Currency Converter Apps – Free, Useful Tools for Travel Exchange Rate Conversion on the Go! | Articles

Published: 28 May at 2 PM by Dave Taylor and tagged under category Currency Exchange||Travel

Using a currency converter app can be incredibly useful for a variety of reasons.

A currency converter app is a versatile tool that provides convenience, accuracy, and essential information for a wide range of situations, from travel and online shopping to financial management and investment decisions. It simplifies currency conversions, keeps you informed about exchange rates, and empowers you to make well-informed decisions in an increasingly globalized world.

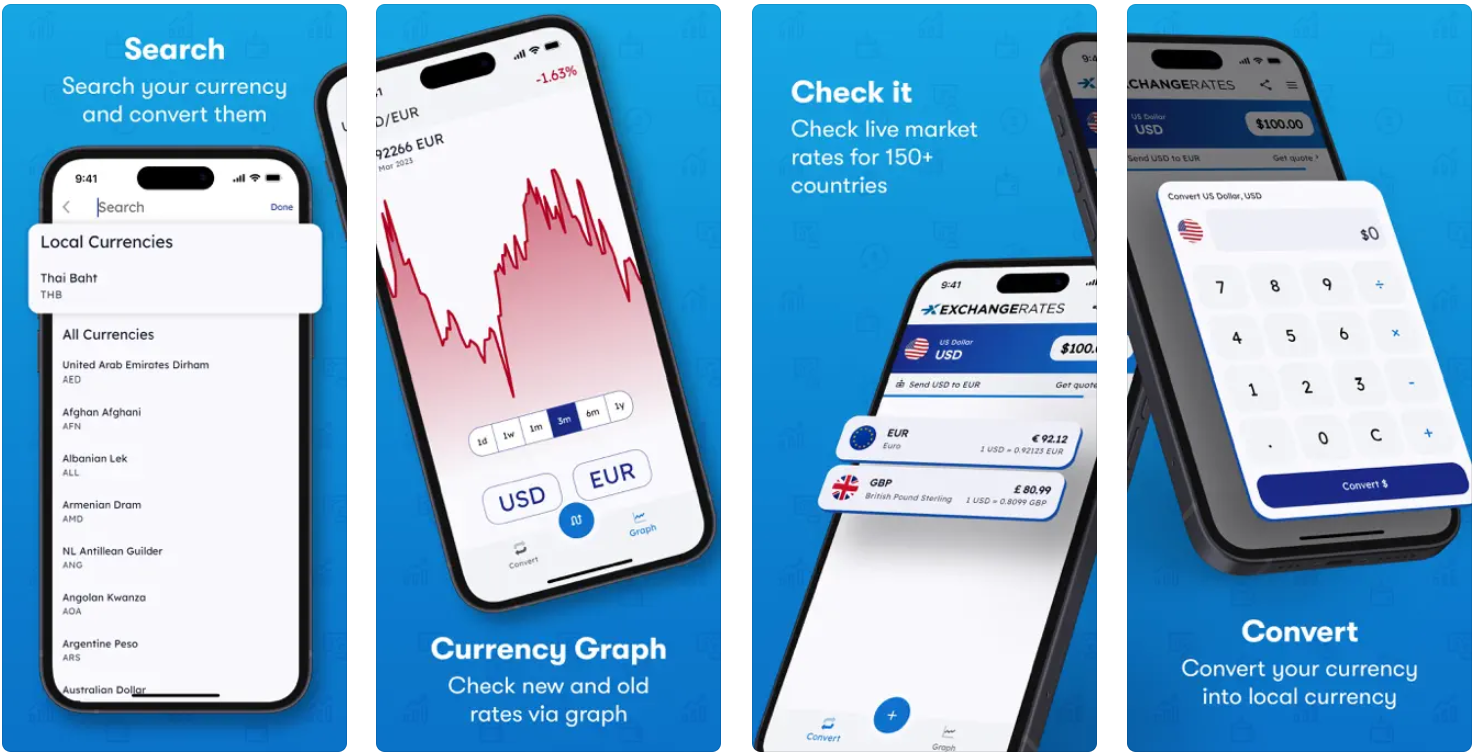

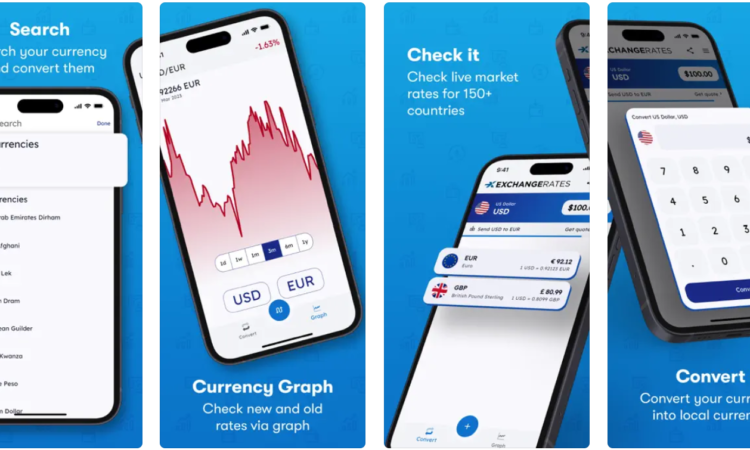

Here at Exchange Rates UK we have just launched our very own brand new currency converter app – get it free here.

Here are the top 10 reasons to use a currency converter app:

International Travel: When travelling to a different country, a currency converter app allows you to quickly convert the local currency to your home currency, helping you understand the value of items and make informed spending decisions.

Currency Exchange: If you need to exchange currency at a bank or exchange bureau, a currency converter app can help you calculate the amount you should receive based on the current exchange rate, ensuring you get a fair deal.

Online Shopping Abroad: Shopping from international websites often involves dealing with different currencies. With a currency converter app, you can easily convert prices to your home currency and compare the cost of items, helping you make better purchasing decisions. Don’t forget: When buying online from abroad, there may be various international taxes and fees that you need to consider. The specific taxes and fees can vary depending on the country you are purchasing from and the country where you reside.

Budgeting and Planning Trips Abroad: Planning a trip or setting a budget for international expenses becomes easier with a currency converter app. You can convert amounts, track expenses, and keep an eye on exchange rate fluctuations to manage your finances effectively.

International Business Transactions: For businesses involved in international trade, a currency converter app is essential for calculating costs, pricing products, and conducting financial analyses across different currencies.

Investment Decisions: If you’re considering investing in foreign stocks, bonds, or other assets, a currency converter app allows you to monitor exchange rates, calculate potential returns, and make informed investment decisions.

Forex (FX) Trading: Currency traders rely heavily on accurate and up-to-date exchange rates. A currency converter app provides real-time rates, charts, and analysis, helping traders make timely and profitable trades.

