Adam Applegarth, the chief executive of UK bank Northern Rock from 2001 to 2007, described 9 August 2007 as a moment in which ‘the world changed’. This day set off a chain of events that would lead to the global financial crisis and the sovereign debt crisis in the eurozone (see Table 1).

What happened?

Up until 9 August 2007, banks were able to raise money from interbank wholesale markets to fund their ever-expanding mortgage businesses.

US banks and banks like Northern Rock in the UK had developed a new banking business model. Instead of raising deposits and then lending them to house buyers, banks originated mortgages and distributed them. This simply involved selling the cash flows coming from mortgage repayments. These cash flows were then sliced, diced and packaged into mortgage-backed securities (MBS) or collateralised debt obligations (CDO), a process known as securitisation.

In 2007, this market and other credit markets froze because of fears that many MBSs and CDOs contained mortgages that had been granted to subprime borrowers – that is, people with a poor credit-rating history who were unlikely to be able to repay the loans.

Within a matter of weeks, Northern Rock was in deep trouble. It was an innovator that had moved aggressively into the buy-to-let and subprime UK mortgage market.

Only 25% of Northern Rock’s mortgages were funded by traditional deposits. The rest came from securitisation and wholesale money markets (House of Commons, 2008). The freezing of credit markets in August 2007 meant that Northern Rock’s aggressive funding model came to a juddering halt.

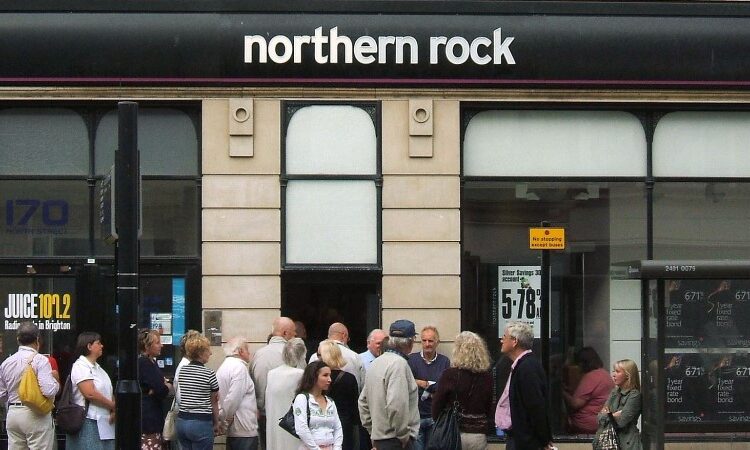

In September 2007, the BBC’s economics editor Robert Peston broke the news that Northern Rock was in trouble. Following his report, depositors in the bank queued up outside its branches. The run on Northern Rock only came to an end when the Chancellor of the Exchequer Alistair Darling announced that the taxpayer would guarantee the bank’s deposits.

Then, in September 2008, US bank Lehman Brothers filed for bankruptcy and the global financial system went into meltdown.

The standard explanation given as to why the US government refused to bail out Lehman Brothers was that doing so would have created a ‘moral hazard’ problem, resulting in other banks taking on too much risk.

But the reality is that the prospect of a bipartisan backlash against a bailout meant that the US government let it fail so that they could rescue the rest of the banking system (Ball, 2018; Quinn and Turner, 2020).

This rescue came in the form of the $700 billion Troubled Assets Relief Program (TARP). The original idea of the TARP was that the US Treasury would buy or insure MBSs, CDOs and other toxic assets from banks.

Within a matter of weeks, the TARP was changed to provide capital, guarantees and direct support to banks. Nearly 50 major US banks participated.

Table1: A timeline of key events in the global financial crisis

| 9 August 2007 | Credit markets freeze when BNP Paribas halts activity in three of their funds due to illiquidity of the subprime mortgages that they are holding. |

| 14 September 2007 | The run on Northern Rock begins, the first on a British bank for 150 years. |

| 17 February 2008 | Northern Rock is nationalised by the Chancellor of the Exchequer Alistair Darling. |

| 16 March 2008 | JP Morgan Chase agrees to rescue the investment bank Bear Stearns, with the US government providing a $30 billion guarantee against its losses. |

| 7 September 2008 | The US government takes Fannie Mae and Freddie Mac – two entities that guaranteed mortgages – into temporary public ownership. |

| 15 September 2008 | US bank Lehman Brothers files for bankruptcy. |

| 16 September 2008 | AIG, a major US insurance company, receives a $85 billion bailout loan from the US Federal Reserve (‘the Fed’). |

