Speech by Fabio Panetta, Member of the Executive Board of the ECB, at Bocconi University

Milan, 3 August 2023

In recent years, the euro area has seen multiple supply shocks hitting the economy at the same time. These shocks have combined to create an inflationary shock of such magnitude and persistence that inflation risked becoming entrenched.

These adverse developments coincided with a phase of highly accommodative monetary policy, following a long period of fighting too-low inflation and the risks to price stability associated with the pandemic shock. To avoid exacerbating inflationary pressures by stimulating demand and to prevent the de-anchoring of inflation expectations, we rapidly normalised our monetary policy stance. We increased rates by a total of 425 basis points in the space of just 12 months.

In parallel, the end of net asset purchases and reinvestments under the asset purchase programme (APP), coupled with the repayment of our targeted longer-term refinancing operations, is making our balance sheet shrink considerably.

With policy rates now firmly in restrictive territory, setting and communicating the direction of monetary policy has become more complex. Our monetary policy stance needs to be calibrated in a way that brings inflation back to target in a timely manner while avoiding unnecessary harm to economic activity.

This is a fine line to walk, as the effects of monetary policy emerge with a lag. While our past decisions have already led to a material tightening in credit conditions and loan dynamics, their effects have yet to be felt in full across the real economy.

At the same time, inflation remains elevated. Even if it is now falling as the effects of adverse supply shocks begin to fade and weaker growth eases price pressures, it will still take some time to reach levels compatible with price stability.

In order to successfully complete the disinflation of the European economy, we need to flexibly adapt our policy to the evolving inflation outlook. In the current context where policy rates are around the level necessary to deliver medium-term price stability, I will argue that monetary policy may operate not just by increasing rates but also by keeping the prevailing level of policy rates for longer. In other words, persistence matters as much as level.

This raises challenges for steering our policy stance. I will argue that our data-dependent approach, underpinned by our firm commitment to returning inflation to its target, is equipped to navigate these intricacies.

The transmission of inflation through the economy

Euro area inflation is largely due to a series of adverse supply shocks, notably the pandemic-induced supply chain disruptions and the energy shock triggered by Russia’s invasion of Ukraine.[1]

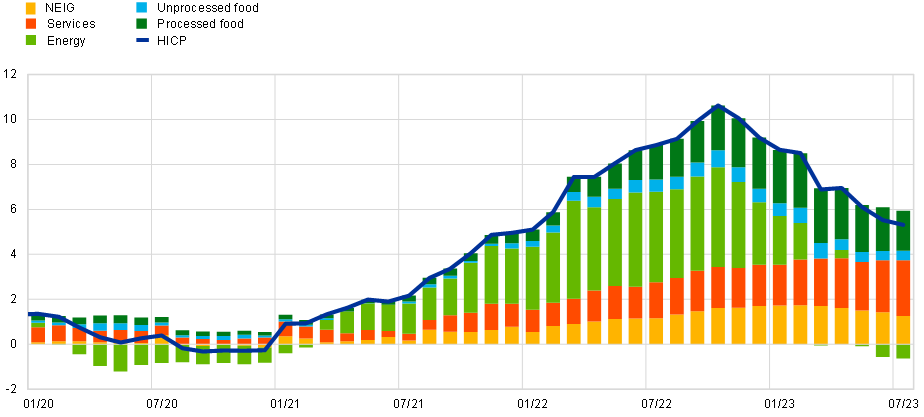

In 2022, energy prices were the main driver of inflation (Chart 1).[2] The energy shock translated into broad-based price pressures given the impact of rising energy prices on all components of inflation.

Chart 1

Contribution of components to euro area headline HICP inflation

(annual percentage changes; percentage points contributions)

Sources: Eurostat and ECB staff calculations. Notes: HICP stands for Harmonised Index of Consumer Prices. NEIG stands for non-energy industrial goods. The latest observations are for June 2023.

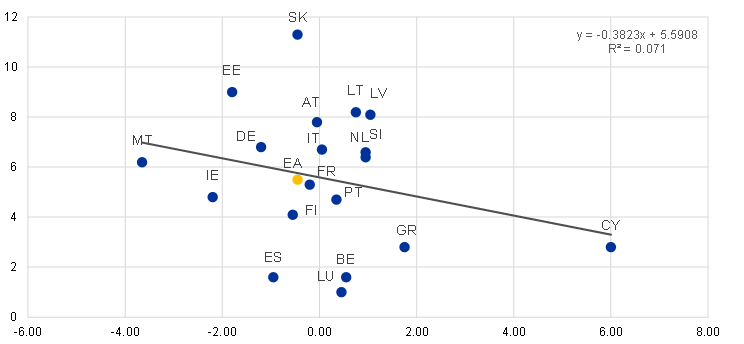

Headline inflation across euro area countries lacks a clear correlation with the strength of domestic demand (Chart 2).