Personal Finance: Whether you’re managing multiple currencies or need to convert funds for personal financial transactions, a currency converter app simplifies the process, providing accurate conversion rates for various currencies.

Remittances/International Money Transfers: Sending money internationally often involves converting currencies. A currency converter app can help you calculate the exchange rate and the amount your recipient will receive, ensuring transparency in remittance transactions.

Educational Purposes: Learning about different currencies and their values can be educational and a bitr of fun! Apps allow you to explore live exchange rates and different global compare currencies.

Using an App for International Travel

International travel is a common use case for currency converter apps, as they provide valuable assistance in understanding the value of foreign currencies and making informed spending decisions. When visiting a different country, it is essential to have a clear understanding of the local currency’s value in relation to your home currency. A currency converter app simplifies this process by offering real-time exchange rates and enabling quick conversions.

For example, imagine you are traveling from the United Kingdom to Thailand. You want to buy a souvenir at a local market and need to know how much it costs in British pounds. With a currency converter app on your smartphone, you can simply enter the amount in Thai Baht and instantly convert it to GBP. This allows you to determine if the price is reasonable and fits within your budget.

Furthermore, currency converter apps provide convenience and accuracy, especially when dealing with unfamiliar currencies. They eliminate the need to carry around bulky conversion charts or rely on manual calculations. Instead, you can rely on the app to provide up-to-date exchange rates, ensuring that you are always aware of the current value of the local currency.

Currency converter apps also come in handy when making larger purchases during your travels, such as booking accommodations or renting a car. By converting the prices into your home currency, you can easily compare the costs and evaluate different options to make cost-effective decisions.

Additionally, currency converter apps help prevent misunderstandings and potential scams when negotiating prices or handling transactions in a foreign country. You can refer to the app to verify the accurate conversion rate and ensure that you are not being overcharged or taken advantage of due to unfamiliarity with the local currency.

Using an App for Currency Exchange on the Go!

