Investors who want to tap into the income and growth potential of a diversified portfolio of direct real estate in continental Europe through an investment structure that is ideally suited to such an illiquid asset class have one option: the Schroder European Real Estate Investment Trust.

It is the only generalist real estate investment trust (REIT) focussed on Europe, making it a compelling proposition for investors who want to diversify their property exposure beyond UK shores.

“The European REIT is a unique proposition,” says lead manager Jeff O’Dwyer. “Every other UK-listed REIT focuses on the UK or focuses on a specific country or sector within Europe, like Germany or logistics, whereas ours is diversified by country and asset, giving investors access to a cross section of offices, industrial, retail and some alternatives in key high-growth markets.”

The benefit of investing in European real estate is manifold. The continental European market is larger and more diverse than the UK market. Additionally, many rental leases in Europe are indexed to annual inflation, whereas typically in the UK rent reviews are restricted to every five years.

Let’s take a closer look at the Schroder European Real Estate Investment Trust and what makes it a worthy addition to an investor’s portfolio today.

What does the trust do?

Launched in December 2015, the Schroder European Real Estate Investment Trust aims to provide shareholders with a regular and attractive level of income together with the potential for long-term income and capital growth by investing in commercial real estate in continental Europe.

The trust focuses on the economically strongest countries and cities – described as ‘winning cities and regions’. These are mature and liquid markets, which boast growth prospects exceeding those of their domestic economy.

How does it do it?

Europe is a market that O’Dwyer knows well, having lived and worked in various European countries for more than 20 years.

He is currently based in London but travels extensively. Importantly, he is part of a 240-strong team of real estate professionals within Schroders (as at May 2023), many of them working on the ground in key European markets. He collaborates closely with this network of colleagues and connections in France, Germany and the Netherlands.

Local teams of investment professionals harness their knowledge and industry relationships to identify and access sub-markets that stand to benefit from either supply constraints, where there are competing demands for uses, or catalysts for growth, where there are transport improvements, for example.

Many of them have specific areas of focus – whether office, industrial or retail – which further enhances the depth of expertise within the team and allows O’Dwyer to expertly execute the trust’s diversified, multi-sector approach.

Why invest?

There are many compelling reasons to invest in the Schroder European Real Estate Investment Trust. Here are ten of them:

1. Focus on continental Europe

The Schroder European Real Estate Investment Trust invests only in continental Europe and has no exposure to the UK. This makes it a diversifying investment for investors who already have direct UK property exposure in their portfolio.

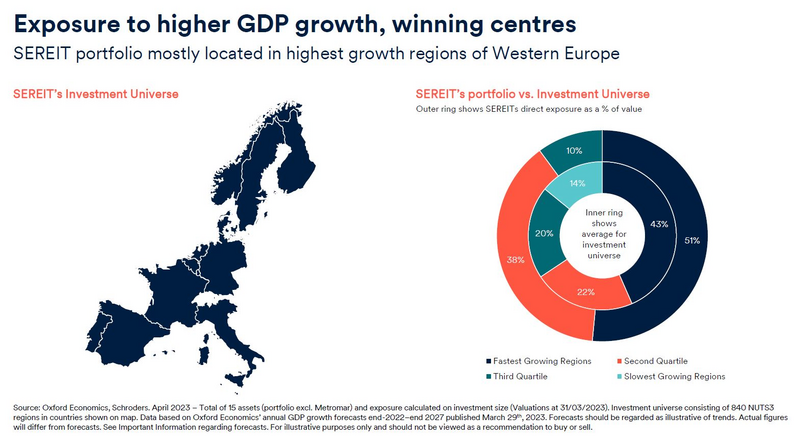

2. Winning cities and regions

The trust is predominantly exposed regions of Western Europe with high growth. In fact, almost 90% of the portfolio by value is invested in these higher-growth regions.

The trust’s assets are located in cities that have a competitive advantage in terms of diversity of business, higher levels of gross domestic product (GDP), employment and population growth, as well as some smaller economies that boast higher-value industries. These are places where people want to live and work, with vibrant communities and well-developed infrastructure.

3. Diversification

The portfolio is highly diversified by asset, city, sector and tenant. It has exposure to the office, industrial and retail sectors, as well as assets that offer the potential for multiple uses.

Despite the headwinds posed by the Covid-19 pandemic and the lasting change to more flexible work patterns, office markets have proven robust with demand for high quality space remaining strong. Vacancy has increased but remains moderate and supply is forecast to decline after 2023. This will support further rental growth for modern, ESG-compliant stock, which will remain scarce.

In the industrial sector, demand for logistics and warehouse assets continues. While lower consumer spending will affect e-commerce in the short term, future growth in this sector, given low on-line penetration, is likely to drive further demand in a market where tight supply is driving rental growth. Demand for space is also being driven by changes to supply chain management, away from ‘just in time’ to one of storing inventory locally and for longer. In addition, manufacturers are re-assessing their dependency on China to a more diversified manufacturing approach. Parts of Europe may benefit from this.

And in retail, the trust is exposed to grocery and DIY, areas that are less susceptible to the structural headwinds that are hindering fashion and leisure assets.