Chart 2

HICP in euro area countries vs. contribution of domestic demand to GDP growth

(y-axis: HICP annual percentage changes; x-axis: average contribution of domestic demand (excluding inventories) to GDP growth quarter on quarter for the fourth quarter of 2022 and the first quarter of 2023 in percentage points)

Sources: Eurostat and ECB calculations. Notes: The observations for HICP are for June 2023. Observation for contribution of domestic demand to GDP growth in Croatia is missing.

While supply shocks are now unwinding, their lagged effects on inflation are still being felt as past increases in input costs are passed on to consumers.

The dynamics of food prices is a case in point. The energy shock and Russia’s war in Ukraine have contributed to a spike in food prices.[3] While the food producer price index peaked last October and food consumption has fallen in real terms in some euro area countries,[4] consumer food inflation has only recently started to moderate from elevated levels.

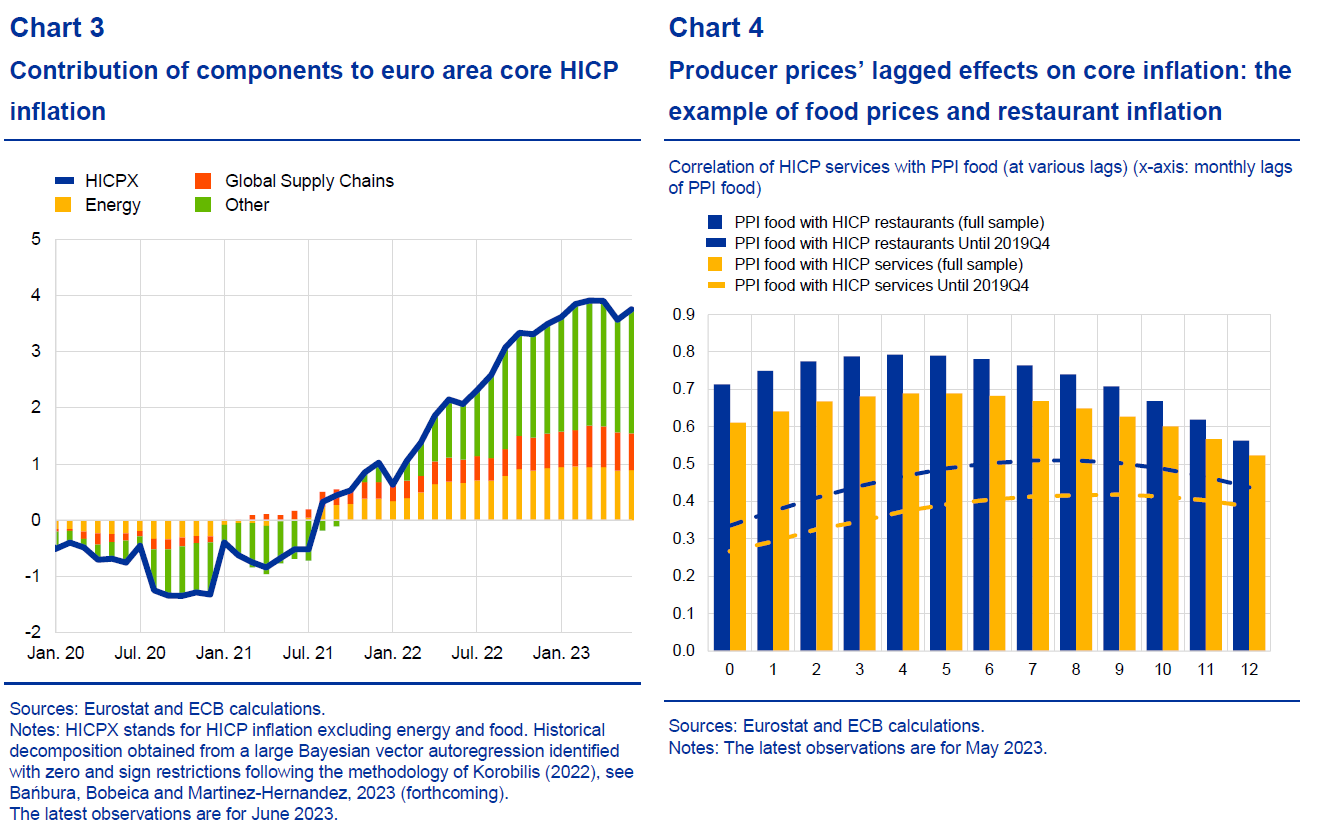

Core inflation – that is, inflation excluding energy and food – provides another example of these lagged effects. Empirical analyses indicate that the contribution to core inflation of higher input costs stemming from supply chain disruptions and the energy shock only peaked last March (Chart 3). Furthermore, movements of producer prices influence retail prices with a delay of some months (Chart 4).[5]

But there have also been other factors at play.

