Office property owners who were able to weather the worst of the pandemic are crashing into a hard reality wrought by sharply lower demand and higher interest rates.

Undercurrents of stress are now emerging in a growing wave of loan defaults. Notably, Columbia Property Trust made headlines with news that it had defaulted on $1.7 billion in loans tied to seven buildings. In another high-profile example, a fund managed by Brookfield also is reportedly defaulting on roughly $750 million in loans for two L.A. properties—Gas Company Tower and the 777 Tower.

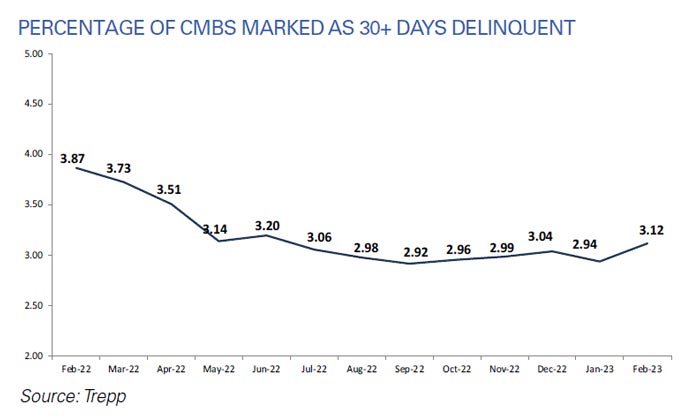

According to Trepp, the commercial mortgage–backed securities (CMBS) delinquency rate for office properties jumped 55 basis points (bps) in February to an average of 2.38 percent, up from 1.83 percent in January and 1.67 percent a year ago. Likewise, the special servicing rate for office CMBS loans also climbed to 4.43 percent, up roughly 60 bps since December. The expectation is that those numbers will continue to climb in the coming year.

“I do think there is going to be a lot of pain ahead for office,” says Manus Clancy, a senior managing director and the leader of the applied data, research, and pricing departments at Trepp.

Trepp is currently watching 15 to 20 loans in 2023 that are approaching their maturity dates that face default risk, which would push up the delinquency rate considerably. However, there also is a lot of speculation around what will happen and not what is happening now, cautions Clancy.

“Over the last six to seven years, retail owners leaned in and fought hard to keep their properties. What we don’t know at this point is whether office owners will have that same persistence and fortitude,” he says.

The common view is that loans won’t be able to refinance when they mature due to lower values and weaker fundamentals, particularly those properties that have seen a major tenant vacate or downsize. On the positive side, major tenant lease expirations are still one, two, or three years away for many office properties. Another caveat is that, specific to CMBS loans, a borrower has to default in order to move the loan to a special servicer where they can work on restructuring terms of a loan. So, while some owners may be ready to hand the keys back to the owners, some may be working hard behind the scenes to hold onto properties.

Given the magnitude of debt and equity backed by office buildings, a lot is at stake for owners, investors, and lenders. According to the Mortgage Bankers Association (MBA), office is the second largest category behind multifamily with roughly $750 billion in mortgages held by both bank and non-bank lenders. Although all property types are going through transitions right now due to higher interest rates and a slowing economy, office is really getting the most focus in terms of what supply and demand looks like going forward, notes Jamie Woodwell, vice president in the research and economics group at the MBA.

“There is a lot of uncertainty around hybrid and remote working and how that will impact demand for office space, and that is still [to be determined],” he says.

Weak fundamentals threaten NOI

Although long-term leases have provided a bit of a buffer to changing space needs, disruption caused by the pandemic and rise of remote and hybrid work is taking its toll on office demand. Nationally, office absorption was negative by 37.1 million square feet (3,45 million sq m) last year, which pushed the average vacancy rate to a new historical high of 18.2 percent, according to Cushman & Wakefield. The vacancy rate also included 33 million square feet (3.1 million sq m) of sublease space that was added to the market last year.

And the forecast is grim. Cushman & Wakefield’s recent Obsolescence Equals Opportunity report predicts that the volume of vacant office space could rise to 1.1 billion square feet (102.2 million sq m) by 2030, with research that further suggests that more than 25 percent of the country’s total inventory of office space will be considered obsolete.

