Autumn statement 2022 live: OBR says living standards to fall 7% as Hunt confirms millions to pay more taxes | Politics

OBR: Eight years of living standards growth wiped out in 7% fall

As Hunt sat down, the Office for Budget Responsibility released its latest economic and fiscal outlook.

It’s grim.

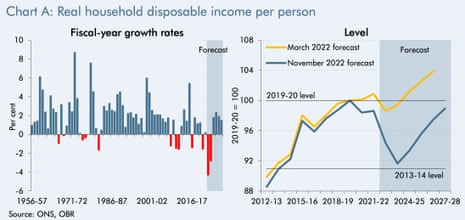

The OBR says that despite the new support with energy bills, living standards are going to fall by 7% over the next two years.

That’s a dire outcome, wiping out eight years of growth.

The OBR says:

Over £100bn of additional fiscal support over the next two years cushions the blow of higher energy prices – but the economy still falls into recession and living standards fall 7% over two years, wiping out eight years’ growth.

Over the medium term, around £40bn in tax rises and spending cuts – in roughly equal measure – offsets higher debt interest and welfare costs and gets debt falling as a share of GDP.

The fall in living standards next year will be the biggest on record, so since at least the mid-1950s, the OBR adds:

On a fiscal year basis, RHDI per person (a measure of living standards) falls by 4.3% in 2022-23, which would be the largest since ONS records began in 1956-57.

That is followed by the second largest fall in 2023-24 at 2.8%.

This would be only the third time since 1956-57 that RHDI per person has fallen for two consecutive fiscal years – the last time this happened was in the aftermath of the global financial crisis.

This chart shows the scale of the hit to living standards, as inflation hammers households.

Key events

-

Average incomes to fall £1,700 in living standard squeeze

-

Anti-poverty campaigners relieved benefits being uprated in line with inflation

-

SNP call for inquiry into Scottish Tory leader Douglas Ross ‘leaking’ autumn statement news to MSPs

-

Dilnot says he is ‘deeply disappointed’ by decision to delay introduction of cap on adult social care costs

-

Treasury to pay £133bn to Bank of England to cover QE losses

-

Families will be 31% poorer in 2027 than they would have been if living standards growth had not stalled after 2008, says IFS

-

Poorest families gain most, proportionally and in cash terms, from autumn statement, Treasury figures show

-

OBR: fuel duty going up in March

-

UK tech regulator to crackdown on Silicon Valley giants

-

Council tax bills to rise 5%, says OBR

-

Tax burden set to reach highest sustained level since second world war – at even higher level than forecast in March, OBR says

-

Teachers’ leaders welcome extra funding for schools

-

Fiscal drag means it’s a boiled-frog budget

-

OBR says government debt interest spending up to highest level since just after second world war

-

House prices to fall 9%, OBR predicts

-

Bulb bailout cost hits £6.5bn

-

Unemployment to rise by 505,000

-

What autumn statement means for climate crisis challenge – analysis

-

Tories have forced economy into ‘doom loop’, Labour’s Rachel Reeves tells MPs

-

OBR: national debt will be £400bn higher than expected

-

OBR: recession to last just over a year

-

OBR: Eight years of living standards growth wiped out in 7% fall

-

Hunt confirms benefits and pensions rising by 10.1% next year, in line with inflation

-

National live wage to rise by 9.7% next year, Hunt says

-

Rent rises in social rented sector to be capped at 7%, Hunt says

-

Hunt says energy price guarantee to be extended, with unit prices capped so average bills are no more than £3,000

-

Hunt says government committed to building Sizewell C nuclear power plant

-

Hunt says he is raising NHS budget by £3.3bn over two years

-

Electricity generator shares fall on windfall tax

-

Hunt announces more money for the NHS but says former Labour health secretary will find ‘efficiency savings’

-

Hunt announces £2.3bn extra spending on schools

-

Hunt: this is a £55bn consolidation package

-

Hunt says government departments must make savings to compensate for inflation

-

Hunt says extending windfall tax on energy firms will raise extra £14bn

-

Underlying debt/GDP to peak in 2025-26

-

Hunt confirms 45% rate of income tax to start at 125,000; tax allowance and threshold being further frozen

-

UK now in recession

-

Hunt says his plans will involve ‘substantial tax increase’

-

Hunt says OBR expects inflation to be 9.1% this year and 7.4% next year

-

Hunt praises Bank of England for doing ‘outstanding job’ in tackling inflation

-

Jeremy Hunt starts autumn statement by stressing there are ‘unprecedented global headwinds’

-

Jeremy Hunt to unveil autumn statement

-

Support for Brexit at lowest level since vote to leave in 2016, poll suggests

-

Jeremy Hunt to unveil autumn statement as Labour says ’12 years of Tory economic failure’ holding UK back

Filters BETA

Mohamed El-Erian, president of Queen’s College, Cambridge, and chief economic adviser to Allianz, the German finance company, told LBC’s Tonight with Andrew Marr that this wasn’t a typical Conservative budget. He said:

I would say they would say we finally we’ve got back more fiscal responsibility. This is not your typical Conservative budget. This puts a significant burden on the better off in society, as it should. So, this is not your typical Conservative budget. This is a world where Conservative ideology has been put aside to economics. And I think that that’s the big contrast with what came before. Under Liz Truss it was about politics ahead of economics. Now, economics has been put ahead of politics.