The reopening of the economy after the pandemic provided a boost to consumption in the summer of last year, with a significant shift in demand towards services such as travel, hospitality and restaurants. These sectors faced labour shortages in a tight job market.

Such sectoral demand-supply imbalances, coupled with the uncertainty generated by high and volatile inflation, have in turn allowed some firms to raise their profit margins.[6] This is consistent with the conspicuous increase in profits in specific sectors, on the back of retail prices rising quickly despite wholesale prices falling.[7]

In this context, even though we were not facing generalised and sustained excess demand – or a significant reduction in production capacity[8] – we recalibrated our policy for three main reasons.

The first was to avoid monetary policy adding to inflation risks. With inflation accelerating, failure to adjust policy rates would have made monetary policy more accommodative when the opposite was needed.

The second was to anchor inflation expectations. Although inflation expectations did remain anchored, we needed to stem the risk of a de-anchoring in the face of persistently high inflation. De-anchoring inflation expectations would have made our disinflationary policy costlier, requiring higher policy rates to obtain the same real rate. It would also have increased the risk of a wage-price spiral, which would have been very costly to stop.[9]

The third reason was to contain the risks connected to the strength of the labour market. With the unemployment rate at a historical low of 6.4% in June, firms tended to retain their workforce in response to slowing growth rather than resort to layoffs.

This increased the risk that a phase of wage catch-up could turn into a self-sustained and destabilising process. Given that wages make up as much as 40% of input costs for service providers, and with services inflation accounting for almost two-thirds of core inflation,[10] we continue to closely monitor this risk.

The shifting balance of risks

These factors that were initially driving our actions have now diminished in intensity.

First, the process of disinflation has been set in motion, pushing inflation expectations down.

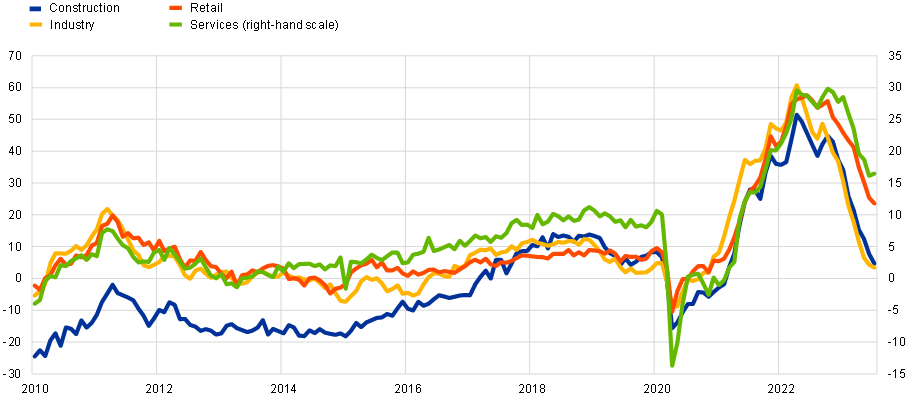

From March onwards, we have observed a consistent decline in consumer expectations for inflation over a 12-month horizon.[11] Likewise, firms’ expectations regarding their selling prices for the coming quarter have markedly decreased from their peak of last year (Chart 5).[12]

Chart 5

Selling price expectations for the next three months in the EU

(percentage balances)

Sources: European Commission (including Eurostat) and ECB calculations. Notes: Percentage balances are the difference between positive and negative answer options, expressed as a percentage of total answers. The latest observations are for July 2023.

Moreover, long-term inflation expectations derived from surveys have remained largely stable.[13] This allays concerns about a wage-price spiral. And so far wage developments have been in line with our staff projections, which envisage inflation reverting to 2% by the end of 2025.

