SawitreeLyaon/iStock via Getty Images

Written by Nick Ackerman.

Investors come in all different types; the broader classifications seem to be “growth” or “income” investors. Even within the income group, there are going to be other types of investors, such as dividend growth investments or just those looking for high yields.

I lean towards an income approach rather than growth. However, that doesn’t mean I only chase whatever is a high-yielding investment choice. While I have a high-yield sleeve of investments, I also look at dividend growth names.

Dividend growth investors could be considered a sort of middle ground between the growth and income classifications as well. Dividend growth investors often look for stocks that are growing their dividend, and that’s generally fueled by the growth of the underlying earnings in the business. A couple of names that fit this grouping could be names like Microsoft (MSFT) or Mastercard (MA).

Today, I wanted to look at a couple of faster-growing dividend investment options that are worth going on the watchlist. These are names that don’t necessarily have the highest yields now, but where they bring in a lower yield, they can make up for faster potential growth going forward.

We normally do a monthly publication of high dividend yield stocks with consistent growth. In this, I wanted to look for the reverse, faster growers even if the yield itself was smaller.

The initial screening parameters that I had included to get an initial list was dividend growth over the last 5 years of at least 10%. The next was looking at consistent growers, where they had to have at least a decade of dividend growth under their belt. There were a total of 113 left at that point, which I sorted by those with the highest dividend growth in the past 5 years for the most aggressive growers.

There were definitely some new and interesting names that I had not been aware of, which I believe is the whole point of screening for stocks in the first place: to find those names that you wouldn’t typically run across but could merit attention. Here are the couple that I thought were interesting based on consistent dividend growth in the past but also expected growth going forward.

Primerica, Inc. (NYSE:PRI)

PRI is a financial company that operates primarily as a term life insurance company, but the company also offers investment and savings products, as well as a senior health segment of its business. Finally, they also have a “corporate and other distributed products segment.” The company would currently be considered a mid-cap stock with its roughly $7.21 billion market cap.

The life insurance segment is their largest in terms of revenue and one where they boast a 138,000 “life-insurance licensed sales force.” From 2020 to 2021 year-end, there was a slight dip in licensed sales force members, but they’ve been growing steadily since. Their latest quarter showed that they grew their representative count by 10% year-over-year.

Though it should be mentioned that Primerica has been described as a multi-level marketing as they have different tiers of representatives and recruiters. That being said, they sell legitimate financial products, so I’ll be trying to stick to the facts in terms of their fundamentals.

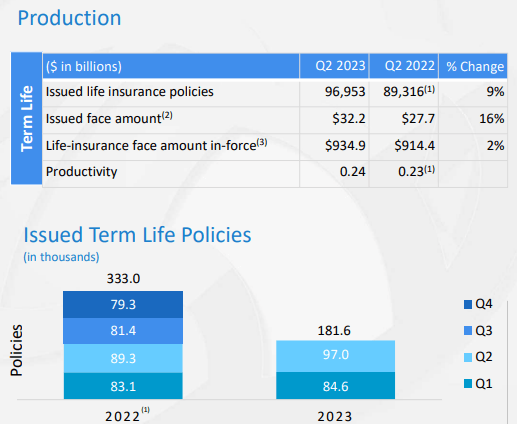

Growing the number of representatives isn’t just adding to the raw sales force in terms of growth for this company either. Each representative was more productive as well. The number of insurance policies grew 9% YoY, and the amount of term life policies also grew substantially by 16% YoY as well.

PRI Production Metrics (Primerica)

We all know that insurance premiums rarely, if ever, go down. This can mean that investing in an insurance company can be a perfect hedge against inflation if that is still a worry on some investors’ minds.

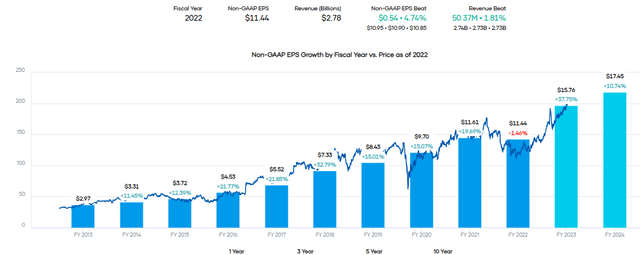

This is reflected by the company’s earnings growth over the years. They have been very consistent, with only a slight trip in 2022. However, the growth expectations going forward would make up for this slight decline and then some to provide a solid trend of upward growth to continue.

