Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

When Stablecoins Depeg

Cryptocurrencies grew out of the crisis of faith in financial markets and fiat currencies that emerged during the global financial crisis. While crypto markets have grown exponentially, they are not immune to the vicissitudes of market speculation. Because the cryptocurrency ecosystem has proved highly volatile, different actors have decided to introduce stablecoins. Stablecoins are designed to maintain a pegged value, frequently to the US dollar, and serve as a bridge between cryptocurrencies and traditional financial markets. The stability of stablecoins has been a matter of debate for some time. Questions have been raised about the composition of assets held by many stablecoins and whether the value of those assets matches the market cap of those stablecoins in circulation. A recent study from researchers at S&P Global titled “Stablecoins: A Deep Dive into Valuation and Depegging” focused on the stability of five prominent stablecoins to understand the situations in which their valuations have diverged from that of their underlying collateral.

The study looked at five stablecoins and compared their valuations over time to their declared underlying assets. All five stablecoins in the study were pegged to the US dollar. Those stablecoins were Tether, USD Coin, Multi-Collateral Dai, Binance USD and USDP Dollar. These stablecoins account for more than 90% of the $125 billion total stablecoin market as of June 2023. They all claim to hold some combination of cash, US Treasurys, money market funds, gold, other cash equivalents and cryptocurrencies, and to maintain their steady value algorithmically.

The study found that stablecoins, like any other asset, are subject to market volatility, market confidence and adoption, technology risk, demand and supply, and market liquidity. Looking at the root causes of depegging events (when the value of the stablecoin varied against the US dollar), the study found a number of factors are endemic to cryptocurrencies, such as technological and design flaws, vulnerability to hacking schemes and regulatory uncertainty.

When looking at depegging events, the study found that stablecoins are more likely to depeg below $1 in value, rather than above $1 in value. Volatility of stablecoin valuations seems to be higher during the weekend. This seems to be because many stablecoins maintain their pegged value through transactions that are only possible during normal banking hours. The weekend of March 10–13 was a significant depegging event for three of the stablecoins under examination since they had exposure to one or more of the three banks that failed in that time frame — Silicon Valley Bank, Signature Bank and Silvergate Bank.

The length and severity of depegging events varied significantly for the five stablecoins. The study’s authors believe that more stable stablecoins tend to have good governance and adequate collateral and reserves alongside liquidity, market confidence and adoption.

Today is Tuesday, September 12, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Economy