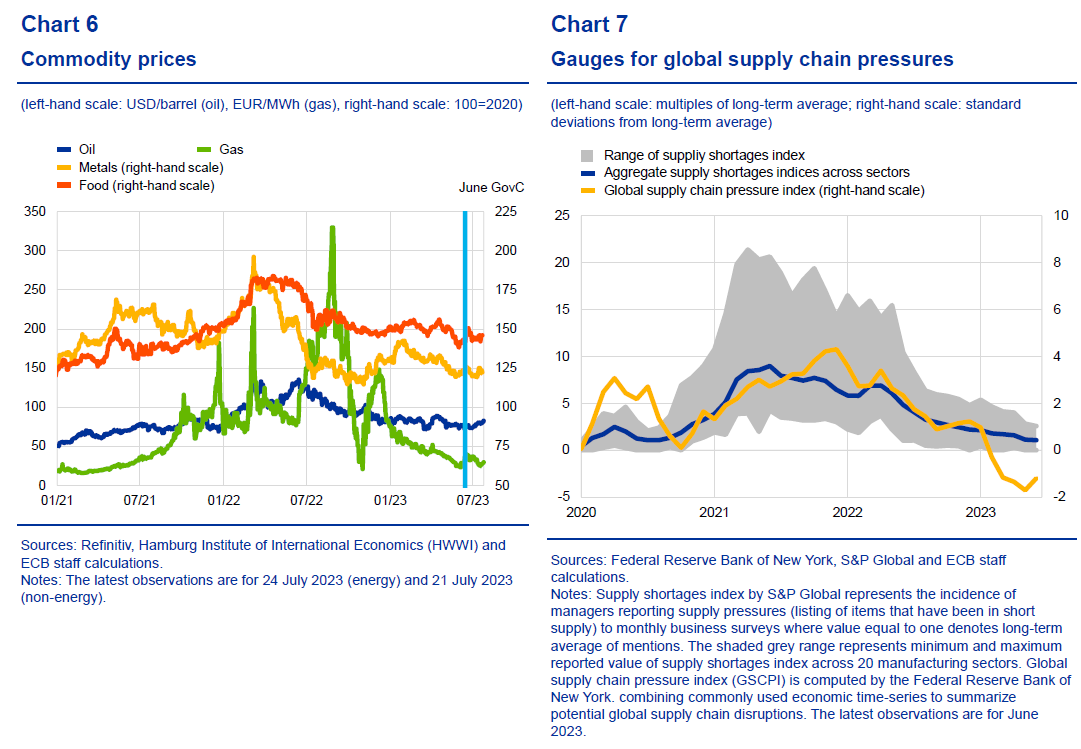

Second, as supply shocks recede, pipeline price pressures are diminishing, and the risks to inflation are becoming balanced. Supply chain pressures have substantially abated compared with last year. Commodity prices have fallen, although persistent upward pressures on energy and food prices due to geopolitical tensions and climatic events could reverse this trend (Charts 6 and 7).

