jumps 9%

Cosmo Films on Monday informed that its board of directors will meet this week on Thursday, December 1, 2022 to consider the proposal of buyback of equity shares of the company. Cosmo Films shares were trading more than 9% higher at ₹761 apiece on the BSE in afternoon deals.

“This is to inform you that the meeting of Board of Directors of the Company is scheduled to be held on Thursday, December 01, 2022, inter-alia to consider a proposal for Buyback of Equity Shares of the Company and other matters necessary/ incidental thereto,” the company said in an exchange filing today. (Read More)

Aditya Birla Group invests in 8 D2C brands

TMRW, an Aditya Birla Group venture and a wholly-owned unit of Aditya Birla Fashion Retail Ltd (ABRFL), on Monday announced investments with eight digital-first lifestyle brands foraying into casual wear, kid’s wear and western wear market.

The D2C brands include women’s western wear label Berrylush, apart from casual wear brand Bewakoof; women’s casual and western wear brand Juneberry. The company has also invested in teen’s occasion wear brand Natilene, kid’s wear label Nauti Nati and athleisure and active wear under Nobero, apart from casual and denim wear brand Urbano and casual wear and fast fashion label Veirdo. (Read More)

Zydus Lifesciences gets USFDA nod for thyroid hormone deficiency drug

Zydus Lifesciences has received approval from the United States Food and Drug Administration (USFDA) to market Levothyroxine Sodium injection, used to treat thyroid hormone deficiency. The company’s US-based unit has received tentative approval from the US Food and Drug Administration (USFDA) to market the medication, the drug firm said in a regulatory filing.

“Zydus Lifesciences Limited’s (formerly known as Cadila Healthcare Limited) U.S. subsidiary Zydus Pharmaceuticals (USA) Inc. has received tentative approval from the United States Food and Drug Administration (USFDA) to market Levothyroxine Sodium for injection, 100 mcg/vial, 200 mcg/vial, and 500 mcg/vial,” Zydus Lifesciences said in a regulatory filing. (Read More)

JSW Steel is one of the biggest laggards of the day; sheds around 2%

View Full Image

Strong bank loan growth in FY23 despite higher interest rates: Fitch

Fitch Ratings on Monday said India’s bank credit will see strong growth in current financial year despite effects of higher interest rates.

It said the strong loan growth should benefit net revenue, particularly as it will be coupled with wider net interest margins.

“We see bank credit expanding by around 13 per cent in FY23, up from 11.5 per cent in FY22. The acceleration will be driven by the normalisation of economic activity after the COVID-19 pandemic, and high nominal GDP growth, which we expect to boost demand for retail and working-capital loans,” Fitch said in a statement.

Fitch forecasts India’s real GDP growth at 7 per cent in 2022-23. It said Indian banks generally remain open to additional capital-raising to fund growth, despite the rise in rates. (PTI)

Taiwan Stocks Sink After Ruling Party’s Local Elections Defeat

Taiwan stocks dropped on Monday, weighed by ruling party DPP’s resounding defeat in local elections and amid a broader selloff across Asia.

The benchmark Taiex slid 1.5%, the most since Oct. 13, as investors worried that the government may stop support measures for the market after opposition Kuomintang’s victory at the polls. The party, which favors eventual unification with China, held onto 13 seats at Saturday’s elections.

The riskoff sentiment in Taiwan was in line with a wider decline across the region as protests against China’s Covid restrictions over the weekend prompted traders to re-think investment plans after jumping back in on reopening hopes.

Results of the local elections may only impact markets for a day, according to Li Fang-kuo, chairman at President Capital Management in Taipei. Further out, “we are still positive on the outlook of stocks as Taiex usually rises in December.” (Bloomberg)

Gold prices in India drop for second day on China jitters, silver rate plunges

Gold prices in India dipped today while silver plunged, tracking a similar global trend as covid protests in China dampened global risk sentiment. Gold futures on MCX fell 0.25% to ₹52,420 per 10 gram, extending losses to the second day. Silver fell 0.8% to ₹61,185 per kg. Other commodities including metals and crude dropped today as unrest in China dampened demand outlook.

