- This monthly roundup brings you a selection of the latest news and updates on global trade.

- Top international trade stories: Ukraine grain deal collapses; Global trade growth returns but could falter; China adds metals export restrictions; COP28 to include first-ever Trade Day.

1. Ukraine grain deal collapses as Russia pulls out

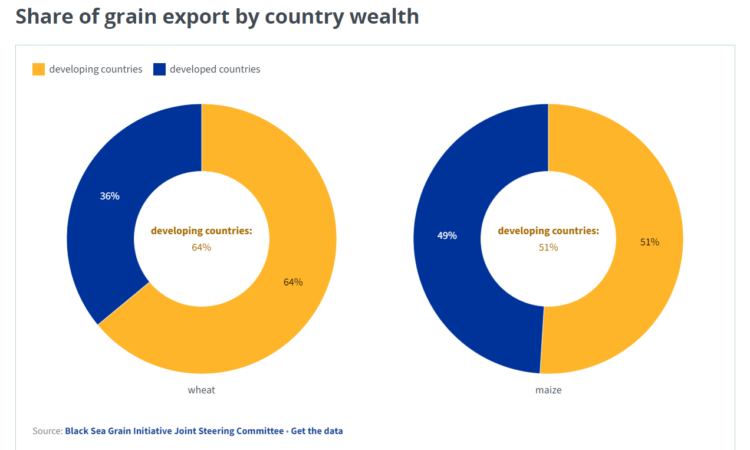

The collapse of the Black Sea grain deal – which allowed Ukraine to safely export over 32 million tons of corn, wheat and other grains – “will strike a blow to people in need everywhere”, according to UN Secretary-General António Guterres.

Russia ended its participation in the year-old deal on 17 July, saying it was doing so because its calls for an agreement to support its food and fertilizer exports had not been answered. Progress on meeting these demands could lead to the revival of the Black Sea agreement, Moscow has suggested. Guterres has written to Russian President Vladimir Putin with a proposal to reinstate the deal.

The Black Sea deal has helped combat a global food crisis that was exacerbated by Russia’s invasion of Ukraine. It had facilitated the export of more than 30 million tonnes of grain and other foodstuffs as of May 2023.

Developing countries have received around 64% of the wheat exported through the agreement. Over 655,000 tonnes has headed to Ethiopia, Yemen, Afghanistan, Sudan, Somalia, Kenya and Djibouti.

The deal was “a lifeline for global food security and a beacon of hope in a troubled world,” according to Guterres. “At a time when the production and availability of food are being disrupted by conflict, climate change, energy prices and more, these agreements have helped to reduce food prices by over 23% since March last year.”

Wheat, corn and soybean prices all jumped following the news of the Black Sea deal’s collapse.

