- This weekly round-up brings you the latest stories from the world of economics and finance.

- Top economy stories: Europe faces lower economic growth; Global debt falls for second year but trend may soon end; China’s economy expected to grow more slowly than previously forecast.

1. ECB raises rates to record level as Eurozone faces lower economic growth

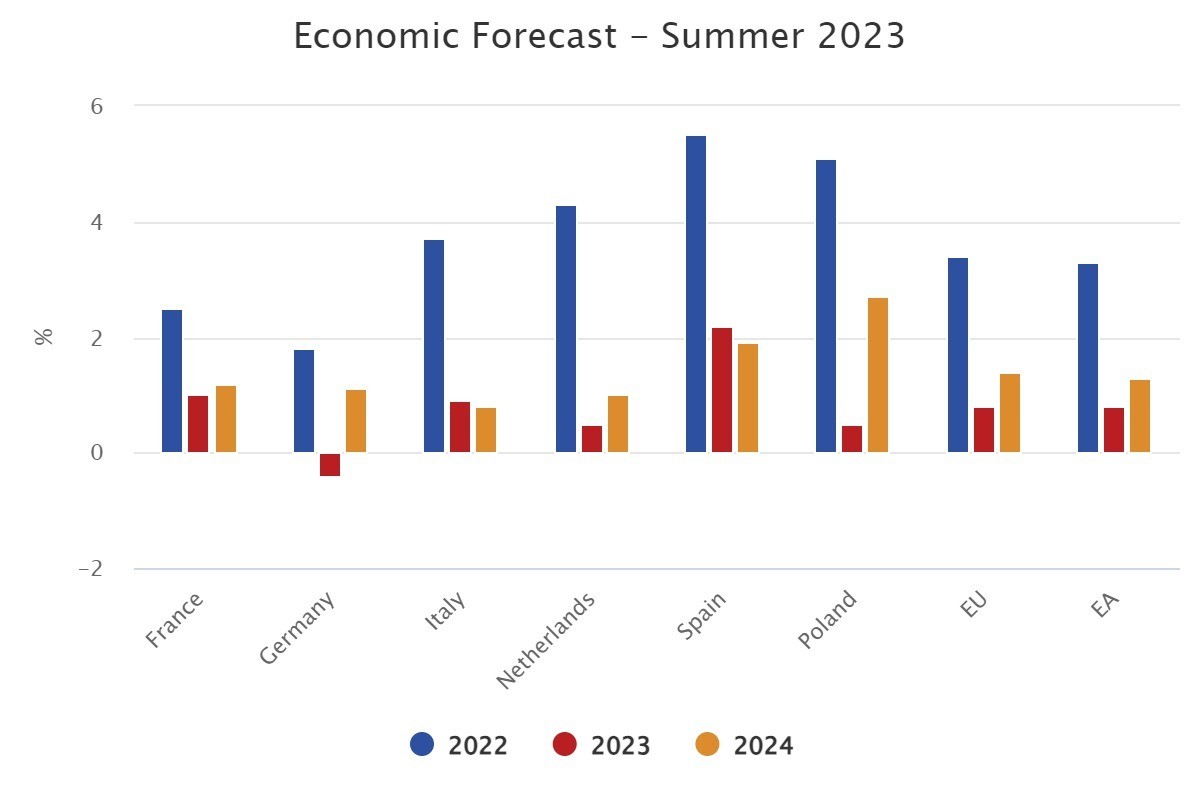

Record-breaking interest rates have been put in place by the European Central Bank (ECB), as the European Commission says Eurozone growth will be lower than previously expected this year following “subdued” economic activity in January-June.

The ECB has raised its key rate to 4% – its 10th raise in 14 months – in a move it hopes will make a “substantial contribution to the timely return of inflation to the target” of 2%.

Inflation was 5.3% in July, the European Commission says, but it sees it averaging 6.5% this year. And it has raised its 2024 forecast for inflation to 3.2%, from 3.1% earlier this year.

The Commission has also revised down its 2023 economic growth forecast for the Eurozone by 0.2 percentage points to 0.8%. And it has lowered its 2024 forecast by 0.3 points to 1.4%, saying that weaker growth momentum is expected to continue as tight monetary policy impacts economic activity.

Increasing risks around the climate crisis are also dragging down the outlook, the Commission says. Wildfires thrashed Southern Europe this summer, and extreme heat poses a major threat to the continent’s $2 trillion travel industry. Travel and tourism makes up 6.2% of Europe’s GDP.

