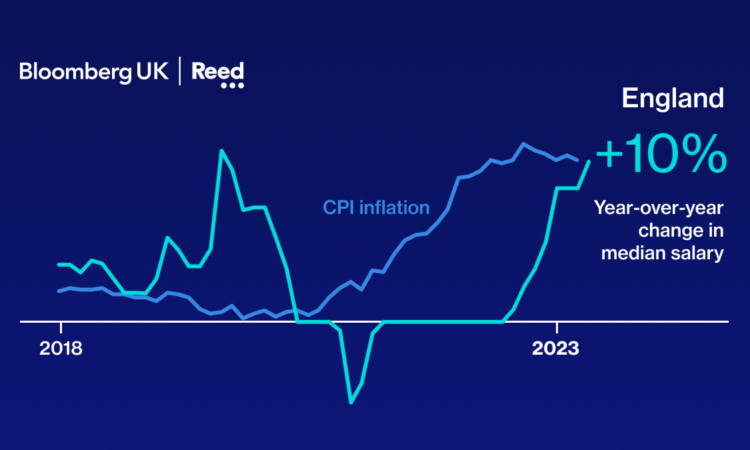

Data through April shows rapid salary gains as the Bank of England prepares to announce another interest rate hike

Changing jobs has paid off for millions of middle-income Britons over the past year, according to data analyzed by Bloomberg.

Wages soared 10% in the past year for those taking new positions in England, data posted on Reed Recruitment’s platform showed. That’s well above the raises recorded in official data across all jobs in the economy.

The figures point to a labor market that remains red-hot, throwing doubt on Prime Minister Rishi Sunak’s vow to cut inflation in half this year. It also adds fuel to the case for higher interest rates from the Bank of England, which is widely expected to deliver another quarter point increase on Thursday.

Pay Is Rising Fasted in Blackpool and Milton Keynes

Year-over-year change in median salary 👆

Note: Includes only towns and cities in England where the relevant Built-Up Area mid-2020 population was at least 100,000 people. Median salary is for a 3-month trailing period.

Sources: Reed Recruitment; Office for National Statistics

Reed gathered data from millions of job advertisements it handled in England between 2018 and April 2023. The report hints at a growing geographical divide within the UK.

Salaries in some areas of the north are rising fast, indicated by the color of the bubbles in the map above. But median advertised salaries are still far larger than the national average in major cities such as London, Cambridge and Manchester. In the likes of York, Gateshead, Norwich and Birkenhead, advertised wages are as much as a third smaller.

And while London is still home to the most lucrative roles, according to Reed’s job adverts, it’s workers outside the capital who stand to gain the most from switching jobs.

Positions posted in neglected northern towns such as Birkenhead, Blackpool and Huddersfield have enjoyed much quicker wage gains than in their southern counterparts. That could help Sunak’s claim a small win on his “levelling up” agenda ahead of the general election expected next year.

But while workers lucky enough to snag a new role may welcome an above-average pay rise, the 10% jump in median advertised salaries is a concern for the Bank of England, which is struggling to cool Britain’s double-digit inflation rate.

“The cost of employing people is increasing, and the reality is some businesses are better able to support this than others,” said James Reed, chief executive officer of the company that bears his name.

There are caveats to Reed’s data. While its platform is one of England’s largest job sites, it has a stronger heritage in and therefore a bias towards sectors such as finance, accounting and administration.

Its data is skewed towards segments of the economy that have felt a sharp increase in demand in the past year – especially technology. Reed also doesn’t capture the most highly-paid roles, which tend to be recruited by specialist headhunters instead of through open advertisements.

Bloomberg has chosen to compare median salaries in order to smooth out the effect of any outliers at both the high and low ends of the income spectrum.

The Bank of England is anxious to head off the risk of a wage-price spiral. More than half a million people dropped out of the UK labor market since the pandemic, prompting businesses to sweeten pay and perks to tempt people back into work. They’re still struggling to recruit enough staff, with vacancy numbers almost matching unemployment.

The result has left inflation near a four-decade high, creating an incentive for workers to change jobs or demand higher pay, many of them by striking. Median salaries for new jobs are up about 10% from a year ago between February and April, Reed’s data shows, close to the current rate of inflation and well above the national average wage increase of 6.3% in March according to the Office for National Statistics.

Approaching Inflation

The annual change in median salaries compared to the rising cost of living

Source: Reed Recruitment; ONS

Wages are one of the main issues driving interest rates higher. The BOE had started to signal a pause in its hiking but is now expected to deliver increases through the summer, starting with a quarter point to 4.5% on Thursday.