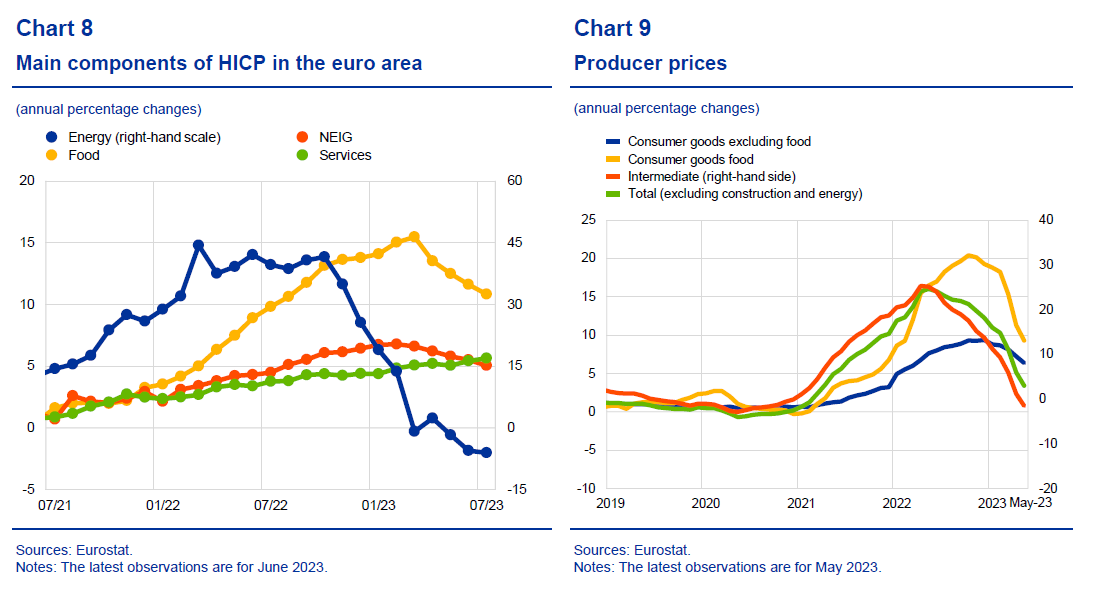

Falling energy prices have already pushed headline inflation lower: energy inflation, which had surged to 44.3% in March 2022, is now in negative territory (Chart 8). And most effects of the unwinding supply shocks on non-energy inflation are yet to emerge. Services inflation is still rising, owing to robust spending on holidays and travel as well as base effects. It is important to monitor this inflation component and its implications for the risks to overall inflation. Underlying inflation is moderating[14]. Inflation pressures at the early stages of the price formation process are easing, with producer price inflation (PPI) declining further in recent months (Chart 9).

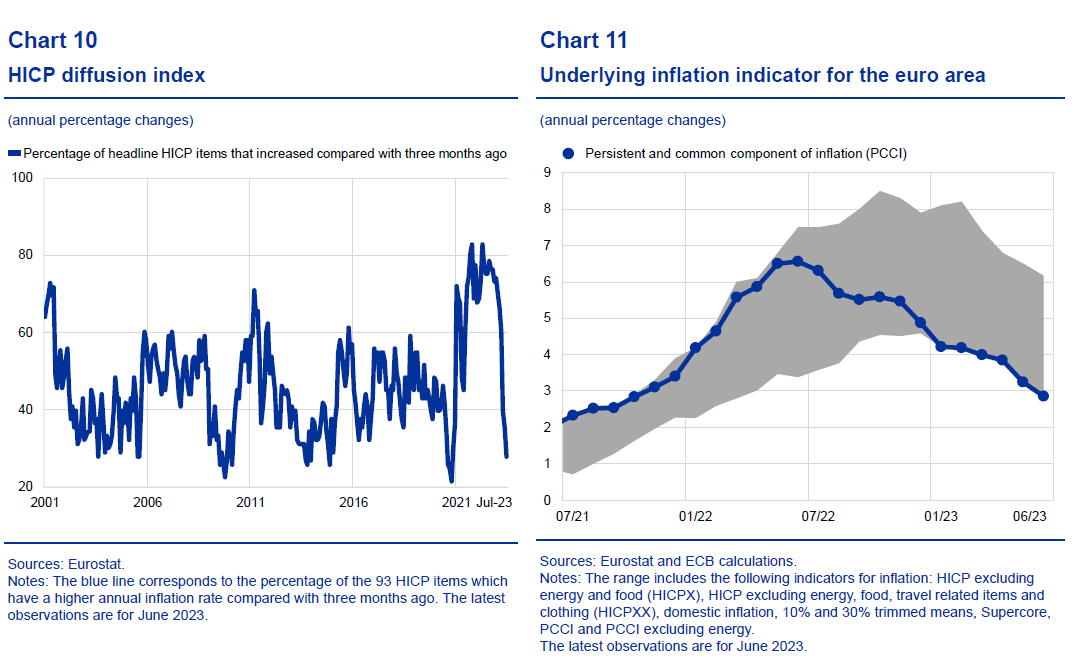

The proportion of items in the consumption basket that have a higher annual inflation rate compared with the previous quarter has fallen from a peak of 80% to less than 30% (Chart 10). Measures capturing the persistent and common component of inflation (PCCI) show increasing signs of softening (Chart 11).

Although core inflation is still elevated and is projected to remain around current levels throughout the summer,[15] empirical evidence suggests that it is a lagging – not a leading – indicator of inflation.[16] In other words, looking at core inflation today does not tell us much about where headline inflation will settle in the medium term. Just as higher energy prices seeped through the economy on the way up, they will also eventually do so on the way down.

Third, as the economic outlook deteriorates, the risks to economic activity are tilted to the downside. The “bullwhip effect” on inventories[17] seems to be reversing, contributing to a manufacturing recession. The downturn in the euro area manufacturing sector intensified in July, with the manufacturing PMI falling to its lowest level in over three years and prices charged by manufacturers falling at the steepest rate since 2009.[18]

