(Bloomberg) — US equities extended a rally Friday as investors wrestled with strong corporate earnings against concerns about regional banks and inflation. Treasuries rose.

Most Read from Bloomberg

The S&P 500 gained 0.8% after better-than-expected earnings from the likes of Exxon Mobil Corp. and Intel Corp., up 1.3% and 4% respectively. However, the gains proved precarious in midday trading after Federal Reserve officials called for broad changes to bank rules in the wake of Silicon Valley Bank’s collapse.

The Nasdaq 100 rose 0.7%, weighed down by Amazon.com Inc.’s 4% loss after a warning over growth in its key cloud computing business. Meanwhile, First Republic Bank fell 43% after reports FDIC receivership is the most likely scenario for the bank after a run on deposits.

“Earnings relative to expectations appear resilient with a little more than half the S&P 500 reported,” wrote Scott Chronert, managing director at Citi Research. “Full-year numbers and revisions have stabilized of late. The issue remains sentiment and positioning.”

Markets are on edge over the uncertainty of Federal Reserve interest-rate hikes, after fresh inflation data Friday increased the likelihood of an increase next week and possibly in June. Traders have been anticipating the end of rate hikes near term, with cuts before year end.

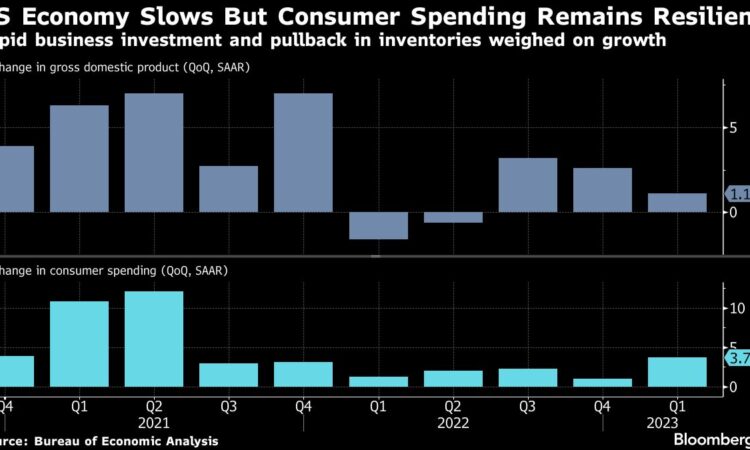

The personal consumption expenditures price index excluding food and energy, one of the Fed’s preferred inflation gauges, rose 0.3% in March for a second month. Compared with a year ago, the measure was up 4.6%, Commerce Department data showed.

Read more: US Core PCE Inflation Stays Brisk While Consumer Spending Stalls

“What looks like sticky contemporaneous inflation remains an issue, preventing the market from getting too carried away on the rate-cutting phase to come in subsequent quarters,” wrote Padhraic Garvey, head of global debt and rates strategy at ING Financial Markets.

The yield on the 10-year Treasury fell nine basis points to 3.44%.

US equities ended the month 1.5% higher, as corporate results have lifted investor sentiment in the face of rate-hike uncertainty and a possible recession. In the latest batch of earnings, Charter Communications Inc. gained 7.6% after reporting results while Snap Inc. plunged 17% after missing revenue estimates.

“April largely is a good month. Again, it’s probably earnings-season driven, but we’ve been getting some economic reports that are also saying that the economy, and especially inflation, is likely going in the right direction — just not maybe fast enough,” said Kim Forrest, chief investment officer at Bokeh Capital Partners. “Businesses and people are spending, inflation is still there, but the data says it’s slowly ramping down.”

Read more: Snap Shares Set for Biggest Drop in Six Months After Sales Fall

In Europe, the Stoxx 600 gained 0.6%, even as an uptick in consumer-price gains pointed to more rate increases by the European Central Bank.

The Bank of Japan, in contrast, renewed its commitment to stimulus after its first meeting under Kazuo Ueda. It left its short-term policy rate at minus 0.1% and maintained its 0.5% ceiling for 10-year bond yields.

Elsewhere, oil prices gained, gold was little changed, and the dollar was modestly stronger against major peers.

Here are some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.8% as of 4 p.m. New York time

-

The Nasdaq 100 rose 0.7%

-

The Dow Jones Industrial Average rose 0.8%

-

The MSCI World index rose 1.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was little changed at $1.1019

-

The British pound rose 0.6% to $1.2567

-

The Japanese yen fell 1.7% to 136.24 per dollar

Cryptocurrencies

-

Bitcoin fell 1% to $29,349.69

-

Ether fell 1.4% to $1,893.84

Bonds

-

The yield on 10-year Treasuries declined nine basis points to 3.43%

-

Germany’s 10-year yield declined 15 basis points to 2.31%

-

Britain’s 10-year yield declined eight basis points to 3.72%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Cecile Gutscher, Sujata Rao and Denitsa Tsekova.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.