If, as Reed’s data suggests, swathes of middle-income families have actually found themselves with a real-terms pay rise, this may spark worries of more persistent upward pressure on prices.

But James Reed was quick to point out that overall, pay is still struggling to keep pace with inflation. “Workers are not the cause of the problem,” he said. “Businesses should take a long-term view and pay people what they can to sustain their workforce.”

Is ‘Levelling Up’ Working?

The areas where the cost-of-living crunch has been felt the most are, of course, those where pay is lowest. According to Reed’s data, looking at towns and cities with a population of more than 100,000 people, York, Gateshead, Norwich, Birkenhead and Ipswich rank bottom when looking at the salaries attached to job adverts.

All have median advertised wages of no more than £28,000 and are in the UK’s less prosperous northern and eastern regions.

London, with its dominant financial district, ranks as the highest-paying area. The median salary in the capital posted on Reed’s site was a little over £40,000, closely followed by growing technology hub Cambridge, northern rival Manchester, Reading and Birmingham, all at £35,000.

Software engineering, software development and IT project management roles were driving up pay in all of those areas, often offering median salaries in excess of £60,000.

But there are signs that the fortunes of some of England’s neglected towns may be improving. The steepest rises in advertised salaries were seen in Blackpool, Milton Keynes, Birkenhead, Huddersfield and Lincoln, all of which saw at least an 18% leap over the last year.

Where Pay Is Rising Fastest

Year-over-year change in median salary, 3-month trailing period

Sources: Reed Recruitment; ONS

It wasn’t the technology sector driving pay in these areas. Instead it was demand for retail workers, school teachers and qualified social workers.

Some of the increase may be due to the rise in the national living wage, which came into force in April. Areas such as Blackpool and Birkenhead tend to employ more people in the hospitality sector, which relies heavily on low-paid workers.

But social carers in Blackpool could have seen their wages rise by up to 78% to some £35,500, according to Reed’s data. Customer service has climbed 47% to £28,500.

In Milton Keynes, another jobs hotspot identified by Reed data, the median salary for a secondary school teacher is now £39,000 — up 82% from a year ago.

However, it isn’t such a good time to be an estate agent in Birmingham or Brighton and Hove. Those two areas had the lowest wage inflation, and both were dragged down by the cooling property market. Advertised positions for estate agents in Birmingham now carry a median salary of £26,000, which is 3.7% below a year ago.

Where Pay Is Rising Slowest

Year-over-year change in median salary, 3-month trailing period

Sources: Reed Recruitment; ONS

The trend toward quicker wage gains away from the capital may indicate that the Conservative government’s Levelling Up agenda is starting to work.

James Reed said it was “unsurprising” that London, Cambridge, and Manchester lead the way on highest median pay, given they also have high rates of job postings. But he said it’s “promising to see other regions such as Huddersfield accelerating wage growth, indicative of some levelling up success.”

If Sunak really does want to spread prosperity outside of London, Reed’s data gives some clues on how that might be done.

Sectors such as banking and finance, strategy and consulting and energy all occupy a sweet spot of offering high and fast-growing wages. While salaries in the IT and telecoms sector are slower to escalate, they’re miles ahead of any other sector advertised by Reed.

Pay Is Rising Fastest in the Energy Sector

Median salary and year-over-year change, February-April 2023

Note: Sectors are sized based on the total number of job postings in the February–April 2023 period. Sources: Reed Recruitment

“The world economy is becoming more digitally led, which we’re seeing first-hand in the UK labor market,” said James Reed. He pointed to a “huge shortage” of relevant skills and urged the government to “prioritize more tech education in less affluent parts of the UK.”

Other sectors currently leading the way in wage rises reflect the unique situation in which the UK economy has found itself.

The Sectors With Largest Pay Gains

Year-over-year change in median salary, 3-month trailing period

Sources: Reed Recruitment; ONS

Education and health and medicine have both been rocked by strikes over the last year and are being forced to hike salaries as much as possible within budget constraints in order to attract the necessary staff.

Pandemic-fuelled demand in the transport and logistics sector, meanwhile, is wearing off.

The Sectors With Little or No Pay Gains

Year-over-year change in median salary, 3-month trailing period

Sources: Reed Recruitment; ONS

But this, says James Reed, only emphasizes the need for Britain to focus on future-proofing its economy and encouraging workers to retrain for more lucrative jobs.

“Technology skills are hugely valuable for job seekers,” he said. “We can expect to see tech advancements facilitate the creation of a new roster of roles. We should embrace the consequent benefits.”