Just as Americans may be looking for a loan to stay afloat, it may be harder to get one.

The rejection rate for people applying for credit jumped to 21.8%, up from 17.3% in February and the highest level in five years, according to a Federal Reserve survey on Monday. The increase was broad-based across age groups and highest among those with credit scores below 680, it said. The highest credit score is 850 and the lowest 350.

The report underscores the caution financial institutions are taking amid one of the most aggressive Fed rate hiking cycles in history and a potential recession. Major banks, like Citigroup, reported last week they were setting aside more money to cover delinquencies. Delinquency rates in credit cards and other retail lines are rising and expected to rise and then ease off again to reach “normal levels” by year end at Citi, the bank’s CFO Mark Mason said on a conference call.

Tapped out:Inflation is going down. Many Americans say they’re still struggling.

What types of loans are seeing the most rejections?

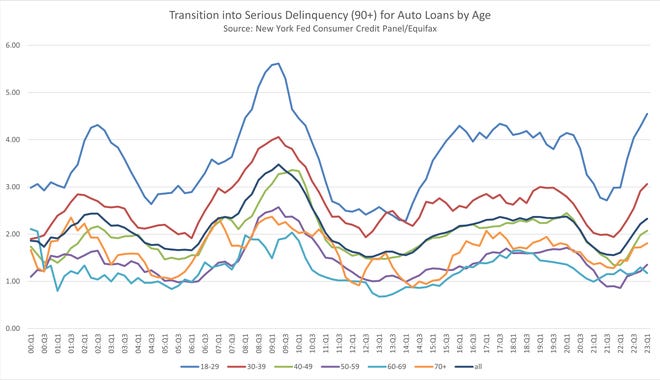

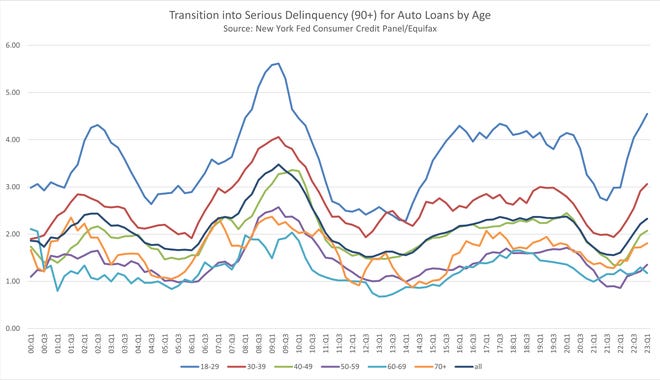

The rejection rate for auto loans rose to 14.2% from 9.1% in February to the highest level since this data was first collected in 2013 and for the first time, exceeded the application rate.

Learn more: Best credit cards of 2023

“It’s risk aversion mode for banks,” said Alex Liegel, chief executive at Tenet, which provides electric vehicle financing, referring to the trend over the past year of banks cutting back or exiting auto lending completely. “Consumers are already under pressure, and even worse off now because banks are reducing their lending.”

Rejection rates for credit cards, credit card limit increase requests, mortgages, and mortgage refinance applications rose to 21.5%, 30.7%, 13.2%, and 20.8%, respectively, the Fed said.

What are consumers doing?

As interest rates rose, overall credit applications fell over the past 12 months to 40.3%, the lowest since October 2020 and down from 40.9% in February, the survey showed. However, the proportion of respondents reporting that they are likely to apply for one or more types of credit over the next twelve months rose to 26.4% from 26.1% in February.

Will new loan applications keep getting rejected?

The average reported probability that a loan application will be rejected increased sharply for all loan types, the Fed said. They were as follows:

- Auto loans rose to 30.7%, the highest level since the Fed started collecting this data in 2013.

- Credit cards rose to 32.8%

- Credit limit increase requests jumped to 42.4%, the highest level since the series began Mortgages climbed to 46.1%, also a data series high

- Mortgage refinances rose to 29.6%

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at[email protected] and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday.