What happens over the course of the next two games will have profound effects on Everton in the years to come.

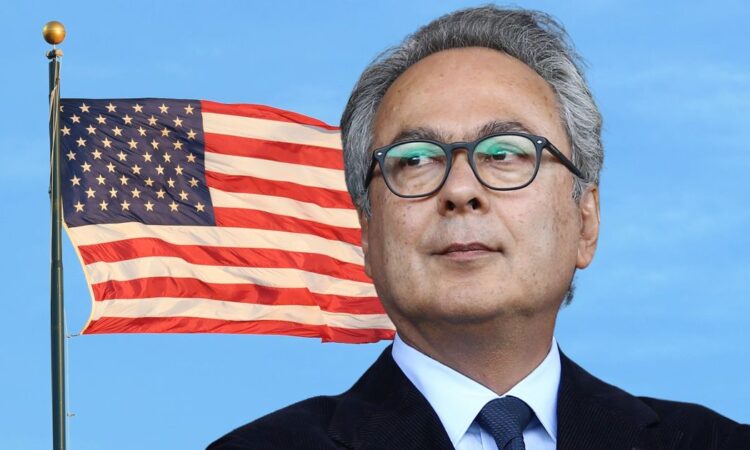

If results go their way, Everton could find themselves escaping the jaws of relegation for a second successive season, and also potentially firing the starting pistol on the end of Farhad Moshiri’s reign at the the helm of the club he has owned since 2016.

Two US investment firms, 777 Partners and MSP Sports Capital, have held discussions with Moshiri and his representatives in recent months, with those talks having now reached the point of, according to The Athletic and the Daily Mail, offers being agreed with both, albeit with caveats attached.

The Mail claimed last week that Miami-based 777, a firm that already has ownership stakes across football through a portfolio that includes Hertha Berlin, Standard Liege, Genoa, Vasco da Gama, Red Star FC, Melbourne Victory and Sevilla, could acquire the club as early as next week. Days later, the Mail claimed that it was MSP, the New York-based firm run by billionaire Phoenix Suns part owner Jahm Najafi, who had made a late play and were now in the box seat.

READ MORE: Sean Dyche opens up on Everton talks with Farhad Moshiri

Both things, according to the Athletic, could be true. There are claims that Moshiri has agreed a ‘non-binding and conditional’ deal with 777 to take over the club, while the Everton owner has also reportedly agreed on a deal with MSP with caveats attached for a large amount of convertible debt that could be used for the completion of the 52,888-seater stadium build at Bramley-Moore Dock, which is set to open next year.

Everton’s financial turmoil in recent times has been well documented, with the club having lost more than £400m over the last four financial years. Should they go down this season they would be faced with revenues being dramatically slashed, despite the softening blow of the parachute payments that currently exist, while striking new commercial deals would arrive at a reduced rate, not ideal when factoring in some of the major opportunities that the building of a new stadium offers, from naming rights to corporate hospitality and beyond.

The caveats that are in place are almost certainly centred around whether or not the football club retains the top flight status that it has held continually since 1954.

“In the case of Everton, I would be almost impossible to imagine any investor pressing ahead with a deal to buy the club if they didn’t know what league that they were going to be playing in,” said Jordan Gardner, a US football investor and former owner of FC Helsingor who now works as a consultant for sports intelligence firm Twenty First Group.

“There are two totally different deals at play there, almost different businesses, if the club goes down. Revenues fall dramatically and you’ve got major liabilities like the wage bill to take into a league where you aren’t earning anywhere close to the kind of money that you were before.

“For a club that has already been losing money, and who have a stadium build that still has to find the remainder of the finance, that’s a completely different proposition to one that is part of the Premier League.”

Some US investors have also been erring on the side of caution in recent times due to the macroeconomic issues that America currently faces, with rising interest rates and the threat of the country potentially defaulting on its debt, something that could be economically catastrophic.

If the world’s biggest economy fails to meet its debt obligations it would have a major ripple effect globally, causing recessions, frozen credit markets and a stock market crash as investors moved to sell stocks and bonds.

The hope remains that a deal can be reached to stop the US from defaulting on its debt for the first time in its history. The US reached its borrowing limit on January 19 but a series of measures has prevented it from defaulting since, although the Treasury is set to be unable to pay its debts by the start of June. A surge of tax receipts from businesses and individuals is set to arrive by mid-June to alleviate some of the pressure.

But with such worry existing, will that be impactful for investment funds from the US who are looking towards putting capital to work at such a volatile time?

“It is a complicated question,” explained Andrew Zimbalist, an economist at Smith College in Boston, Massachusetts, and member of the editorial board of the Journal of Sports Economics.

“Both inflation and the looming debt ceiling put upward pressure on interest rates, which, in turn, make it more expensive to invest in football clubs in Europe. This is bound to have at least an incrementally negative impact on PE (private equity) deals. Yet, any sensible investor is looking at investing in football as a long term investment and, as such, might regard the current financial conditions as a good opportunity (less demand and lower prices for clubs) to invest. So, it depends on the strategy of the PE investors and the details of the purchase.

“Of course, if the US actually does default, the negative impact would be much more substantial, and the longer the default, the more devastating the effect.”

The influx of US capital into European football has accelerated over the past few years, with more and more individuals and investment funds seeing the value proposition that exists when compared with the North American sports market, which has a protected eco-system thanks to no promotion and relegation as well as salary caps, but one where valuations can be prohibitively high with less upside and growth potential.

For Everton, any risk associated with them falling out of the Premier League would be very much at the forefront of the minds of potential investors or buyers.

“I don’t envisage we’ll see a huge change in approach,” added Gardner.

“Of course, if we have a full-blown recession we could see the trickle down effect, but I don’t think it’s having a huge impact right now.

“If interest rates continue to rise it becomes more difficult to raise large sums of money and debt, and that would be impactful. But I don’t think that we are at that point yet.

“I think maybe investors are in something of a holding pattern and just waiting to see what happens, but I don’t think it would be having a huge impact right now.”

For Everton, so much of their future success is tied up in what happens over the course of the next 180 minutes of Premier League football. The stakes have never been higher.

READ NEXT