A slump in the value of sterling made headline news in October when the pound plunged to its lowest level against the US dollar for 50 years.

Other currencies have also suffered a similar fate against the greenback. For example, the euro is down in value by 16% over the last year, while the Japanese yen has taken a 23% hit against the dollar over the same period.

There have also been falls for the Chinese Renminbi and Canadian dollar, down 12% and 7% respectively over the past year.

At home, September’s mini-Budget, with its unfunded tax cuts, sent the pound crashing as investors sought refuge in the relative safety of the dollar.

Although Chancellor Jeremy Hunt’s subsequent reversal of these proposed cuts restored some confidence in the pound, the current volatility in exchange rates looks set to continue for the foreseeable future.

With the US currency towering over many of its global rivals, what does this scenario mean for UK investors? Here’s a look at how a strong dollar affects various investments.

All forms of investment involve risk to capital, and you may get back less than you put in. Past performance is not an indicator of likely future performance. Neither the value of an investment, nor any income derived from it, are guaranteed. Both can fall as well as rise.

Why has the pound fallen against the dollar?

Sterling has been on a downward slide against the dollar for some time. The last time £1 was worth $2 was in 2007.

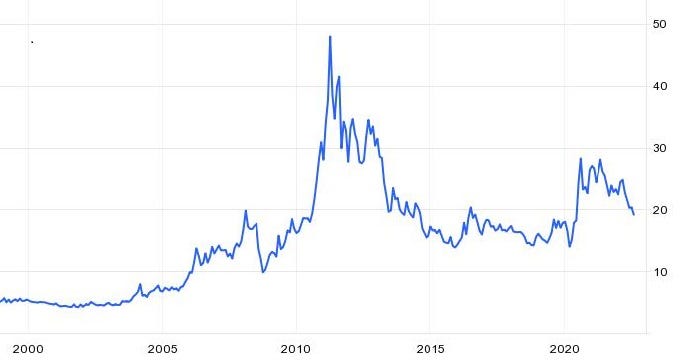

As the graph below shows, the pound has weakened against the dollar by more than 15% in the past 12 months – having plunged from around $1.40 to its current level of $1.15 – £1.18. In the wake of the September mini-Budget, the value of sterling sank as low as $1.04.

British pound to US dollar

There are two main reasons for this ongoing slump in the pound. First, the dollar has strengthened this year given its safe haven status following the geopolitical uncertainty caused by Russia’s invasion of Ukraine.

Added to that, the interest rate rises instigated by the Federal Reserve, the US central bank, has increased demand for the dollar from foreign investors attracted by the higher returns available in the US.

How does a strong dollar affect investments?

We asked financial experts how a strong dollar might affect a range of investments held by UK investors:

UK large-cap companies

The strong dollar has a positive impact on many of the large companies comprising the FTSE 100 index, principally due to the benefit of their dollar-denominated earnings being worth more when converted back into sterling.

As a result, the FTSE 100 has fallen by only 3% in 2022, far lower than the 23% drop in the S&P 100, its US-equivalent.

Over 80% of the FTSE 100’s revenues are generated from overseas markets, according to FTSE Russell which runs the index. AJ Bell’s Alena Kosava comments: “As the UK market is dominated by large multinationals, a weak pound tends to result in a tailwind.”

Victoria Scholar explains: “UK exporting companies like Unilever, Diageo and Coca-Cola on the FTSE 100 tend to get a boost when the pound weakens thanks to increased international competitiveness of their offering priced in sterling.”

A strong dollar also means that US-denominated earnings are worth more when translated back into sterling. According to the latest UK Dividend Monitor report from Link Group, the strengthening of the US dollar is estimated to have added £6 billion to dividends paid by UK companies in 2022.

In addition, the favourable exchange rate may increase the potential for US takeovers of UK companies. Fiduciary Trust’s Hans Olsen comments: “UK Inc. has gone on sale. Indeed, with the currency so weak, it might create opportunities for US and European firms to ‘go shopping’ for UK companies.”

Small and mid-cap UK companies

The weak pound has been less positive for smaller and medium-sized companies in the UK, with the FTSE 250 index, a barometer of mid-cap companies, falling by over 20% this year.

AJ Bell’s Alena Kosava points to the drag of a weak pound on these companies with “greater exposure to the UK economy and thus sterling, with some 50% of revenue derived from the domestic UK economy”.

