eyecrave productions

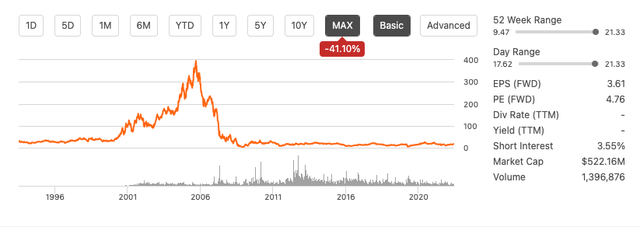

Beazer Homes USA, Inc. (NYSE:BZH) released a robust Q2 2023 Earnings report, surpassing both EPS and revenue projections. However, there was a decrease in the number of home closings, an increase in cancellations, and fewer new home orders. Although the stock has performed better than its competitors in the past year, it is still far from reaching its peak in the mid-2000s.

Historic stock trend (SeekingAlpha.com)

Beazer Homes are experiencing high demand for their homes despite industry challenges. Buying a home provides better expense control in an inflationary market, and there is a housing shortage in the USA. Beazer Homes aims to exceed 200 active communities by 2026, which makes me believe there is long-term upside potential and may make it a good investment opportunity.

Company overview

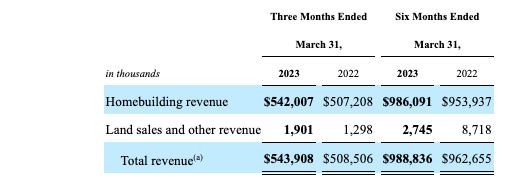

According to recent data, Beazer constructed and closed on 5,287 homes in the United States in 2022, making it the 19th largest home builder in the country. The residential homebuilding industry is estimated to be worth $590 billion and is expected to have a compound annual growth rate of 3% until 2028. Beazer’s revenue primarily comes from homebuilding, with land sales and other sources contributing as well. Homebuilding generates the largest part of their revenue, and their Q2 2023 revenue increased by 7% year-over-year as indicated below.

Company segments Q2 2023 versus Q2 2022 (sec.gov)

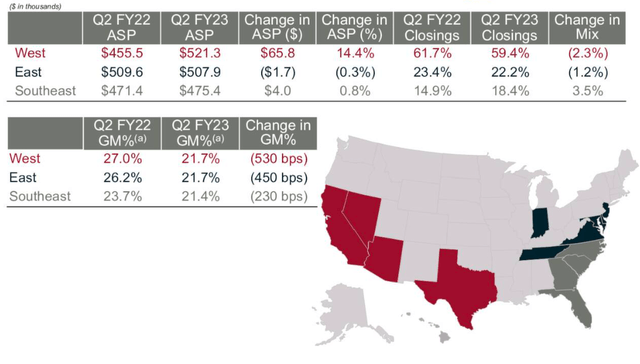

The rise in sales was caused by an 8.4% increase in the average sales price, which reached $509,900. The company followed the trend of the housing industry, reporting a decrease in both the number of home orders and houses closed, while also reporting an increase in cancellations compared to the previous year. The chart below shows the geographic distribution of these numbers across the USA, with only the Southeast region seeing an increase in closings.

Revenue and gross margin by location (Investor presentation 2023)

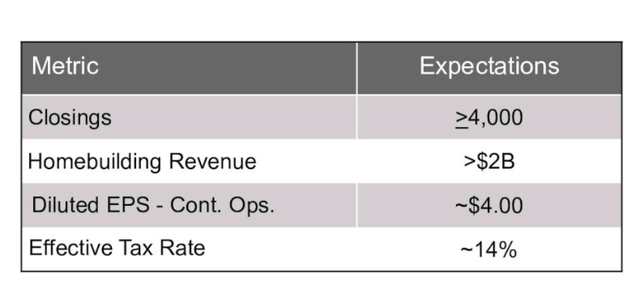

Although the market remains challenging, the company has a positive outlook for its FY2023 and has an ambitious growth plan leading up to 2026. Its strong Q2 results have compensated for a weaker Q1, and the company has seen strength in its spring selling season. Beazer aims to close at least 4,000 homes and generate over $2 billion in revenue for FY2023. There is a backlog of homes, and the speed of closing a house has normalized. By the end of fiscal 2023, the management team predicts an EPS of $4, considering an effective tax rate of 14%.

