The European Commission has chosen the path of regulation for crypto-assets. This is with the aim of supporting innovation and fair competition, and ensuring a high level of consumer and investor protection and market integrity in the crypto-asset markets. At the same time, it aims to address financial stability and monetary policy risks that could arise from a wide use of crypto-assets and DLT-based solutions in financial markets.

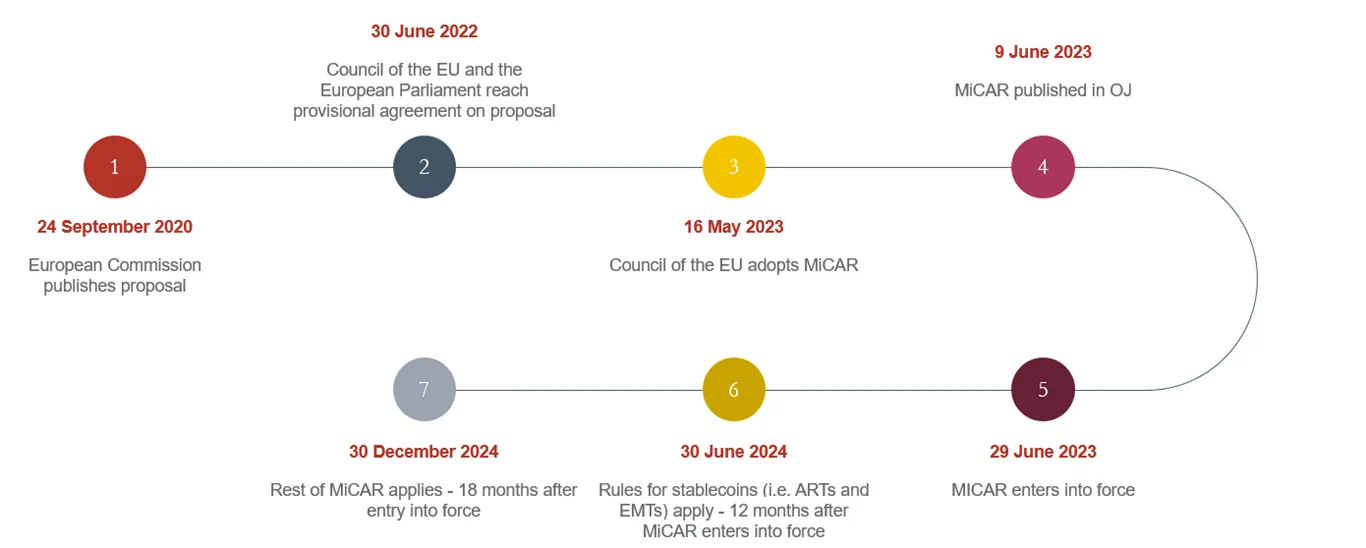

On 9 June 2023, the Regulation on Markets in Crypto-assets (MiCAR) was published in the Official Journal of the European Union. MiCAR regulates crypto-assets, crypto-asset issuers and crypto-asset service providers (CASPs) under a single EU regulatory framework. With MiCAR, the European Commission creates a harmonised framework for crypto-assets with a strong focus on licensing in the EU, and with only limited room for third-country cross-border offerings.

This first edition of our “MiCAR under the microscope” bulletin series provides an overview of MiCAR’s key provisions, and how (and when) they will affect market participants. Over the coming months, we will be looking at MiCAR in more detail, including its scope, the licensing requirements of CASPs, the issuance and marketing of crypto-assets, and the market abuse and AML regimes applicable to crypto-assets.

Why is MiCAR important?

Until now, the crypto industry in the EU has been largely unregulated. Whilst crypto-asset exchanges and custodian wallet providers are subject to some limited anti-money laundering obligations in the fifth Money Laundering Directive, the transposition of these rules has been inconsistent across the EU. In September 2020, the European Commission took the first formal step in response to the blockchain and crypto-assets phenomenon by adopting the EU’s Digital Financial Package. The Digital Finance Package consists of three pieces of legislation: the Regulation on digital operational resilience for the financial sector (DORA), the pilot regime for marketing infrastructure based on DLT (the DLT Pilot regime), and MiCAR.