US Weekly Economic Commentary: Higher For Longer … Growth And Rates

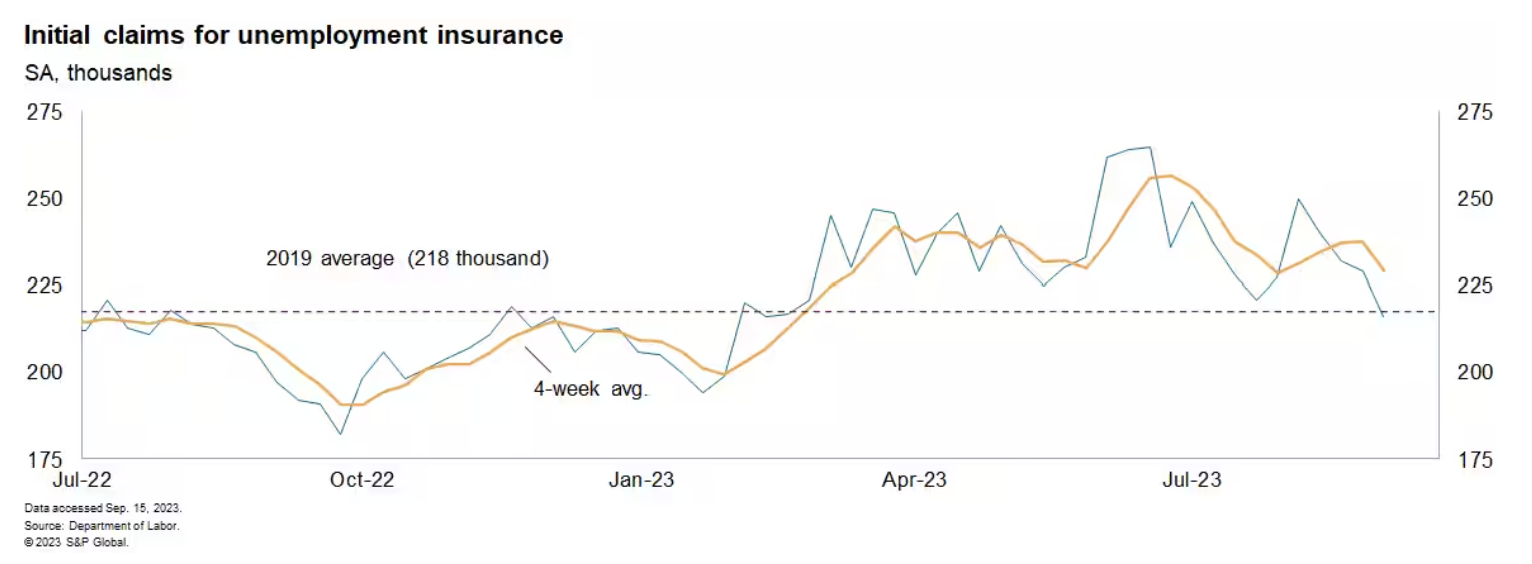

The US economy is growing significantly above its sustainable trend of roughly 1.75% to 2%, showing striking resilience in the growth of spending amid financial conditions that have tightened measurably over the past year or so. Exceptionally tight conditions in the labor market largely remain. In the latest week, initial claims for unemployment insurance declined for the fourth consecutive week and continuing claims edged lower as well; both now sit below their 2019 average.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Capital Markets

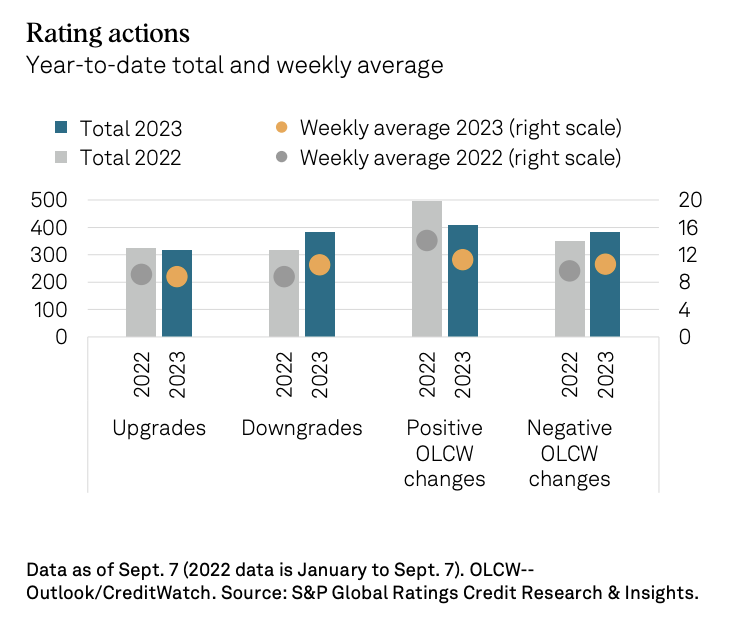

This Week In Credit: A Lot Of Data Incoming

Positive rating performance trends last week — which the Credit Suisse AG (UBS Group AG) upgrade led in debt-volume terms — precede a busy week on the data front. There will be much to digest. An ECB monetary policy decision (Thursday) will come hot on the heels of the European Commission lowering its growth forecasts for the region this morning. There is also a wealth of economic data to come including UK employment statistics (Tuesday), the US CPI release (Wednesday) and a slate of Chinese data on Friday that will include economic and credit activity data.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Global Trade