| 17 September 2008 | Lloyds-TSB agrees, with UK government encouragement, to rescue HBOS. |

| 27 September 2008 | The UK government nationalises Bradford and Bingley Bank. |

| 30 September 2008 | Ireland’s government promises to underwrite the country’s entire banking system. |

| 3 October 2008 | The US Congress approves a $700 billion bailout package for US banks – the Troubled Asset Relief Program (TARP). |

| 13 October 2008 | The UK government bails out the Royal Bank of Scotland, Lloyds-TSB and HBOS by taking large ownership stakes in them and guaranteeing their assets. |

| 16 December 2008 | The Fed cuts its key interest rate to near zero, the lowest ever in its 95-year history. |

| 22 April 2009 | The Chancellor of the Exchequer reveals that bailing out the banking system will result in the largest budget deficit in UK history. |

| 2 May 2010 | Greece is bailed out for the first time. |

| 28 November 2010 | The European Union (EU) and the International Monetary Fund (IMF) agree a bailout package for Ireland. |

| 5 May 2011 | Portugal is bailed out by the EU and the IMF. |

| 21 July 2011 | Greece is bailed out for a second time. |

| 8 June 2012 | Spain accepts a bailout package from the EU. |

| 26 July 2012 | Mario Draghi, the president of the European Central Bank (ECB), states that it will do ‘whatever it takes’ to save the euro. |

| 16 May 2017 | The UK government sells its remaining shares in Lloyds Banking Group. |

| 28 March 2022 | Government ownership of the NatWest Group (formerly the Royal Bank of Scotland) falls below 50% for the first time since its rescue. |

Shortly after the collapse of Lehman Brothers, the UK government announced a package of measures to relieve the financial crisis. Those measures included a capital injection fund, asset guarantees and attempts to improve the liquidity of bank assets (Turner, 2014).

During September and October 2008, the global financial crisis spread to Belgium, France, Germany, Italy, the Netherlands, Sweden and Switzerland. Some major banks in these countries received government capital injections and loan guarantees because they had invested heavily in subprime MBSs and CDOs originated in the United States (Xiao, 2009; Claessens et al, 2010; Hüfner, 2010).

With the crisis deepening, the US Federal Reserve (‘the Fed’) provided dollar liquidity for European banks through its swap line facility. In other words, the US monetary authority provided dollars to the European Central Bank (ECB) and the Bank of England to assist banks that had raised a lot of their funding in US dollars (Tooze, 2018).

While most European economies imported banking instability from the US subprime meltdown, Ireland and Spain had their own home-grown sources of banking instability coming from their domestic property sectors. This required extraordinary actions to save their banking systems.

By 2010, it became apparent that the scale of the losses on property loans in Ireland was much greater than had been originally thought, and there were concerns about the ability of the Irish government to meet the burgeoning costs of fixing the country’s banks.

Subsequently, there were large outflows of foreign money from Irish banks and the yield on the country’s sovereign debt soared (Whelan, 2014). As a result, the European Union (EU) and the International Monetary Fund (IMF) provided a bailout package of €85 billion in late November 2010.

The global financial crisis had now morphed into a sovereign debt crisis in the eurozone (see Table 1).

Why did this happen?

The proximate cause of the global financial crisis was the bursting of the largest property bubble in human history, in the United States (as illustrated in Figure 1).

Ireland, Spain and the UK also had major property bubbles that burst. For example, between 1997 and the market peak in 2007, Spanish, Irish, Northern Irish and UK real house prices increased by 125%, 202%, 227% and 157% respectively. Between the peak and 2012, real house prices across the four countries fell by an average of 43% (Quinn and Turner, 2020).

Property bubbles need credit to inflate. One source of capital for the United States, the UK, Spain and Ireland was money flowing from the likes of China (Turner, 2009; Financial Crisis Inquiry Commission, 2011). Over 60% of the increase in US mortgage funds during the 2000s came from overseas (Gjerstad and Smith, 2014).

This flood of capital combined with loose monetary policy to drive down mortgage rates and stimulate housing starts and home sales (Financial Crisis Inquiry Commission, 2011).

Figure 1: Index of real US house prices

Source: Quinn and Turner, 2020

As a result, there was a very large increase in mortgage debt. For example, in the United States, mortgage debt per household went from $91,500 in 2001 to $149,500 in 2007. In Ireland, it increased from €27,000 to €87,000 in the same period (Quinn and Turner, 2020).

The ratio of mortgage debt to GDP in Ireland, Spain, the UK and the United States was higher by some distance than in any other country (Quinn and Turner, 2020). Further, they all had a very high proportion of lower-income households with mortgages.