FY2023 Expectations (Investor Presentation 2023)

Key takeaways from Q2 2023

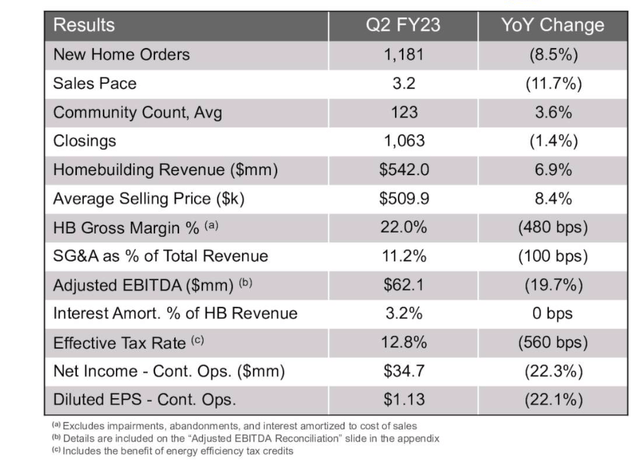

Earlier this week, Beazer announced its Q2 2023 earnings results, and the market has responded positively to its performance. The company surpassed EPS expectations by $0.31, reporting $1.13 per share, and exceeded revenue expectations by $24 million, with a total of $543.91 million for the quarter. The increase in the average selling price resulted in a 6.9% rise in homebuilding revenue. Beazer’s gross margin was 22.0%, and it reported a net income of $34.7 million.

Q2 2023 results (Investor presentation 2023)

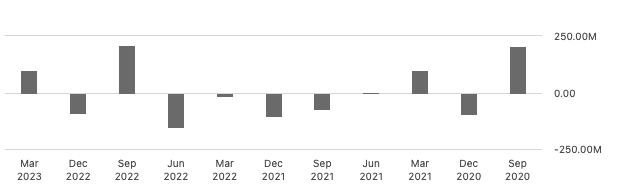

Upon analysing the company’s quarterly trending cash flow, it seems to be somewhat erratic. Although Q2 of 2023 showed a positive free cash flow of $67.2 million, the company has recorded negative annual free cash flow for the last two fiscal years. This may not be favourable for investors who are interested in receiving company benefits such as dividends or share buyback initiatives.

Quarterly levered free cash flow (SeekingAlpha.com)

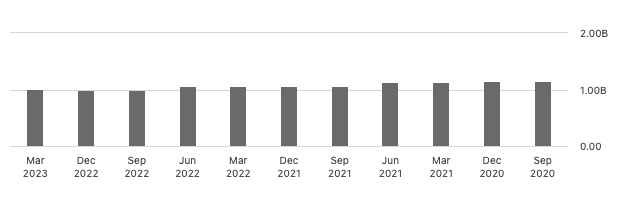

One of Beazer’s long-term goals is to reduce its debt intake. We can see a downward trend in debt over the last few quarters, with total debt ending at $1.001 billion in Q2 2023. Shareholder equity is now higher than its debt levels, and the company has no debt maturities until March 2025.

Total quarterly debt (SeekingAlpha.com)

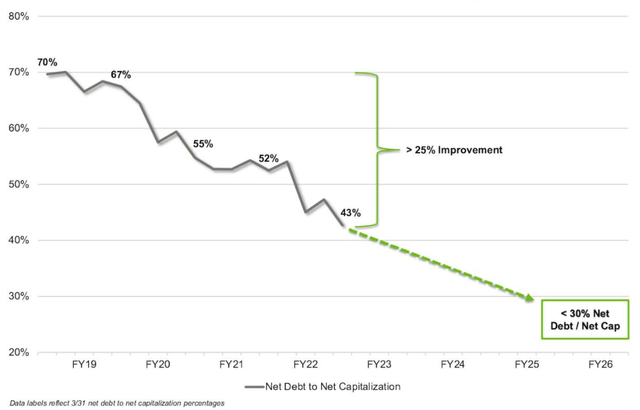

Below we can see the continued reduction in leverage with a net debt to net capital ratio below 30% by the year-end of 2026.