“One of the issues that we faced with the pandemic is that everyone looked at retail and discounted it quite heavily but when you actually look at the kind of retail that’s performed, it’s primarily been DIY, big box and grocery anchored schemes, which is exactly what we have in this portfolio,” says O’Dwyer.

Being diversified gives the trust access to a much broader pool of opportunities. A recent example is its acquisition of a car showroom in Cannes – an investment that sector specialist REITs would be unable to make.

4. Balance

The risk profile of the portfolio is balanced between core investments and value-add opportunities. Core investments typically account for 70% of assets (as at May 2023). These are stable, income-producing real estate assets that provide a strong foundation for delivering sustainable income to shareholders.

The remaining 30% is invested in value-add opportunities – properties where refurbishment or change of use give the potential for strong capital returns.

5. Income profile

The trust has delivered on its objective of paying a regular and attractive level of dividends to shareholders. It has one of the highest yields in the European property sector. And it yields significantly above the average for both diversified and specialist UK property trusts.

Even during the toughest times, the trust’s income profile has proven resilient. The board maintained a dividend during the Covid-19 pandemic. An initial 50% cut was re-instated within a year thanks to strong asset rent collection, asset management and value performance.

One of the reasons for the trust’s robust income profile is that the manager seeks to acquire assets that are accessible and leased off affordable and sustainable rents, allowing them to grow from a relatively low base.

“We’re not an investor that buys the best assets leased off the highest rents,” says O’Dwyer. “We’re about buying in very sensible locations and buying off affordable rents where we can create value.”

6. Inflation hedging

The trust acts as a hedge against inflation. That is because all its leases are subject to indexation. Around 80% of rents are annually indexed based on the increase in the domestic Consumer Price Index (CPI).

The other 20% are linked to a hurdle, wherein the indexation is applied once the compounding of the CPI reaches the hurdle, typically 10%.

7. Value creation

A detailed business plan-led approach aims to unlock value from each portfolio asset. The trust has a track record of successfully executing on asset management initiatives to generate strong long-term shareholder returns.

One example is its repositioning of an office building in Paris, taking it from a grade C to a grade A asset. The trust bought the building for less than €40 million, invested about €30 million and sold it for more than €100 million.

The manager was able to achieve a 39% uplift in the rent and a profit at disposal of 35%, allowing for special dividends to be paid to shareholders.

To give a flavour of current asset management initiatives, the trust is in preliminary talks with the tenant of a data centre in Apeldoorn, the Netherlands, to turn the facility into a hub location including a data centre, call centre and office building, thereby securing the lease beyond its current expiry in 2026. This initiative would require investment and improve the sustainability and certification of the asset to institutional quality.

Elsewhere, a DIY retail outlet in Berlin that sits on four hectares of land has the potential, subject to planning, to be turned into a mixed-use concept comprising retail, office and residential units.

8. Sustainability

The team capitalises on Schroders expertise in ESG to improve sustainability across the portfolio – to the benefit of tenants, local communities and portfolio performance. The trust improved its Global Real Estate Sustainability Benchmark (GRESB) score from three stars to four in 2021, ranking it second in its peer group.

A significant amount of time is spent on net zero modelling for each of the assets and undertaking initiatives to improve ESG performance and achieve sustainable building certification. Improving the sustainability qualities of the portfolio is a key asset management focus which will enhance liquidity from an occupation and investor perspective.

9. Feet on the ground

Schroders is one of the largest real estate managers in Europe and the trust benefits from specialist feet on the ground in key growth markets.

Local investment and asset management teams with in-depth country and sector knowledge drive the trust’s multi-sector specialisation and work collaboratively with tenants to improve assets and generate sustainable long-term returns for investors.

10. Balance sheet resilience

The trust has a strong balance sheet with significant investable firepower. Having cash on the balance sheet allows the manager to improve existing assets and take advantage of new investment opportunities.

The trust is a modest user of leverage. Refinancing debt in the current climate is proving challenging and costly and a greater concern for those real estate trusts that have significant gearing.

“Having the head room we have is a real benefit in managing this vehicle,” adds O’Dwyer.

Fund risk disclosures

The trust may be concentrated in a limited number of geographical regions, industry sectors, markets and/or individual positions. This may result in large changes in the value of the fund,

both up or down, which may adversely impact the performance of the fund.

The Company may borrow money to invest in further investments, this is known as gearing. Gearing will

increase returns if the value of the assets purchased increase in value by more than the cost

of borrowing, or reduce returns if they fail to do so. The trust can be exposed to different

currencies and tax jurisdictions.

Changes in foreign exchange rates could create losses.

The company is focused on managing the portfolio during current the impact that recent

headwinds (Covid-19, Ukraine crisis and inflation) are having on the market and believes it is in

a robust position with a strong balance sheet.

Important information

This information is a marketing communication

Past Performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise.

For help in understanding any terms used, please visit address https://www.schroders.com/en/insights/invest-iq/investiq/education-hub/glossary/

Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. Schroders has expressed its own views and opinions in this document and these may change.

Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk Before investing in an Investment Trust, refer to the prospectus, the latest Key Information Document (KID) and Key Features Document (KFD) at www.schroders.co.uk/investor or on request.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registration No 4191730 England. Authorised and regulated by the Financial Conduct Authority.