2. Trade growth is back, but 2023 outlook remains negative

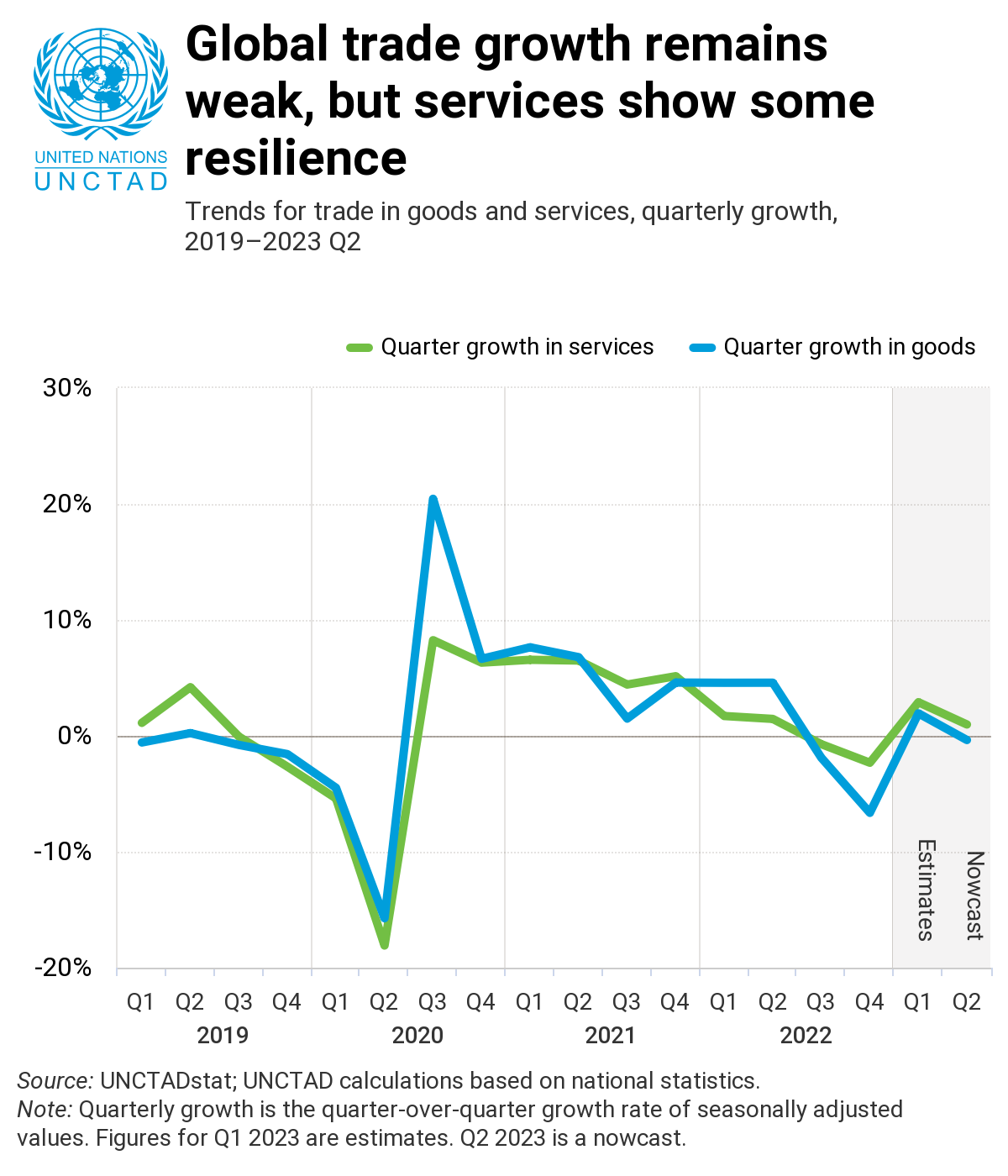

Global trade grew in the first quarter of this year following a downturn in the second half of 2022, but another slowdown is likely on the way, according to UNCTAD.

Goods trade rose by 1.9% in January-March compared with three months earlier, equivalent to about $100 billion. And there was a $50 billion increase in the value of services trade, which was up 2.8%.

But downgrades to world economic forecasts, Russia’s war in Ukraine and other geopolitical tensions point to a probable slowdown in trade growth, UNCTAD’s Global Trade Update says. “Overall, the outlook for global trade in the second half of 2023 is pessimistic, as negative factors dominate the positive,” the report says.

