“I ask myself every night why all countries have to base their trade on the dollar,” says Brazil’s Lula da Silva. The answer is that the US is the world’s only full-spectrum, military, energy, agricultural, economic, financial, technological and scientific superpower.

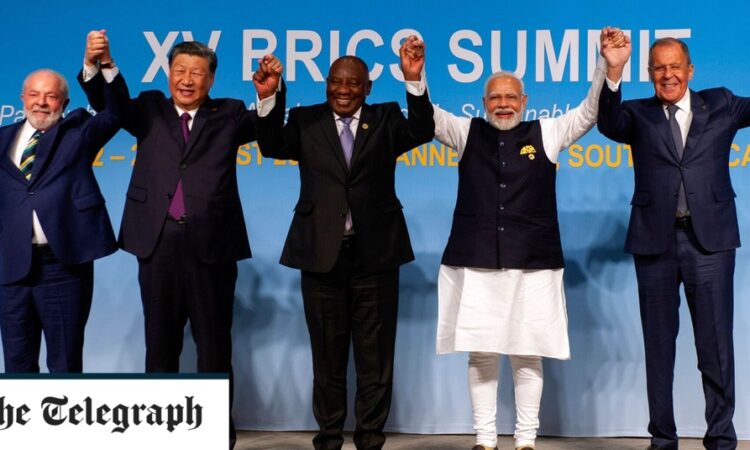

Lula has fixed fervently on his Brics currency, “just like the Europeans created the euro”. In theory it is to be launched by a coalition of the willing, drawn from Brazil, Russia, India, China, South Africa and – following the 15th Brics summit this week in Johannesburg – Saudi Arabia, the Emirates, Argentina, Iran, Egypt and Ethiopia.

The painful lessons of the half-formed euro seem to have been entirely forgotten or never learned. Few Brics ideologues recognise what it takes to forge a monetary union and – much harder – to make it work.

The key eurozone states are all democracies. They are broadly aligned on foreign policy, and all are Nato members. They have a shared legal and commercial Acquis, drafted by a shared parliament and a shared executive, under a shared supreme court, in a union with collective institutions dating back to 1957. Member states have no veto over swathes of policy.

Yet even this level of integration proved too little for a functional currency.

One-size-fits-all interest rates for economies with moderately different structures and trend growth rates led to massive intra-EMU trade and capital imbalances. The bloc lurched from one crisis to another, dividing Europe into hostile camps of creditor and debtor nations, all ending in an investment collapse and an economic lost decade.

The Brics have infinitely less in common.

Some are commodity importers, some are exporters. Some are democracies, some are dictatorships at daggers drawn with democracy. China and India are on opposite sides of Asia’s strategic divide. None is willing to submit to joint laws, joint courts and anything like a joint executive, all sine qua non for the management of a currency.

To try to launch Lula’s moneda on this foundation is “madness”, says Lord Jim O’Neill, former Mr Brics at Goldman Sachs.