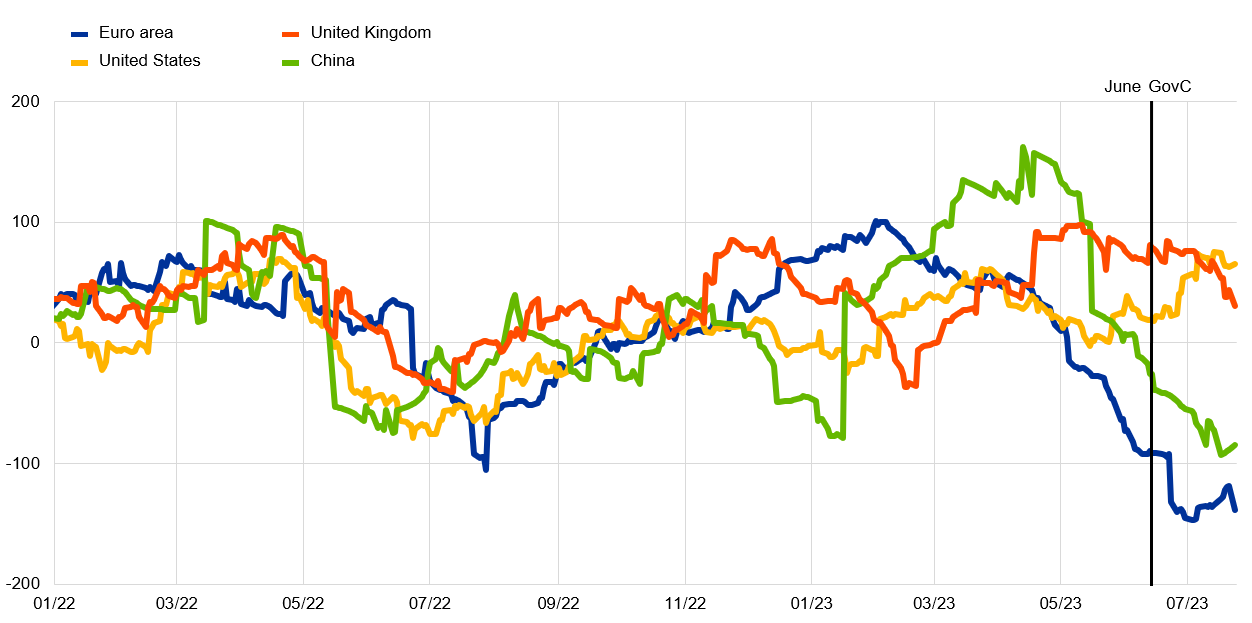

The services sector continued to expand, but it did so at its slowest rate since the start of 2023, suggesting that the resurgence in services spending may be losing momentum.[19] The Citigroup Economic Surprise Index shows a divergence between the euro area and the United States, with the euro area registering mostly negative surprises in recent months (Chart 12).

Chart 12

Citigroup economic surprise indices

(percent)

Sources: Citigroup via Haver Analytics. Notes: The vertical line marks the date of the Governing Council meeting in June 2023. The latest observations are for 24 July 2023.

Demand conditions in the euro area are likely to remain weak as the impact of monetary policy strengthens, governments unwind the fiscal policy measures they adopted in response to the energy crisis and the consumption impulse from excess savings fades.

If downside risks to growth persist and materialise, high wage growth is less likely to be sustained. The decline in inflation could contain wage demands, and high profits may help to absorb them. And if firms start to anticipate a drop in future demand and labour needs, the economic strength represented by firms’ tendency to hoard labour could turn into a vulnerability.

The path ahead for monetary policy

So, what does this mean for how we calibrate monetary policy?

The current juncture is particularly challenging, given that the effects of our past tightening are yet to be felt in full.

We have clear indications that our monetary policy is being transmitted strongly to monetary and credit conditions.

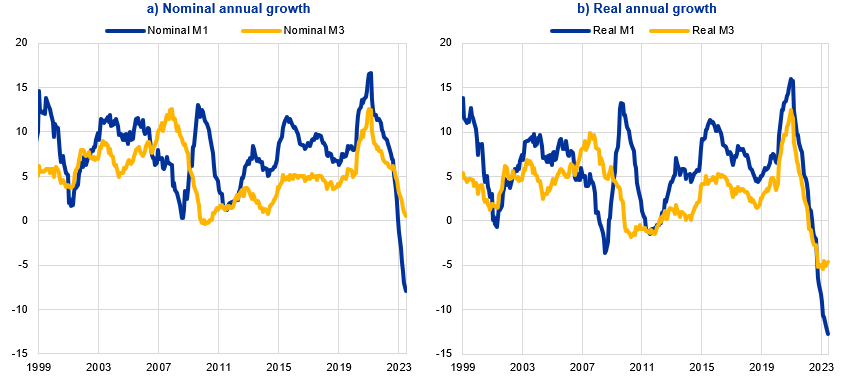

Money growth has fallen dramatically (Chart 13), and both nominal and real rates have increased considerably since the start of the tightening cycle.

