Mitsubishi UFJ Trust & Banking Corp Shows Confidence in United States Steel with Recent Acquisition

Mitsubishi UFJ Trust & Banking Corp, a prominent institutional investor, recently acquired 9,221 shares of United States Steel Co. (NYSE:X) during the first quarter of this year. This purchase amounts to approximately $241,000, as revealed in its most recent filing with the Securities and Exchange Commission (SEC). The move by Mitsubishi UFJ Trust & Banking Corp indicates its confidence in the future prospects of United States Steel.

In its latest financial statement released on July 28th, United States Steel reported strong quarterly earnings. The company exceeded market expectations by posting an earnings per share (EPS) of $1.92 for the quarter, surpassing the consensus estimate of $1.86 by $0.06. Moreover, despite generating revenue of $5.01 billion during the period, slightly below analyst estimates of $5.11 billion, United States Steel managed to maintain a net margin of 7.05% and a return on equity of 13.51%.

However, it is worth noting that the company’s revenue experienced a decline of 20.4% compared to the previous year. During the same quarter last year, United States Steel recorded an EPS of $3.86. Despite this decline in revenue growth, sell-side analysts remain optimistic about United States Steel’s future performance and expect it to post an EPS of 4.02 for the current fiscal year.

Investors and industry observers will be keenly watching how these developments unfold and whether Mitsubishi UFJ Trust & Banking Corp’s investment in United States Steel proves fruitful over time.

About United States Steel Co.

United States Steel, listed under ticker symbol X on the New York Stock Exchange (NYSE), is a leading basic materials company operating within various segments such as Flat-rolled Products, U.S. Steel Europe (USSE), Tubular Products (T), and Others.

Disclaimer: The information presented in this article should not be considered as financial advice. It is always recommended to conduct thorough research and seek professional guidance before making any investment decisions.

Increasing Hedge Fund Interest Indicates Potential Growth for United States Steel

In recent months, various hedge funds have made notable changes to their positions in United States Steel, a leading basic materials company. Two Sigma Advisers LP, for example, increased its stake in the company by 15.1% during the fourth quarter. The fund now owns approximately 4,479,700 shares of United States Steel’s stock with an estimated worth of $112,216,000 after acquiring an additional 589,200 shares.

Similarly, Donald Smith & CO. Inc. raised its stake in United States Steel by 34.8% during the fourth quarter as well. With an additional acquisition of 920,120 shares, Donald Smith & CO. Inc. now possesses about 3,561,945 shares worth $89,227,000.

Geode Capital Management LLC also displayed an increase in its stake in United States Steel by 1.3% during the fourth quarter. By obtaining an additional 44,162 shares during this period alone, Geode Capital Management LLC now has a total of 3,423,901 shares valued at $87,172,000.

Another notable hedge fund that significantly boosted its investment in United States Steel is First Trust Advisors LP with a staggering 155.8% lift during the first quarter. The fund now holds about 3,309.,824 shares worth approximately $124,913.,000 after acquiring an extra 2.,015.,980 shares.

Finally,on the fourth quarter,AQR capital management increased their stake in united states steel by buying an addition al539880 shares making them hold more than milanof(10 mil/20mil) at once out of all money flows.Having lifted its stake by nearly23%,AQR Capital Management LLC currently owns approximately ,896658sharesvalued at around$72.,561.,000.

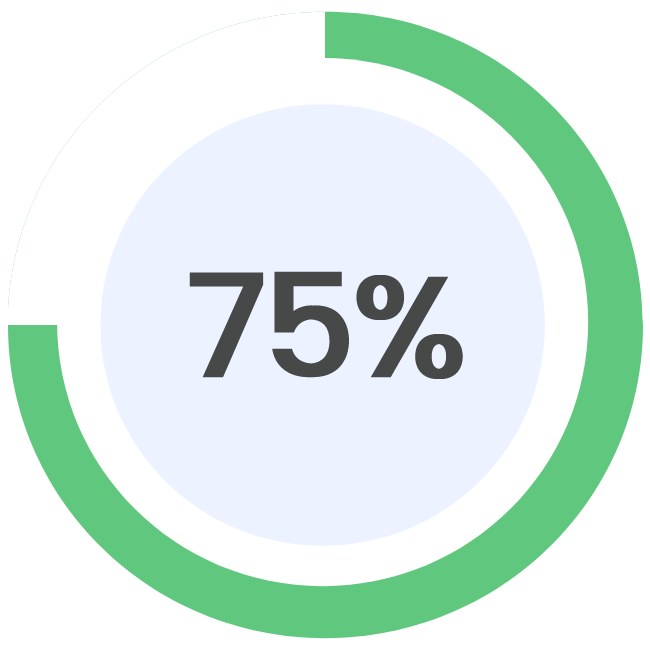

These impressive figures indicate how various institutional investors have shown interest and confidence in United States Steel’s potential for growth and profitability. As of the present, institutional investors own around 72.72% of the company’s stock.

On Friday, August 27th, shares of United States Steel began trading at $30.29. The market capitalization of the firm currently stands at $6.75 billion, while its price-to-earnings ratio is 5.83—indicating a highly favorable valuation compared to industry peers. Additionally, the company’s beta, which measures its volatility relative to the overall market, sits at 2.15.

United States Steel also exhibits strong liquidity metrics with a quick ratio of 1.30 and current ratio of 1.92—a sign of its robust ability to meet short-term financial obligations.The company maintains a debt-to-equity ratio of 0.38,a level that reinforces confidence in its financial stability.

In terms of historical stock performance, United States Steel has had a relatively stable year, with a 52-week low hitting $17.89 and a high reaching $32.52 in record trading activity.

The firm recently announced a quarterly dividend that will be paid on Thursday, September 7th to shareholders who are recorded as such by Monday, August 7th.Those eligible for the dividend will receive $0.05 per share—an annualized yield equivalent to approximately 0.66%. It is important to note that United States Steel has maintained a conservative dividend payout ratio, presently standing at just 3..85%.

Various analyst reports have been published on United States Steel in recent times.Predictably over time yielding does not seem well recurring.Three research analysts have given the stock an adverse “sell” rating, five have assigned it a neutral “hold” rating,and one has provided an optimistic “buy” rating to date.As per Bloomberg’s data consensus,in line with this information corroborated by actual substantial ratings,this gives United Statesteel an overall suspended or hovering hold rating with an approximate target price of $26.00 per share.

In conclusion, recent changes in the positions of hedge funds and institutional investors suggest a rising interest in United States Steel. It is evident that well-established funds such as Two Sigma Advisers LP, Donald Smith & CO. Inc., Geode Capital Management LLC, First Trust Advisors LP, and AQR Capital Management LLC have expressed confidence in the future prospects of this basic materials company. With its stable stock performance, favorable valuation metrics, and responsible dividend payout ratio, United States Steel continues to attract attention from investors looking for a reliable investment opportunity in the ever-changing market landscape.