“The multiple headwinds facing our economies this year have led to a weaker growth momentum than we projected in the spring,” European Commissioner for the Economy Paolo Gentiloni says. “Inflation is declining, but at differing speeds across the EU. And Russia’s brutal war against Ukraine continues to cause not only human suffering but also economic disruption. “

2. Geopolitics to create economic volatility in year ahead

Economic volatility is highly likely in the coming year, with geopolitics one of the main causes, according to the World Economic Forum’s new Chief Economists Outlook.

Nine out of 10 of the chief economists surveyed for the report think geopolitics will unsettle the global economy. Domestic politics could also stoke economic volatility according to 79% of respondents, with the impending US electoral cycle likely a driver of this sentiment.

As a result, 61% of the chief economists surveyed believe the global economy will weaken in the coming year.

But there is optimism when it comes to inflation, with 86% of chief economists believing the worst of the global inflationary surge will have subsided in a year’s time.

The picture varies around the world, however, with the US seen as heading for moderate or lower inflation, while Europe is expected to face high or very high inflation. China’s deflationary pressures mean 81% of chief economists anticipate low or very low inflation in the country this year.

That said, Asia is seen as having the strongest growth prospects – 92% of respondents expect South Asia to record moderate or strong growth this year.

But hopes of achieving the UN’s Sustainable Development Goals (SDGs) by their 2030 deadline are under threat because of the global economic headwinds. Nearly three-quarters of respondents think geopolitical tensions will hinder progress towards global development targets in the next three years, while 59% expect tighter financial conditions to have the same effect.

