An annual survey from Greece has shown how the market share of European banks as a source of global ship finance has dropped below 50% for the first time with notable scaling back in the sector from the likes of HSBC and across Germany. Banks as a whole remain far less committed to funding shipping compared to the position they held at the start of the century.

The Petrofin Index for Global Ship Finance, which commenced at 100 in 2008, stood at 63 in 2022, in updates to the index published this month.

Asian and Australian banks show significant growth, especially their market share, which has jumped from 40% to 44%. In terms of actual exposure their portfolio amounts to $127.3bn compared to 115bn in 2021. European banks’ share declined further to 49.5%.

The growth of the global fleet continues to be funded primarily from non-banking sources, such as leasing, alternative lending, private equity from funds, public markets and investors, according to Petrofin Research.

The report issued with the release of the index noted that rising US interest rates from close to 0% to over 5% has rendered many vessel cash flows weaker in supporting the high prevailing vessel prices, especially for eco vessels.

“For banks in 2022, finding loan transactions that met their credit criteria became increasingly difficult,” the report noted, pointing out that loan terms for eco vessels are better than for non eco vessels.

Petrofin’s 2023 predictions for global ship finance are that volumes will remain at or close to current levels with many lenders “running to stay still”.

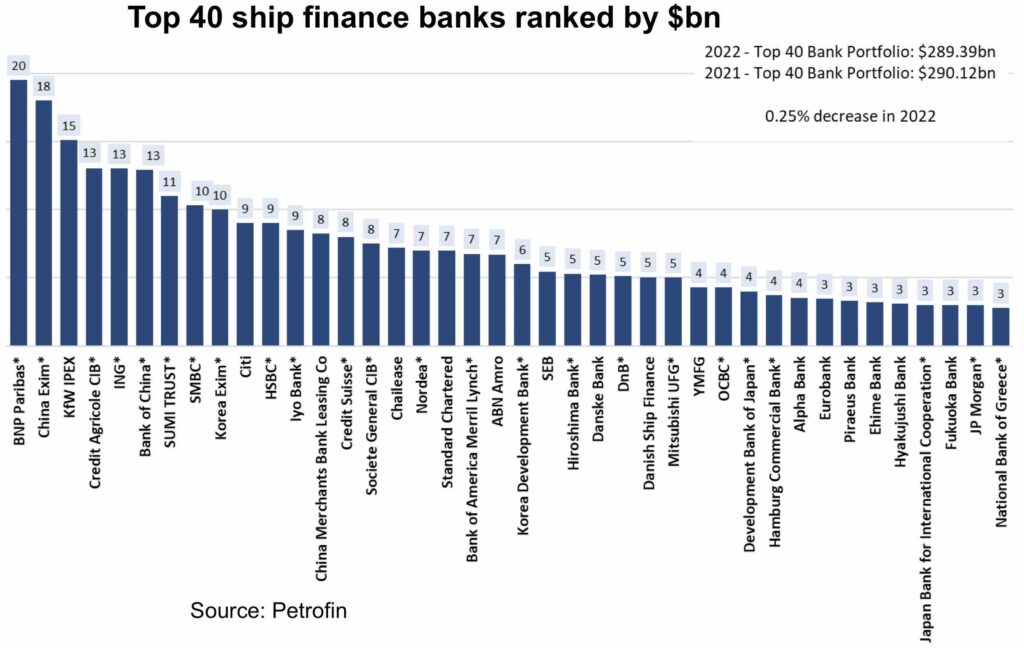

BNP Paribas remained the world’s top ship finance bank (see chart below).