(Bloomberg) — The funding panic triggered by the shock collapse of Silicon Valley Bank and others in March may be subsiding, but the scramble for money by banks isn’t over.

Most Read from Bloomberg

That’s evident in institutions continuing to tap the Federal Home Loan Bank and US central bank for cash amid renewed concerns about First Republic Bank last month. Despite JPMorgan Chase & Co.’s purchase helping ease fears over the fate of the troubled lender, bank funding remains a question as cash keeps pouring into money-market funds in the search of higher interest rates and safe harbors amid worries of the stability of some smaller lenders.

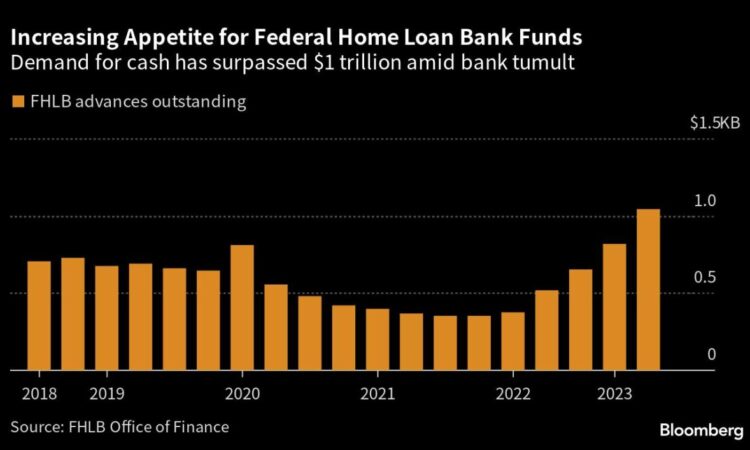

FHLB’s net debt outstanding rose to $1.49 trillion at the end of April, up from $1.47 trillion seen in March when it surged more than 20% in the month as the failure of three US banks sent institutions clamoring to shore up balance sheets. In just the week ended April 26, banks tapped the Federal Reserve’s emergency borrowing facilities for $155.2 billion. While that’s down from more than $300 billion reached in the scramble in March, it shows demand remains robust.

The FHLB system provides funding to commercial banks and other members via so-called advances, financing that demand by issuance to broader market.

The latest surge in FHLB debt issuance likely pushed total outstanding advances to roughly $1.1 trillion to $1.15 trillion, according to estimates by Citigroup Inc. That’s up from a record $1.04 trillion reached in March’s banking crisis. The loans jumped 28% at the end of the first quarter from the end of 2022, according to the FHLB Office of Finance.

Citi strategist Shuo Li noted First Republic Bank reported they only had $12.4 billion of unused borrowing capacity from the Fed’s discount window and $1.7 billion from FHLB at the end of March, which suggests the uptick in demand was caused by more than one bank.

In fact, even before the banking turmoil, the smallest institutions had been increasing their reliance on the FHLB system, to the point it accounts for roughly two-thirds of their total borrowings from just a little over one-third.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.