Bitcoin (BTC) added 2.5% on Friday morning to bring the world’s largest cryptocurrency close to the US$29,100 mark against the greenback.

Bitcoin’s strong performance in the Asia trading hours was helped in part by Apple Inc’s (NASDAQ:AAPL) better-than-expected earnings result, with revenues coming in at around US$95bn for the iPhone maker.

Apple shares have surged 2.5% in pre-market trades on Nasdaq.

Nasdaq-listed cryptocurrency exchange Coinbase Global Inc (NASDAQ:COIN) also posted decent results, managing to limit losses in the first quarter through cost-cutting measures and diversified revenue lines, sending shares over 9% higher in post-bell trades.

Apple and Coinbase’s solid market performance has likely stirred interest in other tech-adjacent equities and asset classes including bitcoin.

At a more macro level, analysts are noting concerns about trading volumes, with Edward Moya, senior market analyst at OANDA stating that “bitcoin isn’t seeing the same amount of flows as it did early during all the banking drama with Silicon Valley Bank”.

Lower volumes may be contributing to bitcoin’s inability to break above 30k again, barring a brief stint in April.

Instead, the BTC/USDT pair appear anchored to the 28k to 29k range, and could remain that way barring a strong catalysing event.

Bitcoin (BTC) appears anchored below 30k for the time being – Source: currency.com

Binance’s order book shows strong selling pressure at 30k, while open interest on the futures market shows a dead-even split between buy- and sell-side orders

Ethereum was 0.9% higher this morning, just failing to break above US$1,900, which has been acting as the bears’ defensive positive position for the past two weeks.

Ethereum’s open interest is also evenly split between buyers and sellers.

Bitcoin and ether are both down around 1.5% over the past seven days.

Altcoin off-season continues

One thing for certain is that interest in the cryptocurrency markets is heavily skewed toward bitcoin, ether and a handful of others.

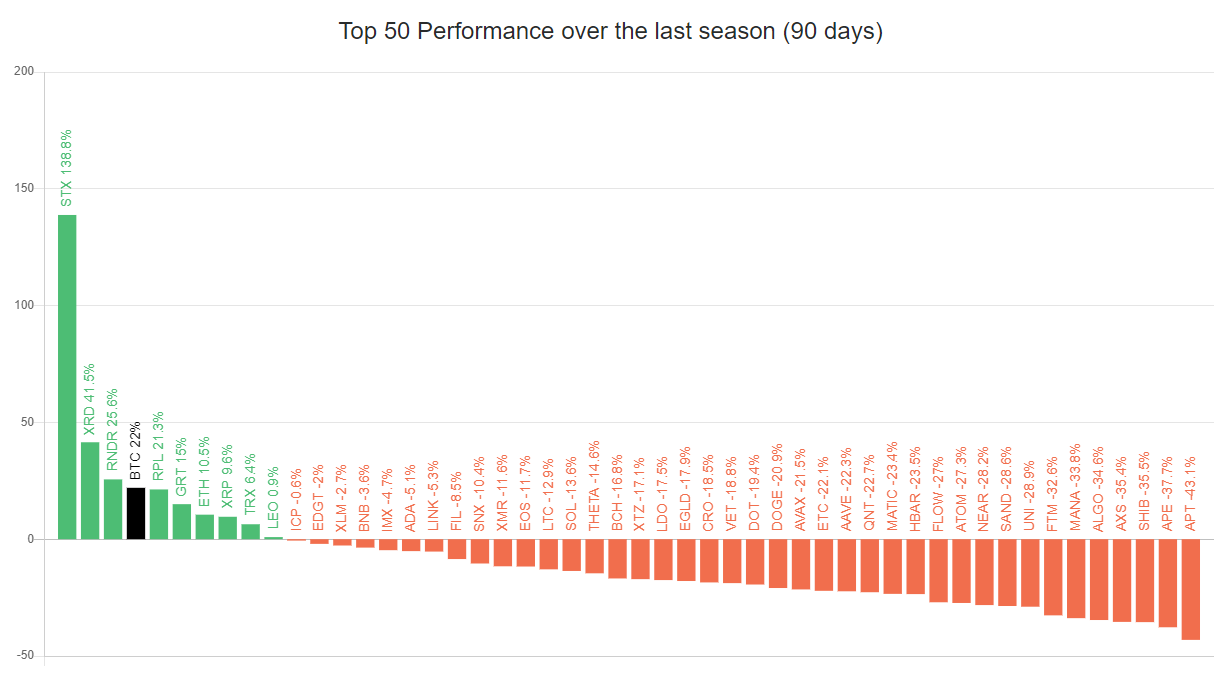

Of the top 50 performing cryptocurrencies over the past 90 days, 40 have given investors negative returns.

Only bitcoin, ether, Ripple (XRP), Tron (TRX), and a handful of small-cap outliers remain in the green, with bitcoin adding 22% and ether adding 10%.

Ripple (XRP) was boosted by promising news emerging from its SEC ligitation – Source: blockchaincenter.net

Cryptocurrency investors are likely engaging in a flight to quality while avoiding unstable and volatile altcoins without a proven track record of returns.

However, an easing of monetary policy from the major central banks could see an increasing appetite for riskier assets in the near to mid-term.

For the time being, global cryptocurrency market capitalisation currently stands at US$1.19tn after dipping 0.15% overnight, while total value locked in the decentralised finance (DeFi) space added 0.12% to edge above US$49bn overnight.