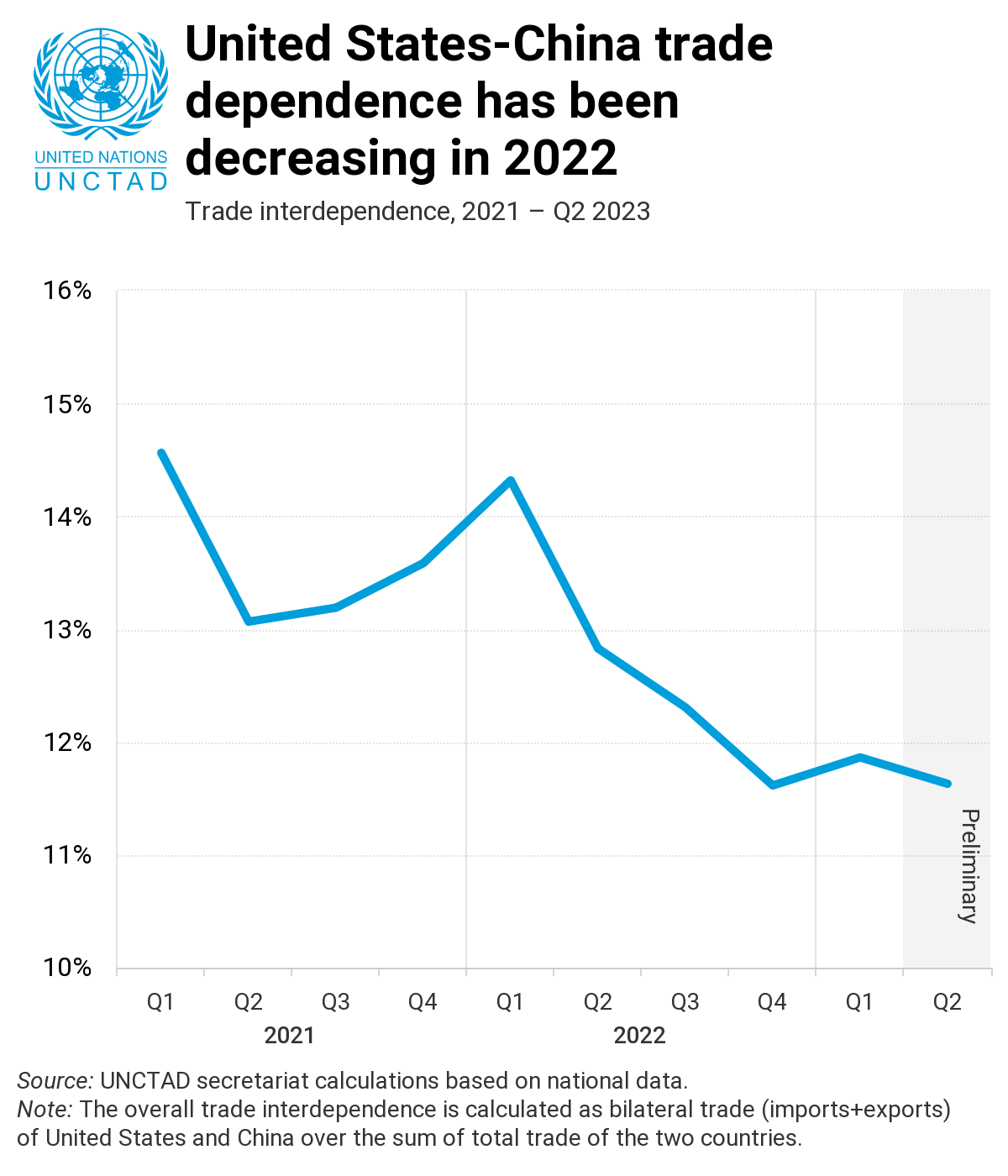

It highlights an ongoing ‘friendshoring’ trend, with supply chain networks narrowing to revolve around countries seen as political and economic allies. The war in Ukraine, Brexit and US-China tensions have all played a part in this shift.

Trade dependence between the US and China has eroded significantly over the past year and a half. Chances of this changing in the near future appear slim, with US Treasury Secretary Janet Yellen saying that relaxing tariffs at this point would be “premature”.

The US – along with many other major economies – saw stagnant or declining goods trade in the first quarter. China and India recorded large rises in exports, of 11% and 7% respectively, although China’s exports have since fallen significantly due to weaker global demand.

3. China adds metals export restrictions

China is imposing further limits on exports of critical metals used in chipmaking. The move has led to emergency meetings involving trade ministers, and to the EU stepping up talks on building its own production base.