This large increase in mortgage debt was only possible because banks substantially lowered their lending standards (Mian and Sufi, 2014; Turner, 2014; Quinn and Turner, 2020).

The chief way of doing this was to increase the loan-to-value ratio, which enabled credit-constrained and lower-income households to enter the housing market. For example, a typical loan-to-value ratio for Northern Rock was more than 100%. This subprime sector in the United States went from 7.6% of mortgage originations in 2001 to 23.5% in 2006 (Financial Crisis Inquiry Commission, 2011).

The ultimate cause of the global financial crisis was political. The policies used in Ireland, Spain, the UK and the United States to deal with housing low-income families differed from most other countries. Governments of the left and right in these countries used housing policy to encourage low-income households to buy their own homes, while deregulating and encouraging the financial sector to lend to these households.

What were the consequences of the global financial crisis for the UK?

Rescuing the UK banking system was costly. Fifteen years later, the UK is still living with the legacy of the events of 2007-09.

The UK and other major economies experienced a significant contraction in GDP because of the global financial crisis (see Figure 2).

In the years since, the UK has experienced an unprecedented slowdown in productivity, in no small part due to the scarring effects of the crisis (Crafts and Mills, 2020). Estimates suggest that the crisis reduced UK potential output anywhere from 3.8% to 7.5% of GDP (Crafts, 2019).

Figure 2: Annual GDP growth (%), 1971-2022

Source: World Bank, 2023

To bail out its banking system, the UK had to borrow substantial amounts of money (see Figure 3). Concerns about these debt levels, as well as the fall in potential output arising from the global financial crisis, resulted in a prolonged period of austerity with major cuts to public spending. Many of these cuts were unevenly distributed and fell disproportionately on poorer areas (Innes and Tetlow, 2015).

The austerity experienced by an area was strongly associated with support for the UK Independence Party and Brexit (Fetzer, 2018; Crafts, 2019). Thus, Brexit can ultimately be blamed on the global financial crisis (Crafts, 2019).

Further, because Brexit will reduce the UK’s potential output by somewhere between 3.9% and 8.7% of GDP, it has been suggested that the total fall in UK potential output due to the crisis of 2007-09 could be as high as 16.2% (Crafts, 2019).

Figure 3: UK public sector net debt/GDP (%)

Source: Office for Budget Responsibility, 2023

One of the responses of central banks around the world during the crisis was to lower their interest rates to near-zero levels and to engage in quantitative easing (QE). The Bank of England started QE in March 2009, by which time its policy rate was 0.5%.

As Figure 4 shows, the Bank’s interest rate stayed close to the zero lower bound up until the post-pandemic surge in inflation. Quantitative easing also remained in place until the Bank started reversing this policy in November 2022.

Have these extraordinary monetary policy measures distorted the economy?

First, there are potential distributional consequences of QE because it tends to increase the prices of financial assets, which are chiefly held by the wealthy (Sterk and Cui, 2018).

Second, QE has left the Bank of England and UK public finances much more exposed to rises in short-term interest rates, which creates a risk of fiscal dominance and undermines the ability of the Bank to get inflation under control (Chadha, 2022).

Third, the prolonged period of low interest rates has perhaps lulled many people into borrowing too much from banks, mistakenly believing that near-zero interest rates were the new norm. Indeed, the legacy of extraordinary monetary policy may well play a part in the next banking crisis (Quinn and Turner, 2020).

Figure 4: Bank of England interest rates (%), 1971-2023

Source: Bank of England, 2023

What are the lessons for policy-makers today?

The foremost lesson from the events of 2007-09 is that the cost of banking crises are so large that governments, regulators and central banks should ensure that banks are not taking excessive and imprudent risks.

There is a related danger of regulatory capture – that public authorities work more in the interests of the companies and sectors that they are regulating than in the interests of society as a whole.

In the housing boom that preceded the global financial crisis, governments were entranced by the economic growth that banks were stimulating, the tax revenue that they were generating, and the role that they played in helping lower-income groups access the housing market (Financial Crisis Inquiry Commission, 2011; Turner, 2014; Quinn and Turner, 2020).

This resulted in them deregulating the banking system and putting pressure on regulators to apply a light touch (Turner, 2014; Quinn and Turner, 2020).

Central banks and regulators need to be insulated from such political pressure by giving them financial stability mandates and independence from political interference to achieve their mandates.

Where can I find out more?

Who are experts on this question?

- Jagjit Chadha

- Rebecca Stuart

- John Turner

- John Wilson