tsingha25

Last week’s comment on the future of the U.S. dollar was…”keep an eye on the value of the dollar.”

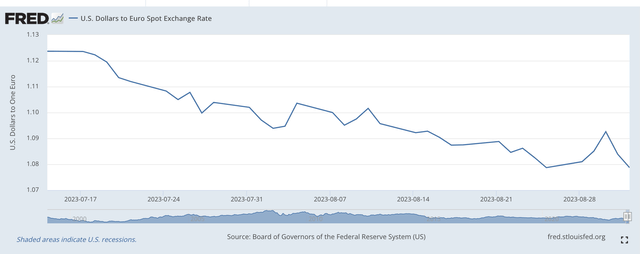

Well, the U.S. dollar had a strong week, especially against the Euro.

The Euro is facing an eight-week decline against the U.S. dollar.

Last week was particularly strong.

Here is the latest view of the past eight weeks.

U.S. Dollar to Euro Spot Exchange Rate (Federal Reserve)

The U.S. dollar to Euro exchange rate closed at just over $1.07 on Friday.

The reason for the decline seems to be the continuing strength in the U.S. economy and the growing weakness of the European economies, especially the weakness in its usual leader, Germany.

The European Central Bank has indicated that it might have one more increase in its policy rates before it stops raising rates, but doubt is growing that this will happen.

In the Financial Times, we read,

“Derivatives markets imply a roughly 35 percent chance of the ECB raising its deposit rate from 3.75 percent to 4.00 percent on September 14. Those chances have fallen after a string of weak economic data in recent weeks. The eurozone’s official second-quarter growth figure was revised down from 0.3 percent to 0.1 percent, and business surveys point to a further slowdown in August.”

Thus, the U.S. economy remains surprisingly strong while the European economies are showing further weakness.

The value of the U.S. dollar rises.

The expectation is for the U.S. economy to go into recession sometime in the near future. The term structure of interest rates in the U.S. has had a negative slope for quite some time now. This has always been a pretty good predictor of upcoming recessions.

But, the U.S. economy continues to perform above expectations.

The Federal Reserve System is in its 18th month of quantitative tightening of its monetary policy. The Fed’s policy rate of interest now stands at an effective level of 5.33 percent, quite a bit higher than the policy rate in Europe.

And, European money, as I have written, has been flowing into the United States, strengthening the dollar.

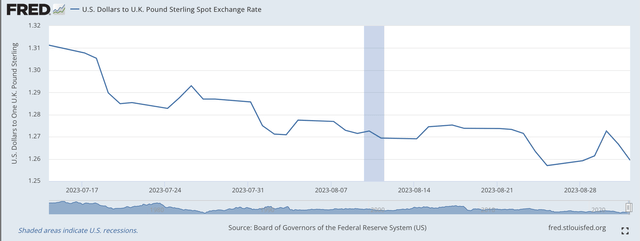

Elsewhere, the value of the U.S. dollar has also risen against the British Pound.

U.S. Dollar to British Pound Exchange Rate (Federal Reserve)

Friday, the dollar/pound exchange rate was around $1.25 for one British pound. On July 14, eight weeks ago, the exchange was $1.31 for one British pound.

Again, the U.S. economy seems to be performing in a stronger way than the British economy. Go figure.

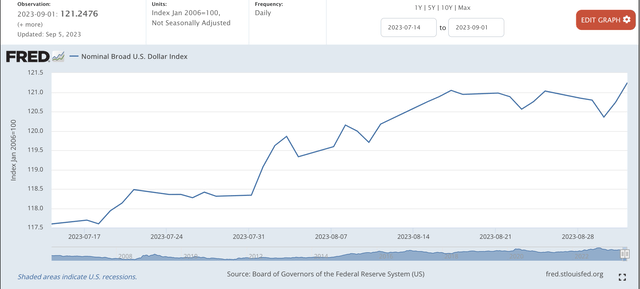

Overall, looking at a general index of exchange rates,

Nominal U.S. Dollar Index (Federal Reserve)

Again, we see eight weeks of pretty strong behavior of this general dollar index.

Chris Turner, head of FX strategy at ING, is quoted in the Financial Times article cited above as stating

“The U.S. data (are) relentless, and it’s coking at a time when the European manufacturing sector is very weak.”

The European situation seems much clearer than the U.S. situation.

The U.S. economy has remained much stronger than many have expected.

The Federal Reserve is maintaining its stance on quantitative tightening.

The Fed will continue with the quantitative tightening until it sees a change in the economy. The Fed is keeping a close eye on what is happening.

And, it is very likely that investors will see another one…or maybe two…more increases in its policy rate of interest.

The situation seems to be one that includes the continuing strength of the U.S. dollar against other currencies in the near future.

So, my advice this week is the same as it was last week…”keep an eye on the value of the U.S. dollar.”

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.