Protests in China have dampened global risk sentiment, according to analysts. “Risk off moves are seen across asset classes this Monday morning in Asia session. The dollar has strengthened across the board, especially against commodity currencies,” IFA Global said in a note. (Read More)

Tokyo shares closed lower on Monday with the markets dragged down by tech-linked shares

The benchmark Nikkei 225 index eased 0.42%, or 120.20 points, to 28,162.83, while the broader Topix index fell 0.68%, or 13.69 points, to 2,004.31. (AFP)

Indices remain in green with Sensex adding 280 points and Nifty 75 points

Auto and Oil & Gas indices lead the rally, while Metal index drags.

View Full Image

What Tata Consumer’s potential Bisleri acquisition could mean for the stock

Bisleri International Pvt. Ltd is in advanced discussions to sell its business, comprising its flagship bottled water brand Bisleri, and Tata Consumer Products Ltd (TCPL) is a frontrunner while other companies are in the race too, as the deal is yet to be finalized.

“Tata Consumer (TCPL) might acquire Bisleri, India’s largest water brand. We like TCPL’s strategy of undertaking bolt-on and niche acquisitions (SOULFULL, whose distribution Tata scaled up 10x). Bisleri is likely to turn in revenue/PAT of ₹25 bn/ ₹2.2 bn in FY23E. Yet, if TCPL acquires it only via debt, interest cost may dent profits from Bisleri,” said brokerage and research firm Edelweiss in a note. (Read More)

Rekha Jhunjhunwala-owned infra stock hits 52-week high. Do you own?

Nagarjuna Construction Company or NCC is one of those Rekha Jhunjhunwala stocks that has slowly but steadily surged to the tune of more than 30 per cent in the last six months. The stock was hit badly post-spread of the Covid-19 pandemic but ace investor Rakesh Jhunjhunwala and his wife Rekha Jhunjhunwala kept their faith in this infrastructure stock. Continuing its uptrend, NCC’s share price today climbed to a new 52-week high of ₹84 apiece levels on NSE. In early morning deals on Monday, NCC shares opened upside and surged over 3 per cent hitting above the mentioned 52-week high. (Read More)

Auto index remains stable in today’s session with almost all stocks in the index in green

View Full Image

From Near 70%, Sri Lanka Sees Inflation at 4%-5% by End 2023

Sri Lanka’s inflation is expected to significantly cool in the coming months after peaking near 70% this year, and the nation may gradually relax a currency band as inflows improve, central bank governor Nandalal Weerasinghe said.

Consumer price gains “will continue on the disinflation path,” Weerasinghe said at a CT CLSA investor forum in Colombo on Monday. He added that inflation is expected to ease to 4%-5% by the end of 2023 and the central bank’s monetary policy transmission is working. As foreign currency inflows improve, the government can also gradually relax a currency band since the nation needs a flexible exchange rate for inflation targeting, he said.

The troubled South Asian economy has raised borrowing costs by 950 basis points this year, taking the key rate to 15.5% as inflation surged to become Asia’s fastest. Prices, however, cooled in October for the first time in a year amid improving domestic supply conditions and tighter monetary policy. (Reuters)

Reliance amongst biggest gainers today; adds 2%

View Full Image

Dhruva Space looking to raise $20-25 mn in 2 years for satellite infra facilities

Dhruva Space, which has sent two tiny satellites recently, is looking to raise USD 20-25 million in the next one to two years to create infrastructure facilities here to be able to launch satellites weighing up to 100Kg, Abhay Egoor, co-founder and CTO of the city-based startup said. He also said after the successful launch of Thybolt 1 and Thybolt 2-the tiny satellites into space, the firm is now currently working on a satellite weighing about 30 kg which will be broadly catering to communications and scientific applications, on their P30 platform. “We are looking to raise or invest about USD 20 to 25 million over the next 1-2 years where this amount of capital would be used to invest and build an infrastructure facility for assembly, integration and testing of satellites up to 100 kg class. We are exploring setting up the same facility in Hyderabad. We are already in conversation with parties,” Egoor told PTI. (PTI)

Covid-19: India’s active cases down to 5123

India’s active covid case tally fell to 5,123, with 291 new coronavirus infections reported in the last 24 hours, the Union health ministry said in an update on Monday. The country’s total reported cases so far, since the pandemic hit in early 2020, stands at 4.46 crore covid, while the death toll is at 530,614.

