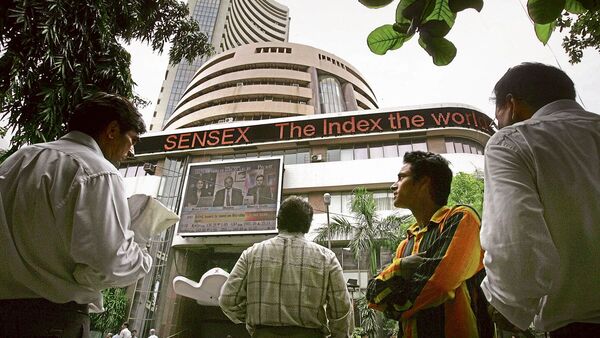

Sensex scaled the 63,000 mark during intraday trading on Monday. The upward momentum helped India reclaim its position as the world’s fifth-largest stock market, after ceding it to France in January. Agreement on the US debt ceiling provided near-term relief. Sustained FPI inflows and positive expectations on the macroeconomic trends also kept investors optimistic.

ONGC plans ₹1 trillion investment to cut carbon emissions; aims to cut both Scope 1 and Scope 2 emissions

Oil and Natural Gas Corp. (ONGC) will spend ₹1 trillion on green initiatives by 2030 to reduce its carbon footprint as part of a broader effort to achieve net-zero emissions by 2038.

ONGC’s chairman and managing director Arun Kumar Singh, told reporters on Monday that the oil explorer has set an ambitious net-zero target and aims to cut both Scope 1 and Scope 2 emissions. Scope 1 emissions are from sources that an organization controls directly, such as fuel used in its operations or in running vehicles, while Scope 2 emissions refer to emissions from, for instance, the electricity it purchases.

According to the company’s presentation, ONGC has a renewable energy portfolio of 189 megawatt (MW) as of FY23, with plans to augment it to 10 gigawatt (GW) by 2030. The energy major plans to venture into offshore wind and green ammonia production, targeting 1 million tonnes per annum (mtpa) of capacity by the same year. “The investments will be in the order of ₹1 trillion,” Singh said. (Read More)

European shares slip on Monday, but debt ceiling deal buoys US futures

European stock indexes edged lower on Monday and euro zone bond yields dropped, but news that the U.S. had reached a debt ceiling deal over the weekend kept Wall Street futures positive.

U.S. President Joe Biden and top congressional Republican Kevin McCarthy reached a tentative deal on Saturday to raise the federal government’s $31.4 trillion debt ceiling, aiming to stop the U.S. from defaulting on its debt.

The deal is expected to provide only short-term relief for markets, as worries linger about inflation and further rate increases.

Asian stocks mostly rose, with Tokyo’s Nikkei surging to a new 33-year high. But Chinese stocks fell after data showed profits slumping at China’s industrial firms.

At 1346 GMT, the MSCI world equity index was up 0.1%. European stock indexes initially opened higher, then faltered, with Europe’s STOXX 600 down 0.2% on the day.

But Wall Street futures rose, with S&P 500 e-minis up 0.2% and Nasdaq e-minis up 0.3%. U.S. and UK markets were closed for public holidays. (Reuters)