Currency converter apps are not only useful for travellers but also for individuals who need to exchange currency at banks or exchange bureaus. These apps provide a convenient and efficient way to calculate the amount you should receive based on the current exchange rate, ensuring you get a fair deal.

Let’s say you need to exchange US dollars (USD) into Euros (EUR) at a local bank. Using a currency converter app, you can input the amount in USD and select the desired currency, in this case, Euros. The app will provide you with the real-time exchange rate and calculate the equivalent amount in Euros. This allows you to have a clear idea of how much you should expect to receive in the foreign currency.

Moreover, currency converter apps often include additional features, such as fee calculations. When exchanging currency, banks or exchange bureaus may charge a fee or commission for the service. A currency converter app can take these fees into account and provide you with the total amount you will receive after deducting the fees. This enables you to compare different exchange options and choose the one that offers the most favorable rates and lowest fees.

For example, imagine you need to exchange a large sum of money for a business transaction. By using a currency converter app, you can compare the exchange rates and fees of different banks or exchange bureaus in your area. The app will help you determine which option will provide the most advantageous conversion, ensuring you maximize the value of your money.

Additionally, currency converter apps can help you keep track of your currency exchanges and monitor the exchange rates over time. This can be particularly useful for individuals who frequently travel or engage in international business transactions. By staying informed about the exchange rates, you can choose the most opportune time to exchange currency and potentially take advantage of favorable fluctuations in rates.

International Online Shopping

Currency converter apps play a crucial role in facilitating online shopping from international websites. When shopping abroad, dealing with different currencies can be a challenge, as prices are often displayed in the local currency of the website. However, with a currency converter app, you can easily convert prices to your home currency, enabling you to make better purchasing decisions.

For instance, let’s say you come across a product on an international website, and the price is listed in a foreign currency such as Japanese Yen (JPY). By using a currency converter app, you can input the price in JPY and convert it to your home currency, such as US dollars (USD) or British pounds (GBP). This allows you to compare the cost of the item in your familiar currency, helping you understand its value and make an informed decision on whether it fits within your budget.

Moreover, currency converter apps often provide up-to-date exchange rates, ensuring that the conversions accurately reflect the current market rates. This is particularly important when shopping online, as exchange rates can fluctuate throughout the day. By using a currency converter app, you can have confidence that you are getting the most accurate conversion, avoiding any surprises or discrepancies in the final amount you pay.

Additionally, currency converter apps can be helpful in identifying potential savings or deals when shopping abroad. For example, if you come across a product that seems more expensive when converted to your home currency, you may consider exploring other international websites or comparing prices with local retailers to find a better deal. The app empowers you to make price comparisons effortlessly and find the most cost-effective option for your desired products.

Don’t forget taxes when shopping online overseas!!

When buying online from abroad, there may be various international taxes and fees that you need to consider. The specific taxes and fees can vary depending on the country you are purchasing from and the country where you reside. Here are some common international taxes and fees that may apply:

Customs Duties: Customs duties, also known as import duties or tariffs, are taxes imposed on goods when they cross international borders. These duties are typically levied by the importing country and are based on the value of the goods being imported. The purpose of customs duties is to protect domestic industries and generate revenue for the government. See importing to UK info here, UK post-Brexit rules summary here, and importing to the US here

Value Added Tax (VAT): VAT is a consumption tax that is applied to the sale of goods and services. Each country has its own VAT rate, and when buying from abroad, you may be subject to the VAT rate of the country you are importing the goods into. Some countries have a threshold for VAT exemption, meaning that purchases below a certain value may be exempt from VAT. See VAT info here

Sales Tax: Similar to VAT, sales tax is a tax imposed on the sale of goods and services. It is applicable in certain countries or regions, such as the United States, where individual states may have their own sales tax rates. When buying from abroad, you may need to consider whether the online retailer includes the relevant sales tax in the purchase price or if it will be applied at the point of delivery.

Goods and Services Tax (GST): GST is a broad-based consumption tax applied in some countries, such as Australia, New Zealand, and Canada. Like VAT, it is typically included in the purchase price and may apply to online purchases from abroad.

Handling Fees: In addition to taxes, there may be handling fees associated with international purchases. These fees cover administrative costs related to customs clearance and processing. They are often charged by the shipping carrier or postal service and vary depending on the value and type of goods being imported.

Forex Trading, can a Currency App Help?