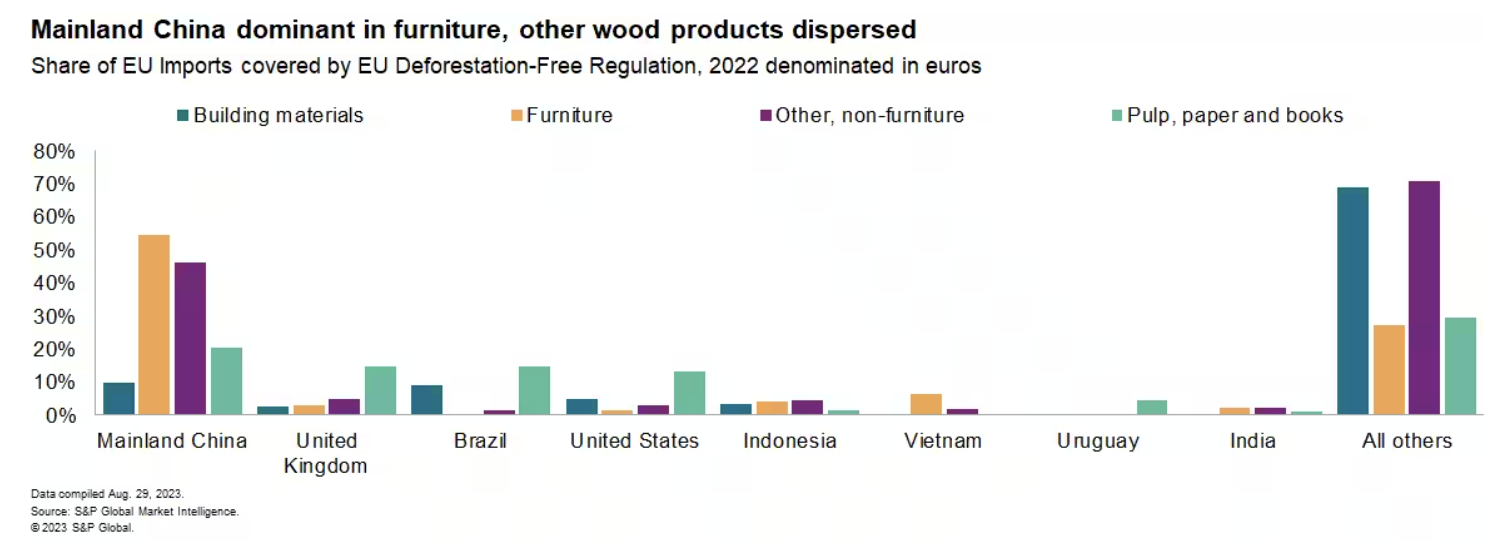

Deforestation Rules’ Impact On Supply Chains

The European Union Deforestation Regulation (EUDR) introduces wide-ranging supply chain reporting requirements for commodities and their downstream supply chains. The EUDR covers €40.9 billion of commodity imports to the EU and €85.0 billion of derived products. Companies have three broad ways to deal with EUDR: improve sourcing visibility; raise prices; reorient supply chains. All three are risky and can be expensive.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Sustainability

