(Aug 25): Some of the US’ top Middle Eastern allies — including the world’s biggest oil exporter — are moving closer into the orbit of China and Russia, further complicating geopolitics upended by Russia’s invasion of Ukraine.

Saudi Arabia, the United Arab Emirates and Egypt are set to join the BRICS grouping of major emerging markets, after being invited Thursday (Aug 24) during a summit in South Africa. They’re likely to join at the start of next year, along with Iran, Argentina and Ethiopia.

The move is part of a push by leaders of the BRICS nations — Brazil, Russia, India, China and South Africa — to increase the group’s influence and counter US power over the global economy and trade, particularly the role of the US dollar.

It also signals the determination of Saudi Arabia, the UAE and Egypt to bolster their status as midsized powers while avoiding taking sides in a world increasingly split between Washington and Beijing.

“They are focused on balancing and maintaining ties with multiple powers, not picking sides and getting wrapped up in a greater power competition,” said Anna Jacobs, a senior analyst at the International Crisis Group.

The US has tried to play down the expansion of the BRICS, with National Security Advisor Jake Sullivan earlier this week saying Washington doesn’t see it as a budding geopolitical rival.

The National Security Council declined to comment further on Thursday, although it highlighted the role of the Group of 20 as “the premier forum for economic cooperation” in a statement after Sullivan met with counterparts from France, Germany Italy and the UK.

US dollar dominance

While Saudi Arabia and Russia already have a strong voice in the global supply of oil through the Opec+ alliance, the BRICS development puts greater focus on the dominance of the US dollar in the oil trade, particularly with both massive producers and importers among the enlarged group, including top buyer China.

China and other BRICS countries have expressed a desire to buy energy in other currencies, but any move to transform the long-standing petrodollar system would be complicated. Both Saudi Arabia and the UAE peg their currencies to the US dollar. They would need any other currency in which they were paid to rival the greenback in terms of liquidity and as a store of value.

Without broad use of non-dollar debt, there will likely only be “a decade-long progression to a multipolar world, a world in which perhaps the dollar, the euro and the renminbi become the dominant currencies in the Americas, Europe and Asia respectively”, analysts at ING, including Chris Turner, wrote in a note Thursday.

ING also estimated that energy accounts for only 15% of global trade and that “Saudi pricing oil exports to China and India in non-dollar currencies does not spell the end of the dollar as the international currency of choice”.

Gulf states want “the ability to transact within both dollarised and de-dollarised zones”, the Bahrain-based International Institute for Strategic Studies said in a report in July.

Still, being part of the BRICS offers Saudi Arabia and the UAE the opportunity and flexibility to rely less on the dollar if needed.

“They are laying the ground for contingency planning in case relations with the US deteriorate significantly,” said Torbjorn Soltvedt, principal analyst for the Middle East and North Africa at the UK-based risk consultancy firm Verisk Maplecroft.

Saudi Arabia is spending trillions of dollars to diversify its economy, investing in everything from new cities to sports franchises and electric vehicles. Crown Prince Mohammed bin Salman sees deeper ties with the likes of China and India as crucial to that goal.

“Our foreign policy is primarily focused on building strong economic partnerships, firstly to support the kingdom’s economic development,” Foreign Minister Prince Faisal bin Farhan told Saudi media. “BRICS has proven that it’s an important and useful channel for this,” especially among lesser-developed countries of the Global South.

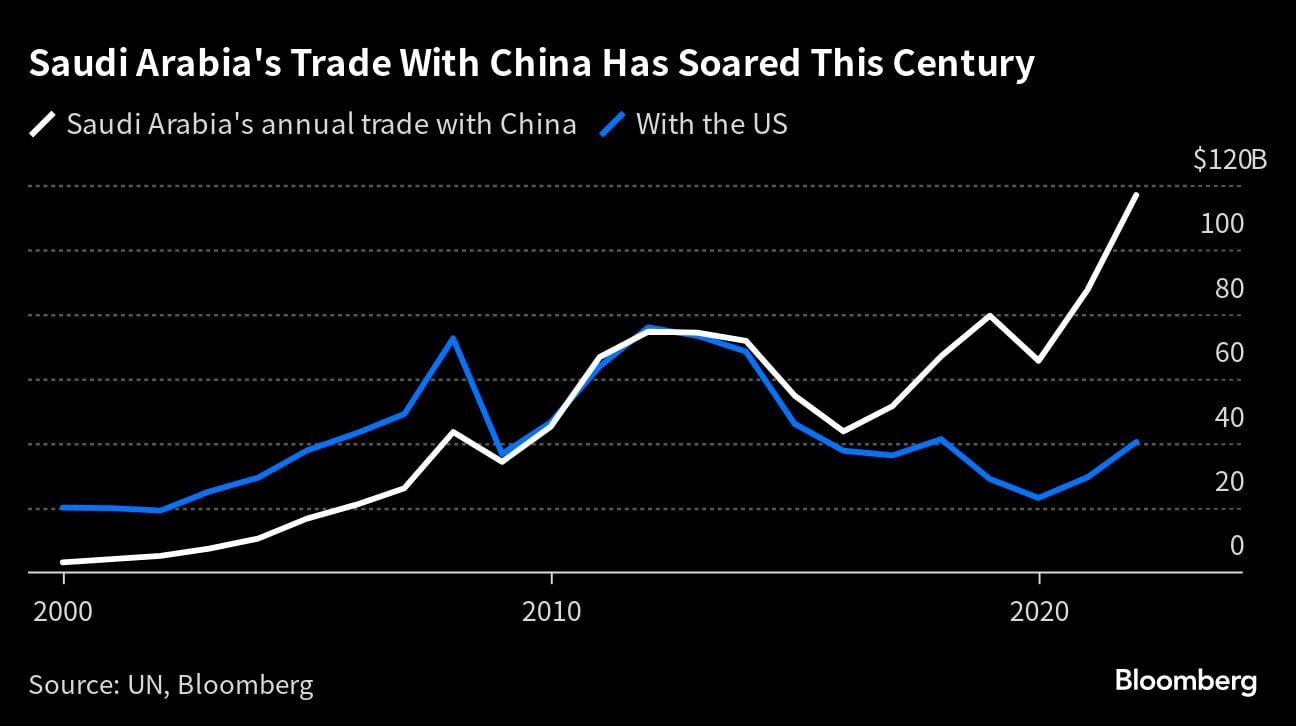

Bringing Saudi Arabia and the UAE into the BRICS fold comes after they’ve built up ties with members in the past decade, thanks largely to the vast oil flows that now head to Asia.

China and India are the top two trading partners for both Saudi Arabia and the UAE. For instance, Saudi Arabia’s trade with China and India reached a record of almost US$175 billion (RM814.6 billion) last year, according to UN data compiled by Bloomberg.

Meanwhile, ties between Washington and some Gulf states have been strained in the past 18 months — partly because of their refusal to sanction Russia over its invasion of Ukraine and their decision not to increase oil supplies when prices soared in the aftermath.

Those relations have improved in recent months, with the US and Saudi Arabia working on a deal that may result in the kingdom recognising Israel in return for American security guarantees.

Moreover, Riyadh and Abu Dhabi have made clear they want the US and Western powers to remain strong economic and security partners.

Dubai’s ruler, Sheikh Mohammed bin Rashid, said joining the BRICS would solidify the UAE’s position as a nation “bridging the world’s north and south as well as its east and west.”