Active cases account for 0.01% of total reported infections, while the recovery rate stands at 98.80%, according to the health ministry. (Read More)

Indian stock markets may rally further, signal F&O bets of foreign investors

Overseas investors have stepped up their return to Indian equities, helping power benchmarks gauges to record highs and derivatives data signals more room for the rally. Global funds have bought a net $3 billion of India stocks so far this month, according to Bloomberg-compiled data.

Holdings of foreign investors in long index futures have risen by about six times from their September lows, to 127,000 contracts, while short bets have dropped 76% over the same period to 38,600 lots — the least bearish positioning since April. The spread between outstanding index futures longs and shorts now stands at its widest since June 2021. (Read More)

Oil & Gas index jumps 1.5% with almost all stocks in green;

View Full Image

Axis Securities Pick of the Week – Cholamandalam Investment & Finance Company (CIFC)

Axis Securities Pick of the Week – Cholamandalam Investment & Finance Company (CIFC)

Outlook & Valuation: CIFC is witnessing increasing disbursements which will help grow its AUM moving forward. The company has managed the Covid-19 pandemic well, thanks to its well-diversified portfolio, robust capitalisation, comfortable liquidity, and cost rationalisation initiatives. The expectation of an increase in the cost of funds, Opex at an elevated level and maintaining NIM in an increasing interest rate scenario would pose a challenge to CIFC. However, management commentary on CIFC growing at a higher rate than the industry because of value growth in terms of inflation and cost of the vehicle as well as growth in market share was encouraging. CIFC with its conservative management, comfortable liquidity position, and diversified portfolio mix is well-placed to ride on the expected demand recovery.

Recommendation: We recommend a BUY rating on the stock with a target price of ₹793/share, implying an upside of 10% from the CMP

Time to bet hard on small caps, says Basant Maheshwari

Calling it the right time to bet on small cap companies, BMS Fund Manager Basant Maheshwari said it will soon launch his ‘BM Small Cap Secular Growth smallcase’ scheme.

Basant Maheshwari announced on twitter the launch of the new scheme and said they will be investing ₹5 lakh every month in it. He also stressed upon the small cap investment being the right choice in the current scenario. (Read More)

Hindalco among the biggest laggards today; sheds more than 2%

View Full Image

India’s economy likely slowed to annual 6.2% in July-Sept: Reuters Poll

The Indian economy likely returned to a more normal 6.2% annual growth rate in July-September after double-digit expansion in the previous quarter, but weaker exports and investment will curb future activity, a Reuters poll showed.

In April-June, Asia’s third-largest economy showed explosive growth of 13.5% from a year earlier thanks mainly to the corresponding period in 2021 having been depressed by pandemic-control restrictions.

But with the Reserve Bank of India (RBI) now raising interest rates to tamp inflation running above its target range of 2% to 6% target, the economy is set to slow further.

The 6.2% annual growth forecast for latest quarter in a Nov. 22-28 Reuters poll of 43 economists was a tad lower than the RBI’s 6.3% view. Forecasts ranged between 3.7% and 6.5%. (Reuters)

Metal stock trades ex-bonus issue. Brokerage has ‘Buy’ tag

Shares of Maharashtra Seamless started trading ex-bonus on Friday, November 25, 2022. The company last month announced the issue of bonus equity shares of the company in the ratio of 1:1 and fixed record date as Monday, November 28, 2022.