A strong dollar hits smaller UK companies on two fronts – the cost of importing goods and services becomes more expensive for companies with US supply chains. As the UK is a net importer of goods, consumers are hit by higher prices, leading to a squeeze in the cost-of-living and consumer demand.

US investments

The strengthening of the US dollar has proved less positive for US companies with an international presence, due to the negative impact of translating overseas sales back into US dollars.

Interactive investor’s Victoria Scholar says: “Even if the fundamentals of a business are robust, international revenues and earnings are taking a hit when reported in US dollars, providing one of the biggest headwinds this earnings season.”

Ms Scholar also points to the impact of a strong dollar on US exporters: “In terms of trade, US goods and services have also become less competitive on the international markets when priced in dollars as the greenback’s appreciation has made them more expensive.”

However, it’s not all bad news for UK investors as the weak pound has meant an increase in the sterling value of dollar-denominated investments. By way of example, the S&P 500 index has fallen by 20% this year but UK investors with exposure to tracker funds replicating the performance of this influential index would have lost only 6% due to the weakening of the pound.

Jason Hollands, managing director of Bestinvest, comments: “For UK-based investors, the strength of the dollar has been a positive factor, shielding UK investors from steep underlying losses on US securities.”

Global Funds

The MSCI World Index is one of the key benchmarks for global funds, comprising over 1,500 companies across 23 countries. As US equities represent over 70% of this index, it has mirrored the US stock market by falling 20% this year.

However, as discussed, the strong dollar helps to insulate UK investors from the fall in the value of global funds.

AJ Bell’s Alena Kosava comments: “Global equities are dominated by the US, and so a weaker pound and stronger dollar tend to result in a better performance for UK-based investors more broadly, and vice versa.”

Emerging markets funds

The strong dollar has taken its toll on emerging markets, with the MSCI Emerging Market index dropping by over 25% this year.

As the US dollar is the de facto currency for global trade, emerging markets have faced a rise in the cost of imports. Investors are also attracted by the higher interest rates and safety offered by the dollar relative to emerging market investments.

Ms Kosava comments: “Emerging markets have really rolled over on the back of a relentless dollar rise this year, as well as more aggressive rate tightening by the Fed.”

Bonds

The UK bond market has been in disarray over the last few months, thanks to the u-turn over unfunded tax cuts announced in September’s mini Budget.

Fiduciary Trust’s Hans Olsen comments: “The mini-budget awakened bond vigilantes in the UK provoking a revolt that saw bond prices plunging, gilt yields rising and investors jamming the doors to get out of the pound.”

AJ Bell’s Ms Kosava adds: “On the currency front, it boils down to what your base currency is. As we’ve seen, US bonds have done better in 2022 simply due to the strength of the dollar across the board, in addition to sterling being weak.”

Commodities

Most raw materials, such as oil and gas, are priced in US dollars, meaning that a strengthening of the dollar may dampen demand as the commodities become more expensive in local currency terms.

Despite this, wholesale energy prices have continued to rise over the past year despite the strong dollar. This is due to supply chain constraints which have been further exacerbated by the war in Ukraine.

As a result, UK investors in commodity funds are likely to be sitting on substantial gains. According to fund information provider Trustnet, the commodity and natural resources sector delivered the second-highest total return of 23% over the past year.

However, gold has had a more muted performance this year. Ms Kosava explains: “Higher nominal [interest] rates and a stronger dollar weighed on the performance of gold.

“Having said that, in the event we see an escalation in geopolitical tensions and some sort of softening in the Fed’s rhetoric around raising rates, this may serve as a catalyst for gold to recover some of the ground it has lost.”

What’s the outlook for the pound?

There’s been some relief for the pound over the last few weeks, with the currency performing strongly in the first half of November.

Alena Kosava, head of investment research at AJ Bell, comments: “The pound has rallied following the recent change in government as Sunak’s administration looks to exhibit greater fiscal prudence having reversed the earlier proposed tax cuts and contemplating austerity measures to rein in deficits.”

The appreciation of the pound may be set to continue, as Victoria Scholar, head of investment at interactive investor, explains: “The dynamics of the currency market could be set to change and arguably already are to some extent. The Federal Reserve’s rate hiking path which has been boosting the dollar against the pound looks like it could be set to slow beyond this week.”

Hans Olsen, chief investment officer of US-based wealth manager Fiduciary Trust Company, says: “Investors should expect a recovery in the pound as policy resets, and the Bank of England raises interest rates to battle inflation. Beware of fleeing the currency, the lows might have been achieved.”