Depending on the type of currency app, some can be indispensable tools for Forex (FX) traders, as they provide real-time exchange rates, charts, and analysis that are essential for making informed trading decisions. In the fast-paced world of Forex trading, having access to accurate and up-to-date exchange rates is crucial for executing trades at the right moment and maximizing profits.

For Forex traders, currency converter apps often offer a range of features that aid in their trading activities. These apps provide real-time exchange rates for a wide range of currency pairs, allowing traders to monitor and analyse the market fluctuations. By keeping track of the exchange rates, traders can identify potential trading opportunities, track the performance of specific currency pairs, and determine the optimal entry and exit points for their trades.

Moreover, some apps often provide charts and technical analysis tools that assist traders in analyzing market trends and patterns. These tools enable traders to visualize the price movements and identify key support and resistance levels, helping them make more accurate predictions about future price movements. By using the charting capabilities of a currency converter app, traders can develop trading strategies based on technical indicators and chart patterns.

To illustrate, let’s consider a Forex trader who wants to trade the Euro to Dollar exchange rate. Using a currency converter app, the trader can monitor the real-time exchange rate between the Euro (EUR) and the US Dollar (USD). By analyzing the historical data and chart patterns available on the app, the trader can identify potential trends and patterns in the EUR/USD exchange rate. Based on this analysis, the trader can make decisions on whether to buy or sell the currency pair and set appropriate stop-loss and take-profit levels.

Additionally, currency converter apps often provide news and analysis from financial experts, keeping traders informed about market developments and events that may impact exchange rates. This information helps traders stay updated on economic indicators, central bank decisions, geopolitical events, and other factors that can influence currency movements. By staying informed through the app, traders can adapt their strategies accordingly and take advantage of market opportunities.

Top 10 Questions Relating to Currency Converter Apps

- How do currency converter apps work?

Currency converter apps work by accessing real-time exchange rate data and performing currency conversions based on the user’s input. Here’s a simplified explanation of how these apps typically work:

Exchange Rate Data: Currency converter apps rely on a reliable source of exchange rate data, which is usually obtained from financial institutions, central banks, or trusted data providers. This data includes the current exchange rates for various currency pairs.

User Input: When a user opens a currency converter app, they can select the currencies they want to convert. They input the amount of the source currency they want to convert.

Conversion Calculation: The app uses the current exchange rate for the selected currency pair to calculate the converted amount. It multiplies the input amount by the exchange rate to determine the equivalent value in the target currency.

Display of Results: The app displays the converted amount to the user, usually in both the source and target currencies. It may also provide additional information such as the historical exchange rate or percentage change.

Currency Pair Selection: Currency converter apps typically support a wide range of currency pairs, allowing users to convert between various global currencies. Users can select the desired currency pair from a list or search for specific currencies.

Real-Time Updates: To ensure accuracy, currency converter apps often provide real-time updates of exchange rates. They constantly fetch and update the exchange rate data to reflect the latest market conditions.

Additional Features: Currency converter apps may offer additional features to enhance the user experience. These can include historical exchange rate charts, currency conversion history, offline mode, and customizable settings.

Behind the scenes, currency converter apps rely on APIs (Application Programming Interfaces) to fetch real-time exchange rate data. These APIs provide access to reliable and up-to-date data sources, allowing the app to retrieve the necessary information for currency conversions.

Overall, currency converter apps simplify the process of converting currencies by providing users with quick and accurate calculations based on real-time exchange rates. They make it easy for individuals and businesses to understand the value of different currencies and facilitate financial transactions in a global economy.

- Are currency converter apps accurate and reliable?

Currency converter apps strive to provide accurate and reliable exchange rate information, but their accuracy can vary depending on several factors. Here are some considerations regarding the accuracy and reliability of currency converter apps:

Data Sources: The accuracy of a currency converter app largely depends on the quality and reliability of the data sources it uses. Reputable apps typically obtain exchange rate data from trusted financial institutions, central banks, or reliable data providers. These sources ensure more accurate and up-to-date rates.

Real-Time Updates: Currency converter apps that offer real-time updates are generally more reliable. Real-time updates ensure that the exchange rates reflect the current market conditions. Apps that fetch data frequently and promptly provide users with more accurate conversion results.

Provider Reputation: Choosing a well-known and reputable currency converter app increases the likelihood of accuracy and reliability. Established apps with a large user base often have robust systems in place to ensure accurate exchange rate information.

API Integration: Some currency converter apps rely on third-party APIs (Application Programming Interfaces) to retrieve exchange rate data. It’s important to consider the reliability and reputation of the API provider to ensure accurate and up-to-date rates.

