Bitcoin (BTC) has its fans and critics. And to understand what makes this cryptocurrency so polarizing, it’s worth investing a small amount of time in unpacking the concept of money. By doing so, you can appreciate the opportunities and concerns on both sides of the digital coin, as well as gain a perspective on potential BTC trends over the longer term.

Going back centuries, civilizations have purchased goods and services using various means, including exchanging livestock and paying in shells. Fast forward to today, and we have trusted fiat currencies such as the US dollar, EURO, British Pound, and Chinese Yuan.

And while digital payments increasingly dominate, technically – for example, in the case of the British Pound issued by the Bank of England – it is the physical notes and coins that represent the promise of payment from the central bank to the bearer of the currency.

This begs the question as to why people are so happy to give their money to retail banks and send funds electronically – if those numbers in the various accounts aren’t, strictly speaking, legal tender. And the answer is that those traditional financial services have government backing.

“Making a deposit into a bank or building society account is like giving your trust to that organisation,” writes the Prudential Regulation Authority (PRA), which monitors banks and building societies in the UK. “You trust that it will look after your money and, when you want to access that money again, it will be there.”

Customers of conventional financial institutions have protection up to a certain value. And while this oversight and government backing is mostly successful in keeping the wheels of traditional finance turning – the promise of payment is only directly tied to the cash in your pocket.

Plus – as wobbles throughout history have shown – if confidence in the ability of the government to control its finances dips, so does the value of that promise to pay the bearer. And when times are shaky, investors reach instead for gold, which has been seen to hold its value during turbulent times.

And this brings the discussion to the idea of cryptocurrency, specifically Bitcoin’s main fork, dubbed Bitcoin Core (BTC), which some advocate has the potential to become a kind of ‘digital gold’.

How does BTC work and what is crypto mining?

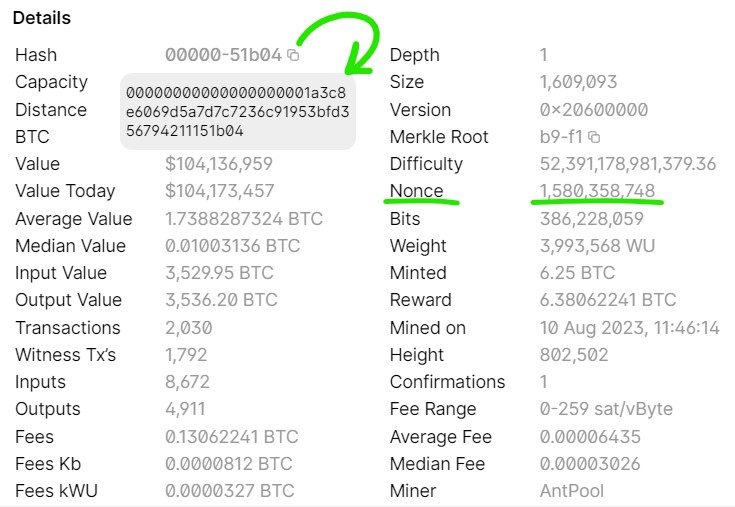

The best way to understand crypto mining is to simply look at a block in the BTC blockchain. And there are a couple of key details to focus on. The first is the hash, indicated in the screengrab below by a green arrow, and the second is the so-called ‘nonce’.

Screenshot of BTC details (block #802502) grabbed from Blockchain.com’s explorer page.

A hash digest is a fixed-length code that’s commonly used as an integrity check on digital files. The one-way function generates a unique fingerprint of a file’s contents. And, if the hash function is truly collision-proof, then no two inputs will produce the same output.

For example, if you apply a SHA256 hash (the function used to digest blocks when crypto mining BTC) to the phrase ‘Helloworld’ you get –

5ab92ff2e9e8e609398a36733c057e4903ac6643c646fbd9ab12d0f6234c8daf

But if we re-run the SHA256 hash on ‘Helloworld+1’, the one-way function generates a different code, or fingerprint –

4865d2b4b49f88cc5a721fdc7ff210878f657219d5a768e317134b66a18a4605

And this tells us quickly that the input (which, rather than our simple example, could instead be a GB-sized file and hence enable rapid integrity checks for software such as large operating system updates) has been modified. Also, while the fingerprint is impossible to predict, we can engineer patterns in the output by adding random values to the input.