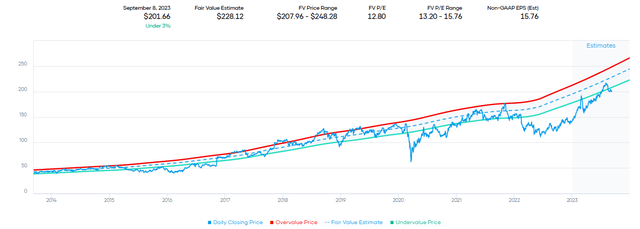

PRI EPS Growth and Projections with Share Price Overlay (Portfolio Insight)

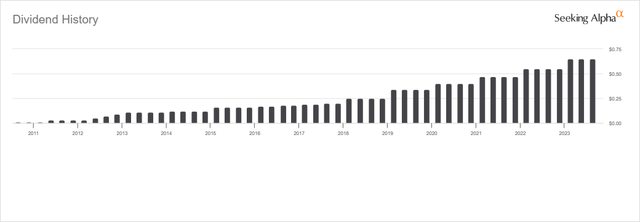

It is this sort of consistency that has pushed PRI to 12 years of dividend growth, with the last 5 years of dividend growth sporting an average of 21.96% increases. Equally impressive is the company, over the last decade, has seen the CAGR of the dividend coming in at 19.53%.

So this rapid dividend growth isn’t something that just happened in the last several years but has been going on for a decade now, backed by the company’s rapid clip of solid earnings growth.

PRI Dividend History (Seeking Alpha)

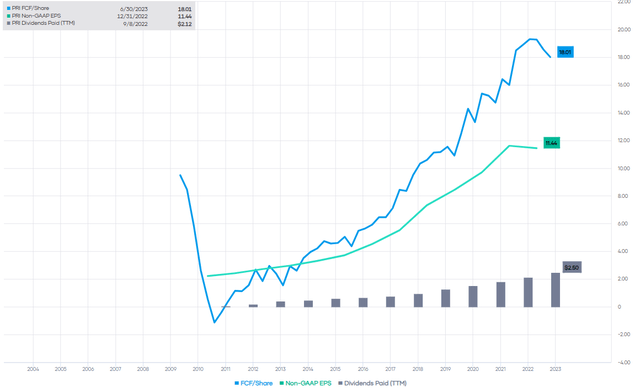

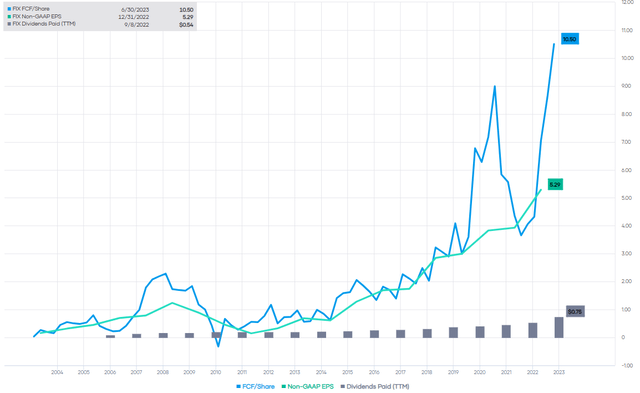

Even with this impressive growth, the EPS payout ratio comes to just 16.5% based on the latest forward estimated EPS. In terms of FCF per share, this company just gushes cash too.

PRI FCF, EPS and Dividends (Portfolio Insight)

On the other hand, that’s where the current yield of 1.3% based on the latest dividend might not appear impressive to some income investors with a more high-yield focus. This seems like a perfect candidate for a dividend growth portfolio, where an investor can anticipate a strong likelihood that this growth can continue based on the latest estimates, and potentially, we would even anticipate some share price appreciation over the long term.

Despite this impressive record, PRI could actually be considered cheap currently. The stock is trading below its longer-term historical P/E range with its 12.80x P/E.

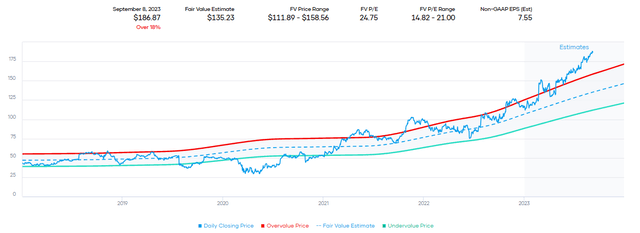

PRI Fair Value Range (Portfolio Insight)

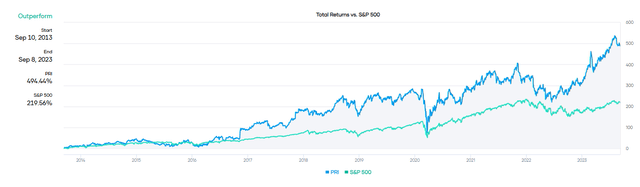

This multiple is actually well below the S&P 500’s own P/E ratio of around 20x, which PRI has been able to dominate handily in terms of total returns.

PRI Total Returns Relative to the S&P 500 Index (Portfolio Insight)

Comfort Systems USA (NYSE:FIX)

FIX is an industrial stock that is described in its corporate profile as,

composed of more than 43 operating companies in approximately 173 locations across the United States. We are a leading building and service provider for mechanical, electrical, modular, and plumbing building systems.

This company is also a mid-cap stock with its roughly $6.67 billion market cap.