“We have not changed our estimates and only given effect to increase in the no of shares. Consequently, we have revised our target prices from ₹930 to ₹465. Maintain buy,” said brokerage PhillipCapital in a note on Friday. (Read More)

Rupee slips 6 paise to 81.77 against US dollar

The rupee depreciated 6 paise to 81.77 against the US dollar in early trade on Monday, tracking a lacklustre trend in domestic equity markets and a firm American currency overseas.

However, lower crude prices in the international market and fresh foreign fund inflows restricted the rupee’s fall, forex dealers said.

At the interbank foreign exchange, the domestic unit opened weak at 81.81 against the dollar, then gained some ground to quote 81.77, registering a decline of 6 paise over its previous close.

In the previous session on Friday, the rupee weakened by just one paisa to end at 81.71 against the dollar. (PTI)

Metal index under pressure early in the day; sheds 1% with most stocks in red

View Full Image

India New Issue-IDFC First Bank to issue 10-yr tier-II bonds -traders

IDFC First Bank plans to raise at least 5 billion rupees ($61.2 million) through Basel-III compliant tier-II bonds maturing in 10 years, three merchant bankers said on Monday.

The lender will offer a coupon of 8.70% on this issue, for which it has invited bids from investors and bankers on Tuesday between 11:00 a.m. and 12:30 p.m. IST on the National Stock Exchange’s electronic platform.

The issue also has a greenshoe option to retain an additional 10 billion rupees and a call option at the end of the fifth year from the allotment date. (Reuters)

Hero MotoCorp shines in early trading, gains 2.5%

Hero MotoCorp on Friday announced that it will be increasing the prices of its motorcycles and scooters soon. The price hike will vary as per specific models and markets and will be effective from December 1, 2022. As announced by the company, products will see a price rise of up to ₹1,500. This will be the fourth time Hero Motorcycles will get a price hike. The last price increase was announced in September this year. The price was increased by up to ₹1,000 then.

View Full Image

Uniparts India IPO: GMP steady ahead of subscription opening this week

Engineering systems and solutions provider Uniparts India on Friday said it has set a price band of ₹548-577 a share for its ₹836-crore initial public offering (IPO). The three-day initial share sale will open for public subscription on November 30 and conclude on December 2. The bidding for anchor investors will open on November 29.

Uniparts India IPO is entirely an Offer for Sale (OFS) of 14,481,942 equity shares by promoter group entities and existing investors. Since the IPO would be entirely an OFS, the company will not receive any proceeds from the public issue. At the upper end of the price band, the public issue is expected to fetch ₹836 crore. (Read More)

Indices fall at open as Sensex sheds 100 pts and Nifty 40

View Full Image

Axis Securities recommendation on Star Cement: Capacity Expansion to Drive Growth; Outlook Remains Positive

Axis Securities has issued Star Cement – Annual Analysis: cement demand is expected to be robust both in North-East and East regions driving the volume growth for the company. Its Siliguri grinding unit is ramping up well and higher capacity utilization of the unit will help the company in improving its fixed cost absorption and will also aid in its volume growth moving ahead. With better cement demand, higher pricing, stabilization of the Siliguri Grinding unit, and cost optimization measures(12mw WHRS plant) undertaken by the company, we foresee Star Cement reporting decent performance moving ahead. The stock is currently trading at 9x FY23E and 8x FY24E EV/EBITDA. We retain our BUY rating on the stock and value the company at 9x FY24E EV/EBITDA to arrive at a TP of ₹115/share, implying an upside of 11% from the CMP.

Sensex is marginally in red at the preopen session; Paytm, ONGC, Hero MotoCorp in focus

View Full Image

Japan’s Nikkei sinks as China COVID worries weigh; tech shares slide

Japan’s Nikkei share average slid for a second day on Monday, as protests in China over renewed COVID-19 clampdowns hurt investor sentiment, while tech stocks fell in line with Wall Street peers.