Chart 13

M1 and M3 growth in the euro area

(annual percentage changes)

Sources: ECB (Balance sheet items (BSI), Harmonised indices of consumer prices (ICP)) and ECB calculations. Notes: Real M3 and M1 are deflated by the HICP. The latest observations are for June 2023.

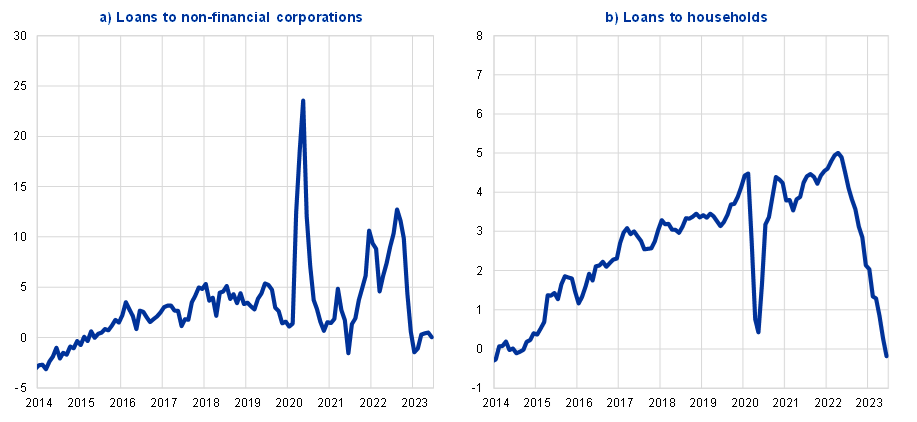

In the credit market, both quantities and rates have reacted to our tightening much faster than in the past.

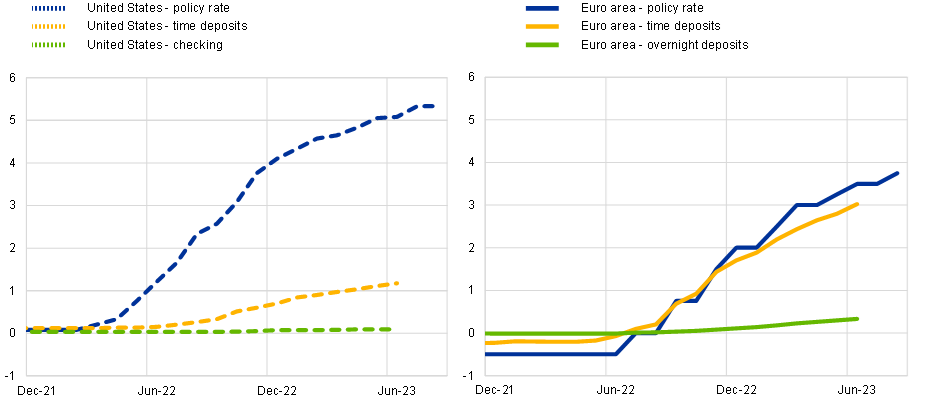

Our bank lending survey finds that firms’ demand for loans in the second quarter of 2023 was at its lowest level since the survey was first launched two decades ago, while the tightening of lending standards since the start of the hiking cycle has been very substantial. These indications are consistent with the ongoing sharp deceleration of credit aggregates (Chart 14).[20] Rates for loans to firms and households are now at their highest levels since the end of 2008 and summer 2012, respectively. Moreover, the transmission of the rate hikes to time deposits – an important source of funding for banks – has been considerably stronger in the euro area than in the United States (Chart 15).[21]

Chart 14

Credit growth in the euro area

(three-month annualised percentage changes, seasonally adjusted)

Sources: ECB (BSI). Notes: In panel a), MFI loans are adjusted for sales, securitisation and cash pooling activities. In panel b), MFI loans are adjusted for sales and securitisation. The latest observations are for June 2023.

Chart 15

Deposit rate pass-through in the euro area and in the United States

(percentages per annum)

Sources: ECB (MFI interest rate statistics (MIR), Financial market data (FM)), RateWatch, Federal Deposit Insurance Corporation and ECB calculations. Notes: US policy rate is the Federal Fund Rate. Left panel: time deposits in the United States are the average rate on a 12-month certificate of deposit with a minimum of USD10,000. Checking rates are the average rate on a USD 2,500 minimum checking account. time deposits in the United States are national rates on 12-month certificate of deposits for non-jumbo deposits (< USD 100,000). Checking rates are national rates on non-jumbo deposits. Right panel: Time deposits in the euro area are those with maturity of up to two years. The ECB policy rate is the main refinancing operations rate up to May 2014 and the deposit facility rate thereafter. The latest observations are for August 2023 for the policy rates and June 2023 for bank deposit rates.