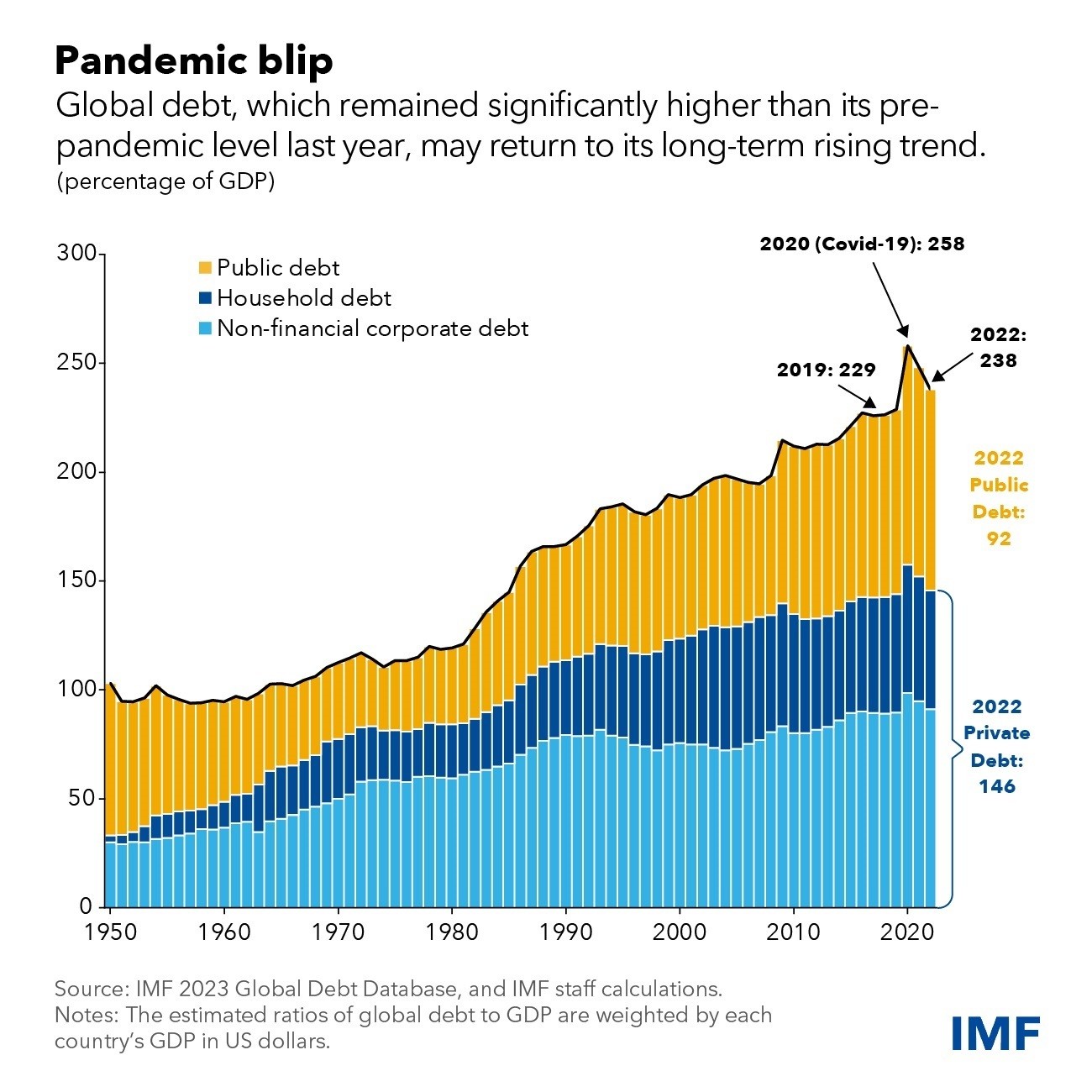

3. Global debt falls for second year but trend may soon end, says IMF

Global debt has dropped for the second year in a row, but it remains “stubbornly high” after accelerating during the pandemic, according to the International Monetary Fund (IMF).

Total debt now stands at $235 trillion, equivalent to 238% of worldwide GDP – down from 258% in 2020, but still above the 229% recorded in 2019.

Public debt has fallen by just 8 percentage points of GDP in the past two years, meaning it has offset only half of the rises associated with increased spending because of COVID-19.

China has been a big part of this, the IMF says, with its borrowing outpacing its economic growth. China’s non-financial corporate debt is also the highest in the world, at 28% of GDP (see more on the Chinese economy in the News in Brief section below).

“Fiscal deficits kept public debt levels elevated, as many governments spent more to boost growth and respond to food and energy price spikes even as they ended pandemic-related fiscal support,” the IMF says.

“Governments should take urgent steps to help reduce debt vulnerabilities and reverse long-term debt trends. Reducing debt burdens will create fiscal space and allow new investments, helping foster economic growth in coming years.”

4. News in brief: Stories on the economy from around the world

China’s economy is expected to grow more slowly than previously forecast. Growth of 5.0% is likely this year, according to a Reuters poll of economists, down from a prediction of 5.5% in July. Retail sales and industrial output rose faster than expected in August, but a major property market downturn is creating a heavy drag on the economy – around 70% of household wealth is in the property market.

Chinese firms will also face a stricter approvals process when making bulk US dollar purchases, as the central bank seeks to counter rising risks of currency depreciation. The yuan has fallen 6% against the dollar this year, leaving it at its lowest since the 2008 financial crisis.

US consumer prices rose at their fastest pace in 14 months in August, climbing 0.6% on the month. Gasoline was the biggest factor, and the rise means annual inflation has risen for two months in a row, taking it to 3.7%. But core inflation – excluding food and energy – rose by its smallest amount since September 2021, meaning the Federal Reserve may refrain from making interest rate rises next week.

The UK’s GDP contracted more than expected in July, with a 0.5% drop on the month. Heavier rain than normal hit retailers and the construction sector, and hospital strikes also dragged on the economy. But broader signs suggest a weakening economy, with the UK unemployment rate rising and vacancy numbers falling below 1 million for the first time in two years.

The World Economic Forum’s Platform for Shaping the Future of Trade and Investment informs business and policy action on critical international trade and investment choices, driving inclusive growth and development by working with companies, governments, and civil society.

Contact us for more information on how to get involved.

Russia has hiked its inflation forecast for the next two years to 7.5%, from a 5.3% projection in April, as the economy faces rising costs from its war on Ukraine. The economy ministry also expects the rouble to weaken against the US dollar. The rouble has recently fallen below the psychological barrier of 100 to the US dollar.

Argentina’s annual inflation rate has hit 124.4%, with soaring prices for basic goods pushing poverty levels above 40%. Prices rose 12.4% in August alone compared with July.

Japan’s annual wholesale inflation – a measure of what companies charge each other for goods and services – fell to 3.2% last month from 3.4% in July. But confidence among Japanese manufacturing firms has dipped because of worries about China’s economic slowdown impacting global growth.

Corporate defaults surged above average levels in August, indicating rising strains from interest rate hikes and pending debt maturities. There were 16 new defaults last month, far above the 8.6 average for August. The annual total stands at 107 with most taking place in Europe and the US.

5. More on finance and the economy on Agenda

The ocean is the world’s seventh-largest economy in terms of gross domestic product, but it is suffering from multiple stressors due to marine and terrestrial economic activities. Companies can accelerate ocean health by pursuing joint advocacy, data stewardship and business transformation.

The global workforce is ageing due to lower youth entry and changing retirement trends. Here are three ways organizations can empower, reskill and integrate older workers into their talent system.

Many financial institutions are using “gamification” and “nudges” to boost customers’ financial resilience. Adding game-like elements such as points, scores and rewards to non-game activities such as financial products can guide individuals towards a particular behaviour or choice.