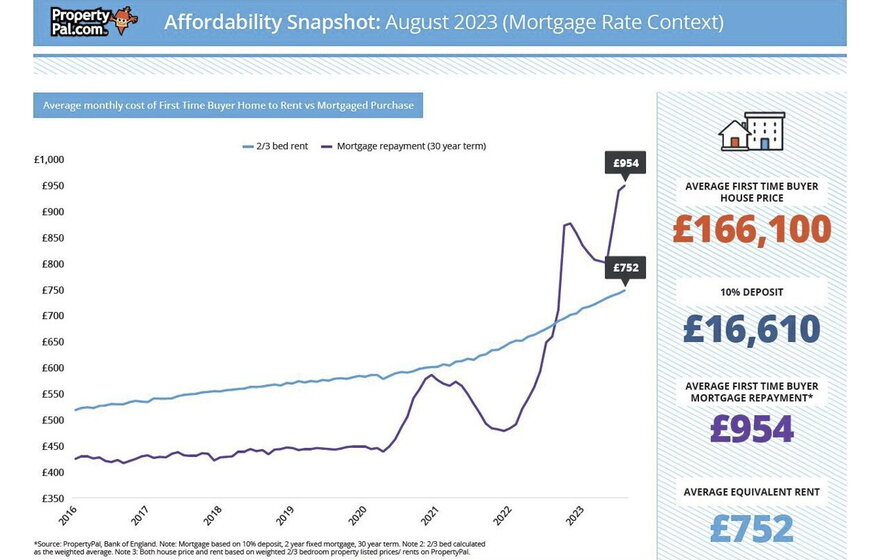

THE average monthly mortgage repayments for first time buyers in Northern Ireland have soared above the average rent price, new analysis from PropertyPal suggests.

The housing website estimates the average mortgage repayment for first time buyers increased to £954 per month in August, £200 more than the rental equivalent (£752) for a two or three-bedroom home.

PropertyPal based its analysis on a 30-year mortgage for a £166,100 house, which it said was the average price paid by first-time buyers last month.

The calculation includes a 10 per cent deposit and a two-year fixed rate.

Rental prices have traditionally been more expensive than mortgage repayments in the north, but that changed in late 2022 when lenders withdrew and repriced products as costs surged on the back of the fiscal plans announced by former Prime Minister Liz Truss and her Chancellor, Kwasi Kwarteng.

The average two-year fixed rate mortgage peaked at 6.65 per cent in late October 2022.

UK mortgage market analyser MoneyfactsCompare, shows rates have slightly eased to around 5.39 per cent this week.

Read more:

But for first-time buyers borrowing around 90 per cent of the value of a home, the two-year fixed rate is at least six per cent, reverting to a rate of 7-8 per cent.

PropertyPal’s latest report put house prices in the resale market at 5.6 per cent up year-on-year in August.

The average three-bed house was listed at £204,100 last month.

The average new build sold for £234,600 in August, which was 2.8 per cent up year-on-year.

The number of enquiries by potential homebuyers was down 11 per cent last month compared with the same month last year, while ‘new inventory’ was down 24 per cent year-on-year.

Enquiries for rental properties was also down (-17 per cent) in August on the same month in 2022.

But the average property was still attracting 87 enquiries, compared to 19 per property in 2019.

Rent prices in August were up 9.5 per cent year on year.

PropertyPal’s chief operating officer Jordan Buchanan, said the data reflected a gradual re-adjustment in the housing market as economic conditions soften.

“An annual decline in property prices is expected later this year and into next year as prices continue their adjustment to ongoing affordability pressures,” he said.

“Encouragingly, policymakers’ ongoing inflation battle is improving prospects with last week’s announcement revealing a fall in both the headline rate and underlying core inflation.

“This is reflected in financial markets downgrading their interest rate projections and is already seeing lenders reducing their product mortgage rates.”

He said while buyer activity is stronger than historic norms, the lower transaction activity and reduced stock remains a key challenge for both house-hunters and the wider industry.

“Overall transaction activity remains on track for approximately 20 cent fewer sales this year,” he added.