The European Central Bank raised interest rates to their highest level in more than two decades on Thursday and warned that there was further to go in order to stamp out inflation.

Unlike the Federal Reserve, which left interest rates unchanged on Wednesday, policymakers who set rates for the 20 countries that use the euro said they hadn’t even discussed pausing rate increases at this week’s policy meeting.

“Are we done? Have we finished the journey? No, we are not at destination,” Christine Lagarde, the president of the bank, told reporters in Frankfurt.

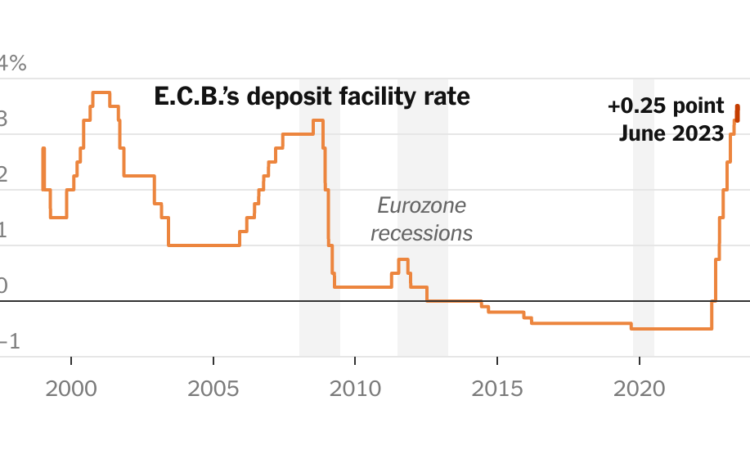

The bank lifted rates by a quarter of a percentage point, putting the deposit rate at 3.5 percent, the highest since 2001, as officials said inflation was forecast to remain too high for too long. It was the bank’s eighth consecutive increase. The move had been well telegraphed since the last meeting of the bank’s Governing Council in early May, when policymakers expressed concern about underlying inflation pressures from wage growth and corporate profits or the impact of rising food prices.

A day earlier, the Federal Reserve held interest rates steady for the first time in more than a year. After last month’s mirror-image move, when both raised rates a quarter point, the two central banks have begun to diverge again. The European Central Bank, which began to raise rates from below zero in July, hasn’t been raising them for as long or as high as the Fed.

“We are not thinking about pausing,” Ms. Lagarde said on Thursday. It is “very likely” that the bank will raise rates again in July, she added, as long as there isn’t a “material change” to the bank’s expectations for inflation.

Policymakers say they want to avoid the risk of declaring victory in their fight against rising prices prematurely, even as the eurozone’s annual rate of inflation has dropped from its double-digit peak late last year to 6.1 percent in May, the slowest pace in more than a year. Much of the slowdown can be attributed to lower wholesale energy costs, but central bankers have been alert to signs that inflation is becoming embedded in the economy, which could impede them from getting inflation back to their 2 percent target.

Ms. Lagarde highlighted the growing effect of wage increases on inflation, saying that “wage pressures, while partly reflecting one-off payments, are becoming an increasingly important source of inflation.” Higher wage costs for companies also explain why core inflation, which excludes energy and food costs, is expected to be higher over the next two years, she said.

Wage growth will be persistent, Ms. Lagarde said, especially in the short term as the summer travel and tourism season begins. While she is laying the groundwork for strong wage gains in the eurozone, unexpectedly fast wage growth in Britain has led traders to bet on higher interest rates there.

The European Central Bank forecasts headline inflation to average 5.4 percent this year, but expects it to still be above the target in two years, at 2.2 percent, slightly higher than projections set out three months ago. That 2.2 percent forecast is “not satisfactory,” Ms. Lagarde said.

As inflation slows, the question of how much policy tightening is the right amount has become difficult to gauge. Too much could restrain the economy more than necessary and cause or worsen a recession. Too little could allow inflation to become a persistent problem that policymakers can’t root out. It’s a challenge facing central bankers around the globe.

On Wednesday, the Fed said it was giving itself time to assess how the U.S. economy was reacting to the rapid pace of past rate increases. But policymakers warned that they might need to raise rates again later. Such a pattern was established recently in Australia and Canada, where central banks held rates steady for a short period before resuming increases.

On Thursday, Ms. Lagarde said policymakers would know where to keep rates only when they arrived there.

Nevertheless, traders are betting that date will arrive at the bank’s September or, more likely, October meeting.

“The E.C.B. just talked itself into two more rate hikes,” Claus Vistesen, the chief eurozone economist at Pantheon Macroeconomics, wrote in a note after Thursday’s announcement. Each one, in July and September, will be a quarter point, leaving the deposit rate at 4 percent, where he predicted it would stay. But economists at Berenberg bank and Commerzbank expect the E.C.B. to stop after one more increase, to 3.75 percent, and keep rates there throughout 2024.

In May, the European Central Bank slowed its rate increases as it acknowledged the impact that tighter monetary policy was having on the region’s economy through more restrictive lending conditions. On Thursday, the bank said tighter financing conditions were expected to further dampen demand.

As the central bank signaled higher interest rates, it also slightly lowered its forecasts for economic growth, predicting that the economy will grow 0.9 percent this year and 1.5 percent next year. The eurozone slipped into recession earlier this year as high prices caused people to spend less.

The central bank’s next decisions “will ensure that the key E.C.B. interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2 percent medium-term target,” it said in a statement, “and will be kept at those levels for as long as necessary.”