First Hawaiian Bank Acquires Position in Comfort Systems USA, Inc.: Positive Financial Performance and Analyst Confidence Signal Future Growth Opportunities

First Hawaiian Bank, a regional bank based in Hawaii, has recently acquired a new position in shares of Comfort Systems USA, Inc. According to the company’s most recent filing with the Securities and Exchange Commission, First Hawaiian Bank purchased 1,518 shares of Comfort Systems USA’s stock during the second quarter, valued at approximately $249,000.

Comfort Systems USA is a construction company listed on the New York Stock Exchange under the ticker symbol FIX. The company recently announced its quarterly earnings results on July 26th. During this quarter, Comfort Systems USA reported earnings per share (EPS) of $1.93, surpassing the consensus estimate of $1.64 by $0.29. The company also generated $1.30 billion in revenue, outperforming the consensus estimate of $1.22 billion.

Additionally, Comfort Systems USA recorded a net margin of 5.17% and a return on equity (ROE) of 23.24%. These figures indicate that the company is efficiently managing its operations and generating profits for its shareholders. In comparison to the same quarter last year, Comfort Systems USA experienced a significant increase in revenue by 27.4%. In the previous year’s equivalent period, they posted earnings per share of $1.17.

Research analysts are projecting that Comfort Systems USA will achieve an EPS of 7.51 for the current fiscal year. This positive forecast reflects the market’s confidence in the company’s ability to sustain profitable growth.

Various research firms have provided their assessment on Comfort Systems USA’s performance and prospects. For instance, DA Davidson raised their price target for Comfort Systems USA from $175 to $190 and assigned a “buy” rating for the stock in July 2023.

Another research firm called StockNews.com initiated coverage on Comfort Systems USA with a “buy” rating on August 17th.

Moreover, UBS Group initiated coverage on Comfort Systems USA with a “neutral” rating and a price objective of $162 on June 1st.

These analysts’ ratings and target prices demonstrate the positive sentiment towards Comfort Systems USA and its potential for future growth.

In conclusion, First Hawaiian Bank has recently acquired shares in Comfort Systems USA, Inc. This construction company has exhibited strong financial performance, beating earnings estimates and surpassing revenue expectations. Analysts have shown confidence in their positive outlook for Comfort Systems USA with upgraded ratings and raised price targets. Investors will be eagerly observing the company’s ongoing success as it continues to contribute value to its shareholders.

Institutional Investors Show Growing Interest in Comfort Systems USA as Stock Attracts Major Players

Comfort Systems USA, Inc. (FIX) is attracting attention from institutional investors as several major players recently made changes to their positions in the company. BlackRock Inc., one of the largest investment management firms, boosted its holdings in shares of Comfort Systems USA by 2.3% during the first quarter. With an additional 136,122 shares acquired during this period, BlackRock now owns 6,016,801 shares of the construction company’s stock worth $878,212,000. Vanguard Group Inc., another prominent institutional investor, also increased its holdings in Comfort Systems USA by 1.0% during the third quarter with an additional 39,263 shares acquired. As a result, Vanguard now owns 3,898,077 shares of Comfort Systems USA valued at $379,399,000.

Capital World Investors also jumped on board and increased its holdings in Comfort Systems USA by an impressive 32.3% during the first quarter. This move saw them acquire an additional 570,560 shares of the company’s stock worth $208,011,000. State Street Corp followed suit and boosted its holdings by 3.3% during the same period by acquiring an additional 39,339 shares worth $178,509,000.

Finally, Geode Capital Management LLC rounded off the list of institutional investors showing interest in Comfort Systems USA by increasing its holdings by 4.2%. The firm acquired an additional 26,372 shares worth $96,506,000 taking their total ownership to 661 ,179 shares.