According to Alex Wickham from Bloomberg, Tory MPs are very depressed about the autumn statement. That is not particularly surprising. Elections are often won on the basis of whether or not people feel better off than they were when the government came in, and today MPs learnt that they are likely to go to the polls after two years of falling living standards. (See 12.35pm.)

Liz Truss was not with fellow ex-PMS in the Commons this afternoon for today’s statement. (See 5.09pm.) She was having lunch in an exclusive club instead, Wickham reports.

Liz Truss was missing from the Commons today

Instead she had lunch with a friend at the Harry’s Bar private members’ club in Mayfair

“One of the most elegant and sophisticated clubs in London… an atmosphere of relaxed luxury” https://t.co/Y5fD4RvBho

— Alex Wickham (@alexwickham) November 17, 2022

NIESR, the economic think tank, have criticised Jeremy Hunt for not providing more support to households, saying:

The Chancellor should have provided more support to UK households at a time when they are suffering the largest fall in their real incomes since records began in 1956.

Given that fiscal targets are arbitrary, these could have been set to enable the Chancellor to bring forward more spending while still committing to sustainable public finances in the medium run.

NIESR adds that the government’s expensive universal subsidy, to cap average bills at £3,000 from April, will disproportionately benefit high-income earners, as they use a much greater amount of energy.

Rory Carroll

Jeremy Hunt’s autumn statement received a cool response in Northern Ireland where relief at a home heating oil support package failed to quell anxiety over austerity and public services.

The chancellor confirmed that all households in Northern Ireland will receive a £200 payment to help with energy costs. Originally the payment was £100 and limited to those who use home heating oil.

However it remained unclear when households in the region will receive an additional, long-promised £400 energy support payment. “This is imperfect but at least there is movement. We now need a clear timetable for this roll-out and the £400 electricity payment,” said Ian Paisley, a Democratic Unionist MP.

Other parties and business groups were more critical and said Northern Ireland remained in political and fiscal limbo, lacking an executive or assembly and facing a £650m hole in public finances.

“What was needed today was a credible plan to rebuild public services and grow the economy through investment in health, skills, and the transition to net-zero,” said Sinn Féin’s finance spokesperson, Conor Murphy. “Instead the Tory budget announced today will push us deeper into an unnecessary recession.”

Northern Ireland’s paralysed political institutions and heavy reliance on the public sector has prompted concern that austerity will deliver a disproportionate hit to its economy.

Average incomes to fall £1,700 in living standard squeeze

UK households face a £1,700 fall in disposable incomes over the next two years, the Resolution Foundation has calculated.

That’s the conseqences of the record-breaking 7% drop in living standards which will hit the economy in 2023 and 2024.

Such a drastic squeeze will push average incomes back to 2014 levels, wiping out eight years of income growth.

Government support this year and next adds 3½% on average to household incomes. But even so, living standards are set for the largest fall on record this year. And real incomes per person fall 7% over the 2 years to 2023-24, wiping out the previous 8 years’ growth. pic.twitter.com/JskoUxk33D

— Office for Budget Responsibility (@OBR_UK) November 17, 2022

Torsten Bell, chief executive of the Resolution Foundation, says Hunt’s autumn statement combined the rhetoric of George Osborne and the policies of Gordon Brown.

“In the short-term, the Chancellor has announced a smaller but more progressive energy support package, with two thirds going to the poorest half of households. But there will still plenty of rough justice – particularly for the 2.3 million low-income households who don’t receive means-tested benefits and therefore don’t qualify for lump-sum payments.

“The Chancellor announced concrete and big tax rises, disproportionately hitting middle and higher income households, while significant spending cuts were only pencilled in for after the next election and are unlikely to be delivered on the scale envisaged.

“Stepping back, the UK government has gone from announcing the biggest tax cuts in 50 years to the biggest tightening since 2010 in just a few weeks. Today provided the more reality-based version – but that reality will feel very tough indeed, as unemployment and energy bills rise, while average incomes fall by £1,700 over this year and next.”

Anti-poverty campaigners relieved benefits being uprated in line with inflation

Robert Booth

Anti-poverty campaigners expressed relief at the chancellor’s decision to raise benefits by 10.1% next year but warned that millions of the poorest people would still see their spending power fall amid rising inflation.

