In the September quarter (Q2FY23) Balkrishna Industries Ltd saw its revenue grow ahead of analysts’ estimates. Also, with easing input costs, the visibility on margin is improving for the remainder of the financial year. Even so, as things stand, the road ahead is likely to be bumpy for investors in this stock.

A crucial downside risk that the company continues to face is demand uncertainty in its biggest market of Europe. In a post-earnings call, the management said demand momentum across Europe was sluggish due to geopolitical issues. Dealers and distributors continue to destock and are expected to reduce inventories to two months, from about three months currently. In the US, fears of a recession have affected growth to a certain extent, the management added. Even though the India business is doing relatively better, the management has withdrawn its previous FY23 volume guidance.

View Full Image

“The stock is likely to remain under pressure in the near term because nearly 70% of its target market is either in a slowdown or facing demand uncertainty,” said Varun Baxi, an analyst at Nirmal Bang Institutional Equities.

Although Balkrishna is better placed than European peers in the replacement market due to price differentials, headwinds on the demand front have dampened its FY24 earnings outlook, Baxi said. Region-wise, Europe contributes half of the company’s volume mix, followed by the US and India, with 20% each.

Elevated natural rubber prices, higher freight costs and unfavourable currency changes hit margins in Q2FY23. The recent correction in raw material and freight costs should buoy margins from early 4QFY23, the management said. In Q2FY23, the company took a 5% price hike, but the management indicated that more price hikes would be difficult.

“The expected margin improvement in H2FY23 would aid the company’s FY23 earnings outlook. However, we have lowered our FY24-25 earnings estimates by 4-6% due to weak demand in US and Europe,“ said Aniket Mhatre, an institutional analyst at HDFC Securities Ltd.

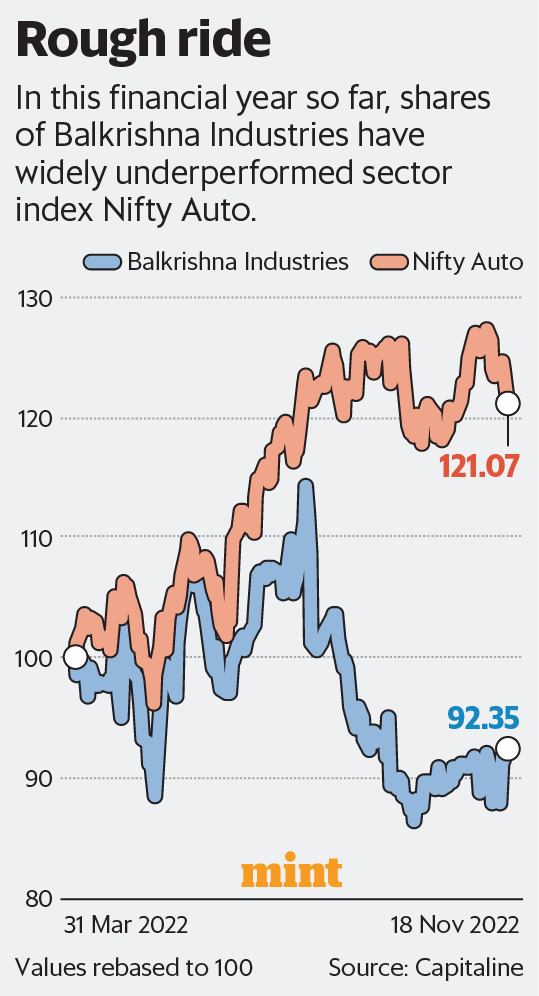

In FY23 so far, the Balkrishna Industries stock has fallen by 7.65%. In comparison, sector index Nifty Auto has rallied 21.07%. A revival in the stock’s performance largely depends on the improvement in global macro-economic conditions.

Mhatre said the only upside trigger for the stock is turnaround in demand scenario in Europe and the US. Unless that happens, the stock is likely to languish at current levels. “Also, at FY24 price-to-earnings of nearly 23x, we find the stock expensive,” he said.

Download The Mint News App to get Daily Market Updates.