Sumitomo Mitsui Trust Holdings Inc. Invests in United States Steel Co. Despite Setbacks, Highlighting Growth Potential in the Steel Industry

DATE: July 27, 2023

United States Steel Co. (NYSE:X) has caught the attention of Sumitomo Mitsui Trust Holdings Inc., as the company recently purchased a new position in shares of the renowned steel producer during the first quarter. This information was disclosed in their most recent Form 13F filing with the Securities & Exchange Commission. The acquisition saw Sumitomo Mitsui Trust Holdings Inc. acquire 9,200 shares of United States Steel Co.’s stock, amounting to an approximate value of $240,000.

The interest shown by Sumitomo Mitsui Trust Holdings Inc. highlights the continued allure and potential profitability of investing in United States Steel Co., despite several setbacks faced by the basic materials company. With their strategic move into this position, Sumitomo Mitsui Trust Holdings Inc. is positioning itself to capitalize on any future growth prospects within the steel industry.

United States Steel Co. reported its quarterly earnings results on Friday, April 28th, revealing an impressive earnings per share (EPS) figure of $0.77 for the quarter. This surpassed analysts’ consensus estimate of $0.61 by an impressive margin of $0.16 per share. The robust performance exhibited by United States Steel Co.’s earnings demonstrates the effectiveness of its operational strategies and successful cost management tactics.

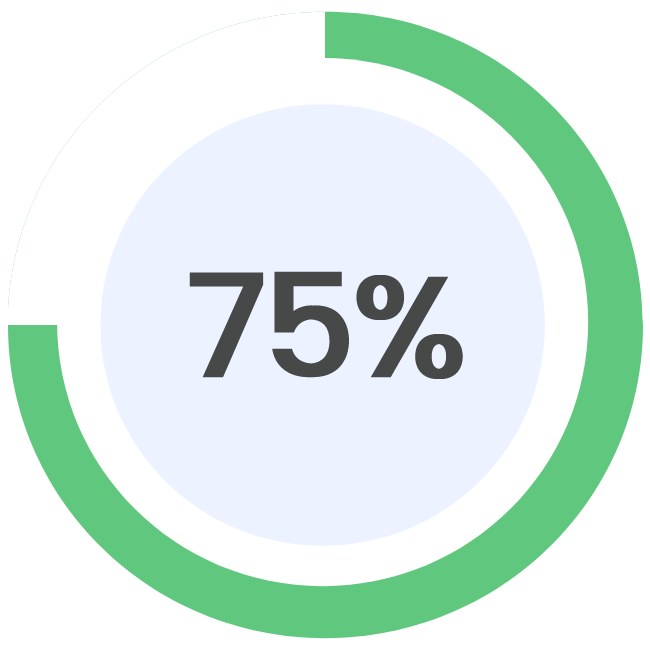

Furthermore, United States Steel Co.’s net margin stood at a commendable 9.07%, indicating a healthy profit after accounting for expenses and taxes incurred during operations. The firm’s return on equity also impressively reached 19.66%, revealing the company’s ability to generate substantial returns for its shareholders.

Revenue figures released by United States Steel Co.. showed that it generated $4.47 billion during the quarter, exceeding analysts’ consensus estimate of $4.25 billion by a significant margin as well – once again demonstrating robust performance in terms of revenue generation compared to market expectations.

However, it is important to note that United States Steel Co.’s revenue for the quarter was down 14.6% on a year-over-year basis. This decline can be attributed to a variety of factors, such as global economic conditions and fluctuations within the steel industry itself. Regardless, market analysts anticipate that United States Steel Co.’s fiscal results will improve moving forward. As a group, sell-side analysts forecast that United States Steel Co. will post an earnings per share figure of 4.29 for the current year.

United States Steel Corporation focuses on producing and selling flat-rolled and tubular steel products across North America and Europe. The company operates through four key segments: North American Flat-Rolled (Flat-Rolled), Mini Mill, U.S. Steel Europe (USSE), and Tubular Products (Tubular). These segments offer a diverse range of products including slabs, strip mill plates, sheets, tin mill products, as well as iron ore and coke.

