Editor’s note: Seeking Alpha is proud to welcome Stonehill Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

William Reagan/iStock via Getty Images

First Merchants Corporation (NASDAQ:FRME) has been oversold in 2023 following panic-selling in the regional banking market as the collapses of SVB, First Republic Bank, and Signature Bank spooked investors. The stock is down ~36% YTD, trading at a P/E FWD (FY1) of 5.9x on consensus earnings, compared to its five-year average of 11.7x. In my opinion, the bank is a good way to play the compressed multiples in the regional banking market. FRME is a stable bank with a solid franchise, good organic loan growth, and a solid risk profile. The bank’s long-term prospects are also strong, supported by abundant M&A opportunities in its fragmented operating markets.

Business Description

Headquartered in Muncie, Indiana, FRME is a Midwestern commercial bank. FRME operates in Indiana, Ohio, Michigan, and Illinois, where it has 121 banking centers. The 1Q23 earnings presentation reveals that total assets are $18.2 billion, of which ~70% are loans. ~75% of loans are commercial while the remaining loans are predominantly residential mortgages and, to a lesser extent, home equity loans. Assets are predominantly funded by deposits sourced from both retail and commercial clients in deposit-rich areas. FRME also offers private wealth management services with $6.7 billion under advisement.

Leading Franchise In Select Mid-sized Cities

FRME has built up a strong franchise in mid-sized cities and regions across Indiana, Ohio, Michigan, and Illinois. The bank has relatively low market shares on a state-wide basis, but it has built strong local presences in a variety of smaller MSAs. For example, using FDIC data from June 2022, FRME is #11 with a 1% deposit market share in Michigan, but it is #1 in Monroe with a 45% deposit market share. The same thing in Indiana where the bank is #5 with a 5% deposit market share state-wide, but ranks #1 in Muncie with a 56% deposit market share.

Track Record Of Growth And Profitability

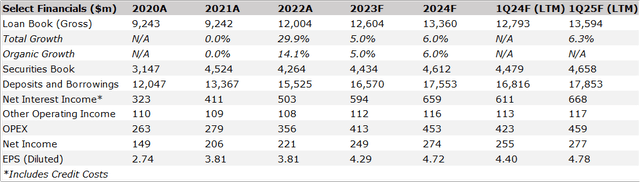

Management has demonstrated solid growth historically, especially when taking into account the highly competitive regional banking market. The balance sheet has grown nicely with total assets and loans growing at CAGRs of 15.1% and 15.5% between 2012 and 1Q23, respectively, according to the bank’s 1Q23 presentation. This growth has been achieved through both organic and inorganic means. In 2022, FRME achieved total loan growth of 30% driven by the acquisition of Level One Bancorp and organic loan growth of 14%, despite the rising rates environment. Management is much more conservative about 2023; on the latest earnings call, management predicted that organic loan growth will be 5-7% and there will be no M&A activity. I think that the bank can easily achieve 5% organic loan growth in light of the bank’s past performance.

EPS has been growing at a CAGR of 10.5% and DPS by 28.7% between 2012 and 2022. Growth is expected to be even better going into 2023. ROTCE in 1Q23 was 19.8% up from 15.0% in 1Q22 and EPS was $1.07 up from $0.91 in 1Q22. The remaining of 2023 should prove even better as FRME carries a highly variable loan book, 66% of loans according to the 1Q23 presentation, which will reprice further in 2023. The total loan yield as of 1Q23 was 6% while the average loan yield on new and renewed loans generated in 1Q23 is 7%.

Controlled M&A Strategy

FRME has acquired 13 banks and thrifts over the last 22 years, equating to almost $10 billion in total acquired assets, as per the bank’s own disclosure. The targets have been small with total asset sizes varying between $2.5 billion and $129.6 million. The last two acquisitions (Level One Bancorp and Monroe Bank & Trust Financial Corporation) had total branches of ~35. The acquired entities have been highly complementary, offering traditional banking products and services while operating in the same geographies as FRME (Indiana, Illinois, Michigan, and Ohio). Franchise strength of targets has been strong with Level One Bancorp being the largest independent franchise in Southeast Michigan among banks with less than $50 billion in total assets, as listed in this presentation.

Acquisitions have bolstered FRME’s franchise and provided large, low-cost deposit bases to fund future growth. Synergies have historically been achieved.

FRME still has plenty of opportunities to grow inorganically. Indiana, Illinois, and Ohio rank in the bottom half in terms of market fragmentation in the USA, according to HHI indices from the FDIC. Indiana is especially fragmented, ranking as the eighth least concentrated market in the USA with an HHI index of 532. Yet, management said at the most recent earnings call that it will not do M&A before 2024, which I think is prudent considering the current environment.

Valuation

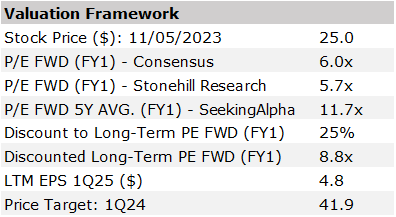

Following the selloff in US-based regional banks, FRME’s valuation has become attractive. FRME’s stock is down ~36% YTD, trading at $25.0 per share as of the 11th of May, equating to a P/E FWD (FY1) of 5.9x on consensus earnings while the five-year average multiple stands at 11.7x, according to Seeking Alpha’s data.