Beijing will restrict shipments of some gallium and germanium products from 1 August. They are used to make high-speed computer chips, as well as in defence and renewable energy applications, including electric vehicles. China produces 80% of the world’s gallium and 60% of the world’s germanium, according to European industry group the Critical Raw Materials Alliance.

Very few companies are able to make gallium at the purity levels required for its use in electronics. One is based in Europe, one is in Canada, and the rest are in Japan and China. As for germanium, Canada, Finland, Russia and the US account for the 40% of production that takes place outside China.

Japan is investigating the potential impact the trade measures could have on domestic companies, while South Korea’s government convened an emergency meeting. Germany is urging companies in the country to reduce their dependence on Beijing, as it sets out its first strategy on China.

The EU buys more than 70% of its gallium from China and has already asked a Greek aluminium producer to look at whether it can produce gallium as a byproduct, the Financial Times reports.

The battle to secure critical raw minerals such as gallium and germanium and rare-earth metals is the focus of the latest Global Trade Alert Report. It promotes the development of a “thick markets approach” that increases the number and capacity of suppliers. The five steps needs to scale up thick markets are outlined in this World Economic Forum Agenda blog.

4. News in brief: International trade stories from around the world

COP28 will include the first-ever Trade Day at a climate conference. It will see multilateral organizations working with the UAE’s Ministry of Economy to highlight the critical role of supply chain policies in decarbonization and shape policy reform on sustainable trade.

A drop in foreign direct investment (FDI) in developing countries is impacting the world’s ability to achieve the UN’s Sustainable Development Goals (SDGs). FDI fell by 12% in 2022, creating an annual investment deficit of $4 trillion across all SDG sectors, according to UNCTAD’s World Investment Report 2023.

The WTO has taken a step to help reverse this by finalizing the text for an agreement on investment facilitation for development. Director-General Ngozi Okonjo-Iweala says it is a “momentous achievement” that should make it easier for members to attract and retain investment.

New rules on the safe recycling of ships will come into force in June 2025. The Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships has been ratified by 15 states and covers 40% of merchant shipping volumes.