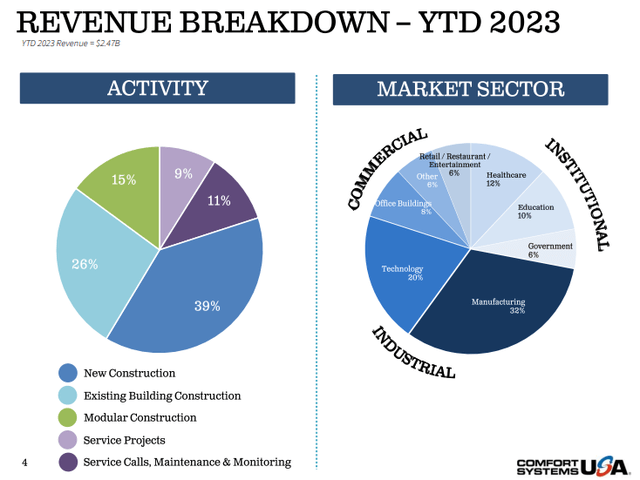

New construction for the company counts as the largest slice of the activity pie while existing building construction isn’t too far behind.

FIX Revenue Breakdown (Comfort Systems USA)

While the company is an industrial stock and one that is focused on construction and engineering, it would be safe to assume it could be quite sensitive to current economic conditions. In a softer economy, we’d naturally assume that construction would be way down, and therefore, the company’s earnings should be way down.

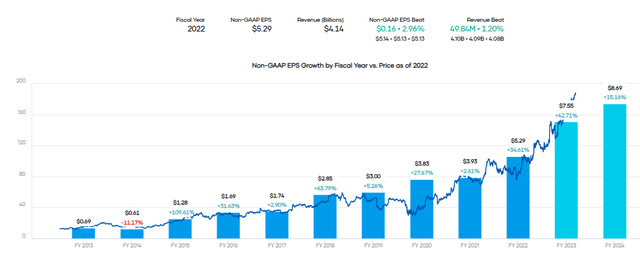

However, if we were to look at the historical earnings of this company, they haven’t been volatile at all. In fact, they’ve put up impressive earnings growth and are expected to continue this trend going forward over the next couple of years.

Despite this consistent earnings growth, we have seen at least the share price of the stock become volatile during uncertain periods, going against the fundamentals. That’s often where opportunities exist, during those times of panic when the share price loses sight of the fundamentals.

FIX EPS Growth and Projections with Share Price Overlay (Portfolio Insight)

As I said, this is looking for potential names to include on the watchlist. Which I believe is where FIX would be the most appropriate. As we can see in the above graph, the companies’ share price has been on an absolute explosion higher. That has pushed the company to trade well above its longer-term historical P/E range.

FIX Fair Value Estimate (Portfolio Insight)

Perhaps that’s justifiable given the anticipated earnings growth this year, but I do suspect the next recession – even if it doesn’t materially impact the company’s earnings and we still see growth – will see the share price react quite negatively as we’ve seen historically.

Paying up a bit for growth is fine in some cases, but we don’t want to get too carried away, and something like PRI above offers a reasonable entry at this time without having to pay up. So, there are alternatives that exist to invest in now while being patient for others to come down.

FIX piqued my interest, and I wanted to include it in today’s write-up, even if it is too expensive to own right now. It also not only fits the criteria above but then some as it, in more recent years, has been upping the dividend on a quarterly basis.

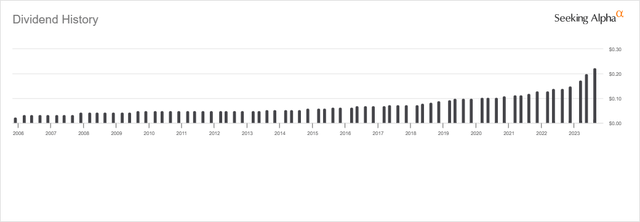

FIX Dividend History (Seeking Alpha)

FIX has seen a 5-year dividend growth of 18.95%. The growth in the dividend over the last decade was a bit slower at a CAGR of 13.85%, but growing, nonetheless. The starting yield here is 0.48%, which, if an investor waits for the next downturn, could very likely see a potentially higher starting yield as a reward for being patient.

In addition to that, the company has also been paying a dividend consistently for 17 years. That means that even during the global financial crisis, they were paying investors; in fact, they still bumped up their payout in that period, too.

As one would imagine, with the impressive earnings growth, the payout ratio for this company at shy of 12% also leaves plenty of room to fuel further growth into the future. The company, similar to PRI, gushes FCF as well.

FIX FCF, EPS and Dividends (Portfolio Insight)

Conclusion

PRI and FIX are two names showing explosive earnings growth that has led to rapid growth in their dividends. They are also anticipated to continue to grow their earnings at a healthy clip going forward, which could lead to yet further dividend growth. At this time, PRI seems like it’s a buy at or near these levels.

For FIX, I think we need to be a bit more patient as we’ve seen historically the share price make some major moves. The stock has nearly doubled over the last year, so certainly, this has been a brisk ascent during a short period of time. If history is any guide, at sub-$160, we could start to consider this name.