MiCAR is therefore part of a wider regulatory effort, and over the last couple of years European co-legislators have worked to design a harmonised and comprehensive regime to both incentivise an efficient digital transformation within the EU, as well as ensure market stability and adequate investor protection.

The European Commission hopes that a unified set of rules for crypto-assets in Europe will provide regulatory certainty and consistency, which in turn will also build trust in the crypto industry. The harmonised framework will also lighten the regulatory burden for crypto firms operating in numerous EU countries.

It also introduces a harmonized regulatory framework in the European Union which, given the global nature of crypto markets, is an improvement compared to the current situation with national legislation in some member states only.

Council of the EU

Who is in scope of MiCAR?

MiCAR applies to any natural or legal persons and certain other undertakings engaging in:

- The issuance, offer to the public and admission to trading of crypto-assets; and/or

- The provision of certain services performed with respect to crypto-assets in the EU (CASPs).

The list of crypto-asset services within scope of MiCAR has expanded since the original text was published, and now includes the:

- Custody and administration of crypto-assets on behalf of clients;

- Operation of a trading platform for crypto-assets;

- Exchange of crypto-assets for funds;

- Exchange of crypto-assets for other crypto-assets;

- Execution of orders for crypto-assets on behalf of clients;

- Placing of crypto-assets;

- Reception and transmission of orders for crypto-assets on behalf of clients;

- Providing advice on crypto-assets;

- Providing portfolio management on crypto-assets; and

- Providing transfer services for crypto-assets on behalf of clients.

Going forward, CASPs must be authorised to offer their services in the EU. They must also comply with rules of conduct, disclosure, governance and organisational requirements, and have prudential safeguards in place.

It is also worth noting that CASPs are required to have their “place of effective management” in the EU and at least one of the directors must be resident in the EU.

Which crypto-assets are in scope of MiCAR?

MiCAR applies to a broad range of currently unregulated crypto-assets. It also introduces specific rules for stablecoins, which are divided into e-money tokens (EMTs) and asset-referenced tokens (ARTs).

Under MiCAR, a “crypto-asset” means a digital representation of a value or of a right that is able to be transferred and stored electronically using distributed ledger technology or similar technology.

Crypto-assets in MiCAR are divided into three types, which are subject to different requirements depending on their risks:

- EMTs – aim to stabilise their value by referencing only one official currency

- ARTs – aim to stabilise their value by referencing another value or right, or combination thereof, including one or several official currencies

- Crypto-assets other than ARTs and EMTs – cover a wide variety of crypto-assets, including utility tokens (for which there are some specific rules)

Which crypto-assets are out of scope?

MiCAR does not apply to crypto-assets that qualify as “financial instruments” as defined in the second Markets in Financial Instruments Directive (MiFID II) (as amended), deposits (including structured deposits), funds including e-money (unless they qualify as EMTs), securitisation transactions, and various insurance and pension products regulated under existing EU financial services legislation.

Some non-fungible tokens (NFTs), and crypto-asset services provided in a fully decentralised manner without any intermediary (i.e. DeFi), are also not in scope.

We will discuss the scope of MiCAR in more detail in our second bulletin of this series.

Key provisions of MiCAR

MiCAR sets out the following:

- Transparency and disclosure requirements for the issuance and offer of crypto-assets to the public and admission of crypto-assets to trading on a trading platform for crypto-assets (admission to trading);

- Requirements for the authorisation and supervision of CASPs, issuers of ARTs and issuers of EMTs, as well as for their operation, organisation and governance;

- Requirements for the protection of holders of crypto-assets in the issuance, offer to the public and admission to trading of crypto-assets;

- Requirements for the protection of clients of CASPs;

- Measures to prevent insider dealing, unlawful disclosure of inside information and market manipulation related to crypto-assets;

- A change in control regime governing the acquisition of interests in CASPs; and

- Powers for competent authorities to supervise in-scope entities, and intervene or take enforcement action, and powers for the European Supervisory Authorities to supervise certain significant issuers and CASPs.

Next steps

MiCAR enters into force on 29 June 2023, 20 days after its publication in the Official Journal of the European Union. It will then apply from 30 December 2024 (18 months after its entry into force), except for the requirements relating to ARTs and EMTs which will apply from 30 June 2024, after a 12-month transitional period.