The Nikkei ended the morning session down 0.62% at 28,107.79, extending its 0.35% decline from Friday, as the benchmark index retreated from a more than two-month high of 28,502.29 hit the day before.

Of the Nikkei’s 225 components, 191 fell versus 23 that rose and 11 that were flat.

The broader Topix sank 0.79%.

Early declines for Japanese stock indexes accelerated after Chinese equity markets opened sharply lower, with Hong Kong’s Hang Seng tumbling as much as 4.2% at one point.

A wave of protests unprecedented under Xi Jinping’s rule has swept China, including clashes with police in Shanghai, after the government doubled down on pandemic restrictions amid a surge in COVID cases. (Reuters)

Promoter raises stake in ₹10 FMCG stock after rebound from 52-week low. Time to buy?

Mishtann Foods share price is giving sharp upside moves after hitting a 52-week low of ₹7.80 apiece in July 20220. While this rebound in ₹10 stock is catching the attention of retail investors, promoters are also looking to cash in this big opportunity. Like retail investors company promoter Hiteshkumar Patel is also among the bargain hunters of this stock. The company promoter has been busy doing bottom-finishing in the scrip since 15th November 2022 raising his stake in the FMCG company to 49.37 per cent. (Read More)

Ashika Stock Broking and Geojit Financial Services views on today’s market

Tirthankar Das, technical & derivative analyst, retail, Ashika Stock Broking Ltd: On the technical front, Nifty formed a small negative candle on the daily chart with a lower shadow, reflecting a breather in the market on the last trading day of the week though presence on the higher high-low formation and positive market breadth continues to maintain a bullish undertone in the market. It seems that the Index is at that phase where a prolonged consolidation might be in the making and forming a higher base, setting itself equipped to eye the sought-after level of 18900 in the near term. The present price structure indicates the market has halted its slide taking support from its 20dma and the lower area of the gap-up region and 18050-18100 might be the elevated bottom for the market followed by 17950 which coincides with a 23.6% retracement of the entire rally since Oct’22. A positive stance in the market would remain due to sharp reversals in the Dollar index, US yields have helped to taper down anxiety around further aggressive rate hike and drop in crude oil prices which is supportive for Indian Equities. Against that backdrop, a sustainable move above 18,600 is likely to pull the 50-scrip index towards a milestone of 18900-18950 in the near term. During the day, Nifty is likely to open on a negative note tracking weak morning cues hence intraday dips towards 18400-18440 need to be utilised for an upside target of 18650 followed by 18900.

Dr V K Vijayakumar, chief investment strategist at Geojit Financial Services: There are two positives which can impart resilience to the ongoing rally in the market: One, the steady decline in crude which has taken Brent crude to below $82. Two, the steady FPI buying ( ₹31630 crores so far in November) particularly in fundamentally strong segments like financials, IT, autos and capital goods. These positives notwithstanding markets are likely to be in wait-and-watch mode for the Fed chief’s speech on Wednesday. Any hawkish statements from Powel will be negative since markets have factored in slower rate hikes taking the terminal rate around 5%. The high futures premium is indicative of the underlying bullishness in the market.

Reliance Securities Stock in Focus for Today: Indus Towers

STOCK IN FOCUS

Indus Towers (CMP 203): In view of better business prospects, likely increase in infra spend by telecom operators, bigger opportunity from 5G rollout and attractive dividend yield of ~5-6%, we have BUY on Indus Towers with a Target Price of Rs225, valuing the stock at a P/E multiple of 10x FY24E earnings.

Intraday Picks

POLYCAB (PREVIOUS CLOSE: 2550) BUY

For today’s trade, long position can be initiated in the range of ₹2520-

2535 for the target of Rs.2610 with a strict stop loss of ₹2510.

TATAMOTORS (PREVIOUS CLOSE: 433) BUY

For today’s trade, long position can be initiated in the range of ₹427-

430 for the target of Rs.445 with a strict stop loss of ₹425.

ZYDUSLIFE (PREVIOUS CLOSE: 402) BUY

For today’s trade, long position can be initiated in the range of ₹395-

398 for the target of Rs.414 with a strict stop loss of ₹392.