Given these developments, we must be prudent in calibrating our monetary policy stance if we are to reach our inflation target without harming economic activity unnecessarily.

It is possible that the transmission of our monetary policy might be even stronger than the staff projections indicate. The rapid increase in interest rates and the fast contraction in our balance sheet may lead to stronger effects on monetary and credit conditions, and eventually on the economy and inflation. In addition, the tightening of monetary policy is being amplified by international policy spillovers.[22]

In these circumstances, our disinflationary monetary policy may be conducted by combining different approaches. One approach – the level approach – entails going higher than where the policy rate is currently, with the risk of then having to cut earlier and faster, as implicit in investors’ expectations about the future interest rate path. Another approach – the persistence approach – instead advocates delivering the same degree of overall restriction while avoiding ups and downs, namely by keeping policy rates at the prevailing level for an extended period.

Emphasising persistence may be particularly valuable in the current situation, where the policy rate is around the level necessary to deliver medium-term price stability, the risk of a de-anchoring of inflation expectations is low, inflation risks are balanced and economic activity is weak. Under such conditions, relying solely on an aggressive approach to rate hikes might amplify the risk associated with overtightening, which could subsequently require rates to be cut hastily in a deteriorating economic environment.

The persistence element can mitigate this risk, giving the central bank more time to assess the lagged effects of its past policy measures and fine-tune the calibration of its stance as new information comes to light over time. This “breathing space” is crucial given that – as I said before – the transmission of our monetary policy may actually turn out to be stronger than our projections indicate.

Moreover, favouring persistence would be in line with our previous proportionate response to the evolving challenges to price stability. We initially prioritised acting swiftly, hiking rates in large steps to normalise our monetary policy stance. We communicated a clear upward path for interest rates to signal commitment to this objective and we brought rates to restrictive levels to address the risks that inflation could remain too high for too long. Later, we reduced the speed, aware of the diminishing distance to our target and the increasing risk of policy misjudgements.

However, emphasising persistence might pose communication challenges. It might give rise to concerns about the effectiveness of our disinflationary policy. Or it might prompt worries that persistence could simply amount to delaying tangible actions, such as rate hikes, in favour of a strategy of keeping rates higher at a later stage – which eventually may or may not be internalised by investors in their anticipation of future policy.

Countering such misconceptions would require clear communication by the ECB. We need to explain that the same degree of restriction can be delivered with different combinations of rate levels and persistence.

In any case, the level approach is not immune to communication problems. For example, under such an approach, a pattern of hiking followed by subsequent rate cuts could undermine the disinflationary impact of our policy if the yield curve inverts in anticipation.[23] But if market participants were to understand persistence as a key element of our policy, the risk of a yield curve inversion would fade.

By determining the duration of a specific policy rate on the basis of incoming data, we can use persistence as a dynamic stabiliser. This would enable us to flexibly adapt our stance based on evolving risks without having to take decisions that might then need to be reversed, at a high cost.

This adaptive methodology aligns seamlessly with our data-dependent approach. And of course, should the inflation outlook materially deteriorate, a further rate adjustment would be warranted.

There are also financial stability aspects to consider, to the extent that they may affect the smooth transmission of our monetary policy. They would be ill-served by aggressive policies that could lead to atypical configurations of the term structure and interfere with usual asset and liability management practices, possibly exposing some intermediaries to substantial interest rate risks.

Conclusion

Let me conclude.

Calibrating monetary policy has become increasingly complex.

We are at a juncture where inflation is falling, with fading supply shocks, but past monetary tightening has yet to be felt in full. With rates now in restrictive territory, monetary policy needs to be calibrated in a way that allows us to reach our inflation target in a timely manner while avoiding unnecessary costs to the economy.

So we need to get disinflation right.

To this end, when steering the monetary policy stance, persistence is becoming as important as the level of our policy rates. This is particularly true given that risks to the inflation outlook have become more balanced, while risks to the economic outlook have shifted to the downside.

A stance that incorporates persistence offers greater scope to flexibly adjust our policy in light of the incoming data, while crucially leaving no room to waver in the fight against inflation. And indeed, let there be no doubt: we are fully committed to bringing inflation back to our target in a timely way.