User Reviews and Ratings: Reading user reviews and ratings can give insights into the accuracy and reliability of a currency converter app. Feedback from other users can indicate whether the app consistently provides accurate conversion results.

- Can currency converter apps be used offline?

Yes, some currency converter apps can be used offline. Offline functionality allows users to access previously downloaded exchange rate data without an internet connection. Here’s how it typically works:

Pre-downloaded Rates: Offline-capable currency converter apps usually require an initial internet connection to download the latest exchange rates for various currencies. These rates are stored locally on the device and can be accessed even when offline.

Currency Conversion: When using the app offline, you can select the desired currencies for conversion and input the amounts. The app will then use the pre-downloaded exchange rates to perform the conversion and display the results.

Limited Functionality: While offline, currency converter apps usually provide basic conversion features using the pre-downloaded rates. However, additional features such as real-time updates, historical data, or dynamic rate adjustments may not be available until an internet connection is established.

It’s important to note that the accuracy and timeliness of the exchange rates in offline mode depend on when the rates were last updated. If you haven’t connected to the internet for an extended period, the rates may not reflect the current market conditions. Therefore, it’s recommended to periodically update the rates by connecting to the internet to ensure the most accurate conversion results.

Offline functionality in currency converter apps can be beneficial, especially when traveling to areas with limited or expensive internet access. It allows you to make quick currency conversions without relying on an internet connection. However, for real-time and up-to-date exchange rates, an internet connection is necessary.

- Are currency converter apps free to use?

Currency converter apps are available in both free and paid versions. The availability of free and paid options depends on the specific app and its features. Here are a few points to consider:

Free Apps: Many currency converter apps offer a basic version with essential conversion functionality at no cost. These apps typically provide real-time exchange rates, basic conversion capabilities, and sometimes limited additional features. Free apps may have advertisements or offer in-app purchases for advanced features or removal of ads.

Paid Apps: Some currency converter apps offer premium or pro versions that require a one-time purchase or a subscription fee. These paid versions often provide additional features such as historical data, offline functionality, customization options, advanced charting tools, and more. Paid apps may offer a more comprehensive and ad-free experience.

In-App Purchases: In some cases, even free currency converter apps may offer in-app purchases for access to specific features or to remove ads. These purchases are optional and allow users to enhance their experience or access advanced functionality within the app.

It’s important to note that the availability of free or paid options may vary among different currency converter apps. Before downloading an app, it’s advisable to review its pricing structure, features, and user reviews to determine if the free version meets your needs or if upgrading to a paid version is worthwhile.

Ultimately, whether you choose a free or paid currency converter app depends on your specific requirements, the features you desire, and your budget. There are numerous options available, so you can explore different apps to find the one that best suits your preferences.

- Which currency converter app offers the best exchange rates?

One currency converter app doesn’t usually offer better exchange rates than the next, as they are only offering information. Exchange rates fluctuate constantly due to market conditions, and different apps may obtain their rates from various sources such as banks, financial institutions, or aggregated data providers.

To find the app that offers the best way of getting your exchange rate information for your needs, consider the following:

Research and Compare: Look for currency converter apps that are well-reviewed and popular among users. Read reviews and compare the rates provided by different apps to get an idea of their accuracy and reliability.

Multiple Sources: Opt for apps that source their exchange rates from multiple reliable providers. This can help ensure that you have access to competitive rates and reduce the risk of relying on a single source.

Real-Time Updates: Choose an app that offers real-time exchange rate updates. This ensures that you have access to the most current rates, which can be crucial, especially during periods of high market volatility.

User Experience: Consider the overall user experience, interface, and additional features offered by the app. Look for apps that are user-friendly, intuitive, and provide additional functionalities that enhance your currency conversion experience.

Personal Preference: Ultimately, the “best” exchange rates can vary depending on individual preferences and needs. It’s worth trying out different currency converter apps to see which one aligns with your requirements and provides accurate and reliable rates for the specific currencies you frequently use.

- Can currency converter apps convert cryptocurrencies?

Yes, some converter apps have the capability to convert cryptocurrencies in addition to traditional fiat currencies. These apps provide users with the ability to convert between different cryptocurrencies or convert cryptocurrencies to fiat currencies and vice versa.

