J2R

NatWest

U.K. bank NatWest (NYSE:NWG) has continued to perform well, and its shares look cheap right now, along with those of its peer group.

I do not like the medium-term risk outlook for U.K. banks, though, given the weak British economy right now.

Understanding The Business

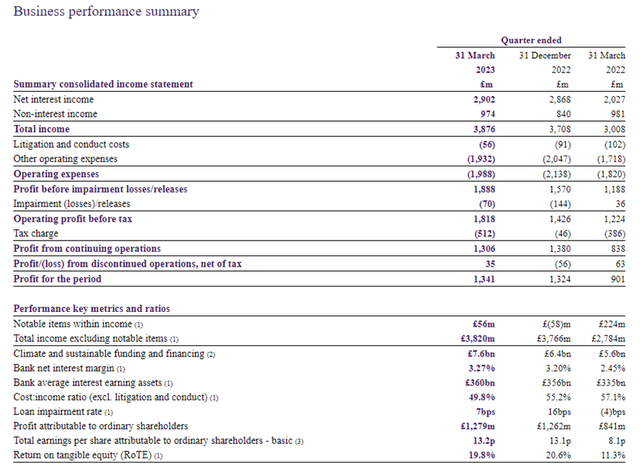

NatWest remains an attractively profitable U.K. bank. Its first quarter results showed a strong performance.

Arguably, the company lacks a point of competitive differentiation. But I would say that also applies to U.K. rivals like Lloyds. They are domestically focused banks, with basic retail and business banking services driving profits. Even without strong differentiation, their position in the market helps them generate sizeable profits year after year.

The U.K. government took a stake in the bank (then named Royal Bank of Scotland) in the 2008 financial crisis. It has been reducing that and currently plans to unwind it completely by 2025 (although that deadline is later than originally planned) but still owns 39% of the bank.

I am not aware that the government investment has been significant for the bank’s strategy or operations, and see the treasury as essentially a sleeping partner.

Long-term Dividend Potential

The dividend yield currently stands around 6%, which I see as attractive.

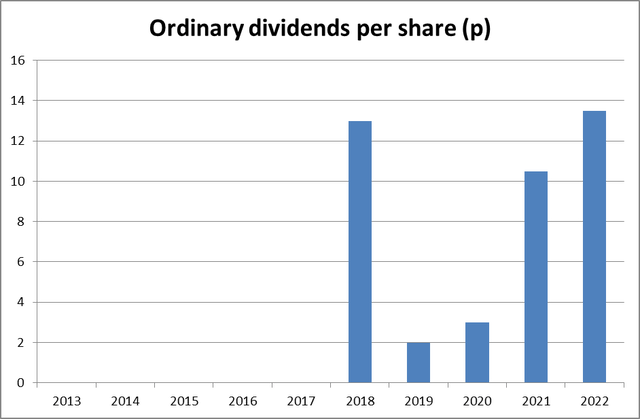

However, NatWest’s dividend history is not reassuring.

U.K. banks were forced by regulatory restrictions to suspend dividends for a while during the pandemic. But even allowing for that, the dividend track record has been erratic.

Chart compiled by author using data from company annual reports

After the financial crisis, there was a long period during which the company paid no dividends. This came to an end in 2018. Last year’s ordinary dividend was slightly higher than the 2018 payout, at 13.5p per share. Last year also saw a special dividend of 7.5p. The overall picture is muddied by a share consolidation (the total per share dividend last year was actually 30.3p, but the share consolidation effectively gave with one hand and took away with the other).

Looking forward, the company’s stated dividend policy is to pay ordinary dividends of 40% of attributable profit. Essentially, that is the share of profit attributable to ordinary dividends, after the government stake has been considered.

Last year such attributable profit came in at £3.3bn, a growth of 13% year-on-year. Given how much bank profits tend to move around, meaning that NatWest’s attributable profit will likely do the same, sticking even roughly to the 40% target will likely mean that the dividend could continue to move around in years to come. I do not see the current 6% dividend yield as a benchmark of what to expect in coming years. That said, with its profitable business franchise, NatWest should hopefully be able to pay meaty dividends over the long term, but I would be surprised to see them move up in a smooth line.

Valuation Could be a Long-Term Bargain

On a price-to-book ratio of 0.6 and price-to-earnings ratio of 6, the shares look cheap right now.

I think the main reason specific to the bank, as opposed to the generally cheap-looking valuation of the London market right now, is the risks to banks including NatWest (though the same applies to the likes of Lloyds in my opinion) that an increasingly shaky looking British economy, combined with rising interest rates, could lead borrower defaults to increase and eat into profits.

If that does not happen, I think the current valuation is cheap. But if it does happen, NatWest shares may not be the bargain they appear.

In its most recent quarterly trading update, the bank sounded fairly sanguine on this point, saying, “A net impairment charge of £70 million, or 7 basis points of gross customer loans, principally reflected the continued strong performance of our lending book. Levels of default remain stable and at low levels across the portfolio.”

However, as we know from plenty of past experience, banking crises can emerge quickly and hurt banks badly. That’s why the U.K. government has a large stake in NatWest itself, after all: if it hadn’t bailed the bank out in 2008, it would likely have gone under (which in my view would have been no bad thing).

U.K. default rates surely must rise given high inflation, increasing interest rates and household budgets not growing in line with the cost of living. In recent days, the U.K. government agreed with mortgage lenders, including NatWest, to a 12-month grace period on home repossessions, which I interpret as a sign of mounting concern. The first quarter of the year saw U.K. home repossessions rise by more than a quarter compared to the same period last year (though in absolute terms the number remains small).

Accepting those risks, there could be value here in the long term. However, I am off banking stocks until it is clearer that the economy is back to strength, so for now, rate NatWest as “hold”.