By Helena Kelly Consumer Reporter For Dailymail.Com

22:27 02 Jun 2023, updated 22:50 02 Jun 2023

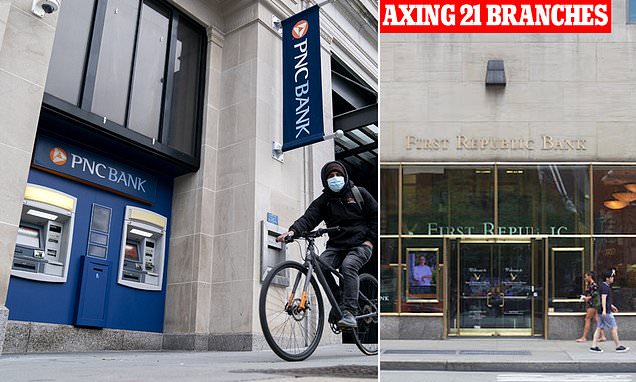

- Banking giant will shutter 29 branches in Maryland and part of Virginia

- Some 26 are located in grocery stores such as Giant Food and Stop & Shop

- First Republic also announced it was shuttering 21 locations this week

PNC Bank is set to shut almost 30 branches, further accelerating America’s transition to automated banking.

The financial giant follows in the footsteps of JPMorgan which yesterday announced it was closing a quarter of First Republic locations after it took over the failed firm earlier this year.

It comes as America faces an access to cash crisis as firms axe branches and ATMs at lightning speed. The number of cash machines fell from 470,000 in 2019 to 451,500 at the end of 2022, according to figures from research body Euromonitor International.

The 29 closures are targeted in Maryland and the Northern part of Virginia, with 26 located in grocery stores such as Giant Food and Stop & Shop.

A spokesman told the US Sun: ‘After a careful review of our business model, PNC’s strategic goals and the potential impact to our customers, the decision was made to close approximately 127 of our Giant Foods and Stop & Shop in-store branches.’

PNC previously unveiled plans to automate 60 percent of its branches – more than 1,000 – by 2026.

On top of the latest round of closures, it is also axing 47 locations across 15 states on June 23.

On Thursday, JPMorgan said it was axing some 21 First Republic branches – around 25 percent of locations nationwide. It did not specify which areas would be affected.

In a statement to CNN news, the banking giant said: ‘These locations have relatively low transaction volumes and are generally within a short drive from another First Republic office.

‘Clients should expect to continue to receive the same level of service with seamless access to their money.’

JPMorgan agreed to buy First Republic’s assets last month following the regional bank’s seizure by the Government.

Its first job has been to slim down the firm, including by cutting workers.

First Republic’s downfall marked the second-biggest banking failure in US history after it followed in the footsteps of Silicon Valley Bank and Signature Bank.

American banks have been steadily automating financial services for years but the trend was accelerated during the pandemic.

Nerves around transmitting the virus deterred households from exchanging cash and encouraged them to use digital payment apps such as Venmo and Block Inc.’s Cash App.

A study by the Federal Reserve showed a 12.4 percent jump in digital transactions in the first quarter of 2020 to the second.

In March JPMorgan told the Wall Street Journal that its banks assess ATM and branch opening hours on a ‘case by case’ basis.

Spokeswoman Julia Tunis Bernard said: ‘Our customers are increasingly using digital channels and transacting less often at ATMs and in branches.

‘At the same time, cash withdrawal amounts have increased over the last several years, indicating cash remains popular among customers.’

Dailymail.com reached out to PNC for comment.