Almost every city has considerable sublease space available, and excess space is not being absorbed with any velocity. “So, it’s dicey times for offices, and there’s not a lot of capital available for office,” says Clancy. Lenders are focusing predominantly on best-in-class buildings with strong leases in place to high-quality tenants.

Maturing loans in the hot seat

Given the current environment, it will be especially challenging for owners that have loans maturing in 2023. Recent news of the rescue of Silicon Valley Bank and Signature Bank could result in wider spreads and more cautious underwriting, which doesn’t bode well for office as the sector was already out of favor with lenders.

The consensus among lenders at the MBA’s conference in February was that office isn’t dead, but lenders are leery of lending to office because of the uncertainty around where the sector is headed in terms of fundamentals and property values, notes Kevin Fagan, head of commercial real estate economic analysis at Moody’s Analytics. Rent growth isn’t keeping up with inflation and rising interest rates are going to push cap rates higher. “We feel that there is about a 20 percent price correction that needs to happen in office, at least temporarily,” says Fagan.

Loan-to-values (LTVs) on CMBS loans for office properties have dropped below 50 percent, which shows that lenders are being more conservative on putting out debt to office properties. There are going to be plenty of cases where borrowers are going to have to bring more equity to the table to refinance a maturing loan, adds Fagan.

According to Moody’s Analytics, there is $91.7 billion in office loans held by non-banks that are maturing in 2023—roughly 22 percent of the total non-bank office debt outstanding. Moody’s analysis of the roughly $25 billion in CMBS loans maturing in 2023 (including conduit and single asset single borrower, or SASB, loans) shows that about 40 percent of those loans are challenged, meaning that they have relatively low debt service coverage ratios (DSCRs) below a 1.1x or a debt yield lower than 8 percent. “That is a significant number. So, while there is a longer view that office has some staying power and is more of a reinvention story, there is very likely going to be pain this year,” says Fagan.

Snapshot of CMBS Conduit Office Loans Maturing in 2023

Looking specifically at CMBS conduit loans, there are $6.045 billion in loans maturing, comprising 478 properties in 206 loans.

Source: Moody’s Analytics

Lender appetite for office

Although capital for office is more constrained, it is still available for good quality assets and borrowers. Loan production across all property types fell by 50 percent in Q4 compared to Q4 2021. Much of that decline had to do with the impact of higher interest rates and uncertainty around cap rates, which is impacting sales transactions and refinances. “Overall, lending dropped dramatically in Q4, and we are expecting lending to continue to be light in the first quarter of this year,” says Woodwell.

However, lenders are eager to make loans on properties where they are confident in the value of the property and cash flow supporting that loan, and here are office properties that check those boxes where lenders can feel comfortable, notes Woodwell. “At the same time, here is probably more uncertainty around office than any other property type with regard to where cash flows and values will be and making sure that they are rock solid for any new loans that will be made,” he says.

Moody’s Analytics has been taking a closer look at CMBS office loans that have successfully refinanced or ones that are in the process of refinancing. “Right now, it’s a real mixed bag. There’s not a clear story on what are the survivors and what aren’t the survivors,” says Fagan. There are a lot of theories on what qualifies as better offices and what others don’t. However, with 40 percent that are challenged, there is expected to be fallout this year among loans that need to be recapitalized.

The stress that is emerging in the office market feels a bit déjà vu when compared to fears of a “retail apocalypse” that hit the real estate market several years ago as retailers battled disruption from e-commerce and an oversupply of space. If history is repeating itself, there may be some lessons learned on what’s ahead, one of which is that challenges in the office market will take years to play out. People first started to talk about mall loan defaults as early as 2017, and six years later a lot of those Class B and C mall loans are still in purgatory, notes Clancy. They haven’t been foreclosed on and they haven’t paid off.

Office also is likely to see a similar bifurcation with newer Class A buildings that are likely to weather challenges better than older Class B and C buildings. Some office properties will need to be reimagined to make them more relevant to tenants. “I think we will see that reinvention happen over the next three to five years in office,” says Fagan. At the same time, there is an experimentation phase occurring as corporate tenants try to figure out, not necessarily how much space to cut, but how do they create a space that maximizes their workforce, he adds.