Table of Contents

Show more

Show less

Investing in the Middle East and Africa provides investors with access to thriving economies such as Saudi Arabia, the United Arab Emirates and Qatar, as well as the opportunity to diversify equity portfolios away from traditionally-favoured western economies.

While much of Europe and the US are struggling with stagnant economic growth, it’s a different story in the Middle East and Africa (MEA). The International Monetary Fund is forecasting GDP growth of 6% in the Middle East and 4% in Africa, considerably above the 1% growth forecast for so-called ‘advanced’ economies.

And investors in the region have also been reaping the rewards, with the top-performing funds delivering impressive returns over the last five years.

We’re going to take a look at some of the benefits and risks of investing in the Middle East and Africa, together with the options for investors wanting to increase their exposure to the region.

How has the sector performed?

The MEA region encompasses a wide range of countries, from the high-growth economies of Saudi Arabia, Qatar, the UAE and Iraq to the lower-growth economies in South Africa, Sudan and Malawi.

However, the focal point for investment opportunities has typically centred around South Africa and the Middle East. The Middle East is not a precise definition but generally refers to the geographic area centred around the eastern Mediterranean Sea and the Arabian Peninsula, including countries such as Saudi Arabia, Iraq and Oman.

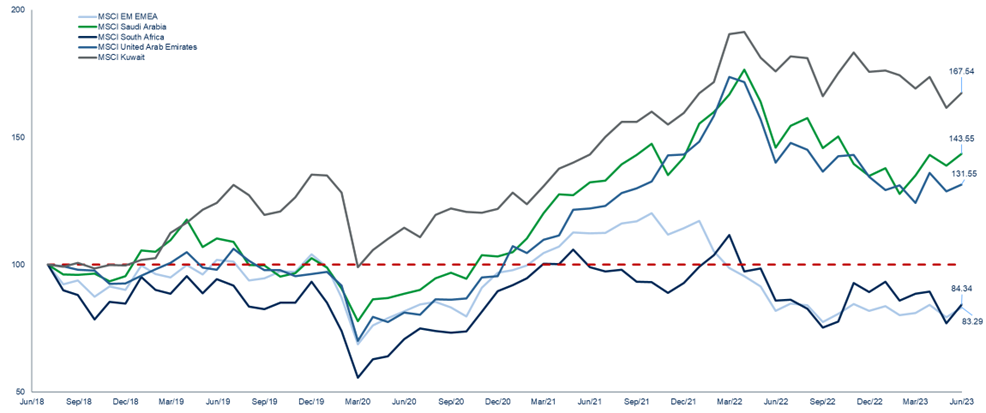

And the Middle East has rewarded investors with some impressive gains over the last five years, as shown below:

Top of the list is Kuwait, with the MSCI country index rising by almost 70% over this period, followed by Saudi Arabia and the United Arab Emirates (UAE) at 44% and 32% respectively.

Matthias Siller, co-manager of the Barings Emerging EMEA Opportunities investment trust, says: “These economies are offering very low inflation relative to the rest of the world, a function of their hydrocarbon-orientated economies.

“This has shielded them from the pressures experienced in the eurozone and globally, supporting their consumers while taking the earned dollars from their natural industries to diversify their economies for the future.”

However, South Africa has suffered a mixed performance over the last five years, ending the period down by more than 15%.

Mr Siller says: “Performance in South Africa has been challenged, with a confluence of drivers ranging from political noise, electric power outages and COVID-19 disruption weighing on the market.”

Why invest in the MIddle East and Africa?

The Middle East is home to a number of booming economies which are succeeding thanks to their leading global position in the export of oil and gas.

However, many countries are looking to diversify beyond fossil fuels by actively encouraging foreign investment, with the UAE, Saudi Arabia and Israel attracting the lion’s share of funds to date.

Israel also has a burgeoning technology sector, with Microsoft, Alphabet and Apple establishing a presence in the country.

Mr Siller says: “As one of the largest EMEA (Europe, the Middle East & Africa) markets, Saudi Arabia’s Saudi Vision 2030 programme has set out an ambitious agenda to reduce dependence on oil, and develop public service sectors such as health, education, infrastructure, recreation and tourism.

“We are already seeing a number of exciting opportunities in the privatisation of state assets, alongside a growing domestic base of entrepreneurial companies.”

Mr Siller also points to the positive impact of the shift in consumer behaviour towards greater online activity: “EMEA offers exposure to companies riding the wave of innovation or benefiting from major structural shifts in consumer needs and behaviour.

“These opportunities are particularly exciting as companies are at a much earlier stage of growth than in developed markets, and e-commerce penetration rates are generally lower.”

Turning to Africa, there has been increasing investment from the Gulf countries in the infrastructure, telecoms and agriculture sectors as governments look to external sources of funding for large development projects. These sources include sovereign wealth funds, part state-owned private enterprises and development funds.

By way of example, Saudi Arabia has been one of the largest acquirers of agricultural land to improve food security and reduce market imports. Parts of the Middle East and Africa also offer significant potential for growth in solar power, with relatively cheap land and high levels of sunlight.

While Europe is ramping up its domestic renewable energy capacity to meet net-zero emission targets, supply constraints remain an issue. As a result, the EU is looking to Africa to meet the shortfall in renewable energy production.

Mr Siller says: “The energy transition requires substantial investments in solar and wind generation capacity, critical areas of development for the EU, and will involve mining and processing significantly higher amounts of ‘green’ metals.

“Some of the largest mining companies in the world are located in South Africa due to the country’s abundant supplies of natural resources, making these export-orientated businesses particularly attractive long-term investments.”

What are the drawbacks of investing in the Middle East and Africa?