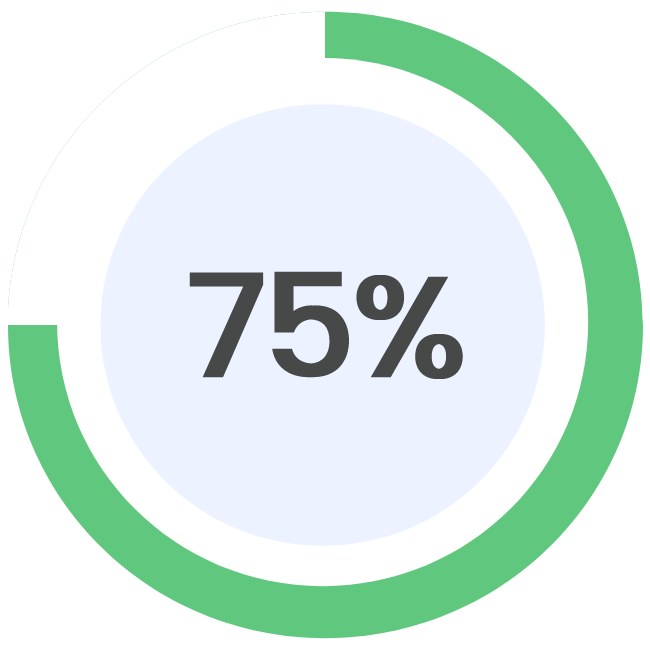

These recent moves show significant bullishness among institutional investors towards Comfort Systems USA as they now collectively own a remarkable 94.18% of the company’s stock.

Shares of FIX opened at $183.89 on Tuesday indicating positive sentiments around the company’s prospects in the market. Over the past year alone, Comfort Systems USA has seen a wide range in stock prices with its one-year low at $95.28 and a high of $192.33.

As of September 19, 2023, the company has a market capitalization of approximately $6.58 billion, a price-to-earnings ratio of 27.16, and a beta value of 1.18. These numbers reflect the confidence investors have in Comfort Systems USA’s growth potential and stability within the construction industry.

The company also maintains a healthy financial position with a debt-to-equity ratio of 0.12, suggesting favorable capital structure management. In addition, it boasts a robust current ratio of 1.01 and quick ratio of 0.98, indicating its ability to meet short-term obligations efficiently.

Analysts from various research firms have also expressed their opinions on FIX’s performance in recent reports. DA Davidson raised their price target on shares of Comfort Systems USA from $175.00 to $190.00 and reiterated a “buy” rating for the company on July 28th.

StockNews.com initiated coverage on Comfort Systems USA and issued a “buy” rating for the company on August 17th. Similarly, UBS Group initiated coverage with a “neutral” rating and set a price objective of $162.00 for the stock back on June 1st.

In terms of dividends, Comfort Systems USA recently announced an increase in its quarterly dividend payment which was paid out to stockholders on August 28th. The new dividend payment amounts to $0.225 per share compared to the previous dividend payout of $0.20 per share, resulting in an annualized dividend yield of 0.49%. The company currently has a dividend payout ratio of 13 .29%, indicating its commitment to returning value to shareholders through regular distributions.

On the insider trading front, Director Vance W. Tang has sold off some shares with two transactions taking place on Tuesday, August 8th. In the first transaction, 1,844 shares were sold at an average price of $182.00, totaling $335,608 and in the second transaction tang sold off another 1,844 shares at the same price and a total value of $335,608. Following these sales Vance W. Tang now owns a total of 25,058 shares in Comfort Systems USA which have an estimated value of $4,560,556.

Another insider sale occurred on August 28th when Brian E. Lane, an insider at Comfort Systems USA sold off 6,400 shares at an average price of $181.29 per share totaling approximately $1 ,160 ,256. With this recent sale,Lane now holds around 277 between these transactions and possesses approximately $50 ,312 ,688 .54 worth of company stock.

The Securities & Exchange Commission has received the necessary filings for these transactions and shared them publicly for transparency purposes.

It is important to note that insiders from Comfort Systems USA have been actively selling their shares lately with a total of 42 ,594 shares being sold by corporate insiders over the last ninety days alone. These insider activities contribute to the overall market perception and investors should take this information into consideration when making investment decisions.

Overall, institutional investors’ increased