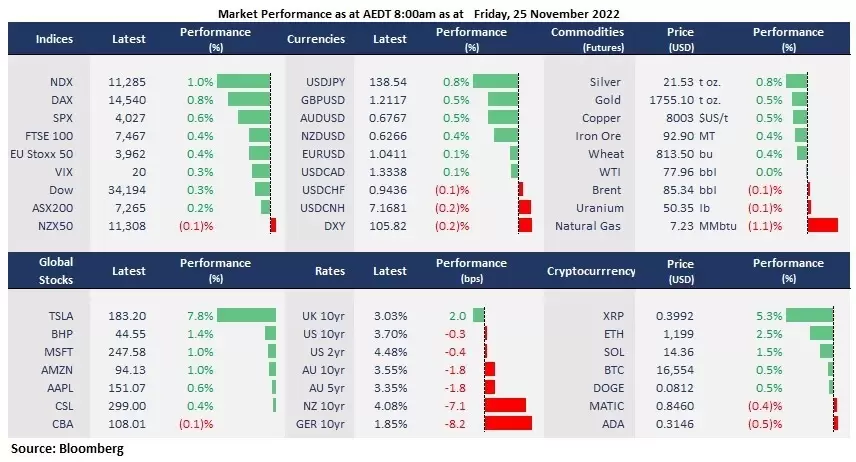

It was a quiet session for the global markets as US stock exchanges closed for Thanksgiving holiday, while the Black Friday kicks off. Following the Fed-induced rally on Wall Street, both European and Asian markets finished higher, with Dax climbing to a 5-month high after Germany reported the highest Ifo business Climate Index. The data indicates that business confidence has improved due to better export expectations but remained at a low level of 86.3. The global bond yields were lower after the Fed meeting minutes signalled a slower pace on rate hikes, which has also helped buoyed global equity markets. The US dollar continued its decline since early November, sending other major curries higher, typically in Asian currencies, with the Japanese Yen strengthening 0.8% against the USD.

- US stock futures finished higher following Wednesday’s rally. Dow futures rose 0.16%, the S&P 500 advanced 0.26%, and Nasdaq futures climbed 0.40%.

- Credit Suisse issued 889 million new shares to existing investors at 2.52 Swiss francs (US$2.67). The bank is expected to raise about 2.24 billion Swiss francs from the offer. The Europe biggest bank’s shares fell 2.3% to an all-time low of 3.56 francs on Thursday, or a 60% year to date loss.

- The spread in WTI and Brent futures is widened due to a deeper drop in Brent crude prices, as Russia offers a roughly 20-25% price discount to Asian countries. China’s Covid resurgence has also weighed on the oil markets.

- Gold futures continued to rise as the US bond yields declined on Wednesday. The precious metal has bounced off the recent support of 1,723 after the FOMC meeting signalled a slower pace on rate hikes, with a near-term resistance around 1,800, which is the high on 15 November.

- China mainland’s covid cases hit a pandemic high of more than 31,000 on Wednesday, which may continue to weigh on broad sentiment, pressing oil and copper futures’ prices. Major cities, including Beijing and Shanghai, are all preparing for mess testing and Covid controls. Apple’s main supplier Foxconn factory is facing challenges of internal Covid spread and worker’s protests in Zhengzhou.

- Asian equity markets are set to open higher. ASX futures were slightly up 0.07%, Nikkei 225 futures rose 0.82% and Hang Seng Index futures climbed 0.48%.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.