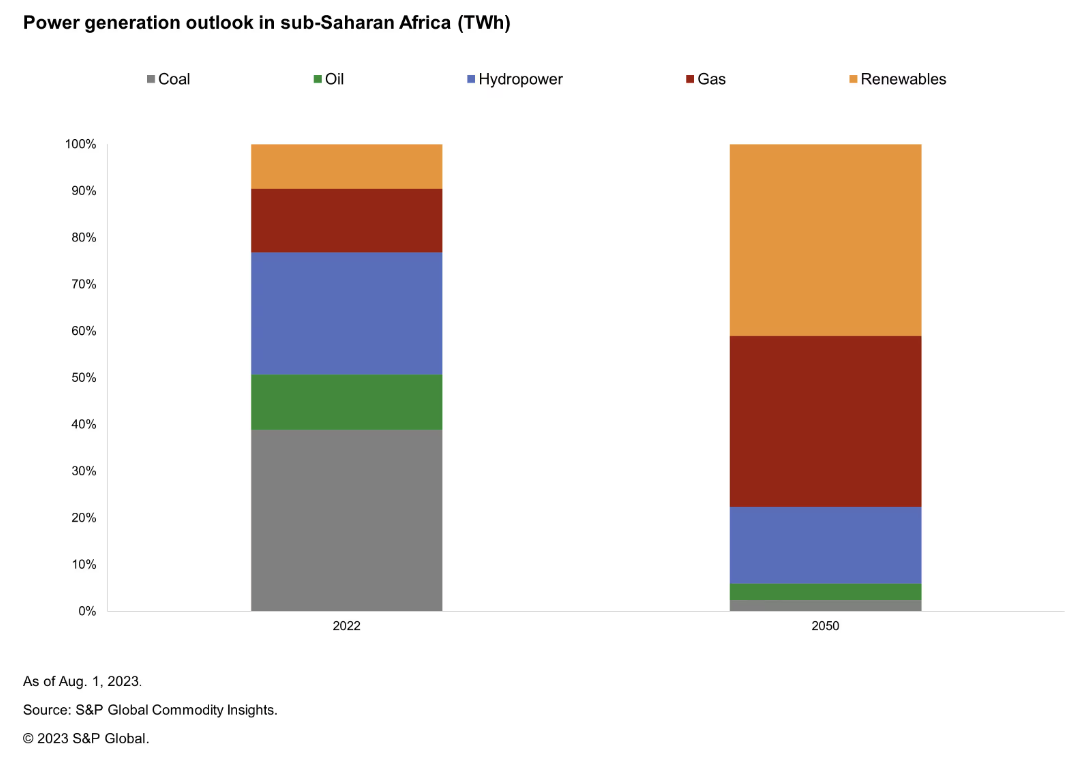

Unfavorable Conditions For New Coal Power Projects Promote Cleaner Power Investments In Sub-Saharan Africa

The role of coal in the energy mix in sub-Saharan Africa is changing. Although coal is currently the leading fuel for power generation in the region, its share is projected to decline, with about 9 GW of coal power retirements by 2030 out of the 42 GW installed today and no new projects to be added. Emissions reduction commitments and self-imposed financial restrictions for new coal plants by global financial institutions are the prime factors for the displacement of coal in the power generation outlook. The supply gap left behind by retiring coal units will open opportunities for cleaner alternatives such as gas and renewables.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Energy & Commodities

Listen: There She Blows: Interior Whales On Oil Industry With Offshore Leasing Restrictions

The Interior Department is set to hold Lease Sale 261 on Sept. 27, but oil and gas producers are not happy with the leasing terms and stipulations that Interior has put forth for this sale. Their main issue is with a voluntary settlement agreement the Biden administration entered into with environmental groups in July intended to protect the endangered Rice’s Whale. The settlement puts restrictions on oil and gas vessels and prompted the department to take millions of acres off the table for leasing. Erik Milito, president of the National Ocean Industries Association, joined the podcast to discuss the upcoming lease sale and hurdles the oil industry faces in acquiring the federal acres he says are needed to boost domestic production and help lower oil and gasoline prices. He also touched on the obstacles the offshore wind industry could face from delays in oil and gas leasing as the Inflation Reduction Act created new links between renewable and fossil fuel development.

—Listen and subscribe to S&P Global Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Technology & Media

Listen: Next In Tech | Episode 132: Are AI Datacenters A Thing?

The explosion of interest in generative AI is impacting many things, including datacenters, with some identifying a new beast in the AI datacenter. Analyst Dan Thompson returns to sort out what’s real and what’s “AI washing”. There are increasing demands being placed by AI and power densities in datacenters have already been increasing. More efficient design, liquid cooling and better air handling may hold off the need for magic sauce to meet AI’s needs today, but the future is uncharted.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence