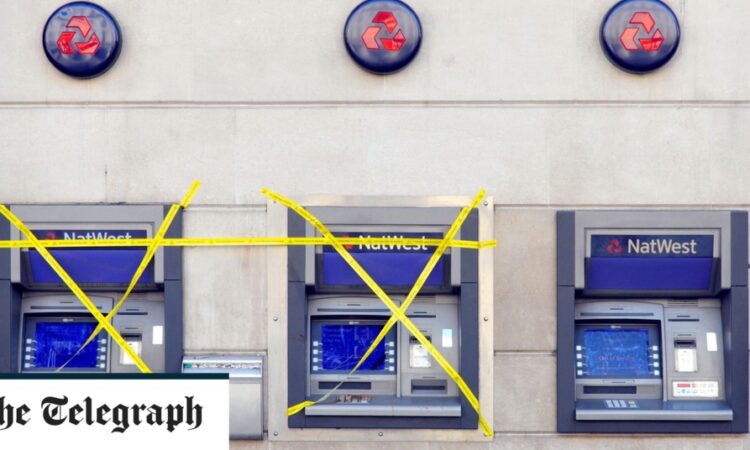

NatWest imposes new cash limits as latest de-banking row suggests push towards cashless society

NatWest has granted itself “sweeping new powers” to limit cash deposits and withdrawals, fuelling warnings that banks are forcing customers towards a “cashless society”.

The high-street bank has told current account holders it is bringing in new conditions “giving us the right to set limits on inbound and outbound payments”.

In a leaflet it said that could include imposing “daily and annual” cash withdrawal and deposit limits and “limiting the amount of cash” paid in or taken out.

The move has raised fears that increasing curbs on the use of paper money across the system could have negative consequences for consumers.

It comes amid a wider scandal over “de-banking” after Nigel Farage revealed that Coutts – which is owned by NatWest Group – had closed his account because it disagreed with his political views.

NatWest said it was making the change to “protect our customers from the risk of fraud” and that it was nothing to do with limiting customers’ access to cash. Banks have been told to do more to tackle financial crime by the City watchdog.

Mr Farage said it was “deeply worrying that banks are now granting themselves sweeping powers to limit their customers’ use of cash”.

“The wider de-banking scandal I have uncovered has already demonstrated that banks cannot be trusted to wield such power responsibly, given the way they have closed people’s accounts purely because of the political views they hold,” he told The Telegraph.

“There will now naturally be fears that customers who fall foul of the corporate thought police could see their access to cash cut off. Jeremy Hunt must act swiftly to make sure that this cannot happen and that legal tender remains legal tender.”

‘Tomorrow begins today’

NatWest announced the changes in a leaflet first sent in June, entitled “tomorrow begins today”, advising customers of changes to their terms and conditions.

The new rules, which come into force on Sept 11, state that: “We may apply limits to payments to and from your account, for example, to the amount of cash you pay in or withdraw, or to payment types where there is a high risk of fraud, scams or other crimes.”

Anne-Marie Morris, a Tory MP who sits on the Commons Treasury Committee, added: “We should not be moving to a cashless society without consumer consultation and consent.

“Of course we must ensure money laundering is not allowed to flourish. But there is a balance and society cannot just be deprived of cash because it suits banks and regulators.

“The fraud and money laundering rules seem to be wagging the tail of the cash dog.”

Daily caps

Most banks impose daily caps on how much cash customers can take out of ATMs and the amount they can transfer out of their account in one go to protect them from fraud.

NatWest allows current account holders to take up to £750 out from a cash machine, or up to £20,000 out of a branch without notifying their branch in advance.

It has insisted that it is fully committed to access to cash, pointing out it has introduced measures such as a scheme to post cash directly to vulnerable customers.

Many banks have also brought in limits on how much cash can be deposited at the Post Office and in cash deposit machines to combat money laundering.

Martin Kearsley, the banking director at the Post Office, says the limits have had “a significant impact on legitimate customers being turned away, unable to do their transactions”.

MPs have raised concerns that bank branch closures and businesses preferring card payments are leaving cash users behind.

Cash is disproportionately used by more vulnerable members of society, including the elderly and the lowest paid who find it easier to budget using physical money.

A poll of voters in Red Wall constituencies on Sunday revealed that eight in 10 believe that customers should have a legal right to pay with cash in shops. One in five now said it was “hard” or “very hard” to pay for goods and services with paper money rather than using a card.

Rishi Sunak said on Tuesday that “people still need access to their cash”, highlighting new laws passed earlier this year to guarantee “reasonable access” for withdrawal and deposit facilities.

The Financial Conduct Authority has been given powers to oversee the new rules, including putting limits on how far people have to travel to get their money.

But the Prime Minister has rebuffed calls from Tory MPs to force businesses to accept notes and coins, saying they “should be able to choose the forms of payment that they will accept”.