It has been something of a baptism of fire for Christopher Berrier since becoming manager of investment trust Brown Advisory US Smaller Companies in spring 2021.

But Berrier, based in Baltimore, Maryland, is confident that better times for the trust’s investors could be around the corner – especially if interest rates in the United States start to fall, the economy gets back on an even keel, and sentiment towards smaller US companies improves.

Berrier was appointed by the trust’s board of directors to run the fund from April 2021 following the retirement of manager Robert Siddles, who worked for UK investment house Jupiter. The change of manager and fund group prompted the trust’s rebranding – from Jupiter US Smaller Companies to its current name.

When the changes were announced, the then trust chairman said the appointment of Brown Advisory ‘should lead to a strong performance, a narrower discount and ultimately the ability to grow the company over time’.

Sadly for shareholders, things have not quite gone the way the former chairman expected. Although the share price performed well in 2021, the last calendar year was a nightmare – not just for the fund, but for all investors with money in the shares of smaller companies (US or here in the UK).

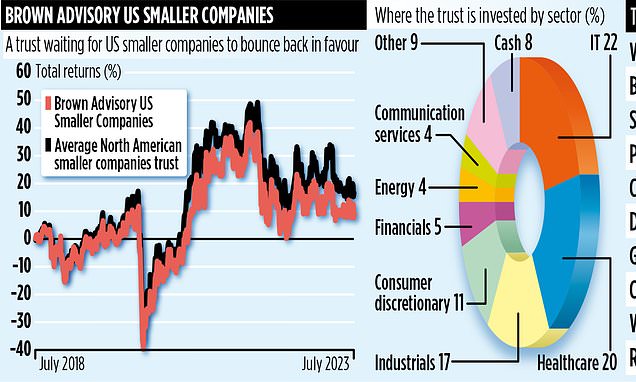

As a result, the trust under Berrier’s command has recorded losses of 11 per cent while the shares stand at a larger discount (17 per cent) than when the ex-chairman gave his verdict on the fund’s prospects under Brown Advisory’s wing.

Berrier admits it has been a difficult time and accepts that the clouds have yet to lift. He says stock market volatility will remain for the time being, but he is heartened that the US economy’s performance has been ‘less bad’ than many forecasted a year ago.

‘What is difficult to predict,’ he says, ‘is the new economic normal that will unfold when interest rates start falling.

Related Articles

HOW THIS IS MONEY CAN HELP

‘It could well be a protracted period of slow economic growth. But whatever the backdrop, we are determined to make a virtue of it from an investment standpoint.’

Berrier says it is indisputable that the shares of many US smaller companies look cheap – and that if there is a strong (and broad) recovery in the US stock market, they are likely to lead the way.

He adds: ‘If you look back to 1993 and 2000 when the valuations of US smaller companies were similar to today, small-caps subsequently went on to outperform large-cap US stocks over a number of years. If this happens again, the trust is well placed to take advantage.’

The fund is valued at £142 million and is invested across 78 stocks. It is run in a disciplined way with no stock allowed to represent more than five per cent of the portfolio.

Stocks that make it into the fund do so because they demonstrate sustained growth potential, good governance and an ability to scale up operations as they are successful.

The largest holding, waste management specialist Waste Connections, accounts for 3.7 per cent of the trust’s assets.

‘It’s a business I’ve known for a long time – from before I joined the trust,’ says Berrier. ‘It epitomises everything we want from a company. It looks after its employees in what is sometimes a challenging job which ticks our sound governance box.

‘It has also kept growing by identifying new markets in both the United States and Canada – acquiring rival companies along the way. It’s a success story generating lots of cash, which we like.’

Annual charges are a tad under one per cent and the fund’s stock market identification code is 0346340.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.