The post-crisis era for stocks was ‘Easy Street’ for investors. It’s not likely to be repeated.

-

Investors expecting the secular bull market to continue will likely be disappointed, RBA said.

-

The S&P 500 has gained 389% since 2010, with the tech sector alone soaring 847% in that time.

-

There are a number of precedents that suggest those gains are unlikely to be repeated, RBA said.

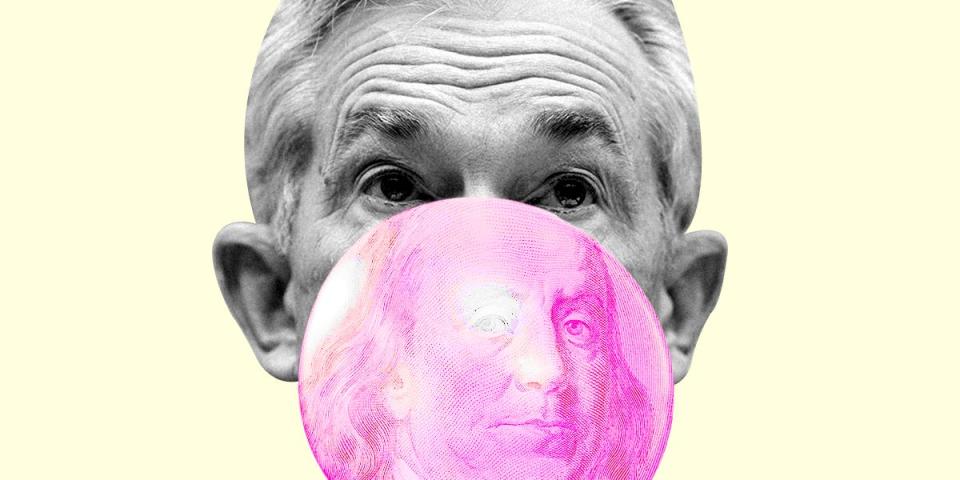

Wall Street became “Easy Street” in the years after the financial crisis, and investors who got used to sitting back and watching the returns pile up are in for something different in the coming years.

The market’s bull run since 2010 was too good to last, according to Richard Bernstein Advisors. In a note on Thursday, RBA deputy CIO Dan Suzuki pointed to the stock market’s long-running growth trend following the 2008 crisis, with S&P 500 soaring 389% since 2010, and the tech sector alone skyrocketing 847%.

And despite the market’s heavy sell-off last year, investors seem to be more or less expecting that growth trend to continue, Suzuki said, given that stock valuations and household stock allocations are now nearing all-time-highs.

But it’s no sure thing that the last decade of stellar returns can be repeated, RBA warned.

“What concerns us about investors doubling down on the best trade of the past decade are the numerous historical precedents suggesting that a continuation of these extreme returns is unlikely. Either these time-tested rules longer apply, and investing is now as easy as simply buying what has worked, or investors are improperly allocated for the next market cycle,” Suzuki warned.

The investment manager pointed to three tenets of stock investing to caution investors from piling into the market’s most crowded trades.

1. Stock returns are greater when capital is low. Investors are more likely to reap gains from stocks when investors aren’t all trying to chase to the hype, which makes it difficult for companies to keep up with investor expectations.

That could potentially spell trouble for some of the market’s biggest players, with AI-related stocks soaring amid Wall Street’s enthusiasm for artificial intelligence.

2. New market cycles typically come with new leaders. That suggests that the top performers of the past secular bull market are likely to be replaced – another potential threat to high-flying stocks like Nvidia, Tesla, and Apple, which have dominated the market’s attention over the past year.

3. Investors should sell bubbles in the market sooner than later. “It can be difficult to time major market reversals and leadership changes, but the unique aspect to a bubble is that it’s never too early to sell. Even if you bought the Nasdaq-100 index a full year before its peak, initially doubling your money, it still took you roughly a decade to recoup your subsequent losses,” Suzuki warned.

Other experts have also warned that US markets are headed into a new era – one defined by higher market volatility, higher inflation, and higher interest rates, BlackRock strategists warned in a previous note. Over the near-term, those factors could spell bad news for stocks, with the asset manager forecasting a full-employment recession and a “rollercoaster trajectory” for inflation that could weigh on asset prices.

Read the original article on Business Insider