Cryptocurrency converter apps typically integrate with popular cryptocurrency exchanges or data providers to fetch real-time exchange rates for various cryptocurrencies. Users can select the cryptocurrencies they want to convert and enter the desired amount to obtain the equivalent value in another cryptocurrency or fiat currency.

These apps may also provide additional features such as portfolio tracking, price alerts, and historical price charts to help users monitor and manage their cryptocurrency investments.

It’s important to note that not all currency converter apps support cryptocurrency conversion. If you specifically require cryptocurrency conversion functionality, it’s recommended to search for apps that explicitly mention cryptocurrency support or explore dedicated cryptocurrency wallet and exchange apps that offer conversion features.

- Do currency converter apps support multiple languages?

Yes, many currency converter apps support multiple languages to cater to a global user base. These apps understand the importance of providing a user-friendly experience for individuals from different regions and language preferences.

Currency converter apps often offer language settings within their settings or preferences menu, allowing users to choose their preferred language from a list of available options. The available languages may vary depending on the app, but popular choices typically include English, Spanish, French, German, Chinese, Japanese, and more.

By supporting multiple languages, currency converter apps enable users around the world to navigate the app, understand the conversion rates, and access other features with ease. This helps to enhance the user experience and make the app more inclusive and accessible to a diverse range of users.

If you have a specific language requirement, it’s advisable to check the app’s description or reviews to ensure that it supports the language you prefer before downloading or installing it.

- Are currency converter apps available for both iOS and Android devices?

Yes, currency converter apps are available for both iOS and Android devices. These apps cater to a wide range of users who use different mobile platforms.

Currency converter apps can be found on both the Apple App Store for iOS devices (such as iPhones and iPads) and the Google Play Store for Android devices (such as smartphones and tablets). They can be downloaded and installed directly from the respective app stores onto the compatible devices.

When searching for a currency converter app, users can simply visit their device’s app store and search for “currency converter” or related keywords. This will provide them with a list of available apps that they can choose from.

It’s worth noting that while some currency converter apps are available on both iOS and Android, there may be slight differences in terms of features, design, or user interface between the versions developed for each platform. However, the core functionality of converting currencies remains consistent across both iOS and Android apps.

Regardless of the operating system you use, you should be able to find a suitable currency converter app that meets your needs on your preferred platform.

- Can currency converter apps track historical exchange rates?

Yes, many currency converter apps provide the functionality to track historical exchange rates. This feature allows users to access and view past exchange rate data for different currencies over a specified period.

With historical exchange rate tracking, users can analyze and monitor currency fluctuations over time, which can be valuable for various purposes such as financial planning, historical data analysis, or business transactions.

Currency converter apps that offer historical exchange rate tracking typically provide charts or graphs that visually represent the exchange rate movements over a selected time frame. Users can input specific dates or choose from pre-defined time periods to view the historical rates.

By accessing historical exchange rate data, users can gain insights into currency trends, compare rates across different time periods, and make more informed decisions related to currency conversions or international transactions.

It’s important to note that the availability and extent of historical exchange rate data may vary depending on the specific currency converter app. Some apps may offer limited historical data, while others may provide a more extensive range of historical rates. Users should explore different apps and choose the one that best suits their needs in terms of historical exchange rate tracking capabilities.

- Do currency converter apps have additional features like currency charts or currency alerts?

Yes, currency converter apps often include additional features beyond basic conversion functionality. Two commonly found features are currency charts and currency alerts (by the way, we offer both on this website – find any charts on a currency pair page, such as the Pound to Euro rate page here and see our currency alert signup)

Currency Charts: Currency converter apps may offer currency charts or graphs that provide visual representations of exchange rate trends over time. These charts allow users to analyze historical exchange rate data, track fluctuations, and identify patterns or trends. Currency charts can be useful for understanding the performance of currencies and making informed decisions about currency conversions or international transactions.

Currency Alerts: Many currency converter apps also offer currency alert functionalities. Users can set up custom alerts to receive notifications when a specific currency reaches a desired exchange rate. This feature is particularly useful for individuals or businesses that monitor exchange rates closely and want to take advantage of favorable rates or be alerted to specific rate thresholds. Currency alerts help users stay informed and make timely decisions regarding currency conversions or financial transactions.

These additional features enhance the functionality and usefulness of currency converter apps, providing users with more comprehensive tools for managing their currency-related needs. However, it’s important to note that the availability and specific features may vary across different currency converter apps. Users should explore different apps and choose the one that best aligns with their requirements in terms of currency charts, alerts, and any other desired features.