Net debt to net capitalisation (Investor Presentation 2023)

Valuation

Beazer Homes USA is trading above its average target price of $20.33 after a solid year in which we saw the stock reward investors with 63.55% in returns year to date. The short interest is not exceptionally high at 3.55%, and there is a general bullish consensus regarding the stock.

Stock trend YTD (SeekingAlpha.com)

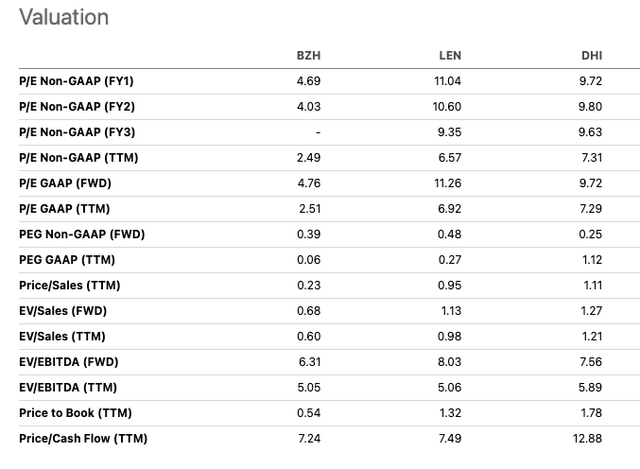

In December 2005, the stock of Beazer reached its peak at $395.60 during the US housing bubble in the 2000s. Compared to its larger peers like Lennar Corporation (LEN) and D.R. Horton (DHI), Beazer is still relatively cheaper and has an attractive valuation. However, it is important to note that its growth rate is not as impressive, with only 6.5% YoY revenue growth compared to LEN’s 21.24% and DHI’s 10.55%.

Relative peer valuation (SeekingAlpha.com)

Risks

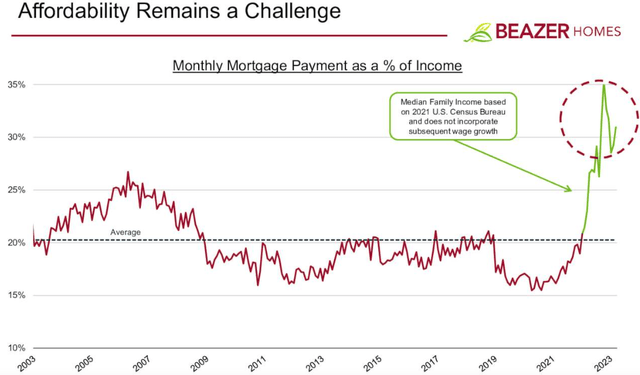

Investing in homebuilding stocks can be risky due to the cyclical nature of the industry. Factors such as rising mortgage rates and contract cancellations can negatively impact the housing market. Beazer, in particular, has a significant amount of debt that may continue to hinder its ability to increase liquidity and provide rewards to shareholders. Furthermore, Beazer’s history of low return on total capital and operating margins makes it less attractive compared to other market competitors.

High interest rates (Investor presentation 2023)

Final thoughts

Despite a challenging market environment, Beazer delivered impressive results in its second quarter of 2023 after a solid financial finish in 2022. The stock price has outperformed its peers, rising by 63.55% this year, and it has a low forward price-to-earnings ratio of 4.76. While the growth rate is slow, the stock is inexpensive compared to the industry, and the management expects the momentum to continue throughout the year. As such, investors may want to consider a bullish outlook on this stock.