Through its various divisions and international operations, United States Steel Corporation has cemented its position as a leading player in the steel industry. Despite the challenges faced by this dynamic sector, which is influenced by economic cycles and market demand fluctuations on a global scale, United States Steel Co. has consistently demonstrated resilience and adaptability.

In conclusion, Sumitomo Mitsui Trust Holdings Inc.’s recent purchase of shares in United States Steel Co., coupled with the company’s impressive quarterly earnings performance and strong market positioning, underscores the potential investment opportunities in the steel industry going forward. While varying factors continue to shape the landscape of this challenging market segment, careful analysis indicates future growth prospects for established players like United States Steel Co., making it an appealing prospect for investors seeking long-term profitability in this sector.

DISCLAIMER: The views expressed in this article are solely those of the author and should not be taken as financial advice or investment recommendations.

Institutional Investors Navigate Uncertain Waters with United States Steel amidst Market Volatility

Institutional Investors Make Strategic Moves in United States Steel as Company Faces Uncertain Market Conditions

Institutional investors have recently made significant changes to their stakes in United States Steel Corporation, signaling a dynamic period for the company. Bornite Capital Management LP saw a remarkable 300% increase in its position during the first quarter of this year, acquiring an additional 300,000 shares. Similarly, Natixis Advisors L.P. and Healthcare of Ontario Pension Plan Trust Fund entered the market by purchasing new positions. Great West Life Assurance Co. Can and Blair William & Co. IL demonstrated more cautious approaches, expanding their holdings by smaller increments.

Shaky Market Performance:

NYSE:X experienced a decline of $0.33 during midday trading on July 27, reaching $25.17 per share. While this drop does not immediately appear substantial, it contributes to a larger narrative of volatility within the market sector and hints at possible challenges encountered by United States Steel.

Corporate Snapshot:

United States Steel Corporation is a notable producer and distributor of flat-rolled and tubular steel products primarily across North America and Europe. The company operates through four segments: North American Flat-Rolled (Flat-Rolled), Mini Mill, U.S. Steel Europe (USSE), and Tubular Products (Tubular). Its diverse range of offerings includes slabs, strip mill plates, sheets, tin mill products, iron ore, and coke.

Key Financials:

The firm’s stock has displayed a fifty-two week low of $17.89 and a fifty-two week high of $31.55. Currently trading at around $25 per share with an average volume of 6,776,979 shares exchanged daily, United States Steel has been underpinned by consistent trading activity despite the overall market uncertainty. Significant moving averages comprise a fifty-day simple moving average standing at $23.28 alongside a two-hundred day simple moving average positioned at $25.42. United States Steel holds a market capitalization of $5.70 billion with a PE ratio of 3.79, making it an enticing prospect for investors.

Dividend Payout:

United States Steel Corporation recently disclosed a quarterly dividend, which was paid on June 7th to investors of record as of May 8th. Each shareholder received a dividend of $0.05 per share, resulting in an annualized dividend of $0.20 and a yield of 0.79%. This payout represents approximately 2.97% of the company’s dividend payout ratio (DPR), reflecting its commitment to shareholders amid challenging market conditions.

Expert Opinions:

Numerous brokerages have expressed their views on United States Steel Corporation, highlighting the uncertain landscape confronting the company in recent months. Wolfe Research downgraded the stock from “peer perform” to “underperform,” setting a target price of $19 per share. StockNews.com initiated coverage with a “hold” rating while UBS Group lowered its price objective from $27 to $25 per share. BNP Paribas followed suit by downgrading the shares from “outperform” to “neutral” and establishing a $26 target price. JPMorgan Chase & Co., meanwhile, reduced its target price to $23 under a “neutral” rating. Overall, there seems to be consensus among investment analysts suggesting that investors exercise caution until clearer market trends emerge.

Conclusion:

As institutional investors make notable moves in United States Steel Corporation, it is evident that the company faces complex and ever-changing market dynamics. The recent positioning by Bornite Capital Management LP and other respected players reflects both bullish and conservative approaches towards United States Steel’s future performance amidst choppy waters within the broader industry context. With a wide range of steel products offered and consistent trading activity observed, United States Steel Corporation remains an intriguing prospect despite current uncertainties in the market.