Image source: Getty Images

Vodafone (LSE:VOD) shares have traded in pennies for the majority of 2023. Impacted by declining revenues in core European markets and the company’s high net debt burden, the Vodafone share price has trailed the FTSE 100 index’s performance this year.

So, what return would I have made from a £1,000 investment in the telecoms giant at the start of January? And does a mighty 10.2% dividend yield tempt me to buy the stock today, despite poor recent returns?

Let’s explore.

Share price fall

Vodafone shares started the year trading at just under 86p. After briefly breaching the £1 barrier in February, the stock’s price has spiralled downwards. As I write, it stands just above 77p.

With £1k to invest at the beginning of 2023, I could have bought 1,164 shares. Today, my shareholding would be worth £898.96 — that’s a 10% decline.

However, I would also have earned some passive income, softening the blow. Adding £44.97 in dividend payments would bring the total figure up to £943.93.

Granted, that’s still a negative return over the period and long-term shareholders have been disappointed with a 52% share price fall over five years.

Weak revenues and high debt

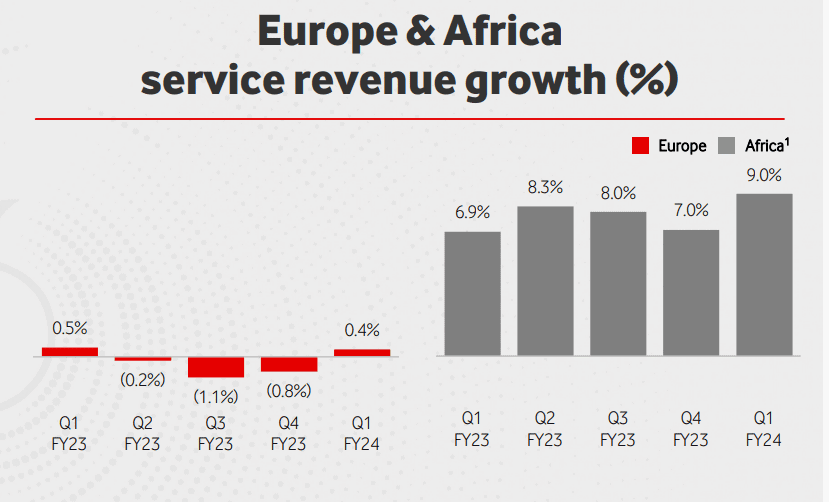

Vodafone’s difficulties on the European continent have contributed to the share price weakness. Although group service revenue growth reached 1.8% in Q1 FY24 (excluding Turkey), that figure has been negative for five consecutive quarters in Germany, Italy, and Spain.

| Market | Q1 service revenue growth |

|---|---|

| Germany | -1.3% |

| Italy | -1.6% |

| Spain | -3.0% |

Coupling revenue weakness across major European markets with the company’s €33.4bn net debt mountain, there are major risks on the horizon.

Vodafone’s net debt level looks too high to me measured against a market cap of £20.83bn. This has been a longstanding issue and is a significant reason why I haven’t invested in the shares before.

Growth opportunities

In brighter signs for the future, service revenue growth elsewhere in Europe lifted the region into positive territory in Q1 and the UK continues to impress, marked by a 5.7% improvement.

Africa remains the star performer — and the company’s most exciting growth opportunity in my view. Growing smartphone penetration across key African markets bodes well for future demand.

Vodafone has enjoyed notable success in Egypt, with increased data usage and an expanding customer base underpinning 27.6% service revenue growth in Q1.

Beyond this latest achievement, Vodafone also owns M-PESA, which it describes as “Africa’s most successful mobile money service and the region’s largest fintech platform“.

Should I buy this stock?

Although Vodafone shares have failed to impress this year, the 10.2% dividend yield on offer looks appealing. Plus, there are reasons to be optimistic about the growth outlook in Africa, as well as the company’s long-awaited merger with Three, which could have blockbuster potential.

That said, the tie-up still faces scrutiny from competition regulators — and occupying a dominant position in the market brings risks as well as opportunities. A further concern is the long-term sustainability of the dividend in light of Vodafone’s weak balance sheet.

For now, the stock will remain on my watchlist as I focus on finding other FTSE 100 stocks to buy. I’ll monitor the company’s future results and news about the merger with a close eye.