Rupee seen lower at open on yuan-led losses on Asian currencies

The Indian rupee is expected to open lower versus the dollar on Monday as protests in China against COVID restrictions dented demand for Asian currencies and shares.

The rupee is tipped to around 81.85 per U.S. dollar in early trades, against 81.6850 in the previous session.

The offshore yuan dropped 0.6% to 7.24 to the dollar following rare protests in major Chinese cities against the country’s strict zero-COVID policy.

After opening lower, the rupee should receive “decent” support at around the 81.90 levels, a trader at a Mumbai-based bank said. (Reuters)

Stocks to Watch: Paytm, Adani Transmission, Hero MotoCorp, Coal India, ONGC, TIL Ltd, Muthoot Finance, L&T Finance, Gateway Distriparks, Venus Pipes

Valecha Engineering and Wabury will be among the stocks in focus as they will be declaring their September quarter earnings today. (Read More)

Bitcoin, ether, Solana, other crypto prices today plunge, while dogecoin surges 6%

In cryptocurrencies, the world’s largest and most popular digital token Bitcoin’s price today was trading more than 2% lower at $16,129. On the other hand, Ether, the coin linked to the ethereum blockchain and the second largest cryptocurrency, also fell by more than 4% to $1,162.

The global cryptocurrency market cap today remained below the $1 trillion mark, as as it was down over 2% in the last 24 hours to $852 billion, as per the data by CoinGecko. (Read More)

Re 1 to ₹9.70: Penny stock that recently split in 1:10 ratio turns multibagger in 5 years

Shares of Leading Leasing Finance are one of the multibagger stocks in India. The small-cap stock with a market cap of around ₹52 crore is one of those stocks in 2022 that announced the subdivision of shares as well. The board of directors of the company announced a 1:10 stock split this year and the stock traded ex-split on 22nd September 2022.

In the last one month, this small-cap stock has delivered over 25 per cent return to its shareholders. However, this stock has a history of delivering whopping returns to its shareholders as it surged from around Re 1 to ₹9.70 apiece levels in the last 5 years, delivering to the tune of an 870 per cent return to its long-term positional investors. (Read More)

Hero MotoCorp to hike prices by up to ₹1,500 from Dec 1

The country’s largest two-wheeler maker Hero MotoCorp on Friday said it will increase the prices of its motorcycles and scooters by up to ₹1,500, with effect from December 1.

The price will increase up to ₹1,500, and the exact quantum of the hike will vary by specific models and markets, the company said in a statement.

“The upward revision of the prices of our motorcycles and scooters has been necessitated due to overall inflationary costs,” Hero MotoCorp Chief Financial Officer Niranjan Gupta said.

The company will continue to provide innovative financing solutions in order to cushion the impact on the customers, he added.

“We have also put in place accelerated savings programmes, which will help us to offset any further cost impact, and drive improvement in margins,” the two-wheeler major said. (PTI)

Deadlock deepens at Adani’s Vizhinjam port in Kerala as protesters block trucks

Protesters from a fishing community blocked attempts by India’s Adani Group to restart work on a $900 million transhipment port in south India, a company spokesperson said on Saturday, prolonging a deadlock that has stalled the port’s development.

Construction at Adani’s Vizhinjam seaport in Kerala state on the southern tip of India has been halted for more than three months after protesters, mostly Christian and led by Catholic priests, erected a large shelter blocking its entrance, saying the port’s development had caused coastal erosion and deprived them of their livelihoods. (Read More)

Kirit Parikh panel likely to recommend price cap for ONGC gas, no change in formula for Reliance

A government-appointed gas price review panel, led by Kirit Parikh, is likely to recommend price caps for natural gas produced from legacy fields of state-owned firms to help moderate CNG and piped cooking gas rates, while keeping the pricing formula for difficult fields unchanged.