One disadvantage is the concentration of wealth across a small number of countries. Saudi Arabia contributes a third of the Middle East’s gross domestic product (GDP), and the combined GDP of the 54 African countries is only 2.7 times higher than that of Saudi Arabia.

As a result, Middle Eastern and Africa funds generally invest around 40-60% of their portfolios in Saudi Arabia, followed by South Africa, the UAE, Qatar and Kuwait.

Despite efforts to reduce dependence on fossil fuels, any fall in energy prices has a significant effect on leading exporters such as Saudi Arabia, Kuwait and the UAE, and their sovereign wealth funds.

The top 10 sovereign wealth funds in the Gulf region manage almost $4 trillion in funds, according to CNBC, which, put into context, is more than the GDP of the UK.

In addition, investors may be concerned by the potential insolvency risk of countries with high public debt in the region. Zambia, Mali, Ghana and Lebanon have defaulted on their sovereign debt in the last few years and there are fears that Tunisia and Egypt may follow suit.

Political instability also remains at the forefront of investors’ minds, given unrest in parts of the region, including South Africa and Niger. Furthermore, stock markets are not as tightly regulated as the UK and there is a risk that reforms to foreign ownership regulations are paused or even reversed.

What are the options for investing in the Middle East and Africa?

There are a number of options available, from investing in individual companies to broader-based funds.

Investing in Middle Eastern and African companies

Within Saudi Arabia, Barings’ Mr Siller points to companies such as Al Rajhi, one of the largest retail banks in the Middle East with over 13 million customers. The bank has benefited from Saudi’s Vision 2030 plan, with mass construction of affordable housing driving a rise in mortgages.

Staying within the financial services sector, Tawuniya is a market leader in multi-line insurance. Mr Siller says: “Tawuniya stands to benefit from rapidly rising insurance density [the ratio of insurance premiums to population] in Saudi Arabia and has embarked on a robust digitalisation strategy over the past three years, which has significantly improved its product offering and driven market share gains.”

Mr Siller also picks out Tadawul, which operates the stock exchange in Saudi Arabia: “It operates as a monopoly with high barriers to entry and is well-placed to benefit from the large flow of IPOs (individual public offerings) in Saudi Arabia.”

According to consultancy firm EY, there was a record number of IPOs in the Middle East and north Africa last year, with 51 firms making their debut on stock markets. Shares in Presight AI, a data analytics company, were 136 times oversubscribed before their IPO on the Abu Dhabi bourse earlier this year. And the forward IPO pipeline looks similarly healthy, according to advisory firm Citigroup.

Looking at South Africa, MTN is one of the largest telecoms groups, with around 290 million subscribers across Africa and the Middle East. The roll-out of its MoMo mobile payment app has added 70 million active users across 17 markets.

Mr Siller adds: “Its long-term growth is driven by increasing mobile and internet penetration across the region. This sets it apart as a unique proposition, especially in an environment such as Africa, where banking is highly fragmented and mobile payments are a key cornerstone of economic activity.”

In the commodity sector, Anglo American may benefit from the global transition to renewable energy. The mining company is a major producer of nickel, a key component in electric batteries, together with other energy transition metals such as copper and platinum, with mines in South Africa and other countries.

Investing in Middle East and Africa funds

Investing in MEA funds provides investors with exposure to the sector through a ready-made, diversified portfolio of shares.

James Yardley, senior research analyst at Chelsea Financial Services, says: “As an asset class it is quite niche. There is some excitement around countries like Saudi Arabia at the moment as they look to invest and diversify away from oil but there are not many funds available in the space.”

Mr Yardley highlights the Redwheel Next Generation Emerging Markets Equity fund, which has delivered a total three year return of 125%, according to Trustnet: “James Johnstone [the manager] has delivered an excellent performance. It has exposure to Saudi Arabia, the UAE, Egypt and other African countries, although it invests in frontier markets all over the world.”

The JPM Emerging Middle East Equity fund offers more direct exposure to the Middle East, with two-thirds of the fund invested in Saudi Arabia, followed by the UAE, Qatar and Kuwait. It has achieved a three year return of 67%, according to Trustnet.

Alternatively, the Barings Emerging EMEA Opportunities investment trust has over half of its portfolio invested in Saudi Arabia and South Africa, with significant holdings in the UAE and Qatar. It currently offers a dividend yield of just under 4% and is trading at a 23% discount to net asset value.

What’s the outlook for investing in the Middle East and Africa?

The region may face headwinds in terms of foreign investment due to an uncertain global economy and caution among international investors. However, energy exporters are likely to continue to perform strongly as countries reduce their dependence on Russia.

Barings’ Mr Siller says: “The Middle East continues to invest large sums of capital to further diversify their economies and this, combined with a healthier consumer, lower inflation and higher labour participation rate, should continue to support earnings growth across multiple sectors.

“The representation of the Middle East in major indices has risen recently, while a burgeoning IPO market is broadening the investment opportunity.”

After its recent lacklustre performance, South Africa may be well-positioned for a turnaround in fortunes, offering a wealth of opportunities in natural resources.

Mr Siller says: “South Africa presents another interesting investment opportunity, primarily because of its access to a broad range of metals, many of which have a role to play in the energy transition.

“We believe that the widespread pessimism related to the electricity crisis will ultimately give way to confidence that private sector driven investment in renewables will enable a gradual return to electricity security, allowing South Africa to grow out of its public sector utility mess.”

It’s worth noting that fees for trading and holding overseas shares and funds vary considerably by provider. To help investors navigate through the options on offer, we’ve produced a guide to our pick of the best trading platforms, stocks and shares ISA providers and SIPP providers.