Management targets mid- to high-single-digit organic loan growth in the long term but believes that growth will be contained to 5-7% in the current environment. In my forecast, I take the lower end of this range and expect loans to grow at 5% in 2023 followed by 6% growth in 2024. Looking at yields, the same presentation reveals that average loan yields on loans originated in 1Q23 is 7%, so I expect the total average loan yield to move closer to that number throughout 2023. This will in part be offset by higher deposit yields as I expect that FRME has to hike deposit rates fairly quickly to maintain its deposit base. In sum, I believe that net interest income will increase by 18% in 2023 and 11% in 2024. These estimates include credit costs equal to those seen in 2022. Other operating income and OPEX costs largely follow historical trends in my forecast. In the end, my EPS estimates for 2023 and 2024 are $4.29 and $ 4.72, respectively.

SEC Filings and author’s own estimates

I base my 1Q24 target price on a P/E forward (FY1) multiple and my EPS estimate for 1Q25 LTM. As of the 11th of May, the P/E FWD (FY1) on my 1Q24 LTM EPS is 5.7x while the five-year average P/E FWD (FY1) on consensus earnings is 11.7x. To be conservative, I consider a gradual recovery in the P/E FWD (FY1) multiple until 1Q24; thus, I apply a 25% haircut to the long-term multiple, equating to 8.8x. Multiplying 8.8x with my 1Q25 LTM EPS forecast of $4.8 results in a target price of $41.9 per share.

SEC filings, author’s own estimate, and Seeking Alpha data

Key Risks

In light of the recent collapses in the regional banking industry, banks’ risk profiles are under even more scrutiny than usual. In my opinion, FRME has a quite healthy risk profile, and I believe that it is well positioned in the current environment. However, the continued weak perception of the regional banking market will keep multiples and valuations compressed.

Liquidity And Funding

The 1Q23 earnings presentation shows that the bank’s deposit portfolio has a moderate amount of uninsured deposits (28% in 1Q23), which compares very reasonably to SVB (94% in 4Q22), Signature Bank (89% in 4Q22), and First Republic Bank (67% at 4Q22) as per this overview by S&P. Compared to liquidity, the uninsured deposits are covered 1.2x by on- and off-balance sheet liquidity.

The deposit base is also highly granular with the average deposit balance being $35 thousand, meaning that a significant amount of depositors need to make withdrawals before the bank is impacted meaningfully.

Lastly, FRME grew its deposit base by 2.2% between 4Q22 and 1Q23, proving its strong franchise amidst market concerns.

Investment Portfolio

The second key risk relates to FRME’s investment portfolio, which is comprised of both held-to-maturity (HTM) and available-for-sale (AFS) securities. Portfolio losses are unavoidable in a rising rates environment unless one is holding a purely variable rate portfolio. FRME’s bond portfolio is no exception, but its HTM and AFS losses are limited and decreasing.

In 1Q23, FRME’s AFS portfolio loss amounted to $245.7 million down from $296.7 million in 4Q22. The HTM portfolio loss declined to $328.8 million from $379.5 million. Using the capitalization disclosure in the latest 10-Q, the static excess CET1 capital above the regulatory requirement amounts to 96% of the collective loss of the AFS and HTM portfolios. Most importantly, the AFS loss is covered 2.3x by the excess CET1 capital, providing a comfortable buffer.

For comparison, SVB’s latest 10-K shows that HTM losses amounted to $15.2 billion and AFS losses amounted to $2.5 billion which accounted for 1.3x of total CET1 capital.

Loan Book Quality

CRE is the most cyclical spot in most banks’ balance sheets. The 1Q23 earnings presentation and 10-Q capitalization data show that FRME has a relatively modest Non-Owner Occupied CRE portfolio, amounting to $2.4 billion, which is equivalent to just below 20% of total loans and 1.5x of CET1 capital. The CRE portfolio is highly granular, with the average loan balance standing at $1.3 million, has low exposure to offices (2.1% of total loans), and is reasonably diversified with some concentration in the multi-family sector (approximately 30% of CRE loans). Another point to mention is that FRME has almost $1 billion of construction finance loans, which also are vulnerable in a downturn. The book is predominantly made up of multi-family projects.

The bank only saw minimal movement in its asset quality measures in 1Q23. The NPAs + 90 days past due loans moved from 0.42% in 4Q22 to 0.50% in 1Q23, predominantly driven by two 90 days past due loans that have been resolved after the end of the quarter, according to management. A slightly more substantial movement was seen in so-called classified loans, which increased from 1.79% of total loans in 4Q22 to 2.04% in 1Q23.

Continued Concerns In The Regional Banking Market

My thesis relies to some extent on that FRME’s P/E FWD (FY1) multiple will recover over the next year. If the concerns in the US regional banking market continue, FRME’s multiple will remain low.

The Bottom Line

FRME is not going to be the growth story of the century, but, if one is looking for a way to take advantage of compressed multiples in the regional banking market, FRME is a good candidate. The bank demonstrated deposit growth in 1Q23 and is going to see strong EPS growth on the back of the higher rates environment and decent organic loan growth. The track record and deep market for M&A opportunities make the bank attractive in the longer term. Consequently, I deem the stock a buy. I will turn bearish on FRME if the CRE market starts deteriorating and 1Q23 shows cracks in the bank’s underwriting standards.