The panel, which was tasked with suggesting a “fair price to the end-consumer” while ensuring “market-oriented, transparent and reliable pricing regime for India’s long-term vision for ensuring a gas-based economy”, may opt to suggest two different pricing regimes, officials said.

For the legacy or old fields of Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL) — where the cost has long been recovered and which are currently governed by a formula that uses rates in gas-surplus nations such as the US, Canada and Russia — the committee is likely to recommend a floor or minimum base price and cap or ceiling rates.

This would ensure that prices do not fall below cost of production, as they did last year, or do not spike to record levels as currently. (PTI)

RBI pauses onboarding of online merchants by Paytm Payments Services; firm says no material impact on biz

Banking regulator RBI has put a pause on onboarding of online merchants by Paytm Payments Services, even as the company said it will have no material impact on its business, according to a regulatory filing.

One97 Communications (OCL), which owns the Paytm brand, had proposed to transfer the payment aggregator services business undertaken by it to Paytm Payments Services (PPSL) in December 2020 to comply with payment aggregator (PA) guidelines of the Reserve Bank of India (RBI) but the banking regulator had rejected its application.

The company had re-submitted the required documents in September 2021.

Paytm said PPSL has now received a letter from RBI in response to an application for the authorisation to provide PA services for online merchants. (PTI)

Dharmaj Crop Guard IPO opens today. Should you subscribe? GMP, other details

The initial public offering (IPO) of Dharmaj Crop Guard will open for public subscription on Monday, November 28, 2022 and the three-day issue will conclude on Wednesday, November 30. The price band has been fixed in the range of ₹216–237 per share for the initial share sale.

As per market observers, Dharmaj Crop Guard shares are available at a premium (GMP) of ₹65 in the grey market today. The shares of the company are expected to list on the stock exchanges BSE and NSE on Thursday, December 8, 2022. (Read More)

Buy or sell: Vaishali Parekh recommends 2 stocks to buy today

Vaishali Parekh has recommended two shares to buy today. Here we list out details in regard to those day trading stocks:

1] Hero Motocorp: Buy at ₹2708, target ₹2780, stop loss ₹2670; and

2] Tata Motors: Buy at ₹433, target ₹445, stop loss ₹426. (Read More)

Oil edges lower with China unrest rippling through world markets

Oil edged lower as unrest in China hurt risk appetite and the demand outlook, adding to stresses in an already-fragile global crude market.

West Texas Intermediate traded near $76 a barrel following three weeks of declines. The dollar rose on demand for havens as protests over harsh anti-virus curbs spread across the world’s largest crude importer. Large crowds gathered in Shanghai and demonstrations were reported in Beijing and Wuhan. (Read More)

Cement firms hope for better demand, price after dismal Q2

After a forgettable second quarter when margins dipped to multi-quarter lows, respite is on the horizon for cement manufacturers as cost pressures ease. However, pickup in cement demand and sustenance of price hikes are key to earnings improvement, analysts said.

Prices of imported coal, which remained elevated at $250-350 a tonne between March and October, fell 19% in the last one month, suggests analysts’ data. Pet coke prices have inched up from mid-October, but analysts say it remains 29% below first-quarter prices on average. (Read More)

Asian stocks fall amid China unrest, dollar advances

Shares were under downward pressure and the dollar climbed as markets opened in Asia on Monday to news of growing unrest in China over Covid restrictions.

US stock futures and Australian equities fell. The greenback made some of its biggest early gains against the currencies of Australia and South Africa, both of which are exposed to trade with China.

“The near-term clarity suggests we might see some derisking around Chinese markets,” said Chris Weston, head of research at Pepperstone Group Ltd. “We are seeing some outflows of the offshore yuan, which I think is a pretty good indication of how Chinese markets may fare,” he said, while adding that the outlook for China over the longer term remains relatively robust.

The downbeat mood emanating from China contrasts with the boost to sentiment in global markets last week after the Federal Reserve’s Nov. 1-2 meeting minutes showed most officials backing slowing the pace of interest-rate hikes. (Bloomberg)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!