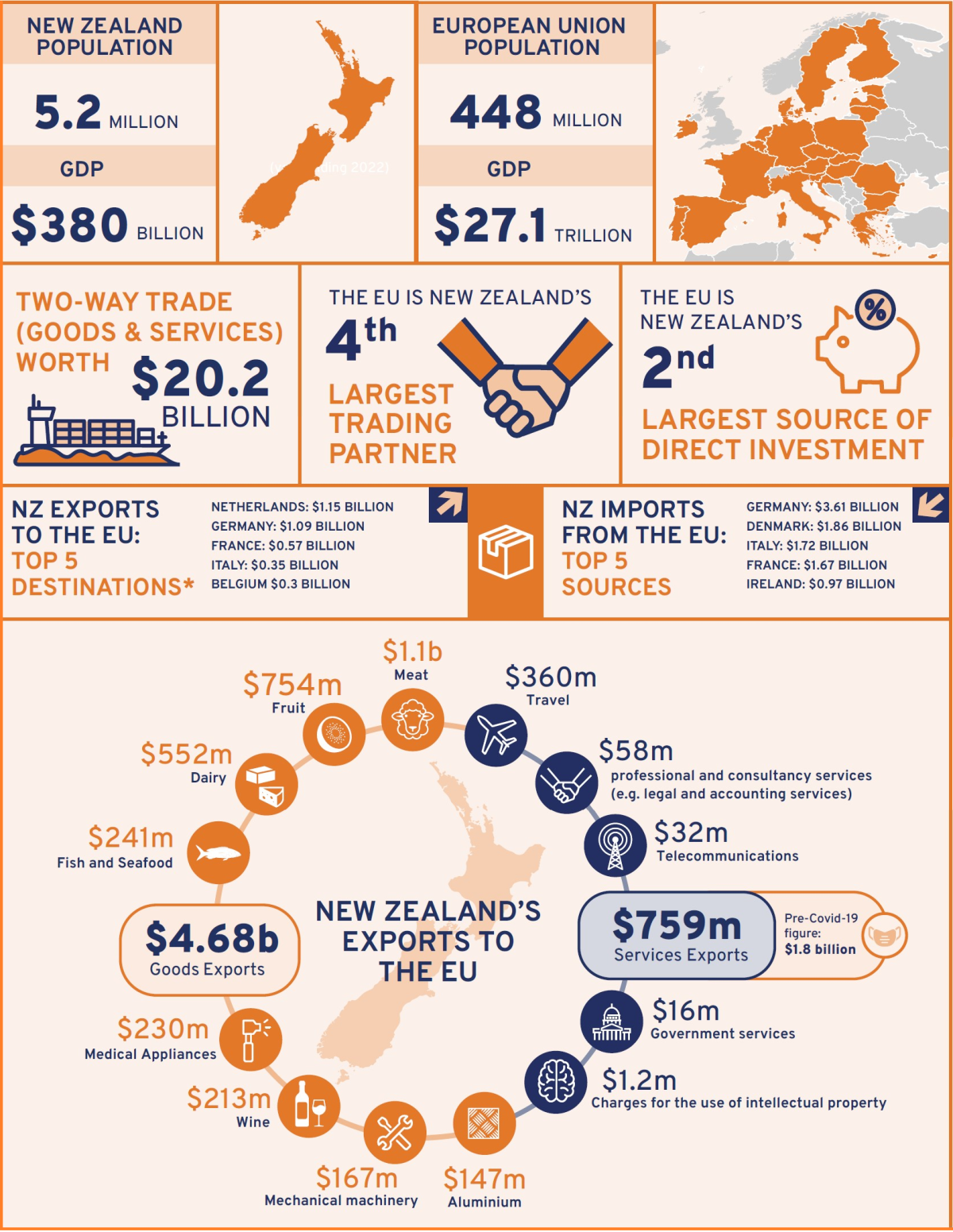

The EU and New Zealand have signed a free trade agreement, with Brussels saying it could boost bilateral trade by 30% over the next 10 years. The EU is New Zealand’s fourth-biggest trading partner, with meat, fruit and wine topping the export list.

It aims to help governments in developing and least developed countries implement the World Trade Organization’s Trade Facilitation Agreement by bringing together governments and businesses to identify opportunities to address delays and unnecessary red-tape at borders.

For example, in Colombia, the Alliance worked with the National Food and Drug Surveillance Institute and business to introduce a risk management system that can facilitate trade while protecting public health, cutting the average rate of physical inspections of food and beverages by 30% and delivering $8.8 million in savings for importers in the first 18 months of operation.

But trade talks between the EU and Australia have stalled. The issue in this case is meat quotas – the level of Australia’s beef export quota equates to each European eating just one Australian steak every 40 years, the country’s trade minister says.

South American trade bloc Mercosur and the EU aim to secure a trade deal this year, after talks in early July concluded without an agreement. Brazilian and Argentinian officials were unhappy with some EU demands over agriculture and environmental rules, but Brazilian President Lula da Silva says the differences are not insurmountable.

5. More on trade from Agenda

Will trade and efforts to fight climate change clash or align? Experts from the World Economic Forum and Boston Consulting Group look at four scenarios that showcase how carbon mitigation measures might impact global trade, and how countries and companies should respond.

Efforts towards socially sustainable supply chains are not only a moral imperative, but also indispensable for ecological, legal and economic reasons. Anahita Thoms, Partner of law firm Baker McKenzie’s International Trade Practice, maps out the reasons why.

Reshoring and friendshoring may help to reduce vulnerability to supply disruptions, but they can also lead to higher prices and fewer choices for consumers. This is why a strong multilateral trading system is essential for economic security.