The crypto market is gearing up for a pivotal week, with several economic events on the horizon and the looming FTX liquidation. Market experts are bracing for a notable spike in crypto market volatility.

On Monday, the European Commission revised its 2023 economic growth forecasts downward for the eurozone and the 27-member European Union.

US Set to Release Crucial Inflation Data on Wednesday

The EU’s growth is estimated to reach just 0.8% for 2023, a drop from the earlier projection of 1%. The 2024 projections have also seen an adjustment, now standing at 1.4%, down from 1.7%.

Similarly, the revised growth rates for the eurozone in 2023 and 2024 now stand at 0.8% and 1.3%, respectively, down from the earlier estimates of 1.1% and 1.6%.

Of significant concern, the European Commission anticipates that Germany, a major player in the bloc, will face a recession this year. Reacting to these projections, the price of Bitcoin momentarily slipped below $25,000, increasing the crypto market volatility.

Read more: How To Prepare for a Recession: 11 Quick Tips

The coming days will focus on the fallout from the beleaguered cryptocurrency exchange FTX. On Wednesday, the exchange is set to seek court permission to liquidate crypto assets worth $3.4 billion.

If approved, FTX plans to systematically liquidate its assets in chunks of $100 to $200 million each week.

Read more: What Will Happen to Dogecoin, Solana, and Aptos as FTX Readies to Dump

This development has raised alarms about a possible market downturn. A massive sell-off could saturate the vulnerable crypto market, pushing prices down further.

Crypto Market to React to Consumer Price Index Report

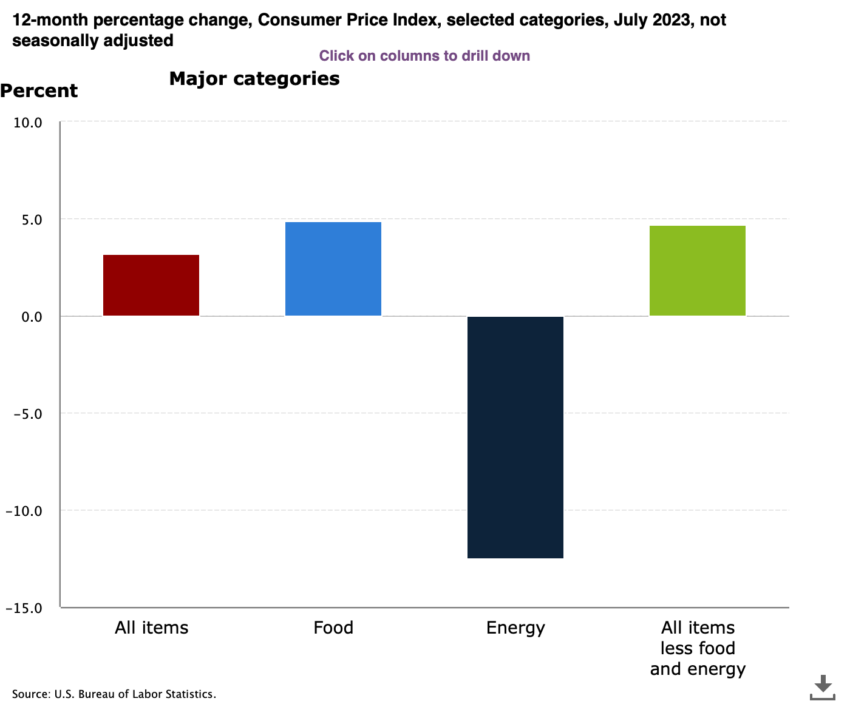

Another key event this week is the United States’ announcement of the Core Consumer Price Index (CPI) figures on Wednesday. The Core CPI, which excludes the fluctuating prices of food and energy, shows a predicted year-on-year decrease.

When CPI figures outperform forecasts, they strengthen the USD, leading to a bullish trend. On the other hand, underwhelming figures could weaken the USD, resulting in a bearish outlook.

Interestingly, crypto markets have not consistently followed macroeconomic patterns. For example, Bitcoin has often diverged from trends seen in traditional assets over the past decade.

While Bitcoin has typically moved inversely to the US Dollar Index (DXY), which compares the dollar to six major global currencies, heightened inflation might spur interest in Bitcoin as a perceived safe haven asset.

Most Leading Cryptos Reflect a Downward Trend

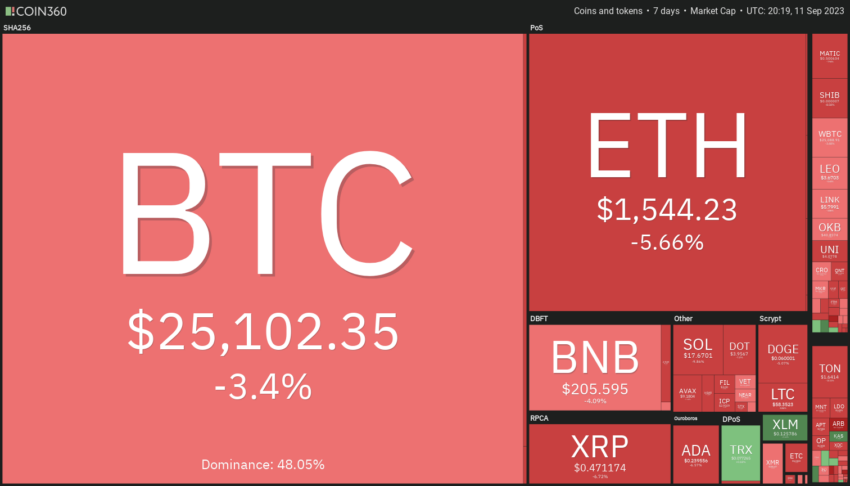

Investor sentiment appears cautious, evidenced by the predominant selling pressure. 18 out of the top 20 cryptocurrencies by market capitalization have reported losses in the past week.

Thursday will bring more insights with the release of the US Producer Price Index (PPI) — a measure that indicates the cost of goods at the manufacturing level. This can hint at future shifts in consumer prices. Additionally, data for August’s Retail Sales, an essential consumer spending gauge, will be unveiled.

Rounding off the week, the European Central Bank is slated to announce its benchmark interest rate decision on Thursday. The latest rate, declared on July 27, 2023, stood at 4.25%, up from the preceding rate of 4.00%.

Decision-makers are closely monitoring European inflation trends, ensuring the rate determination remains finely balanced.

Yet, according to Arthur Hayes, the founder of BitMEX, the dynamics between key macroeconomic indicators and the crypto markets might be evolving.

Speaking at Korea Blockchain Week, Hayes pointed out that Bitcoin has weathered some of the most aggressive Fed hikes and seems resilient regardless of whether the Fed opts to increase or decrease rates.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.