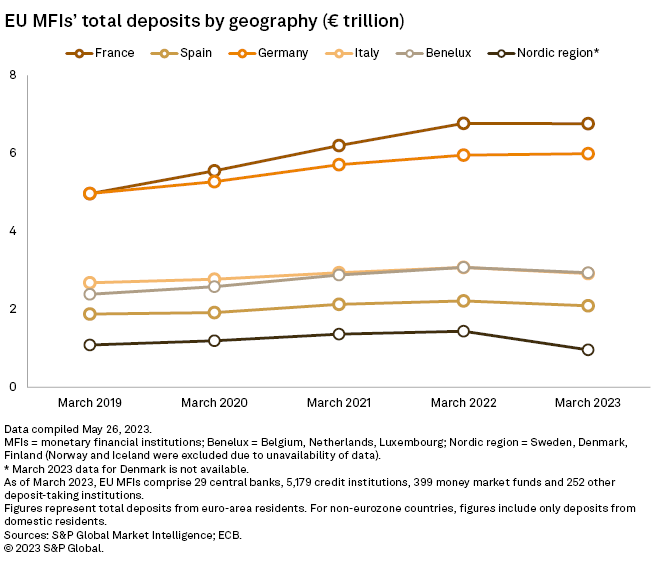

Total deposits fell in several major European markets in the early part of 2023, marking an end to a sustained period of growth in customer funding.

Deposits at monetary financial institutions (MFIs) in France, Italy, Spain and the Benelux region were all lower as of March 2023 compared to 12 months prior, data from S&P Global Market Intelligence and the European Central Bank (ECB) shows. Deposits also fell in the Nordic region, although the latest figures do not account for Denmark.

Deposits had grown consistently across all the sampled regions in recent years. In France, MFI deposits grew 36.5% between March 2019 and March 2022 to €6.77 trillion, before dipping to €6.76 trillion in the latest period. The largest year-over-year decline among regions for which all data is available was in Spain, with a 5.9% drop.

Deposit outflows came into sharp focus in March following the collapse of several US lenders and that of Credit Suisse Group AG. The speed at which customers can withdraw money digitally has sparked debate among regulators as to how to prevent future bank runs.

Banks have been slow to pass on higher interest rates to depositors, who in turn have sought better yielding options for their cash, including money market funds. Lenders across the continent are also scheduled to repay €1.3 trillion to the ECB later this month as it winds down its TLTRO III cheap money program, which will add further pressure to bank funding.

On a quarter-over-quarter basis the picture was more balanced, with just over half of the 26 banks sampled reporting deposit outflows. Aside from Credit Suisse, Intesa Sanpaolo SpA, UBS Group AG, Deutsche Bank AG and Crédit Agricole Group had the largest quarterly declines.

Some of the deposit outflows seen since the start of the year may reflect seasonal patterns and portfolio adjustments from financial customers seeking higher-yielding products, the ECB said in its latest financial stability review. Deutsche Bank CFO James von Moltke noted during the bank’s first-quarter earnings call that some of the deposit outflows remain within the bank in other products.

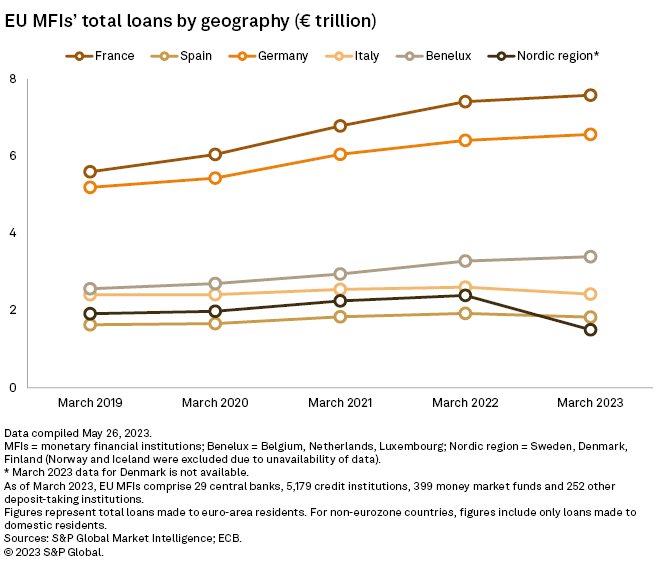

The trend on the other side of banks’ balance sheets continued on its existing trajectory, with loan growth evident in almost all major European regions. Only Italy recorded a decline in total loans among the markets for which all data is available, dropping 7.3% year over year to €2.42 trillion as of March.

Headwinds are, however, mounting on bank lending. European banks tightened their credit standards during the first quarter at the fastest pace since the eurozone sovereign debt crisis of 2011, the ECB’s latest bank lending survey found. Demand for loans fell in the first three months of the year, and banks expect further tightening of credit standards in the second quarter, according to the survey.

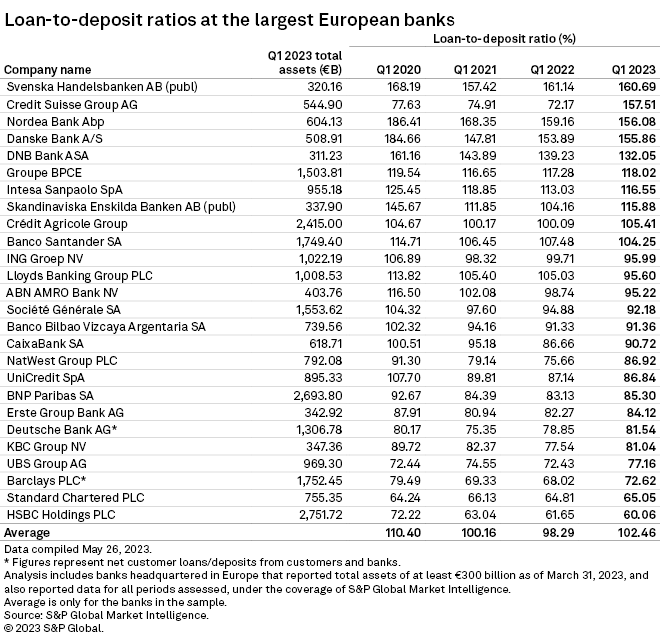

European banks’ aggregate loan-to-deposit ratios rose for the first time in several years, from 98.3% in the first quarter of 2022 to 102.5% this year, reflecting the diverging trends. As in previous quarters, Nordic banks had some of the highest ratios, while UK banks had the lowest.