In our case and sticking with the SHA256 algorithm, if we try ‘Helloworld+1580358748’, we get –

5a0506dd28159d6d8bb1e1e2a3edc4d10e1fa2519193726e9bff6960887a2aa2

And you’ll notice that adding ‘1580358748’ to the list of cryptocurrency transactions comprising BTC block #802502 (plus a hash of the previous block, to secure the blockchain) produces a string of zeros at the front of the hash digest –

00000000000000000001a3c8e6069d5a7d7c7236c91953bfd356794211151b04

Finding a suitable ‘nonce’, which can be added to a block so that its hash has a string of preceding zeros, gets to the heart of bitcoin mining. And although the exercise may sound a little abstract, it gives BTC coins – which are issued to the crypto miner that’s first to solve the challenge for each block – their scarcity.

With the blocks themselves representing sequences of transactions, stamped with an integrity check thanks to the hash functions, we now have the makings of a digital currency. What’s more, if a bad actor wanted to rewrite history and change any of the entries on the digital ledger, the hash would fail to match due to the modified contents.

Plus, coming up with new ‘nonces’ – which is a trial and error process – represents too big a challenge were adversaries to try and cover their tracks.

Digital gold, or not?

Likening BTC to gold serves as a useful comparison in picturing a possible role for future cryptocurrencies. Although, time has yet to pass the same degree of judgement on BTC, with gold having been accepted for thousands of years as a trusted store of value.

“Bitcoin and gold are similar from both a psychological perspective and, especially, as a resource,” write the economists Wolfgang Härdle, Campbell Harvey, and Raphael Reule in a useful discussion paper on ‘Understanding Cryptocurrencies’ [PDF]. “Neither can be created arbitrarily: each must be mined and each has a finite supply (at least on planet Earth)”.

Similarly, just as it takes energy to extract gold from rock buried underground, it typically requires a vast number of guesses before crypto miners discover a suitable nonce. The probability of an input generating an output with zero as the first digit is 1 in 16 (the hash digest is hexadecimal). But to find 19 leading zeros, as in the hash digest of BTC block #802502, drops that likelihood to just (1/16)19 – an incredibly small number.

The probability of successfully hashing a new block is many times less than winning a national lottery. But, of course, crypto miners can (sticking with the example of a lottery) buy trillions of tickets per second to boost their chances of hitting upon a valid guess.

Looking at the hash rate for BTC – the number of guesses being made on finding a suitable nonce value – that figure is more than 382 million per second, and it’s measured in units of terahashes (1 trillion guesses).

In the physical world, mining equipment is big and bulky and requires industrial scale power. And the analogy holds for digital crypto mining rigs too. To be competitive, crypto miners need pools of computing hardware that’s been designed specifically for the task.

Units such as Bitmain’s popular S19 model, which is specified as delivering a hashrate of 151 terahashes per second (TH/s) and consumes more than 3kW of power at the wall, are whirring away all over the world (where allowed) to validate BTC transactions on a decentralized digital ledger.

Long-term BTC trends

Critics of such a consensus mechanism, dubbed proof-of-work, point to the power that’s consumed. But, without coming down on either side of the fence, it should be noted that managing traditional currencies consumes energy too. There’s a vast amount of backend services supporting modern banking operations, and it’s the price to pay for running systems that customers trust.

As mentioned, the use of gold goes back thousands of years, which is ages long compared with the not-yet two-decade-old practice of BTC crypto mining. We live in interesting times with ambitious projects to deliver zero-knowledge proof, privacy-preserving World IDs, and the boom in AI.

There’s an element of the unknown when new technologies emerge, and it’s fair to say that cryptocurrencies occupy that space. Parallels with the utility of gold may serve as a guide on how the story of BTC plays out, but time will tell whether Bitcoin has similar appeal, and that clock has only just started ticking.