The increase is lower than the current 11.1% rate of inflation and follows years of cuts to the real value of benefits, affecting the lives of 9 million households – 7 million of which include someone who works.

On average, a family on universal credit will benefit next year by about £600, but analysts pointed out that increased payments would not arrive for another five months.

“This winter and beyond is still going to be a frightening obstacle course just to afford the essentials,” said Rebecca McDonald, the chief economist at the Joseph Rowntree Foundation.

Alison Garnham, the chief executive of Child Poverty Action Group, said: “It’s a relief that benefits and the benefit cap will rise with inflation. But … today’s package will not stop the ice from cracking under struggling families.”

Action for Children’s director of policy, Imran Hussain, said: “Families we support will be greatly relieved,” but he said benefit levels “are still well out of step with what families need to live on”.

Hunt said there would be additional cost-of-living payments next year of £900 for households on means-tested benefits, but only £150 for people on disability benefits, which Disability Rights UK said was below inflation and like “being thrown peanuts”.

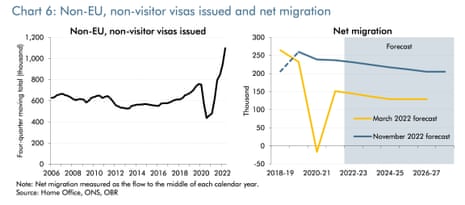

Migration into the UK will be higher than expected over the next few years.

The Office for Budget Responsibility has lifted its migration forecast. It now expects that net migration will be 224,000 in 2023, up from 136,000 forecast in March.

Net migration is now forecast to settle at 205,000 from 2026 onwards, up from 129,000.

The OBR explains:

This upward revision reflects evidence of sustained strength in inward migration since the post-Brexit migration regime was introduced.

It also reflects discussions with the Home Office’s migration advisory committee over what levels of net migration for the next several years might be consistent with the current migration regime.

This assumption of higher net migration adds 0.6% to the adult population by 2027, the OBR adds.

SNP call for inquiry into Scottish Tory leader Douglas Ross ‘leaking’ autumn statement news to MSPs

Douglas Ross, the Scottish Conservative leader, is being accused of leaking one of the main announcements in the autumn statement when he spoke in the Scottish parliament this afternoon.

At first minister’s questions Ross said the UK government was uprating pensions and benefits in line with inflation. At the time, Jeremy Hunt, the chancellor, was on his feet in the Commons. But the SNP say Hunt had not delivered the inflation-uprating news before Ross announced it to MSPs.

The SNP MP Brendan O’Hara said he was writing to the cabinet secretary demanding an inquiry. He said:

There are serious questions here, including on whether the ministerial code may have been breached – something which has even more relevance given the recent tawdry examples of Tory ministers playing fast and loose with the rules.

Douglas Ross may have thought he was being smart by pre-empting the chancellor in this way – but if the tables were turned he would be the first on his feet demanding an investigation, so he and his Westminster colleagues should now face the same level of scrutiny.

In 1947, Hugh Dalton resigned as chancellor after giving some details of his budget to a journalist a few minutes before he delivered his speech. The journalist worked for an evening paper, and the information appeared in print before Dalton had concluded his speech.

But nowadays budget leaking is much more common, and no one was surprised by the decision to uprate benefits in line with inflation, because ministers had strongly hinted this was coming.

The UK has double-digit inflation today, but the OBR predicts prices will be falling in a few years’ time.

The fiscal watchdog’s forecasts show inflation dropping sharply over the course of next year.

It is dragged below zero in the middle of the decade by falling energy and food prices before returning to its 2% target in 2027.

The pound has lost ground in the foreign exchange markets, after Jeremy Hunt announced his £55bn package of spending cuts and tax rises.

Sterling has lost more than a cent against the US dollar, falling to $1.18 – partly due to dollar strength today.

But it’s also lower against the euro, losing half a euro cent to stand at €1.142.

Michael Hewson, of CMC Markets, says the OBR’s gloomy forecasts have also hit UK assets.

The pound has come under pressure and gilts have sold off, sending yields higher after the chancellor of the exchequer outlined a budget that was long on tax hikes and short on spending cuts, although today’s moves have also got caught up today’s rebound in the US dollar and yields in the US.

The OBR outlined a very difficult couple of years, predicting that living standards could fall by as much as 7% over the next two years and house prices could fall by 9%. That comes across as optimistic, particularly on house prices, at a time when inflation isn’t expected to fall below 7% until 2024, and tax thresholds are being kept at the same levels until 2028.

Sterling isn’t being helped by a rebound in the US dollar, which is also exerting downward pressure on it, but the fact that it’s also lower against the euro suggests that the weakness is not just US dollar driven.