(Bloomberg) — European shares gained for a second straight week as investors weighed the outlook for central bank rate hikes. SAP SE dropped on underwhelming results, while Sartorius AG jumped after issuing a reassuring guidance.

This advertisement has not loaded yet, but your article continues below.

The Stoxx 600 was up 0.3% by the close. It gained nearly 1% for the week. Technology stocks declined, with SAP sliding as much as 4.2% in its worst day since December. Mining shares also dropped, while energy and media outperformed.

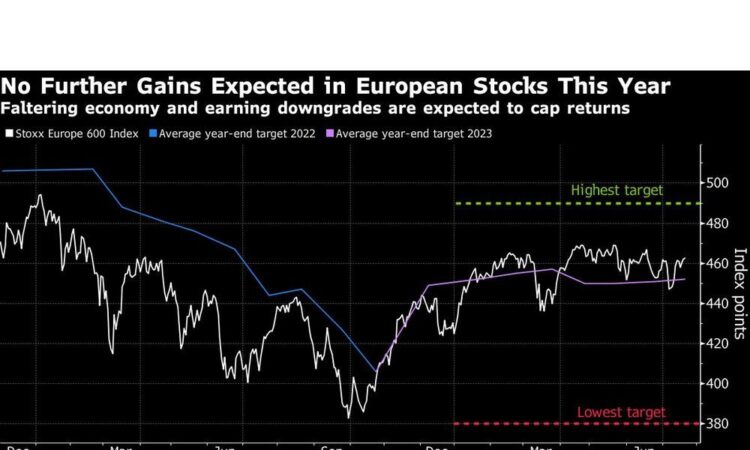

Europe’s stock rally has moderated in July as investors weigh the possibility of hawkish central banks against signs that US inflation is cooling. Strategists are sticking to their view that the region’s equities will see no further gains by the end of the year, according to a Bloomberg poll. An unexpected pullback in US jobless claims on Thursday supported bets for another Federal Reserve rate hike, while disappointing tech results also weighed on the market.

“Markets are really just quite erratic and hard to explain through a macro lens at the moment,” said James Athey, investment director at Abrdn. “Economic data is most certainly not yet negative enough to put the bears in the driving seat. And in a market so dominated by systematic and momentum-fueling strategies, the path of least resistance is likely still higher equity prices for now.”

This advertisement has not loaded yet, but your article continues below.

Focus is also on the second-quarter earnings season, which is off to a slow start in Europe, according to Morgan Stanley strategists. “Earnings revisions have now turned negative and we also note a more cautious tone around forward guidance, with mentions of ‘weaker demand’ surging to recent highs,” strategist Giorgio Magagnotti wrote in a note.

Meanwhile, European equity funds had outflows of $1.6 billion in the week through Wednesday — a 19th straight week of redemptions, according to a note from Bank of America Corp. citing EPFR Global data.

For more on equity markets:

- Strategists See No Reason to Buy Equities Now: Taking Stock

- M&A Watch Asia: Sosei, Mundipharma International, Chalice Mining

- BofA Bankers See Slow IPO Revival, Rush Some Way Off: ECM Watch

- US Stock Futures Unchanged; Digital World Acquisition Gains

- UK Retail Stocks in Focus After Sales Surprise: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

—With assistance from Michael Msika.