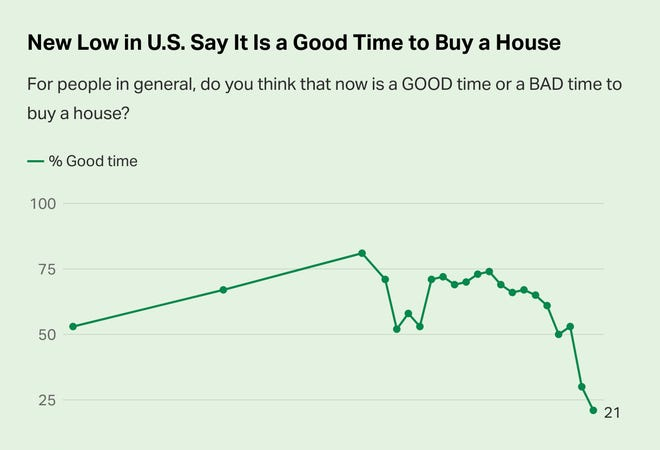

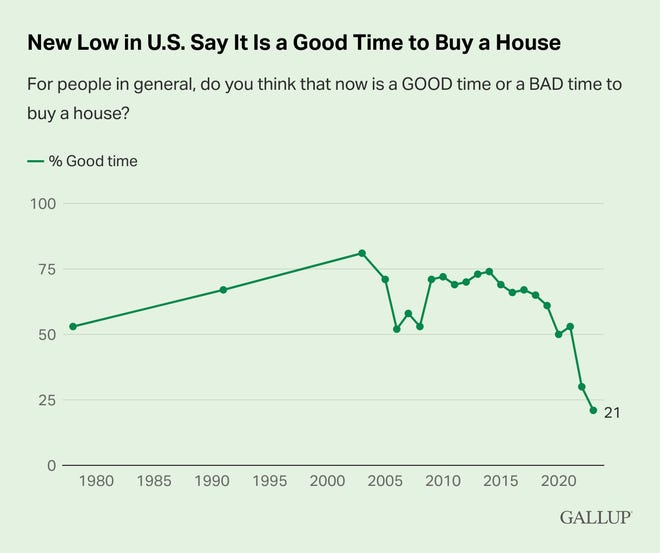

Homebuyers’ pessimism about market conditions have hit a new low.

Only 21% of U.S. adults say it’s a good time to buy a house, according to a new Gallup poll, a record low since 1978 when the company began conducting its annual poll. It’s down nine percentage points from a year ago, and the second time the figure has dipped below 50%.

The latest results are from Gallup’s annual Economy and Personal Finance poll, conducted April 3-25, and comes at a time when elevated mortgage rates, high home prices and low inventory levels have slowed the housing market.

“Opinions of the housing market are bleak and generally similar among all major subgroups, including by region, urbanicity, homeownership status, income, education and party identification,” says Jeff Jones, an editor at Gallup.

Gallup first asked Americans about their perceptions of the housing market in 1978, when 53% thought it was a good time to buy a house. Thirteen years later, when the question was asked again, 67% held that view. The record high of 81% was recorded in 2003, at a time of growing homeownership rates and housing prices.

Homebuying:Is it better to rent or buy? The best house prices vary city to city

Mortgages:‘Locked in’ mortgage rates mean few homes on market. How new construction has been a solution.

HousingHousing market on the rise? Mortgage rate dip has immediate impact on several aspects.

Even during the height of the housing crisis, from 2006-2008, Americans were more optimistic about home buying, with about 52% of people saying it was a good time to buy a home. The current sentiment is more than 30 percentage points below the how people felt during the Great Recession.

Will home prices continue to increase?

In addition to measuring Americans’ housing market perceptions in general, Gallup monitors public expectations for housing prices in their area. In 2021, 71% predicted local home prices would increase over the next year, the highest percentage holding that view in Gallup’s trend dating back to 2005. Last year, a similar 70% expected home prices to increase.

Currently, 56% hold this view, while 25% believe prices will stay the same and 19% think they will decrease.

Despite the declines this year, current expectations for home prices are still relatively high. In 2020, 40% thought home prices would increase, and from 2009 through 2012, after the housing bubble burst, between 22% and 34% did.

Expectations of home price appreciation vary regionally

Regionally, Midwestern residents are less likely than those in other parts of the country to predict that home prices in their area will increase over the next year. Whereas 45% of Midwestern residents expect prices to rise, 55% of Western residents, 61% of Southern residents and 62% of Eastern residents do.

Also, those who live in towns or rural areas (45%) are much less inclined than city (64%) or suburban (57%) residents to predict an increase in local home prices.

Midwestern, Western and town/rural residents show the greatest drops since 2022 in the percentage believing local home values will increase, each dropping by 21 points or more. Southern, city and suburban residents show modest declines, while there has been no change among Eastern residents.

Real estate still considered the best long-term investment

More Americans continue to name real estate than stocks, gold, savings accounts/CDs or bonds when asked which is the best long-term investment.

A full 34% of Americans chose real estate this year, but it is down sharply from last year’s record-high 45%. However, at 34%, it is on par with the typical proportion selecting real estate from 2016 to 2020, before housing prices skyrocketed during the pandemic.

Meanwhile, the perception that gold is best has nearly doubled, rising from 15% in 2022 to 26% today. As a result, gold has overtaken stocks for second position.

Although 19% of Americans expect home prices to decrease in the coming year — far below the 38% and 34% who did so in 2008 and 2009, respectively — they are much less likely than in the past two years to expect prices to go up. Any stabilizing or downward pressure on home prices could make houses more affordable for Americans, particularly if interest rates also stabilize or decline in the coming years.

Swapna Venugopal Ramaswamy is a housing and economy correspondent for USA TODAY. You can follow her on Twitter @SwapnaVenugopal and sign up for our Daily Money newsletter here.